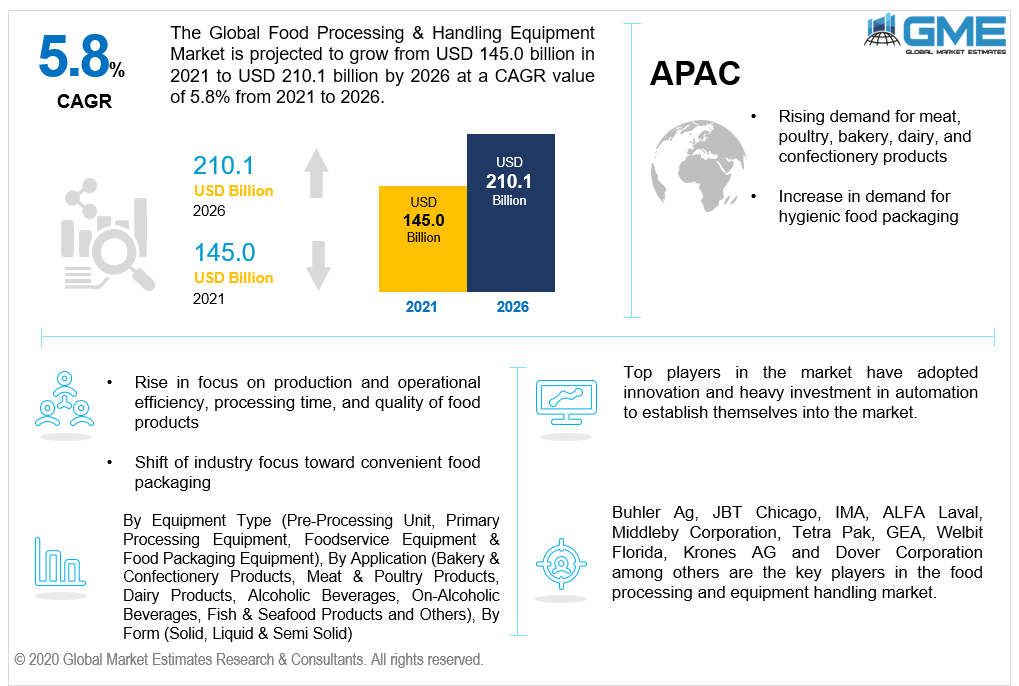

Global Food Processing & Handling Equipment Market, Trends & Analysis - Forecasts to 2026 By Equipment Type (Pre-Processing Unit, Primary Processing Equipment, Foodservice Equipment & Food Packaging Equipment), By Application (Bakery & Confectionery Products, Meat & Poultry Products, Dairy Products, Alcoholic Beverages, On-Alcoholic Beverages, Fish & Seafood Products and Others), By Form (Solid, Liquid & Semi Solid), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global food processing & handling equipment market is projected to grow from USD 145.0 billion in 2021 to USD 210.1 billion by 2026 at a CAGR value of 5.8% between 2021 to 2026.

Processing and handling equipment refers to a machine that enables easy process of manufacturing, packaging, storing and transporting of production plants. Food processing is done for various reasons, one of which is to extend the shelf life of the product and ensuring that the flavour and freshness remains unaffected. As per the GME analysis, the future of market provides immense growth opportunities for dairy products, bakery and condectionary, fruits and vegetables and ready to eat products.

Technological advancements in the food processing industry, innovation in processing technology, and continuous growth in the demand for processed food especially from the developing nations are some of the prime factors supporting the growth of the food & beverage processing equipment market.

Moreover, the expansion of food manufacturing capacities and growth of the food processing industry in countries like Malaysia, China, and India will also support the growth of the food & beverage processing equipment market.

With the growing preference for healthy food and functional foods, manufacturers are expected to adopt new equipment to fulfill the demand for healthy functional foods & beverages. Companies across food processing, food retail, and foodservice value chains have various opportunities to access or increase their penetration of equipment products, either organically or through acquisition.

Equipment cost and the high maintenance of smart and latest technologies could be a major factor that would hamper the market growth to some extent.

The COVID-19 pandemic affected various industries as supply chains were disrupted and manufacturing had to shut down to comply with government regulations. However, food industry is an integral part of the economy and the pandemic has plunged the entire food system into eccentric circumstances.

Considering the safety measures, various governments across globe have layed few guidelines and regulations related sanitisation during food processing and packaging process.. Additionally, Food Safety Management Systems (FSMS) have executed several codes to achieve food safety protocols based on Hazard Analysis and Critical Control (HACCP). Increasing investment to promote automated, human-free robot based production and storage will help the market grow rapidly during the forecast period.

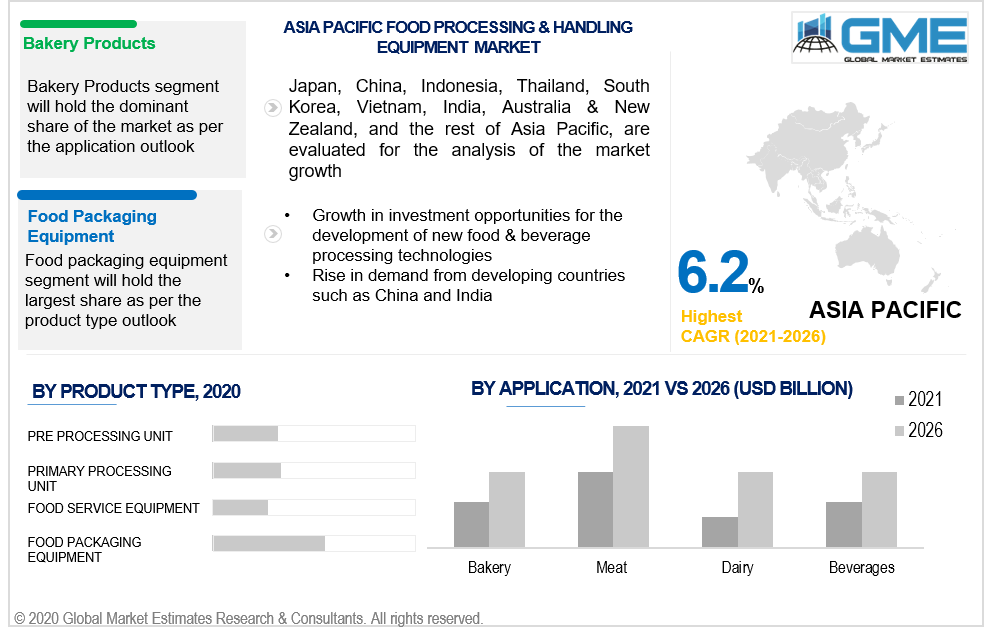

Based on the type of equipment/units, the market can be segmented into Pre-processing unit, primary processing equipment, foodservice equipment & food packaging equipment.

Food processing equipment is further classified into- pre-processing equipment which includes sporting equipment’s, peeling, grinding and washing equipments, whereas the primary processing equipment includes coating products, drying, freezing, thermal equipments. Food service equipment includes cooking, refrigeration and storage equipment, food preparation and serving equipment.

The food processing equipment is analyzed to be the largest segment in the market. Food companies are focusing on product innovations and providing efficient and advanced technologies to food producers who are demanding operationally advanced machinery to cater to the growing demand from the food industry. New technologies such as non-thermal processing are also being developed to support the manufacturing process by reducing production time, ingredient & food waste, and overall cost. The growing health awareness is driving the demand for healthy and convenience food products, which is also expected to drive the food processing & handling market in the food industry.

Based on application, the market is further classified by bakery & confectionery products, meat & poultry products, dairy products, alcoholic beverages, non-alcoholic beverages, fish & seafood products & others. Bakery and confectionery segment is analyzed to be the largest market share holder as of 2020.

Processing equipment such as industrial ovens, molders, formers, mixers, blenders, and cutters form an integral part of bakery & confectionery products manufacturing. Their high demand is mainly due to the highly fragmented bakery & confectionery market and high prevalence and demand for these products in both developed and developing countries.

Based on form, the market is classified into solid food (includes infant cereals, meat, fruits, vegetables and cheese); and semi solid food (includes yogurt, salad dressings, butter spread, sauce, etc.) and liquid food (includes packaged drinking water, oil, sugar syrups, pudding).

Out of the above mentioned, solid food holds the largest share in the market as of 2020. It is further projected to grow at the fastest rate during the forecast period of 2021 to 2026. With growing urbanisation and increasing awareness and demand for ready to cook bakery items, the segment is ought to have the capacity to outperform during the forecast period.

Based on region, the market can be segmented into North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, and Rest of Europe), Central & South America (Brazil and Rest of Central & South America), Middle East and Africa (UAE, Saudi Arabia and Rest of Middle East & Africa), and Asia Pacific (China, Japan, India and Rest of Asia Pacific). The North American region is expected to hold the lion’s share whereas APAC region is expected to be the fastest growing segment in the market.

The Asia Pacific region is expected to experience a sharp rise in the demand for advanced food processing machinery that helps reduce processing time and enhance the efficiency of manufacturing operations. The expected growth in the number of food processing units in this region is further projected to boost the supply and consumption of food & beverage processing equipment.

Buhler Ag, JBT Chicago, IMA, ALFA Laval, Middleby Corporation, Tetra Pak, GEA, Welbit Florida, Krones AG and Dover Corporation among others are the key players in the food processing and equipment handling market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Food Processing & Handling Equipment Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Equipment Type Overview

2.1.3 Form Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Food Processing & Handling Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Demand for Meat, Poultry, Bakery, Dairy, and Confectionery Products

3.3.2 Industry Challenges

3.3.2.1 Stringent Environmental Regulations

3.4 Prospective Growth Scenario

3.4.1 Equipment Type Growth Scenario

3.4.2 Form Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Food Processing & Handling Equipment Market, By Product Type

4.1 Product Type Outlook

4.2 Pre-Processing Equipment

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Primary Processing Equipment

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Foodservice Equipment

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Food Packaging Equipment

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Food Processing & Handling Equipment Market, By Application

5.1 Application Outlook

5.2 Bakery & Confectionery Products

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Meat & Poultry Products

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Dairy Products

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Alcoholic and Non-Alcoholic Beverages

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

Chapter 6 Food Processing & Handling Equipment Market, By Form

6.1 Solid

6.1.1 Market Size, By Region, 2016-2026 (USD Billion)

6.2 Liquid

6.2.1 Market Size, By Region, 2016-2026 (USD Billion)

6.2 Semi Solid

6.2.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 7 Food Processing & Handling Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Billion)

7.2.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.2.3 Market Size, By Form, 2016-2026 (USD Billion)

7.2.4 Market Size, By Application, 2016-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.2.4.2 Market Size, By Form, 2016-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2016-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.2.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Billion)

7.3.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.3 Market Size, By Form, 2016-2026 (USD Billion)

7.3.4 Market Size, By Application, 2016-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.6.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.9.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.10.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2016-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.3.11.2 Market Size, By Form, 2016-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2016-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Billion)

7.4.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.3 Market Size, By Form, 2016-2026 (USD Billion)

7.4.4 Market Size, By Application, 2016-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.6.2 Market Size, By Form, 2016-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.9.2 Market size, By Form, 2016-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2016-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.4.10.2 Market Size, By Form, 2016-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2016-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Billion)

7.5.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.5.3 Market Size, By Form, 2016-2026 (USD Billion)

7.5.4 Market Size, By Application, 2016-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.5.6.2 Market Size, By Form, 2016-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2016-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.5.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.5.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Billion)

7.6.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.6.3 Market Size, By Form, 2016-2026 (USD Billion)

7.6.4 Market Size, By Application, 2016-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.6.6.2 Market Size, By Form, 2016-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.6.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

7.6.7.2 Market Size, By Form, 2016-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Buhler Ag

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 JBT Chicago

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 ALFA Laval

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 IMA

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Tetra Pak

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Middleby Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 GEA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Other Companies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

The Global Food Processing & Handling Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Food Processing & Handling Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS