Global Farm Equipment Rental Market Size, Trends & Analysis - Forecasts to 2028 By Equipment Type (Tractors, Harvesters, Sprayers, Balers, and Other Equipment Types), By Power Output (<30HP, 31-70HP, 71-130HP, 131-250HP, and >250HP), By Drive (Two-wheel Drive and Four-wheel Drive), and By Region (North America, Asia Pacific, Central and South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

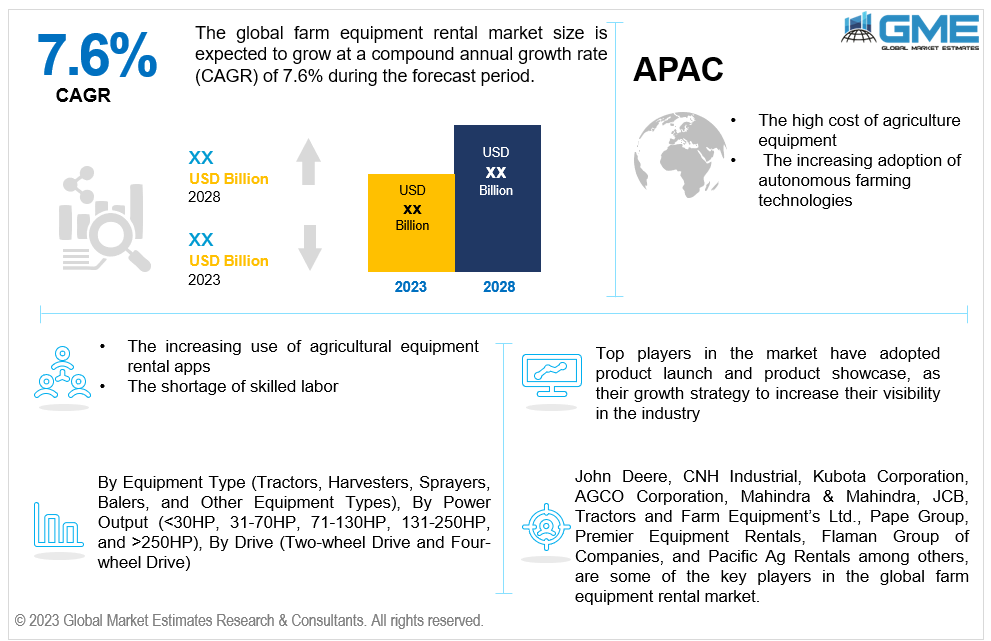

The global farm equipment rental market is estimated to exhibit a CAGR of 7.6% from 2023 to 2028.

The primary factors propelling the market growth include the high cost of agriculture equipment and the increasing adoption of autonomous farming technologies. Various technologies are helping the autonomous agricultural revolution acquire significant market traction. For many years, self-driving technology has been revolutionizing farm equipment. Some robots can harvest crops, and autonomous tractors and drones can be used to sow and monitor crops. For instance, in Central and Northern California, Monarch Tractor launched its first line of autonomous electric tractors in December 2022.

Many small and medium-sized farmers need help to buy expensive farm gear, including tractors, harvesters, and sprayers. The high initial price of new farm equipment and ongoing maintenance costs can be prohibitive. Therefore, these farmers are more inclined to choose equipment rental services as a practical substitute to purchase the required apparatus without worrying about up-front expenditures.

The increasing use of agricultural equipment rental apps and the shortage of skilled labor are expected to support the growth of the market during the forecast period. Farmers have a useful method to explore, choose, and hire the particular equipment they require due to agricultural equipment rental applications. Farmers can use these apps from their cellphones or other devices, improving accessibility and user-friendliness of the renting process. Additionally, a lot of agricultural equipment rental applications come with cutting-edge technological capabilities. These capabilities can consist of GPS monitoring, telematics, and data analytics, enabling farmers to keep an eye on equipment utilization, streamline processes, and make data-driven choices for their farms. For instance, Sonalika Group introduced "Sonalika Agro Solutions," an app that allows farmers to rent cutting-edge farm equipment, in 2021. The app links farmers with a variety of equipment renters that provide cutting-edge agricultural implements for rent in their locality.

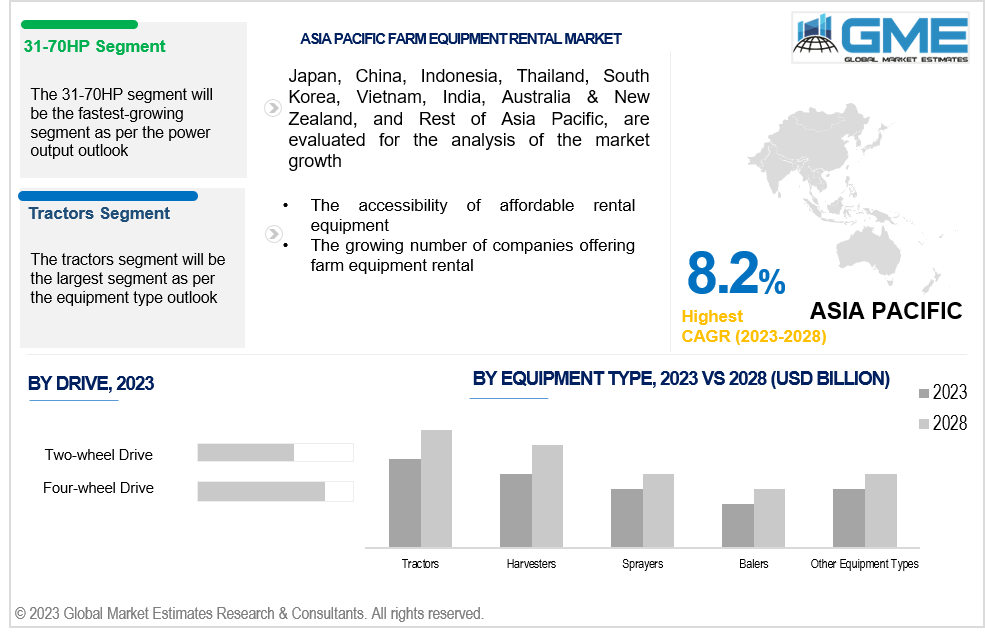

The accessibility of affordable rental equipment and the growing number of companies offering farm equipment rental propel the market growth. Farmers can get the equipment needed for their operations with the help of cost-effective rental equipment, which saves them from having to pay a hefty upfront cost for new equipment. Small and medium-sized farmers who cannot afford the finances to invest in expensive gear can significantly benefit from these cost reductions. For instance, Jacto, a Brazil-based agricultural machinery and solutions company, introduced spraying robot rentals in September 2022 for USD 6 per acre.

The increasing use of cutting-edge technologies, such as big data and artificial intelligence, advancements in the field of autonomous tractors, and rising demand for farm equipment from emerging economies such as Indonesia, Turkey, Nigeria, and others are creating opportunities in the farm equipment rental market. Moreover, offering ecologically responsible and sustainable equipment alternatives, such as electric or hybrid gear, can meet farmers' environmental concerns and fulfil the rising need for sustainable farming methods.

The tractors segment is expected to hold the largest share of the market. Market players are witnessing high demand for horsepower tractors, especially those with over 30 horsepower (HP), such as utility tractors and row crop tractors, from established regions like Europe and North America. For instance, small farmers in Tamil Nadu were provided 16500 tractors and 26,800 tools on a "free-of-cost" leasing basis by Tractors and Farm Equipment (TAFE), a leading tractor manufacturer in India, in May 2021.

The harvesters segment is expected to be the fastest-growing segment in the market from 2023-2028. The harvesters are self-propelled, versatile machines designed to quickly harvest a range of grain crops. Modern harvesters come with features like productivity monitoring, GPS guiding, and data collecting capabilities. These innovations can increase production and efficiency, making them appealing choices for tech-savvy farmers who are interested in renting the most recent models. As a result, the farm equipment rental market is witnessing a rise in demand for harvesters due to high labor prices and a shortage of workers in the harvesting sector.

The 71-130HP segment is expected to hold the largest share of the market. As nations in the Asia-Pacific region try to increase the rate of agriculture mechanization, demand for these tractors is increasing. For instance, emerging economies like India and China, have a increasing need for these tractors because of factors like greater need for food production, higher power needs on farms, and the sizeable size of agricultural holdings.

The 31-70HP segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Farming enterprises can use machinery in the 31-70HP range for various purposes. It is a useful tool for both small- and medium-scale farmers, as it can perform various jobs including tilling, planting, mowing, and light carrying.

The four-wheel drive segment is expected to hold the largest share of the market. Four-wheel drive equipment offers superior grip and stability for farming tasks in rugged terrain and bad weather. This equipment ensures that farming activities are not hampered by bad weather because it can readily navigate uneven and muddy areas. The increased demand for four-wheel-drive farm equipment has prompted the launch of new products by several businesses. For instance, the Farm Equipment Sector (FES), a division of Mahindra & Mahindra Ltd. announced the release of its 4 Wheel Drive (4WD) series of tractors in West Bengal in 2018.

The two-wheel drive segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Tractors with two-wheel drive are often less expensive than four-wheel drive. These tractors have low buying price since it contains fewer mechanical parts and simpler designs. They appeal to small-scale, resource-constrained farmers, who are more likely to employ rental services because of their affordability.

North America is expected to be the largest region in the market. This is due to the growing government subsidies for farming equipment and the introduction of automation in the agriculture and farming sectors. For instance, in December 2021, GUSS Automation, a U.S.-based manufacturer of mobile spraying robots for agriculture, introduced a miniature autonomous sprayer designed to automatically apply agricultural pesticides to crops.

Asia Pacific is predicted to witness rapid growth during the forecast period. Government programs and the active involvement by key players aiming at reducing farmers' expenses in Asia Pacific region nations like China and India serve as important growth drivers for the regional farm equipment rental market growth. In addition, to strengthen their market position, major market players in the region are focusing on mergers and acquisitions. For instance, Mahindra & Mahindra acquired 69% share in Carnot Technologies, a company that developed Krish e app, in March 2022. Each season, more than 25,000 tractors, harvesters, and sprayers from Carnot Technologies operate on more than 3 million acres of land.

John Deere, CNH Industrial, Kubota Corporation, AGCO Corporation, Mahindra & Mahindra, JCB, Tractors and Farm Equipment’s Ltd., Pape Group, Premier Equipment Rentals, Flaman Group of Companies, and Pacific Ag Rentals among others, are some of the key players in the global farm equipment rental market.

Please note: This is not an exhaustive list of companies profiled in the report.

John Deere introduced a new line of 8R wheel tractors, 8RT two-track tractors, and the company's first-ever four-track tractors in November 2019. These provide a smoother ride and are easier to operate than other wheel vehicles. The new Fendt momentum planter was introduced by AGCO Corporation in North America in January 2020 in an effort to improve seed placement accuracy.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL FARM EQUIPMENT RENTAL MARKET OUTLOOK

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL FARM EQUIPMENT RENTAL MARKET, BY EQUIPMENT TYPE

4.2 Farm Equipment Rental Market: Equipment Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Tractors Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Harvesters Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Sprayers Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Balers Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Other Equipment Types Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL FARM EQUIPMENT RENTAL MARKET, BY POWER OUTPUT

5.2 Farm Equipment Rental Market: Power Output Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 <30HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 31-70HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 71-130HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 131-250HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.8.1 >250HP Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL FARM EQUIPMENT RENTAL MARKET, BY DRIVE

6.2 Farm Equipment Rental Market: Drive Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Two-wheel Drive Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Four-wheel Drive Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL FARM EQUIPMENT RENTAL MARKET, BY REGION

7.2 North America Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1 U.S. Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2 Canada Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3 Mexico Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3 Europe Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1 Germany Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2 U.K. Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3 France Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4 Italy Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5 Spain Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6 Netherlands Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7 Rest of Europe Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4 Asia Pacific Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1 China Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2 Japan Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3 India Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4 South Korea Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5 Singapore Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6 Malaysia Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7 Thailand Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8 Indonesia Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9 Vietnam Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10 Taiwan Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1 Saudi Arabia Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2 U.A.E. Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3 Israel Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4 South Africa Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1 Brazil Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3 Chile Farm Equipment Rental Market Estimates and Forecast, 2020-2028 (USD Million)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Tractors and Farm Equipment’s Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Premier Equipment Rentals

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Flaman Group of Companies

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Mllion)

2 Tractors Market, By Region, 2020-2028 (USD Mllion)

3 Harvesters Market, By Region, 2020-2028 (USD Mllion)

4 Sprayers Market, By Region, 2020-2028 (USD Mllion)

5 Balers Market, By Region, 2020-2028 (USD Mllion)

6 Other Equipment Types Market, By Region, 2020-2028 (USD Mllion)

7 Global Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Mllion)

8 <30HP Market, By Region, 2020-2028 (USD Mllion)

9 31-70HP Market, By Region, 2020-2028 (USD Mllion)

10 71-130HP Market, By Region, 2020-2028 (USD Mllion)

11 131-250HP Market, By Region, 2020-2028 (USD Mllion)

12 >250HP Market, By Region, 2020-2028 (USD Mllion)

13 Global Farm Equipment Rental Market, By Drive, 2020-2028 (USD Mllion)

14 Two-wheel Drive Market, By Region, 2020-2028 (USD Mllion)

15 Four-wheel Drive Market, By Region, 2020-2028 (USD Mllion)

16 Regional Analysis, 2020-2028 (USD Mllion)

17 North America Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

18 North America Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

19 North America Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

20 North America Farm Equipment Rental Market, By Country, 2020-2028 (USD Million)

21 U.S Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

22 U.S Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

23 U.S Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

24 Canada Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

25 Canada Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

26 Canada Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

27 Mexico Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

28 Mexico Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

29 Mexico Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

30 Europe Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

31 Europe Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

32 Europe Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

33 Germany Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

34 Germany Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

35 Germany Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

36 UK Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

37 UK Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

38 UK Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

39 France Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

40 France Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

41 France Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

42 Italy Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

43 Italy Farm Equipment Rental Market, By T Power Output Type, 2020-2028 (USD Million)

44 Italy Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

45 Spain Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

46 Spain Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

47 Spain Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

48 Rest Of Europe Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

49 Rest Of Europe Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

50 Rest of Europe Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

51 Asia Pacific Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

52 Asia Pacific Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

53 Asia Pacific Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

54 Asia Pacific Farm Equipment Rental Market, By Country, 2020-2028 (USD Million)

55 China Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

56 China Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

57 China Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

58 India Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

59 India Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

60 India Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

61 Japan Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

62 Japan Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

63 Japan Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

64 South Korea Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

65 South Korea Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

66 South Korea Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

67 Middle East and Africa Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

68 Middle East and Africa Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

69 Middle East and Africa Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

70 Middle East and Africa Farm Equipment Rental Market, By Country, 2020-2028 (USD Million)

71 Saudi Arabia Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

72 Saudi Arabia Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

73 Saudi Arabia Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

74 UAE Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

75 UAE Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

76 UAE Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

77 Central and South America Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

78 Central and South America Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

79 Central and South America Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

80 Central and South America Farm Equipment Rental Market, By Country, 2020-2028 (USD Million)

81 Brazil Farm Equipment Rental Market, By Equipment Type, 2020-2028 (USD Million)

82 Brazil Farm Equipment Rental Market, By Power Output, 2020-2028 (USD Million)

83 Brazil Farm Equipment Rental Market, By Drive, 2020-2028 (USD Million)

84 John Deere: Products & Services Offering

85 CNH Industrial: Products & Services Offering

86 Kubota Corporation: Products & Services Offering

87 AGCO Corporation: Products & Services Offering

88 Mahindra & Mahindra: Products & Services Offering

89 JCB: Products & Services Offering

90 Tractors and Farm Equipment’s Ltd. : Products & Services Offering

91 Pape Group: Products & Services Offering

92 Premier Equipment Rentals, Inc: Products & Services Offering

93 Flaman Group of Companies: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Farm Equipment Rental Market Overview

2 Global Farm Equipment Rental Market Value From 2020-2028 (USD Mllion)

3 Global Farm Equipment Rental Market Share, By Equipment Type (2022)

4 Global Farm Equipment Rental Market Share, By Power Output (2022)

5 Global Farm Equipment Rental Market Share, By Drive (2022)

6 Global Farm Equipment Rental Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Farm Equipment Rental Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Farm Equipment Rental Market

11 Impact Of Challenges On The Global Farm Equipment Rental Market

12 Porter’s Five Forces Analysis

13 Global Farm Equipment Rental Market: By Equipment Type Scope Key Takeaways

14 Global Farm Equipment Rental Market, By Equipment Type Segment: Revenue Growth Analysis

15 Tractors Market, By Region, 2020-2028 (USD Mllion)

16 Harvesters Market, By Region, 2020-2028 (USD Mllion)

17 Sprayers Market, By Region, 2020-2028 (USD Mllion)

18 Balers Market, By Region, 2020-2028 (USD Mllion)

19 Other Equipment Types Market, By Region, 2020-2028 (USD Mllion)

20 Global Farm Equipment Rental Market: By Power Output Scope Key Takeaways

21 Global Farm Equipment Rental Market, By Power Output Segment: Revenue Growth Analysis

22 <30HP Market, By Region, 2020-2028 (USD Mllion)

23 31-70HP Market, By Region, 2020-2028 (USD Mllion)

24 71-130HP Market, By Region, 2020-2028 (USD Mllion)

25 131-250HP Market, By Region, 2020-2028 (USD Mllion)

26 >250HP Market, By Region, 2020-2028 (USD Mllion)

27 Global Farm Equipment Rental Market: By Drive Scope Key Takeaways

28 Global Farm Equipment Rental Market, By Drive Segment: Revenue Growth Analysis

29 Two-wheel Drive Market, By Region, 2020-2028 (USD Mllion)

30 Four-wheel Drive Market, By Region, 2020-2028 (USD Mllion)

31 Online Stores Market, By Region, 2020-2028 (USD Mllion)

32 Others Market, By Region, 2020-2028 (USD Mllion)

33 Regional Segment: Revenue Growth Analysis

34 Global Farm Equipment Rental Market: Regional Analysis

35 North America Farm Equipment Rental Market Overview

36 North America Farm Equipment Rental Market, By Equipment Type

37 North America Farm Equipment Rental Market, By Power Output

38 North America Farm Equipment Rental Market, By Drive

39 North America Farm Equipment Rental Market, By Country

40 U.S. Farm Equipment Rental Market, By Equipment Type

41 U.S. Farm Equipment Rental Market, By Power Output

42 U.S. Farm Equipment Rental Market, By Drive

43 Canada Farm Equipment Rental Market, By Equipment Type

44 Canada Farm Equipment Rental Market, By Power Output

45 Canada Farm Equipment Rental Market, By Drive

46 Mexico Farm Equipment Rental Market, By Equipment Type

47 Mexico Farm Equipment Rental Market, By Power Output

48 Mexico Farm Equipment Rental Market, By Drive

49 Four Quadrant Positioning Matrix

50 Company Market Share Analysis

51 John Deere: Company Snapshot

52 John Deere: SWOT Analysis

53 John Deere: Geographic Presence

54 CNH Industrial: Company Snapshot

55 CNH Industrial: SWOT Analysis

56 CNH Industrial: Geographic Presence

57 Kubota Corporation: Company Snapshot

58 Kubota Corporation: SWOT Analysis

59 Kubota Corporation: Geographic Presence

60 AGCO Corporation: Company Snapshot

61 AGCO Corporation: Swot Analysis

62 AGCO Corporation: Geographic Presence

63 Mahindra & Mahindra: Company Snapshot

64 Mahindra & Mahindra: SWOT Analysis

65 Mahindra & Mahindra: Geographic Presence

66 JCB: Company Snapshot

67 JCB: SWOT Analysis

68 JCB: Geographic Presence

69 Tractors and Farm Equipment’s Ltd. : Company Snapshot

70 Tractors and Farm Equipment’s Ltd. : SWOT Analysis

71 Tractors and Farm Equipment’s Ltd. : Geographic Presence

72 Pape Group: Company Snapshot

73 Pape Group: SWOT Analysis

74 Pape Group: Geographic Presence

75 Premier Equipment Rentals, Inc.: Company Snapshot

76 Premier Equipment Rentals, Inc.: SWOT Analysis

77 Premier Equipment Rentals, Inc.: Geographic Presence

78 Flaman Group of Companies: Company Snapshot

79 Flaman Group of Companies: SWOT Analysis

80 Flaman Group of Companies: Geographic Presence

81 Other Companies: Company Snapshot

82 Other Companies: SWOT Analysis

83 Other Companies: Geographic Presence

The Global Farm Equipment Rental Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Farm Equipment Rental Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS