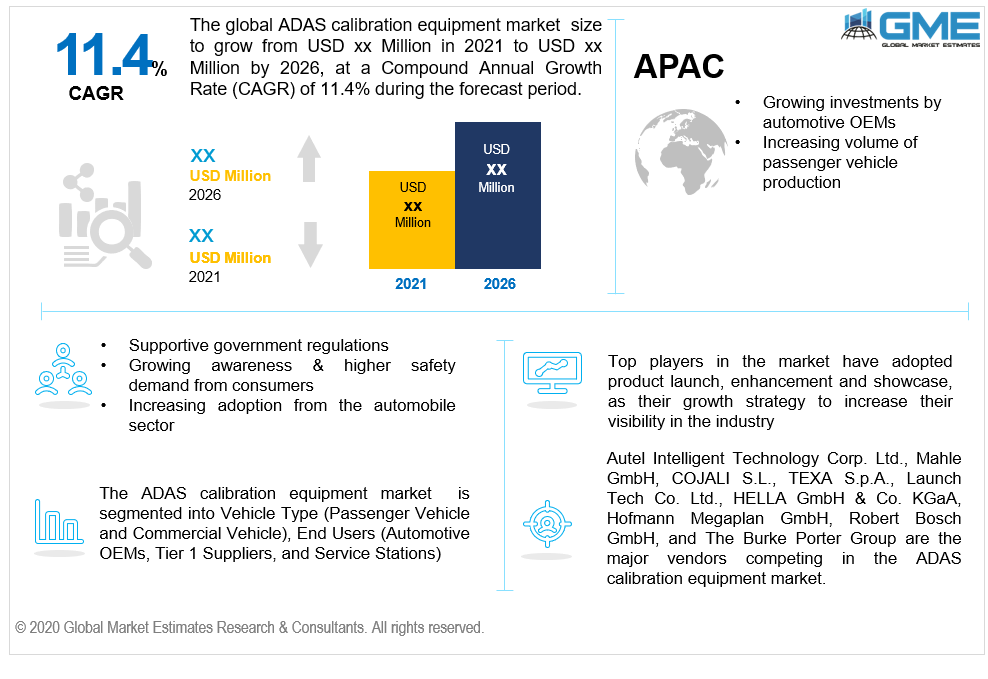

Global ADAS Calibration Equipment Market Size, Trends, and Analysis - Forecasts To 2026 By Vehicle Type (Passenger Vehicle and Commercial Vehicle), By End Users (Automotive OEMs, Tier 1 Suppliers, and Service Stations), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

ADAS applications track nearby barriers or driver mistakes using advanced technologies such as sensors and cameras. The involvement of a supportive government in terms of road safety is expected to boost demand for ADAS calibration equipment in the near future. The ADAS industry would benefit from increased awareness of vehicle safety ratings and lower component costs due to the widespread use of cameras and radars. ADAS technologies are being adopted by major OEMs to obtain better safety ratings and draw more customers. This is leading to the wider adoption of ADAS calibration equipment.

In recent years, a large portion of the global population has been more receptive to the use of ADAS in mid-range passenger cars. This factor is a major contributor to the global ADAS calibration equipment market's expansion. Apart from that, companies in the automobile industry are stepping up their attempts to integrate new technology into their vehicles. The fundamental reason for taking this move is to increase driver safety. As a result, it's fair to conclude that the automobile industry is increasingly incorporating active and passive vehicle safety systems into all forms of vehicles. This action is boosting the global demand for ADAS calibration equipment.

As a result, major OEMs either standardize safety technologies across models or provide them as additional features. As a result, throughout the forecast period, demand for components such as ultrasonic sensors, radar sensors, cameras, and LiDAR would increase due to the growing penetration of ADAS features. Following growing acceptance from prominent automotive manufactures for steering, tracking, braking, and alerting functions, national and international demand for ADAS (advanced driver assistance systems) has been expanding.

Moreover, as AI and IoT continue to accelerate the automobile industry's progress toward autonomous driving, precision in the application of ADAS systems has become more important, boosting demand for ADAS calibration equipment in the coming years. For ADAS to function properly, it requires basic infrastructure such as well-organized roads, lane marking, and the availability of GPS. The development of the ADAS industry in emerging economies is hampered by a lack of infrastructure outside of urban areas, cost factors, and inadequate driving training or discipline.

Restricted functionality and exorbitant costs are two major roadblocks to the implementation of ADAS systems. As a result, ADAS system developers are increasingly investing in camera-based technologies, with technological advancements aimed at improving tracking effectiveness beyond that of lidar and radar. Due to lower costs, the deployment of such capability is foreseen to culminate in the dominance of the ADAS cameras market, in conjunction with laser detection techniques in the ADAS sector, which will significantly help the advancement of partially autonomous driving. In the coming years, these factors are expected to have a significant effect on the production of ADAS calibration equipment.

ADAS calibration technology is used by both passenger cars and commercial vehicles. Among them, the market for ADAS calibration equipment for passenger automobiles is expected to be greater during the forecast period. Growing customer demand for sophisticated functionality targeted at more automation of driving activities, particularly for mid-range and luxury automobile variants, and increased deployment levels amongst vehicle OEMs can be ascribed to the rise.

Improved road safety norms, supporting laws and regulations, and consumer awareness are all contributing to increased demand for safety systems in developing economies. In addition, various countries in Europe, North America, and the Asia Pacific have passed legislation requiring the use of various types of ADAS in passenger vehicles.

Automobile OEMs, service stations, and tier 1 vendors are the most popular end-users of ADAS calibration equipment. Throughout the forecast period, automotive OEMs will continue to be the primary consumers of ADAS calibration equipment, owing to the increasing demand for luxury vehicle models. Service stations, on the other hand, are increasing at a much faster pace than automotive OEMs and are projected to approximately equal them in terms of market share by the end of 2030, due to partnerships between market leaders and service stations to raise sales revenue.

The biggest market for ADAS calibration systems is expected to be Europe. ADAS services including lane departure warning, automatic emergency braking, lane-keeping assist, electronic stability control, and pedestrian protection are standardized under safety ratings, as per the European Commission, which is a major element strengthening the reach of the ADAS industry, and hence the ADAS calibration market, in Europe. In addition, automobile manufacturers' investments in the manufacturing of electric vehicles, as well as supportive policies introduced by policymakers in the region, are driving demand. In the coming years, demand for ADAS and calibration systems will increase as OEMs shift toward automated driving and customers demonstrate a greater preference for luxury automobiles.

The demand for ADAS calibration equipment in North America has gradually increased in recent years, and it is now the second-largest regional market. The region's growth has been fuelled by the United States' major automobile industry, particularly in the production of light and heavy commercial vehicles. Along with the demand from the region's automotive OEMs and aftermarkets, the ADAS calibration equipment market in the United States is being influenced by the increased adoption of emerging technology such as the Internet of Things (IoT), LiDAR technologies, radar, and smart glass for HUD applications.

APAC is one of the fastest-growing regional markets for ADAS calibration equipment, attributable to China's large automotive industry. By the end of the forecast period, this region is predicted to outperform North America in terms of sales. The ADAS calibration equipment market has been propelled by increasing investments by automobile OEMs in the area towards safety ratings, as well as the large volumes of passenger vehicle production.

Autel Intelligent Technology Corp. Ltd., Mahle GmbH, COJALI S.L., TEXA S.p.A., Launch Tech Co. Ltd., HELLA GmbH & Co. KGaA, Hofmann Megaplan GmbH, Robert Bosch GmbH, and The Burke Porter Group are the major vendors competing in the ADAS calibration equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global ADAS Calibration Equipment Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Vehicle Type Overview

2.1.3 End Users Overview

2.1.4 Regional Overview

Chapter 3 Global ADAS Calibration Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Prevalence of Camera-Based Systems

3.3.1.2 Strict Road Safety Regulations

3.3.2 Industry Challenges

3.3.2.1 Highly Cost Prohibitive

3.4 Prospective Growth Scenario

3.4.1 Vehicle Type Growth Scenario

3.4.2 End Users Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global ADAS Calibration Equipment Market, By Vehicle Type

4.1 Vehicle Type Outlook

4.2 Passenger Vehicle

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Commercial Vehicle

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global ADAS Calibration Equipment Market, By End Users

5.1 End Users Outlook

5.2 Automotive OEMs

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Tier 1 Suppliers

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Service Stations

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global ADAS Calibration Equipment Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.2.3 Market Size, By End Users, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By End Users, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.3 Market Size, By End Users, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.4.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By End Users, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By End Users, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.3 Market Size, By End Users, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By End Users, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By End Users, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By End Users, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By End Users, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By End Users, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.5.3 Market Size, By End Users, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By End Users, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By End Users, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By End Users, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.6.3 Market Size, By End Users, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By End Users, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By End Users, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Vehicle Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By End Users, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Autel Intelligent Technology Corp. Ltd.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Mahle GmbH

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 COJALI S.L.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 TEXA S.p.A.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Launch Tech Co. Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 HELLA GmbH & Co. KGaA

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Hofmann Megaplan GmbH

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Robert Bosch GmbH

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 The Burke Porter Group

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global ADAS Calibration Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ADAS Calibration Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS