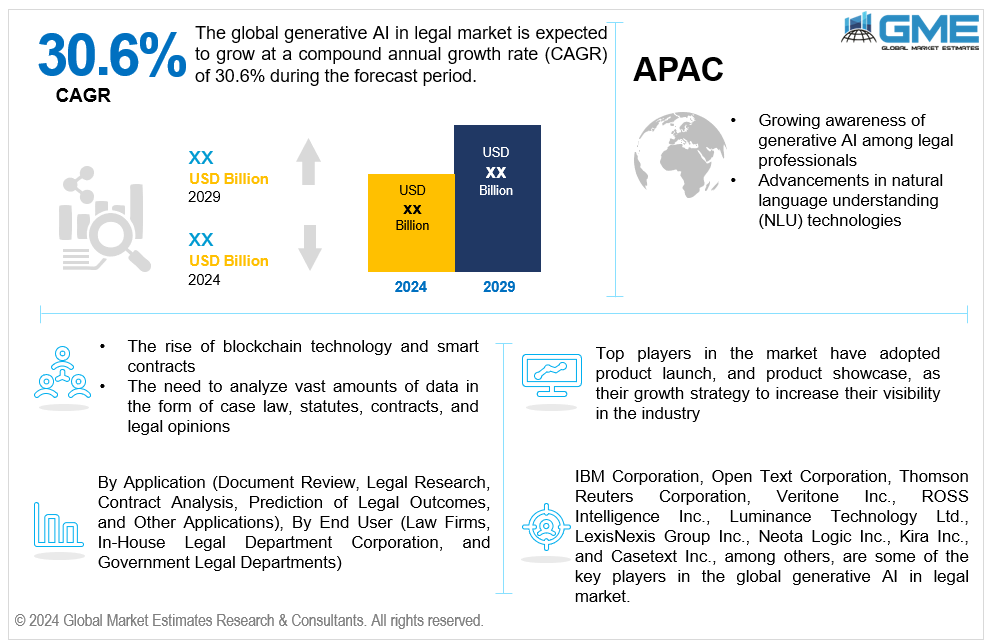

Global Generative AI in Legal Market Size, Trends & Analysis - Forecasts to 2029 By Application (Document Review, Legal Research, Contract Analysis, Prediction of Legal Outcomes, and Other Applications), By End User (Law Firms, In-House Legal Department, and Government Legal Departments), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global generative artificial intelligence (AI) in legal market is estimated to exhibit a CAGR of 30.6% from 2024 to 2029.

The primary factors propelling the market growth are the growing awareness of generative AI among legal professionals and advancements in natural language understanding (NLU) technologies. Legal practitioners are becoming more conscious of the potential advantages of generative AI technology in enhancing the quality of legal services provided, cutting expenses, and streamlining workflows. To remain competitive in a legal market that is shifting quickly, legal professionals are becoming increasingly aware of the potential uses and capabilities of generative artificial intelligence (AI). For instance, a survey report released by LexisNexis in 2023 indicates that over 1,000 legal professionals in the UK know about generative artificial intelligence (GenAI).

The rise of blockchain technology and smart contracts and the growing need to analyze vast amounts of data in case law, statutes, contracts, and legal opinions are expected to support the market growth. Traditional legal research techniques require a lot of time and effort. With the help of generative AI technologies, legal experts and lawyers can save much time and effort by swiftly sorting through enormous volumes of data to find pertinent information. Furthermore, generative AI systems can precisely and accurately analyze legal documents since they are developed to comprehend and interpret complicated legal terminology. When making legal choices, this can help attorneys avoid mistakes and guarantee that they have taken into account all pertinent information.

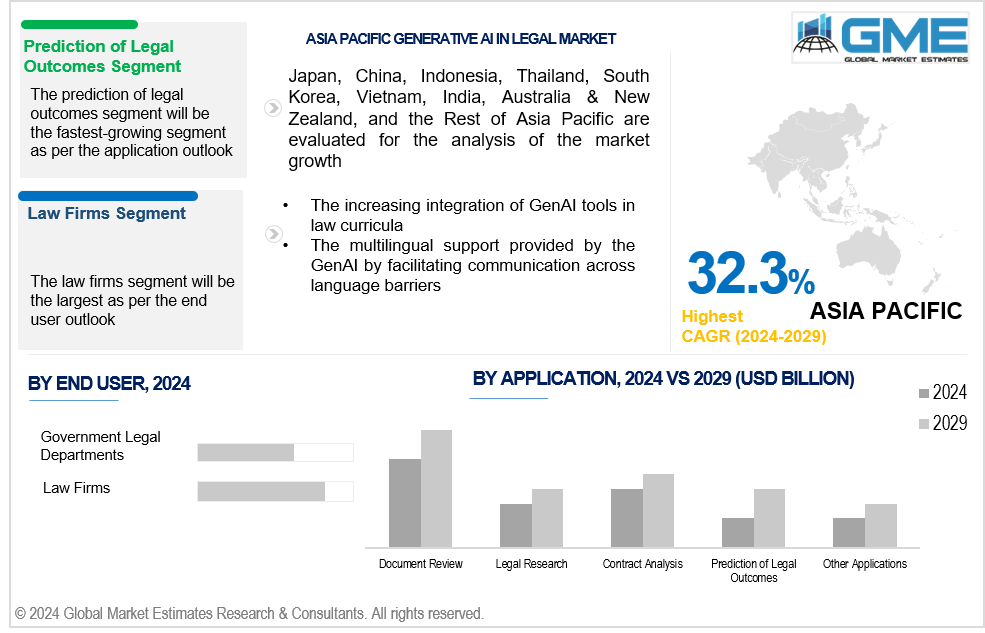

The increasing integration of GenAI tools in law curricula and the multilingual support provided by the GenAI propel market growth. GenAI tools are progressively being integrated into law school courses, which promotes the use of technology in legal teaching. This growth improves student learning experiences and prepares them for current legal practice. Future attorneys are made aware of the potential uses and capabilities of GenAI in the legal sector through this exposure, which will increase demand for these tools once they enter the workforce.

Through analyzing policies, procedures, and regulatory documents, generative AI can assist enterprises in ensuring compliance with legal regulations and requirements. It can spot any problems with compliance and offer suggestions for reducing risks. Furthermore, virtual assistants driven by generative AI can help attorneys and legal professionals handle fundamental inquiries, set up appointments, organize paperwork, and carry out other administrative duties.

However, data privacy and security concerns and high implementation costs impede market growth.

The document review segment is expected to hold the largest share of the market over the forecast period. The legal industry is filled with enormous quantities of paperwork, including agreements, court filings, contracts, and precedents. Manually reviewing these documents requires a significant amount of time and money. Generative AI provides a solution by automating the review procedure and facilitating the rapid analysis of massive document volumes.

The prediction of legal outcomes segment is expected to be the fastest-growing segment in the market from 2024 to 2029. A growing number of attorneys are looking for resources that can give them insights into possible legal outcomes. With the use of generative AI and predictive analytics, court procedures can be predicted by analyzing vast databases of cases, laws, and precedents. This demand stems from the need to plan, anticipate problems, and create efficient legal solutions.

The law firms segment is expected to hold the largest share of the market over the forecast period. Law firms handle numerous legal matters for clients across various industries. Complex workflows, such as document review, legal research, case analysis, contract preparation, and litigation support, are frequently involved in these legal matters. Generative AI provides solutions to improve productivity, optimize workflows, and provide clients value-added services.

The government legal departments segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Government legal departments frequently handle complex legal cases requiring in-depth investigation and evaluation. Automating repetitive operations and offering insights into legal data are two ways that generative AI can help streamline these procedures.

North America is expected to be the largest region in the global market. The market's growth is driven by its robust legal industry, which is embracing technology to increase consumer satisfaction and service delivery and gain a competitive edge. Legal practitioners view GenAI as a useful tool that can enhance their abilities, automate repetitive work, and extract insights from legal papers.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Artificial intelligence and machine learning technologies are developing at a rapid pace in the Asia Pacific region. Legal firms are using generative AI tools to improve their services and remain competitive as these technologies grow more advanced and accessible.

IBM Corporation, Open Text Corporation, Thomson Reuters Corporation, Veritone Inc., ROSS Intelligence Inc., Luminance Technology Ltd., LexisNexis Group Inc., Neota Logic Inc., Kira Inc., and Casetext Inc., among others, are some of the key players in the global generative AI in legal market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2023, the legal technology company Casetext, Inc. was acquired by Thomson Reuters Corporation for a cash purchase price of USD 650 million.

In May 2023, Luminance announced the release of the AI-powered "Ask Lumi" chatbot, the most recent novel application of its specialized legal large language model (LLM). As the first chatbot powered by this legal-grade AI, "Ask Lumi" enables users to open any contract in Microsoft Word, ask the AI questions about it, and get prompt answers.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 End User Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GENERATIVE AI IN LEGAL MARKET, BY Application

4.1 Introduction

4.2 Generative AI in Legal Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Document Review

4.4.1 Document Review Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Legal Research

4.5.1 Legal Research Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Contract Analysis

4.6.1 Contract Analysis Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Prediction of Legal Outcomes

4.7.1 Prediction of Legal Outcomes Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Other Applications

4.8.1 Other Applications Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL GENERATIVE AI IN LEGAL MARKET, BY END USER

5.1 Introduction

5.2 Generative AI in Legal Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Law Firms

5.4.1 Law Firms Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 In-House Legal Department Corporation

5.5.1 In-House Legal Department Corporation Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Government Legal Departments

5.6.1 Government Legal Departments Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL GENERATIVE AI IN LEGAL MARKET, BY REGION

6.1 Introduction

6.2 North America Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By End User

6.2.3.2 Canada Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By End User

6.2.3.3 Mexico Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By End User

6.3 Europe Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By End User

6.3.3.2 U.K. Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By End User

6.3.3.3 France Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By End User

6.3.3.4 Italy Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By End User

6.3.3.5 Spain Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By End User

6.3.3.6 Netherlands Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By End User

6.4 Asia Pacific Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By End User

6.4.3.2 Japan Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By End User

6.4.3.3 India Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By End User

6.4.3.4 South Korea Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By End User

6.4.3.5 Singapore Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By End User

6.4.3.6 Malaysia Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By End User

6.4.3.7 Thailand Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By End User

6.4.3.8 Indonesia Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By End User

6.4.3.9 Vietnam Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By End User

6.4.3.10 Taiwan Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By End User

6.5 Middle East and Africa Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By End User

6.5.3.3 Israel Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By End User

6.5.3.4 South Africa Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By End User

6.6 Central and South America Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By End User

6.6.3.2 Argentina Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By End User

6.6.3.3 Chile Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Generative AI in Legal Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 IBM Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Open Text Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Thomson Reuters Corporation

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Veritone Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 ROSS Intelligence Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 LUMINANCE TECHNOLOGY LTD.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 LexisNexis Group Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Neota Logic Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Kira Inc.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Casetext Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

2 Document Review Market, By Region, 2021-2029 (USD Mllion)

3 Legal Research Market, By Region, 2021-2029 (USD Mllion)

4 Contract Analysis Market, By Region, 2021-2029 (USD Mllion)

5 Prediction of Legal Outcomes Market, By Region, 2021-2029 (USD Mllion)

6 Other Applications Market, By Region, 2021-2029 (USD Mllion)

7 Global Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

8 Law Firms Market, By Region, 2021-2029 (USD Mllion)

9 In-House Legal Department Corporation Market, By Region, 2021-2029 (USD Mllion)

10 Government Legal Departments Market, By Region, 2021-2029 (USD Mllion)

11 Regional Analysis, 2021-2029 (USD Mllion)

12 North America Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

13 North America Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

14 North America Generative AI in Legal Market, By COUNTRY, 2021-2029 (USD Mllion)

15 U.S. Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

16 U.S. Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

17 Canada Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

18 Canada Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

19 Mexico Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

20 Mexico Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

21 Europe Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

22 Europe Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

23 EUROPE Generative AI in Legal Market, By COUNTRY, 2021-2029 (USD Mllion)

24 Germany Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

25 Germany Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

26 U.K. Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

27 U.K. Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

28 France Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

29 France Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

30 Italy Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

31 Italy Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

32 Spain Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

33 Spain Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

34 Netherlands Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

35 Netherlands Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

36 Rest Of Europe Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

37 Rest Of Europe Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

38 Asia Pacific Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

39 Asia Pacific Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

40 ASIA PACIFIC Generative AI in Legal Market, By COUNTRY, 2021-2029 (USD Mllion)

41 China Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

42 China Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

43 Japan Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

44 Japan Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

45 India Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

46 India Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

47 South Korea Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

48 South Korea Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

49 Singapore Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

50 Singapore Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

51 Thailand Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

52 Thailand Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

53 Malaysia Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

54 Malaysia Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

55 Indonesia Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

56 Indonesia Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

57 Vietnam Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

58 Vietnam Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

59 Taiwan Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

60 Taiwan Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

61 Rest of APAC Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

62 Rest of APAC Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

63 Middle East and Africa Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

64 Middle East and Africa Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

65 MIDDLE EAST & ADRICA Generative AI in Legal Market, By COUNTRY, 2021-2029 (USD Mllion)

66 Saudi Arabia Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

67 Saudi Arabia Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

68 UAE Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

69 UAE Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

70 Israel Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

71 Israel Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

72 South Africa Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

73 South Africa Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

76 Central and South America Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

77 Central and South America Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

78 CENTRAL AND SOUTH AMERICA Generative AI in Legal Market, By COUNTRY, 2021-2029 (USD Mllion)

79 Brazil Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

80 Brazil Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

81 Chile Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

82 Chile Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

83 Argentina Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

84 Argentina Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Generative AI in Legal Market, By Application, 2021-2029 (USD Mllion)

86 Rest Of Central and South America Generative AI in Legal Market, By End User, 2021-2029 (USD Mllion)

87 IBM Corporation: Products & Services Offering

88 Open Text Corporation: Products & Services Offering

89 Thomson Reuters Corporation: Products & Services Offering

90 Veritone Inc.: Products & Services Offering

91 ROSS Intelligence Inc.: Products & Services Offering

92 LUMINANCE TECHNOLOGY LTD.: Products & Services Offering

93 LexisNexis Group Inc.: Products & Services Offering

94 Neota Logic Inc.: Products & Services Offering

95 Kira Inc., Inc: Products & Services Offering

96 Casetext Inc.: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Generative AI in Legal Market Overview

2 Global Generative AI in Legal Market Value From 2021-2029 (USD Mllion)

3 Global Generative AI in Legal Market Share, By Application (2023)

4 Global Generative AI in Legal Market Share, By End User (2023)

5 Global Generative AI in Legal Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Generative AI in Legal Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Generative AI in Legal Market

10 Impact Of Challenges On The Global Generative AI in Legal Market

11 Porter’s Five Forces Analysis

12 Global Generative AI in Legal Market: By Application Scope Key Takeaways

13 Global Generative AI in Legal Market, By Application Segment: Revenue Growth Analysis

14 Document Review Market, By Region, 2021-2029 (USD Mllion)

15 Legal Research Market, By Region, 2021-2029 (USD Mllion)

16 Contract Analysis Market, By Region, 2021-2029 (USD Mllion)

17 Prediction of Legal Outcomes Market, By Region, 2021-2029 (USD Mllion)

18 Other Applications Market, By Region, 2021-2029 (USD Mllion)

19 Global Generative AI in Legal Market: By End User Scope Key Takeaways

20 Global Generative AI in Legal Market, By End User Segment: Revenue Growth Analysis

21 Law Firms Market, By Region, 2021-2029 (USD Mllion)

22 In-House Legal Department Corporation Market, By Region, 2021-2029 (USD Mllion)

23 Government Legal Departments Market, By Region, 2021-2029 (USD Mllion)

24 Global Generative AI in Legal Market: Regional Analysis

25 North America Generative AI in Legal Market Overview

26 North America Generative AI in Legal Market, By Application

27 North America Generative AI in Legal Market, By End User

28 North America Generative AI in Legal Market, By Country

29 U.S. Generative AI in Legal Market, By Application

30 U.S. Generative AI in Legal Market, By End User

31 Canada Generative AI in Legal Market, By Application

32 Canada Generative AI in Legal Market, By End User

33 Mexico Generative AI in Legal Market, By Application

34 Mexico Generative AI in Legal Market, By End User

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 IBM Corporation: Company Snapshot

38 IBM Corporation: SWOT Analysis

39 IBM Corporation: Geographic Presence

40 Open Text Corporation: Company Snapshot

41 Open Text Corporation: SWOT Analysis

42 Open Text Corporation: Geographic Presence

43 Thomson Reuters Corporation: Company Snapshot

44 Thomson Reuters Corporation: SWOT Analysis

45 Thomson Reuters Corporation: Geographic Presence

46 Veritone Inc.: Company Snapshot

47 Veritone Inc.: Swot Analysis

48 Veritone Inc.: Geographic Presence

49 ROSS Intelligence Inc.: Company Snapshot

50 ROSS Intelligence Inc.: SWOT Analysis

51 ROSS Intelligence Inc.: Geographic Presence

52 LUMINANCE TECHNOLOGY LTD.: Company Snapshot

53 LUMINANCE TECHNOLOGY LTD.: SWOT Analysis

54 LUMINANCE TECHNOLOGY LTD.: Geographic Presence

55 LexisNexis Group Inc. : Company Snapshot

56 LexisNexis Group Inc. : SWOT Analysis

57 LexisNexis Group Inc. : Geographic Presence

58 Neota Logic Inc.: Company Snapshot

59 Neota Logic Inc.: SWOT Analysis

60 Neota Logic Inc.: Geographic Presence

61 Kira Inc., Inc.: Company Snapshot

62 Kira Inc., Inc.: SWOT Analysis

63 Kira Inc., Inc.: Geographic Presence

64 Casetext Inc.: Company Snapshot

65 Casetext Inc.: SWOT Analysis

66 Casetext Inc.: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Generative AI in Legal Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Generative AI in Legal Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS