Global Fluorosurfactant Market Size, Trends & Analysis - Forecasts to 2026 By Type (Cationic, Amphoteric, Non-Ionic, Anionic), By Application (Waxes & Polishes, Oilfields, Paints and Coatings, Adhesives, Industrial Cleaners, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

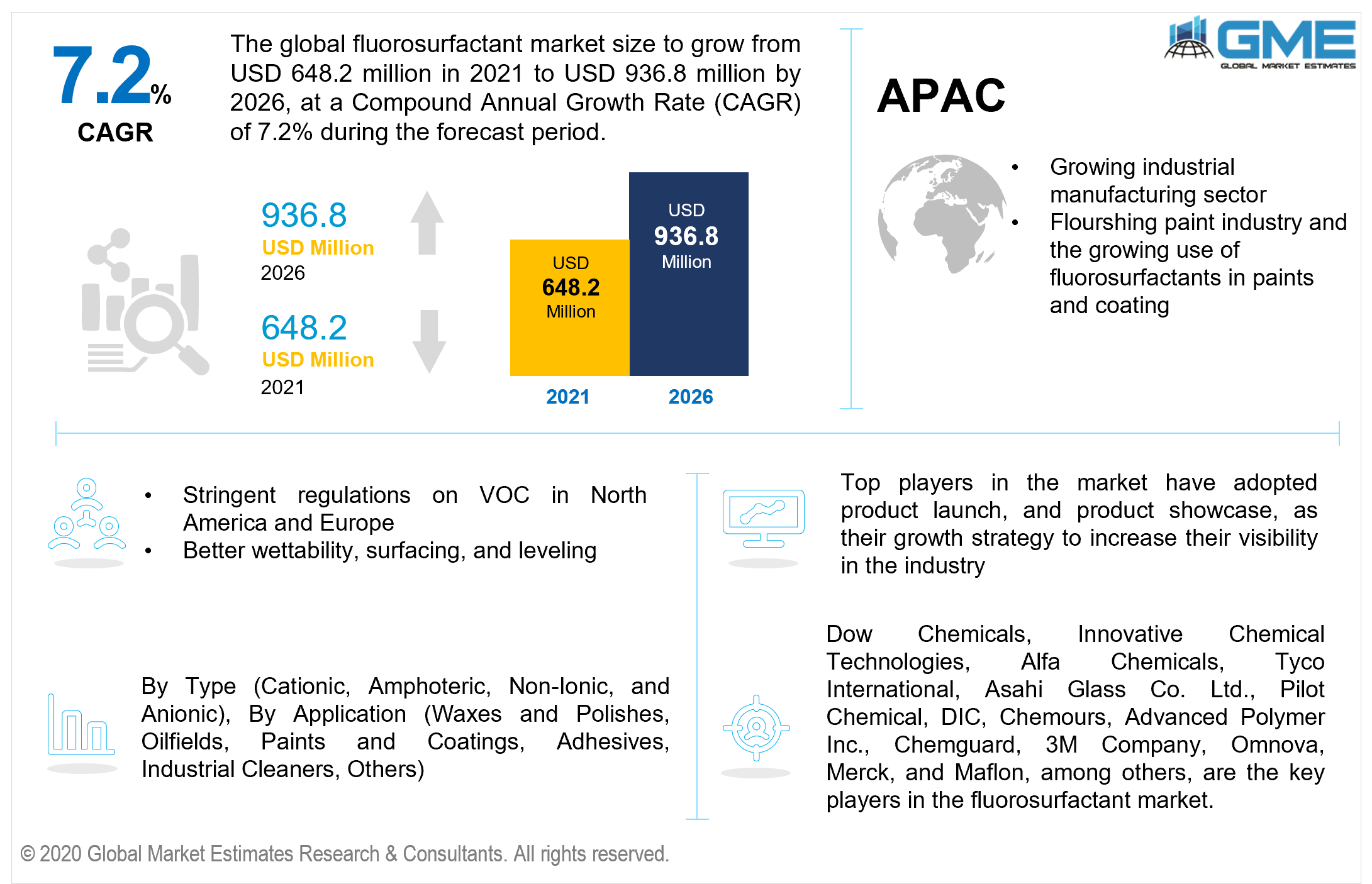

The global fluorosurfactant market size is projected to grow from USD 648.2 million in 2021 to USD 936.8 million by 2026 at a CAGR value of 7.2%. Fluorosurfactants are a subgroup of perfluorinated alkylated substances with a fluorine tail and a hydrophilic head. These compounds are effective in lowering the surface tension which makes them more effective than other hydrocarbon-based surfactants. By lowering surface tension, coatings can give a smoother and better finish to the final product. These compounds are used extensively in coatings due to their ability to reduce surface tension which can provide a better finish. The compound has excellent leveling properties that allow cleaners and waxes to remove hard to remove stains and dirt from the surface. Their wetting property is ideal for adhesives as they allow adhesives to seep into pores on the surface and improve the bond strength between the adhesive and surfaces.

In addition to the wetting and leveling properties, these compounds provide thermal stability and better foam control which enhances the effects of coatings, adhesives, waxes, and cleaners. The growing usage of these surfactants in coatings, adhesives, waxes, and cleaners, among applications, is one of the major factors that contribute to the growth of the fluorosurfactants market value. Hydrocarbon-based surfactants are becoming heavily scrutinized by environmental watchdog agencies due to the emission of volatile organic compounds. These surfactants do not accumulate within the human body like other perfluorinated alkylated and hydrocarbon surfactants.

The non-toxic nature of the compound is expected to further increase their demand resulting in greater revenue streams for fluorosurfactant manufacturers during the forecast period. These compounds are also used in inks and paints as they can prevent the ink or paint from transferring to another surface after they are applied. They provide better abrasion resistance and adherence between the surface and the ink or paint. The fluorosurfactant market report by GME entails more drivers, opportunities, and restraints on the fluorosurfactant market.

The fluorosurfactant market has been impacted by the Covid-19 pandemic as industrial manufacturing had to be shut down in countries across the world. As a result, prices of raw materials increased, supply chains were disrupted, and large projects were halted to prevent further losses. These surfactants are also used in the oilfield industry who faced heavy losses during the initial periods of the Covid-19 pandemic. The market is restrained by the higher price of these compounds when compared to its counterparts.

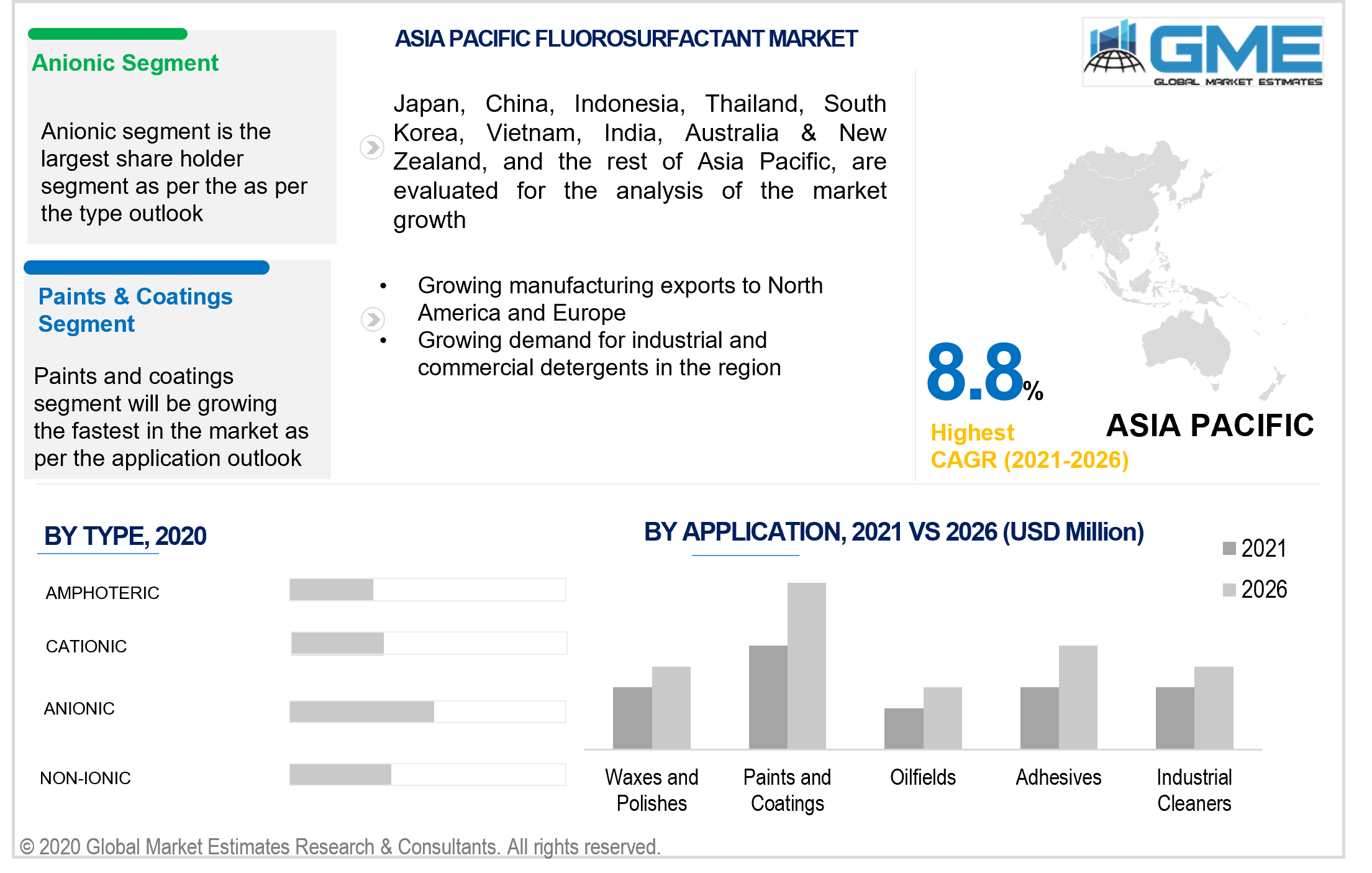

Based on the various types of fluorosurfactants available in the market, the market can be fragmented into cationic, amphoteric, non-ionic, and anionic segments. The anionic segment of the market is envisaged to grasp the largest share of the fluorosurfactant market during the forecast period. Anionic fluorosurfactants have excellent wetting, allow greater penetration onto the surface, and have better leveling properties than other surfactants available in the market. These compounds are used extensively in industrial grade and specialty detergents to enhance the cleaning properties of such detergents to remove deep stains.

The anionic segment has dominated the market due to the increased use of these compounds to make coatings and their increased usage in crude oil production as an alternative to volatile organic compounds. The expected growth of the market for coatings and other applications of anionic fluorosurfactants is foreseen to result in a significantly increased growth rate during the forecast period.

Based on the various applications of fluorosurfactants, the market can be differentiated into segments such as waxes and polishes, oilfields, paints and coatings, adhesives, industrial cleaners, and others. The large demand for fluorosurfactants in the coatings industry has culminated in the coatings segment holding the preponderance in the market. The non-toxic nature of these compounds combined with the growing stringent regulations on the hydrocarbon surfactants in North America and Europe have resulted in these compounds benefiting immensely.

The growth of industrial manufacturing and technological advancements are expected to further increase the demand for coatings during the forecast period. With such an expected increase in demand for coatings, the coatings segment of the market is also envisaged to register a commendable growth rate during the forecast period.

Based on region, the market can be broken into various regions such as North America, Europe, CSA, MENA, and the Asia Pacific regions. The North American region is expected to grasp the majority of the market as per the regional analysis. The oil drilling industry is one of the major backers of the growing fluorosurfactant market as these novel compounds are becoming increasingly popular in the oil industry. Other hydrocarbon-based surfactants are strictly regulated by the environmental watchdog bodies in the region. With the growing demand for crude oil products like lubricants and emulsifiers as the North American region dominates the crude oil production industry, this region is also expected to hold its dominant position over the market.

The APAC region is envisaged to register a considerably greater growth rate among all regions during the forecast period. The region’s growing industrial manufacturing industry and the export market are expected to support the growth of the fluorine tail perfluorinated alkylated surfactants market. With stringent regulations on hydrocarbon-based surfactants in North America and Europe, exporters in the region are also being forced to use fluorosurfactants for their coating and adhesive needs. The growing paint industry in the region and the growing usage of these compounds in detergents are envisaged to be the major contributors to the growth of the APAC market.

Dow Chemicals, Innovative Chemical Technologies, Alfa Chemicals, Tyco International, Asahi Glass Co. Ltd., Pilot Chemical, DIC, Chemours, Advanced Polymer Inc., Chemguard, 3M Company, Omnova, Merck, and Maflon, among others, are the key players in the fluorosurfactant market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Fluorosurfactants Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Fluorosurfactants Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing stringent regulations on other hydrocarbon-based surfactants due to emission of VOC

3.3.2 Industry Challenges

3.3.2.1 The greater cost of fluorosurfactants compared to other surfactants

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Fluorosurfactants Market, By Type

4.1 Type Outlook

4.2 Cationic

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Anionic

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Non-Ionic

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Amphoteric

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Fluorosurfactants Market, By Application

5.1 Application Outlook

5.2 Paints & Coatings

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Waxes & Polishes

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Oilfields

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Adhesives

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Industrial Cleaners

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Fluorosurfactants Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.7.2 Market size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Dow Chemicals

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Innovative Chemical Technologies

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Alfa Chemicals

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Tyco International

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Asahi Glass Co. Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Pilot Chemical

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 DIC

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Chemours

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Advanced Polymer Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Chemguard

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 3M Company

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Omnova

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Merck

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Maflon

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Other Companies

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

The Global Fluorosurfactant Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fluorosurfactant Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS