European Data Center Market Size, Trends & Analysis - Forecasts to 2028 By Infrastructure (IT Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, and General Construction), By Tier Standards (Tier I, Tier II, Tier III, and Tier IV), By Facility Type (Hyperscale Data Centers, Colocation Data Centers, and Enterprise Data Center), and By Region (Europe), Competitive Landscape, Company Market Share Analysis, and End User Analysis

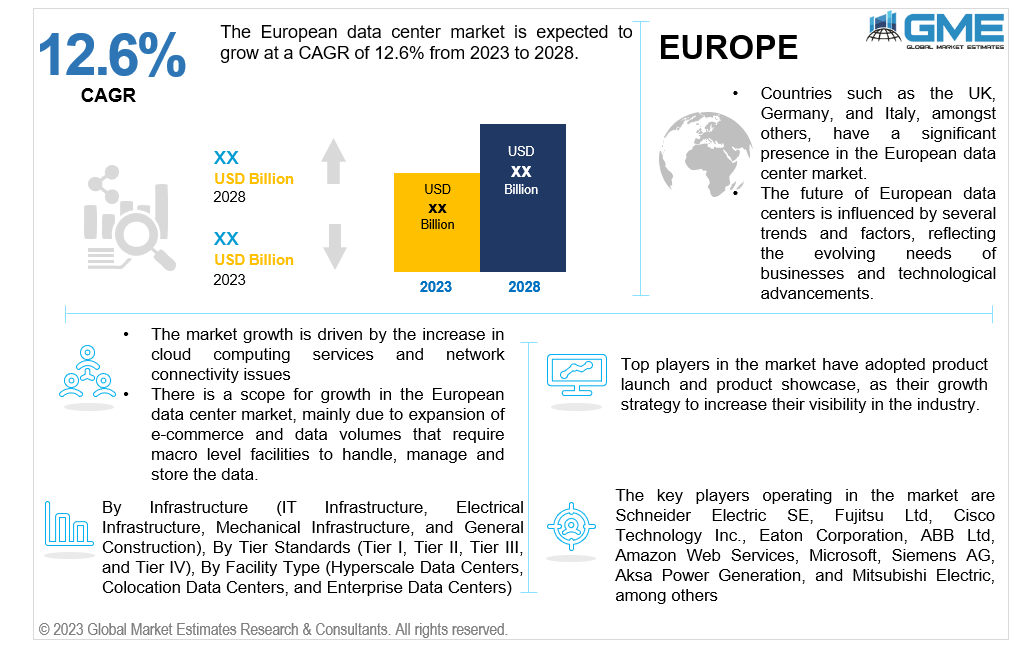

The European data center market is expected to grow at a CAGR of 12.6% from 2023 to 2028. European data centers are a vital component of the digital infrastructure supporting various industries, including finance, healthcare, e-commerce, and more. They are created to store, operate, and maintain computer systems, networking hardware, and other associated parts for digital data processing, storage, and administration throughout Europe. These data centers, which supply the infrastructure required for various online services, cloud computing, and data storage needs, are an essential component of the modern technology infrastructure.

The European data center market growth is driven by factors such as an increase in cloud computing services and network connectivity issues. One important factor has been the increasing use of cloud computing services by governments and corporations. In response to the increasing demand for cloud services, major cloud-based service providers such as Google Cloud, Microsoft Azure, and Amazon Web Services (AWS) have increased the number of data centers they operate in Europe. The region also has a well-developed internet connection system. This makes it a prime spot for internet exchange.

The market also has some restraints. There are regulatory complications as the region is heavily regulated, which requires the data center operators to implement strict security and compliance measures. There is also a significant risk of cybersecurity due to the sensitive nature of the data they store.

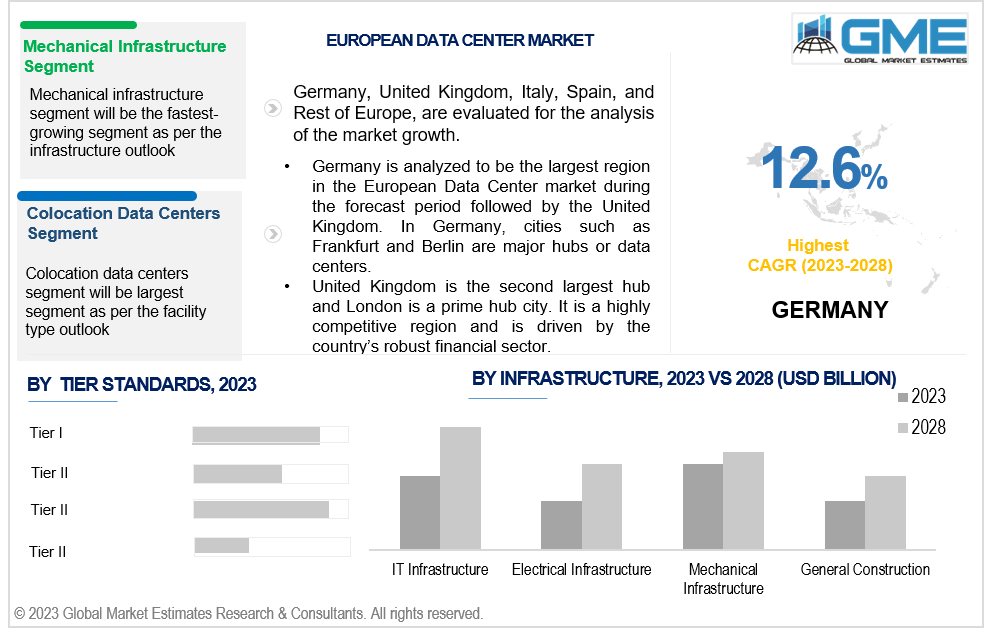

Based on infrastructure, the market is segmented into IT infrastructure, electrical infrastructure, mechanical infrastructure, and general construction. The IT infrastructure segment is expected to hold the largest share of the market over the forecast period due to the fact that most operations in Europe are turning digital and opting for cloud computing services. There is a significant amount of digital intervention in all sectors, such as real estate, construction, and more.

The mechanical infrastructure segment is projected to exhibit the highest growth rate in the forecast period. This is attributed to the fact that data centers operate using servers, routers, switches, telephones, and much more, which requires added mechanical assistance of cooling and air filtration using HVAC systems. This is essential to maintain equipment health and prevent it from contamination.

Based on tier standards, the market is segmented into tier I, tier II, tier III, and tier IV. Tier I segment is expected to be the dominant segment in the market during the forecast period. Frankfurt, London, Amsterdam, Paris, and Dublin are known as the tier I cities in Europe and have the maximum data centers located. They are prime internet exchange points, which is one of the main factors aiding in European data centers expansion.

Tier II segment is expected to witness fastest growth over the forecast period. This is because tier II cities outside the traditional FLAP-D market which is Frankfurt, London, Amsterdam and Paris and Dublin, have more open space and near to tier 1 cities. They can conveniently divert the crowd. Cities like Barcelona, Milan, and Rome are some of the prime tier II locations.

Based on facility type, the market is segmented into hyperscale data centers, colocation data centers, and enterprise data centers. The colocation data centers segment is expected to hold the largest share of the market in the forecast period. These data centers are facilities where multiple organizations or businesses rent space, power, cooling, and network connectivity to host their IT infrastructure, such as servers, storage, and networking equipment. Organizations can pay for the services they need on a subscription basis. They also offer robust security measures such as controls, surveillance cameras, and biometric authentication to prevent unauthorized access and theft.

The hyperscale data centers segment is projected to have the fastest growth rate in the forecast period. They are data centers that have infrastructure designed to meet the demands of large-scale cloud-based services and applications. They are known for their massive physical and computing space, which allows them to house tens of thousands of servers, storage devices, and networking equipment. They typically have multiple levels of redundancy for power, cooling, and networking to ensure minimal downtime. This is crucial for supporting mission-critical cloud services.

European data centers are dispersed throughout the continent's member states. Data center facilities are located in major cities and regions with thriving business and technology ecosystems. Strict data security and privacy laws, such as the General Data Protection Regulation (GDPR), regulate how personal data is handled and protected in the European Union (EU) and must be followed by European data centers. Countries such as the U.K., Germany, and Italy, amongst others, have a significant presence in the European data center market. The future of European data centers is likely to be influenced by several trends and factors, reflecting the evolving needs of businesses and technological advancements such as sustainability, artificial intelligence, and more, thereby driving the European data center market growth.

Germany is analyzed to be the largest country in the European data center market during the forecast period, followed by the United Kingdom. In Germany, cities like Frankfurt and Berlin are major hubs or data centers. Germany is known to offer good connectivity service, and this is a prime location for data centers and a key internet exchange point in Europe. The United Kingdom is the second largest hub, and London is a prime city. It is a highly competitive region driven by the country's robust financial sector. These nations are desirable locations for data center investments because of their robust infrastructure, dependable business climates, and availability of a trained labor force.

The key players operating in the market are Schneider Electric SE, Fujitsu Ltd, Cisco Technology Inc., Eaton Corporation, ABB Ltd, Amazon Web Services, Microsoft, Siemens AG, Aksa Power Generation, and Mitsubishi Electric, amongst others.

Please note: This is not an exhaustive list of companies profiled in the report.

On November 1, 2023, Amazon Web Services launched an independent cloud designed for public sector customers and companies operating in highly regulated industries within the European Union. The new service will offer European customers more granular control over their data and greater operational autonomy that only Europe-based users can manage and provide support.

On October 31, 2023, Siemens AG and Microsoft Corporation announced their collaboration to drive cross-industry AI adoption. They are introducing Siemens Industrial Copilot, an AI-powered jointly developed assistant aimed to improve human-machine collaboration in manufacturing.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 EUROPEAN DATA CENTER MARKET, BY INFRASTRUCTURE

4.1 Introduction

4.2 European Data Center Market: Infrastructure Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 IT Infrastructure

4.4.1 IT Infrastructure Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Electrical Infrastructure

4.5.1 Electrical Infrastructure Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Mechanical Infrastructure

4.6.1 Mechanical Infrastructure Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 General Construction

4.7.1 General Construction Infrastructure Market Estimates and Forecast, 2020-2028 (USD Million)

5 EUROPEAN DATA CENTER MARKET, BY TIER STANDARDS

5.1 Introduction

5.2 European Data Center Market: Tier Standards Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Tier I

5.4.1 Tier I Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Tier II

5.5.1 Tier II Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Tier III

5.6.1 Tier III Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Tier IV

5.7.1 Tier IV Market Estimates and Forecast, 2020-2028 (USD Million)

6 EUROPEAN DATA CENTER MARKET, BY FACILITY TYPE

6.1 Introduction

6.2 European Data Center Market: Facility Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Hyperscale Data Centers

6.4.1 Hyperscale Data Centers Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Colocation Data Centers

6.5.1 Colocation Data Centers Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Enterprise Data Centers

6.6.1 Enterprise Data Centers Market Estimates and Forecast, 2020-2028 (USD Million)

7 EUROPEAN DATA CENTER MARKET, BY REGION

7.1 Europe European Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.1 By Infrastructure

7.1.2 By Tier Standards

7.1.3 By Facility Type

7.1.6 By Country

7.1.6.1 Germany Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.1.1 By Infrastructure

7.1.6.1.2 By Tier Standards

7.1.6.1.3 By Facility Type

7.1.6.2 U.K. Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.2.1 By Infrastructure

7.1.6.2.2 By Tier Standards

7.1.6.2.3 By Facility Type

7.1.6.3 France Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.3.1 By Infrastructure

7.1.6.3.2 By Tier Standards

7.1.6.3.3 By Facility Type

7.1.6.4 Italy Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.4.1 By Infrastructure

7.1.6.4.2 By Tier Standards

7.1.6.4.3 By Facility Type

7.1.6.5 Spain Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.5.1 By Infrastructure

7.1.6.5.2 By Tier Standards

7.1.6.5.3 By Facility Type

7.1.6.6 Netherlands Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.6.1 By Infrastructure

7.1.6.6.2 By Tier Standards

7.1.6.6.3 By Facility Type

7.1.6.7 Rest of Europe Data Center Market Estimates and Forecast, 2020-2028 (USD Million)

7.1.6.7.1 By Infrastructure

7.1.6.7.2 By Tier Standards

7.1.6.7.3 By Facility Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Schneider Electric SE

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Poducts & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Fujitsu Ltd

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Poducts & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Cisco Technology Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Poducts & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Eaton Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Poducts & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 ABB Ltd

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Poducts & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Amazon Web Services

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Poducts & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Microsoft

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Poducts & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.8 Siemens AG

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Poducts & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Aksa Power Generation

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Poducts & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Mitsubishi Electric

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Poducts & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Poducts & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & SegElectrical Infrastructuretation

9.2 Information ProcureElectrical Infrastructuret

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential End User Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 European Data Center Market, By Infrastructure, 2020-2028 (USD Mllion)

2 IT Infrastructure Market, By Region, 2020-2028 (USD Mllion)

3 Electrical Infrastructure Market, By Region, 2020-2028 (USD Mllion)

4 Mechanical Infrastructure Market, By Region, 2020-2028 (USD Mllion)

5 General Construction Market, By Region, 2020-2028 (USD Mllion)

6 European Data Center Market, By Tier Standards, 2020-2028 (USD Mllion)

7 Tier I Market, By Region, 2020-2028 (USD Mllion)

8 Tier II Market, By Region, 2020-2028 (USD Mllion)

9 Tier III Market, By Region, 2020-2028 (USD Mllion)

10 Tier IV Market, By Region, 2020-2028 (USD Mllion)

11 European Data Center Market, By Facility Type, 2020-2028 (USD Mllion)

12 Hyperscale Data Centers Market, By Region, 2020-2028 (USD Mllion)

13 Colocation Data Centers Market, By Region, 2020-2028 (USD Mllion)

14 Enterprise Data Centers Market, By Region, 2020-2028 (USD Mllion)

15 Regional Analysis, 2020-2028 (USD Mllion)

16 European Data Center Market, By Infrastructure, 2020-2028 (USD Million)

17 European Data Center Market, By Tier Standards, 2020-2028 (USD Million)

18 European Data Center Market, By Facility Type, 2020-2028 (USD Million)

19 European Data Center Market, By COUNTRY, 2020-2028 (USD Million)

20 Germany Data Center Market, By Infrastructure, 2020-2028 (USD Million)

21 germany Data Center Market, By Tier Standards, 2020-2028 (USD Million)

22 GERMANY Data Center Market, By Facility Type, 2020-2028 (USD Million)

23 UK Data Center Market, By Infrastructure, 2020-2028 (USD Million)

24 U.k Data Center Market, By Tier Standards, 2020-2028 (USD Million)

25 U.K Data Center Market, By Facility Type, 2020-2028 (USD Million)

26 France Data Center Market, By Infrastructure, 2020-2028 (USD Million)

27 france Data Center Market, By Tier Standards, 2020-2028 (USD Million)

28 FRANCE Data Center Market, By Facility Type, 2020-2028 (USD Million)

29 Italy Data Center Market, By Infrastructure, 2020-2028 (USD Million)

30 italy Data Center Market, By Tier Standards, 2020-2028 (USD Million)

31 ITALY Data Center Market, By Facility Type, 2020-2028 (USD Million)

32 Spain Data Center Market, By Infrastructure, 2020-2028 (USD Million)

33 spain Data Center Market, By Tier Standards, 2020-2028 (USD Million)

34 SPAIN Data Center Market, By Facility Type, 2020-2028 (USD Million)

35 Rest Of Europe Data Center Market, By Infrastructure, 2020-2028 (USD Million)

36 REST OF EUROPE Data Center Market, By Tier Standards, 2020-2028 (USD Million)

37 REST OF EUROPE Data Center Market, By Facility Type, 2020-2028 (USD Million)

38 Schneider Electric SE: PRODUCTS & SERVICES OFFERING

39 Fujitsu Ltd: PRODUCTS & SERVICES OFFERING

40 Cisco Technology Inc.: PRODUCTS & SERVICES OFFERING

41 Eaton Corporation: PRODUCTS & SERVICES OFFERING

42 ABB Ltd: PRODUCTS & SERVICES OFFERING

43 AMAZON WEB SERVICES: PRODUCTS & SERVICES OFFERING

44 Microsoft: PRODUCTS & SERVICES OFFERING

45 Siemens AG: PRODUCTS & SERVICES OFFERING

46 Aksa Power Generation: PRODUCTS & SERVICES OFFERING

47 Mitsubishi Electric: PRODUCTS & SERVICES OFFERING

48 Other Companies: PRODUCTS & SERVICES OFFERING

LIST OF FIGURES

1 European Data Center Market Overview

2 European Data Center Market Value From 2020-2028 (USD Mllion)

3 European Data Center Market Share, By Infrastructure (2022)

4 European Data Center Market Share, By Tier Standards (2022)

5 European Data Center Market Share, By Facility Type (2022)

6 European Data Center Market, By Region (Europe Market)

7 Technological Trends In European Data Center Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The European Data Center Market

11 Impact Of Challenges On The European Data Center Market

12 Porter’s Five Forces Analysis

13 European Data Center Market: By Infrastructure Scope Key Takeaways

14 European Data Center Market, By Infrastructure Segment: Revenue Growth Analysis

15 IT Infrastructure Market, By Region, 2020-2028 (USD Mllion)

16 Electrical Infrastructure Market, By Region, 2020-2028 (USD Mllion)

17 Mechanical Infrastructure Market, By Region, 2020-2028 (USD Mllion)

18 General Construction Market, By Region, 2020-2028 (USD Mllion)

19 European Data Center Market: By Tier Standards Scope Key Takeaways

20 European Data Center Market, By Tier Standards Segment: Revenue Growth Analysis

21 Tier I Market, By Region, 2020-2028 (USD Mllion)

22 Tier II Market, By Region, 2020-2028 (USD Mllion)

23 Tier III Market, By Region, 2020-2028 (USD Mllion)

24 Tier IV Market, By Region, 2020-2028 (USD Mllion)

25 European Data Center Market: By Facility Type Scope Key Takeaways

26 European Data Center Market, By Facility Type Segment: Revenue Growth Analysis

27 Hyperscale Data Centers Market, By Region, 2020-2028 (USD Mllion)

28 Colocation Data Centers Market, By Region, 2020-2028 (USD Mllion)

29 Enterprise Data Centers Market, By Region, 2020-2028 (USD Mllion)

30 Regional Segment: Revenue Growth Analysis

31 European Data Center Market: Regional Analysis

32 European Data Center Market Overview

33 European Data Center Market, By Infrastructure

34 European Data Center Market, By Tier Standards

35 European Data Center Market, By Facility Type

36 European Data Center Market, By Country

37 Germany Data Center Market, By Infrastructure

38 Germany Data Center Market, By Tier Standards

39 Germany Data Center Market, By Facility Type

40 U.K. Data Center Market, By Infrastructure

41 U.K. Data Center Market, By Tier Standards

42 U.K. Data Center Market, By Facility Type

43 France Data Center Market, By Infrastructure

44 France Data Center Market, By Tier Standards

45 France Data Center Market, By Facility Type

46 Italy Data Center Market, By Infrastructure

47 Italy Data Center Market, By Tier Standards

48 Italy Data Center Market, By Facility Type

49 Spain Data Center Market, By Infrastructure

50 Spain Data Center Market, By Tier Standards

51 Spain Data Center Market, By Facility Type

52 Rest Of Europe Data Center Market, By Infrastructure

53 Rest Of Europe Data Center Market, By Tier Standards

54 Rest Of Europe Data Center Market, By Facility Type

55 Four Quadrant Positioning Matrix

56 Company Market Share Analysis

57 Schneider Electric SE: Company Snapshot

58 Schneider Electric SE: SWOT Analysis

59 Schneider Electric SE: Geographic Presence

60 Fujitsu Ltd: Company Snapshot

61 Fujitsu Ltd: SWOT Analysis

62 Fujitsu Ltd: Geographic Presence

63 Cisco Technology Inc.: Company Snapshot

64 Cisco Technology Inc.: SWOT Analysis

65 Cisco Technology Inc.: Geographic Presence

66 Eaton Corporation: Company Snapshot

67 Eaton Corporation: Swot Analysis

68 Eaton Corporation: Geographic Presence

69 ABB Ltd: Company Snapshot

70 ABB Ltd: SWOT Analysis

71 ABB Ltd: Geographic Presence

72 AMAZON WEB SERVICES: Company Snapshot

73 AMAZON WEB SERVICES: SWOT Analysis

74 AMAZON WEB SERVICES: Geographic Presence

75 Microsoft: Company Snapshot

76 Microsoft: SWOT Analysis

77 Microsoft: Geographic Presence

78 Siemens AG: Company Snapshot

79 Siemens AG: SWOT Analysis

80 Siemens AG: Geographic Presence

81 Aksa Power Generation.: Company Snapshot

82 Aksa Power Generation.: SWOT Analysis

83 Aksa Power Generation.: Geographic Presence

84 Mitsubishi Electric: Company Snapshot

85 Mitsubishi Electric: SWOT Analysis

86 Mitsubishi Electric: Geographic Presence

87 Other Companies: Company Snapshot

88 Other Companies: SWOT Analysis

89 Other Companies: Geographic Presence

The European Data Center Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the European Data Center Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS