Global Gas Turbine Filters Market Size, Trends & Analysis - Forecasts to 2026 By Product (Intake Systems, Self-Cleaning Air System, Static Air Filters, Cartridge Filters, Compact Filters, Pulse Filters, Panel Filters, Pre-Cleaning Filters, and Others), By Application (Power Generation, Oil & Gas, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

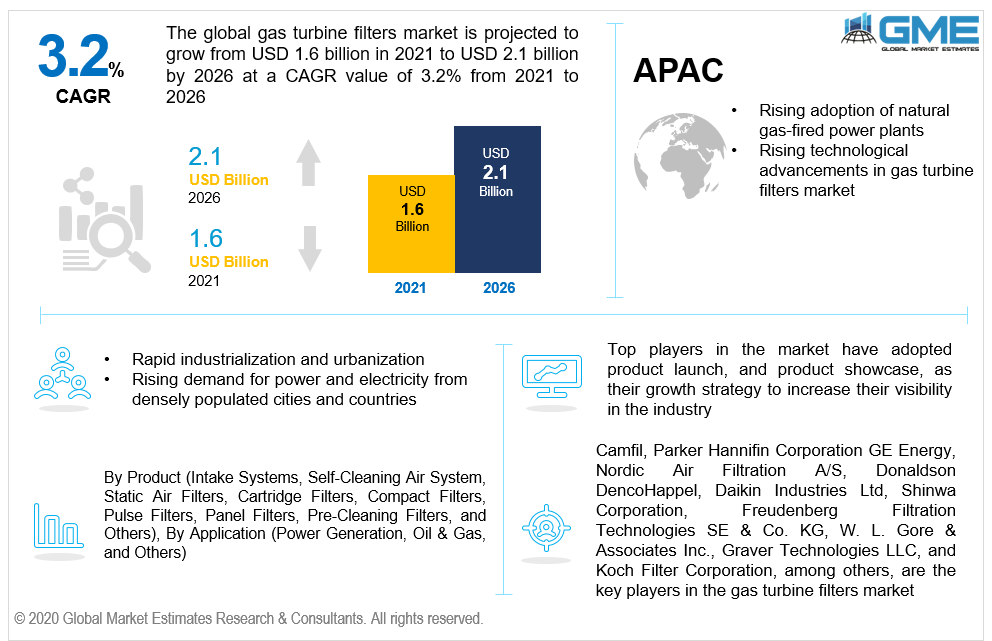

The global gas turbine filters market is projected to grow from USD 1.6 billion in 2021 to USD 2.1 billion by 2026 at a CAGR value of 3.2% from 2021 to 2026.

The rising adoption of natural gas-fired power plants, due to increasing focus on clean power generation, is expected to experience robust growth during the forecast period, and this, in turn, is expected to drive the gas turbine filters market due to its vast application in the power sector.

The growing energy consumption numbers across the globe have promoted the adoption of power generation through the use of natural gas and other sources. Power generation industries rely on gas turbines for their energy generation needs and inefficient running of gas turbines can prove to be costly. As industries aim to reduce their footprint, efficient generation of power with minimal wastage is becoming vital. Inadequate air filtration systems can result in severe loss of power capacity, reduce runtime, and damage turbines.

The use of filters in the gas turbines can help companies to maintain clean engine performance, minimize downtime and save on maintenance costs. These filtration systems protect turbines from the pollutants in the air and prevent fouling, erosion, and cooling holes in turbines. Preventing contaminants such as particulate matter and airborne salts is becoming a necessity among various industries.

Technological advancements in filters have also increased their demand as industries look to prevent losses due to the inefficient running of power generators and engines. The development of the high-efficiency particulate arrestor (HEPA) filters made from hydrophobic expanded polytetrafluoroethylene has increased the efficiency of gas turbines as these filters can protect the turbines from water and salts within the intake air.

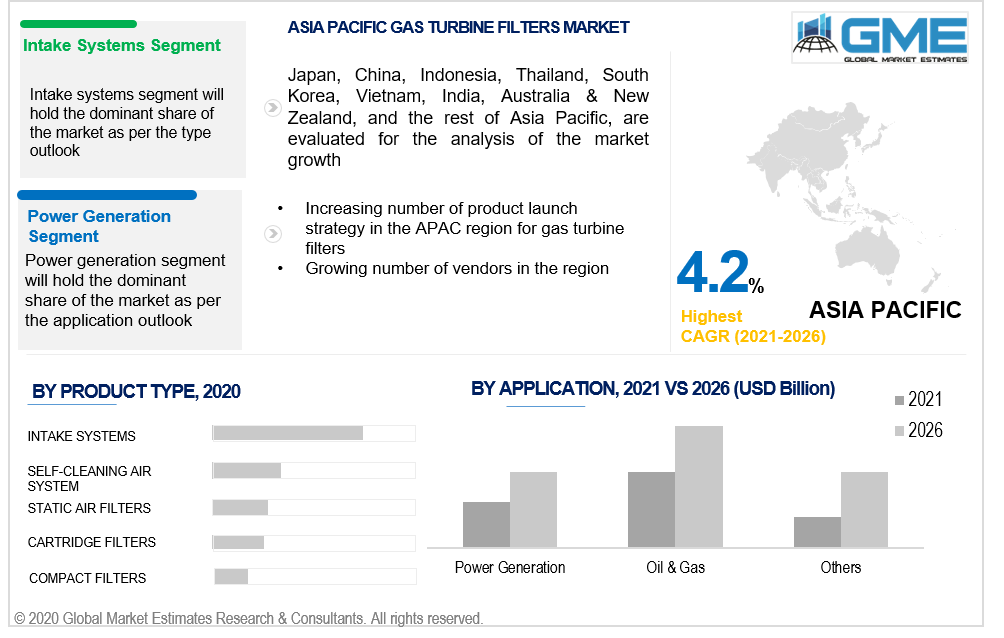

Based on the gas turbine filters used, the gas turbine filters market can be segmented into intake systems, self-cleaning air systems, static air filters, cartridge filters, compact filters, pulse filters, panel filters, pre-cleaning filters, and others. The intake systems segment is expected to hold the largest share of the gas turbine filters market during the forecast period of 2021 to 2026. Intake systems have been widely implemented in various industries as they are more efficient at filtering out contaminants. The large demand for these systems from the oil & gas and power generation industries has been the major driver of this segment.

Based on the various applications in which the transradial approach is used, the gas turbine filters market is segmented into power generation, oil & gas, and others. The power generation segment held the lion’s share of the gas turbine filters market. Growing usage of natural gas in power generation has increased the demand for gas turbine filters resulting in the dominance of the power generation segment.

Owing to its clean nature, natural gas is quickly becoming very popular fuel for electricity. Natural gas-fired electricity is expected to account for 80% of all further electricity generation capacity, by 2035.

Furthermore, some of the factors driving the demand for gas turbine in power generation sector are rising demand for multiple fuel capabilities (renewable and synthesis fuels, short construction lead time, and modular construction), low power generation operational cost, low installation cost, reduced emissions, and very high efficiency. Hence, the booming power generation industry is expected to boost the demand for the air filtration systems during the forecast period.

Gas turbines are commonly used in gas-fired power plants. As of 2019, more than 23% of the global power generation came from natural gas. Natural gas is one of the growing sources of power generation as it is in line with the global goals of reducing greenhouse gas emissions.

Based on region, the gas turbine filters market is segmented into various regions such as North America (United States, Canada, and Mexico), Europe (Germany, United Kingdom, France, Italy, Spain, Netherlands, Russia, and Rest of Europe), Central, and South America (Brazil, Argentina, and rest of Central and South America), the Middle East and Africa (South Africa, Saudi Arabia, UAE, and rest of Middle East & Africa), and the Asia Pacific (Japan, China, India, South Korea, Malaysia, Singapore and Rest of Asia Pacific). The North American region (United States, Canada, and Mexico) is expected to hold the lion’s share of the global gas turbine filters market. However, Asia Pacific will be growing the fastest in the market from 2021 to 2026.

The factors driving the Asia Pacific market are rapid industrialization and urbanization, rising demand for power and electricity from densely populated cities and countries, and low labor wages, resulting in a growing manufacturing sector. Moreover, the rapidly increasing construction activities in China, Japan, and India have contributed to a considerable increase in pollution levels. To combat these issues, the governments of China, India, and other developing economies have been imposing laws to use low-polluting gas-based stations. Such initiatives are expected to boost the demand for the gas turbine filters in the Asia Pacific market.

Further, owing to the fact that Asia Pacific is a major source for low cost labourer and highly skilled technicians, most of the turbine air filtration manufacturers have started aligning their focus toward business expansions across India, and China. (One of the biggest manufacturing industries in the world). This trend is expected to support the rapid growth of the APAC market from 2021 to 2026.

Asian countries, such as India, in a bid to increase the utilization of gas-fired powered plants in December 2019, announced that it is working on a new plan to revive the gas-based power generation in the country. The plan was to bundle natural gas-based power generation (electricity rate of ~INR 4/unit) with the electricity generated from solar (~INR 2.95/Unit) and thus reduce the financial burden on the power generation companies and increase profitability. The implementation is likely to propel the demand for gas turbine filters during the forecast period.

The gas turbine filters market forecast study includes information on the top players offering robust product portfolios with a dominant presence in the developed nations. The market is largely segmented and competitive attributed to the prevalence of prominent competitors in the gas turbine filters industry.

Camfil, Parker Hannifin Corporation, GE Energy, Nordic Air Filtration A/S, Donaldson, Dencohappel, Daikin Industries Ltd, Shinwa Corporation, Freudenberg Filtration Technologies SE & Co. KG, W. L. Gore & Associates Inc., Graver Technologies LLC, and Koch Filter Corporation, among others, are the key players in the gas turbine filters market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Gas Turbine Filters Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Gas Turbine Filters Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising adoption of natural gas-fired power plants

3.3.2 Industry Challenges

3.3.2.1 Stringent regulations on the use of gas turbine filters and rising environmental concerns

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Gas Turbine Filters Market, By Product Type

4.1 Product Type Outlook

4.2 Intake Systems

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Self-Cleaning Air System

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Static Air Filters

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Cartridge Filters

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Compact Filters

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Pulse Filters

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Panel Filters

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

4.9 Pre-Cleaning Filters

4.9.1 Market Size, By Region, 2020-2026 (USD Billion)

4.10 Others

4.10.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Gas Turbine Filters Market, By Application

5.1 Application Outlook

5.2 Power Generation

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Oil & Gas

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Industrial

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Gas Turbine Filters Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Camfil,

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Parker Hannifin Corporation GE Energy

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Nordic Air Filtration A/S

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Donaldson DencoHappel

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Daikin Industries Ltd

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Shinwa Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Freudenberg Filtration Technologies SE & Co.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Graver Technologies LLC

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Koch Filter Corporation

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Gas Turbine Filters Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Gas Turbine Filters Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS