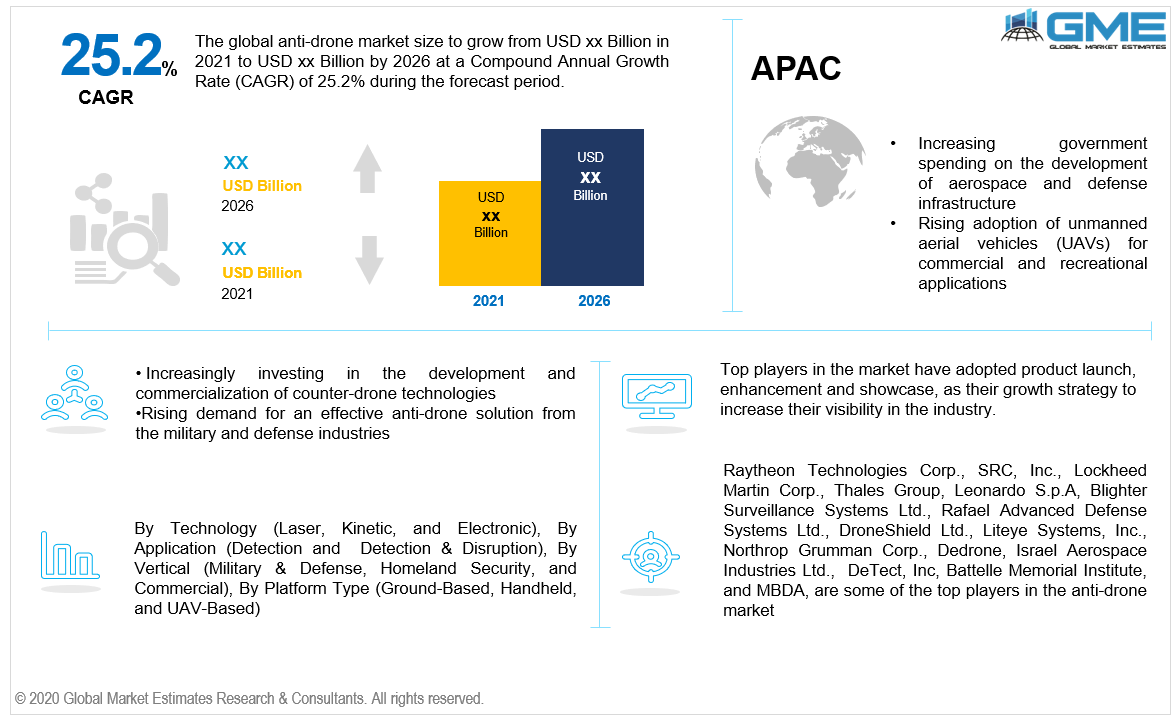

Global Anti-Drone Market Size, Trends, and Analysis - Forecasts To 2026 By Technology (Laser, Kinetic, and Electronic), By Application (Detection and Detection & Disruption), By Vertical (Military & Defense, Homeland Security, and Commercial), By Platform Type (Ground-Based, Handheld, and UAV-Based), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Anti-Drones are effective in preventing unnecessary disruption by unmanned aerial vehicles (UAV). Anti-drone systems monitor, locate, and detect unmanned aerial vehicles (UAVs), preventing illegal activities. These are mainly utilized in the military and defense industries.

The anti-drone market is projected to be driven by the implementation of FBG (Fiber Bragg Grating) technology in numerous industries for a variety of applications. The anti-drone industry is being influenced by rising demand from the commercial sector, organizations for express package delivery, and military groups for attacking against alleged terrorists. The use of all types of unmanned aerial vehicles (UAVs) has grown significantly in recent years.

Anti-drone technology is still comparatively nascent in the market and the techniques used to produce counter-UAV devices are witnessing extensive R&D. Several leading companies who are developing these emerging innovations want to trademark them. Furthermore, the cost of R&D is very high due to the use of lasers and other expensive technology. As a result of the high upfront capital involved, medium- and small-sized players are unable to build and implement anti-drone systems. As a result, there seems to be a small availability and requirement for counter-drone devices.

Anti-nuclear activists, hobbyists, industry rivals, and extremist organizations are also credible for a sudden growth in demand. Moreover, drones are now increasingly prevalent and highly accessible as a result of their low cost. Unmanned aircraft observations have risen significantly in the United States, according to pilots, civilians, and law enforcement. Per month, the FAA collects over 100 such records. As an outcome, security breaches have emerged at vital infrastructure and public locations, prompting an increase in demand for anti-drone devices.

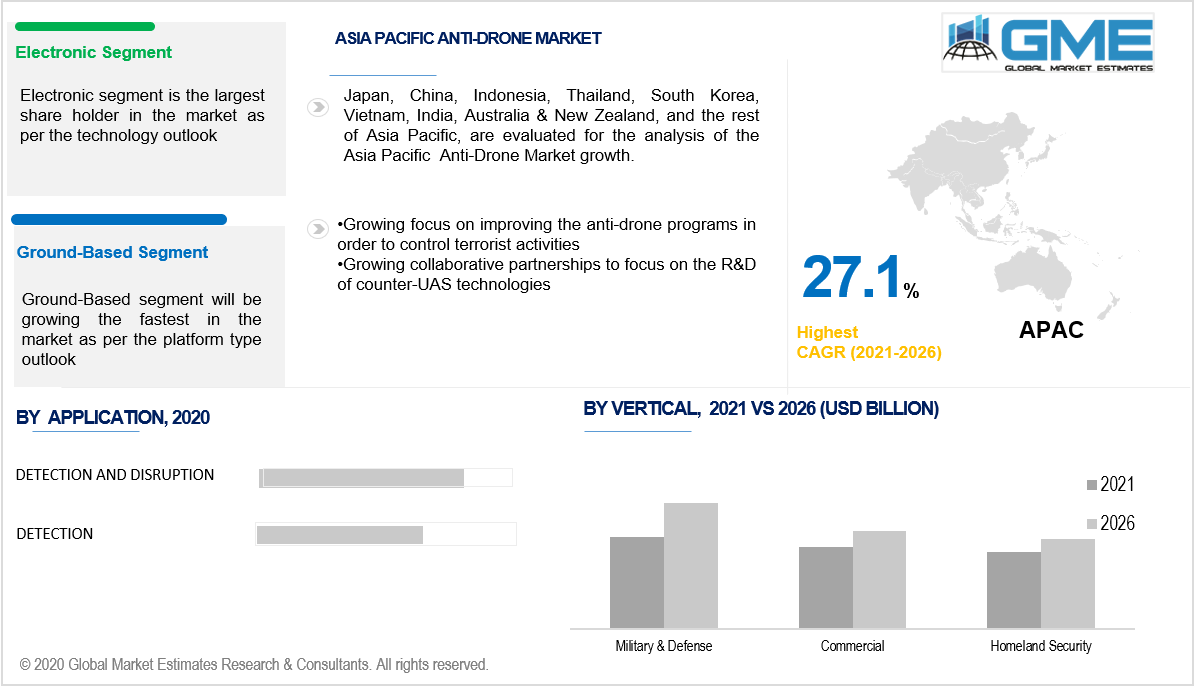

The anti-drone market can be classified into three categories depending on technology: laser, kinetic, and electronic. Electronic has held the highest share of the market and it is projected to become the fastest-growing segment in the coming years. It is attributed to the large funds invested by many major global players in the development of electronic anti-drone devices. Moreover, the demand for electronic anti-drone systems is growing due to low production costs and the deployment of advanced technologies. Drones are being countered with electronic devices including electro-optical systems, radar, GNSS jammers, RF jammers, and infrared sensor systems. Thus, increasing the demand for the electronic segment.

Based on the Application, the anti-drone market can be divided into detection and detection & disruption. The detection and disruption segment is presumed to be the dominant player during the forecast period. This is due to the augmentation in the prevalence of militant groups showing their ability to run a variety of drones, like armed devices. Moreover, detection and disruption systems have important applications in the homeland security verticals, and military & defense, in which any illegal drone entering a country's restricted area is identified and then immediately interrupted.

The anti-drone market can be classified into three categories depending on vertical: military & defense, homeland security, and commercial. During the forecast period, the military & defense segment is presumed to dominate the market. This is because many countries are increasingly prioritizing the enhancement of anti-drone initiatives to control terrorism attacks, which is increasing demand for anti-drone systems. Furthermore, drones are increasingly being used for border trespass, piracy, and spying. As a result, the military and security sectors are likely to expand the overall demand for effective anti-drone solutions.

Based on the platform type, the anti-drone market can be divided into ground-based, handheld, and UAV-based. The ground-based segments are predicted to account for the majority of the demand. Identification, drone detection, and tracking capabilities of fixed or ground-based anti-drone devices are long-range and extremely effective. To manage the increasing threat of illegal and rogue drones, the majority of firms have ground-based mobile or fixed anti-drone solutions.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). Over the forecast period, North America is projected to lead the global anti-drone market. The aerospace and defense industries, especially in the United States, are experiencing an increasing trend in the usage of anti-drone technologies and services. Over the last several years, the Federal Aviation Administration (FAA) in the United States has been reviewing numerous counter-UAS technology at many airports across the world, thus increasing the regional demand for anti-drones. Furthermore, the United States military, along with other North Atlantic Treaty Organization (NATO) participants, have been employing these infrastructures in military conflict regions of Afghanistan and Syria, resulting in increased sales volume in the region. Asia Pacific region is likely to rise at the highest rate during the forecast period. Owing to enhanced government expenditure on the advancement of aerospace & defense infrastructure across different countries, like China and India. Furthermore, several organizations and companies across the country, like Nova Sky, China National Nuclear Corporation, and the Beijing Institute of Technology, are forming joint ventures to work on counter-UAS research & development, implying enormous market opportunities for the region.

Raytheon Technologies Corp., SRC, Inc., Lockheed Martin Corp., Thales Group, Leonardo S.p.A, Blighter Surveillance Systems Ltd., Rafael Advanced Defense Systems Ltd., DroneShield Ltd., Liteye Systems, Inc., Northrop Grumman Corp., Dedrone, Israel Aerospace Industries Ltd., DeTect, Inc, Battelle Memorial Institute, and MBDA, are some of the top players in the anti-drone market.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2020 SRC, Inc. (US) won a USD 90 million deal to assist the US Air Force's action to tackle small unmanned aerial vehicle systems. The Air Force will buy the C-sUAS and associated components from SRC under an indefinite supply, indefinite-quantity contract.

In July 2020, The US Army awarded Leonardo DRS a possible five-year, USD 190 million contract to develop new technologies to defend its forces from hostile unmanned aerial vehicles (UAS). The organization, the cost-plus-fixed-fee contract calls for the organization to design, manufacture, deploy, and help the Mobile-Low, Slow, and Small UAS Integrated Defeat System.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Anti-Drone Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Application Overview

2.1.4 Vertical Overview

2.1.5 Platform Type Overview

2.1.6 Regional Overview

Chapter 3 Anti-Drone Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising usage of drones in illicit activities

3.3.1.2 Growth in drone-based terrorist activities

3.3.2 Industry Challenges

3.3.2.1 Organizational challenges to regulatory enforcement and compliance

3.4 Prospective Growth Scenario

3.4.1 Technology scenario

3.4.2 Application scenario

3.4.3 Vertical scenario

3.4.4 Platform Type scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.7 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Anti-Drone Market, By Technology

4.1 Technology Outlook

4.2 Electronic

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Laser

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Kinetic

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Anti-Drone Market, By Application

5.1 Application Outlook

5.2 Detection

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Detection & Disruption

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Anti-Drone Market, By Vertical

6.1 Vertical Outlook

6.2 Military & Defense

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Commercial

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Homeland Security

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Anti-Drone Market, By Platform Type

7.1 Platform Type Outlook

7.2 Ground-Based

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Handheld

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 UAV-Based

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Anti-Drone Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Technology, 2019-2026 (USD Million)

8.2.3 Market Size, By Application,2019-2026 (USD Million)

8.2.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.5 Market Size, By Platform Type, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Application,2019-2026 (USD Million)

8.2.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Technology, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Application,2019-2026 (USD Million)

8.2.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Technology, 2019-2026 (USD Million)

8.3.3 Market Size, By Application,2019-2026 (USD Million)

8.3.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.5 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.6 Germany

9.3.6.1 Market Size, By Technology, 2019-2026 (USD Million)

9.2.6.2 Market Size, By Application,2019-2026 (USD Million)

9.2.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

9.2.6.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Application,2019-2026 (USD Million)

8.3.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Application,2019-2026 (USD Million)

8.3.8.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Application,2019-2026 (USD Million)

8.3.9.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Application,2019-2026 (USD Million)

8.3.10.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Application,2019-2026 (USD Million)

8.3.11.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Technology, 2019-2026 (USD Million)

8.4.3 Market Size, By Application,2019-2026 (USD Million)

8.4.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.5 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Application,2019-2026 (USD Million)

8.4.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Application,2019-2026 (USD Million)

8.4.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Application,2019-2026 (USD Million)

8.4.8.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Technology, 2019-2026 (USD Million)

8.4.9.2 Market size, By Application, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.9.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Application,2019-2026 (USD Million)

8.4.10.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Technology, 2019-2026 (USD Million)

8.5.3 Market Size, By Application,2019-2026 (USD Million)

8.5.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.5 Market Size, By Platform Type, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Application,2019-2026 (USD Million)

8.5.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Application,2019-2026 (USD Million)

8.5.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Application,2019-2026 (USD Million)

8.5.8.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Technology, 2019-2026 (USD Million)

8.6.3 Market Size, By Application,2019-2026 (USD Million)

8.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.5 Market Size, By Platform Type, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Application,2019-2026 (USD Million)

8.6.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Application,2019-2026 (USD Million)

8.6.7.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Platform Type, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Platform Type, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2. Advanced Radar Technologies S.A.

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3. Airbus Group SE

9.3.1. Company overview

9.3.2. Financial analysis

9.3.3. Strategic positioning

9.3.4. Info graphic analysis

9.4. Blighter Surveillance Systems

9.4.1. Company overview

9.4.2. Financial analysis

9.4.3. Strategic positioning

9.4.4. Info graphic analysis

9.5. Dedrone

9.5.1. Company overview

9.5.2. Financial analysis

9.5.3. Strategic positioning

9.5.4. Info graphic analysis

9.6. DeTect, Inc.

9.6.1. Company overview

9.6.2. Financial analysis

9.6.3 Strategic positioning

9.6.4. Info graphic analysis

9.7. Droneshield LLC

9.7.1. Company overview

9.7.2. Financial analysis

9.7.3. Strategic positioning

9.7.4. Info graphic analysis

9.8. Enterprise Control Systems

9.8.1. Company overview

9.8.2. Financial analysis

9.8.3. Strategic positioning

9.8.4. Info graphic analysis

9.9. Israel Aerospace Industries Ltd. (IAI)

9.9.1. Company overview

9.9.2. Financial analysis

9.9.3. Strategic positioning

9.9.4. Info graphic analysis

9.10. Liteye Systems, Inc.

9.10.1. Company overview

9.10.2. Financial analysis

9.10.3. Strategic positioning

9.10.4. Info graphic analysis

9.11. Lockheed Martin Corporation

9.11.1. Company overview

9.11.2. Financial analysis

9.11.3. Strategic positioning

9.11.4. Info graphic analysis

9.12. Orelia

9.12.1. Company overview

9.12.2. Financial analysis

9.12.3. Strategic positioning

9.12.4. Info graphic analysis

9.13. Prime Consulting & Technologies

9.13.1. Company overview

9.13.2. Financial analysis

9.13.3. Strategic positioning

9.13.4. Info graphic analysis

9.14. Raytheon Company

9.14.1. Company overview

9.14.2. Financial analysis

9.14.3. Strategic positioning

9.14.4. Info graphic analysis

9.15. Saab Ab

9.15.1. Company overview

9.15.2. Financial analysis

9.15.3. Strategic positioning

9.15.4. Info graphic analysis

9.16. Selex Es Inc.

9.16.1. Company overview

9.16.2. Financial analysis

9.16.3. Strategic positioning

9.16.4. Info graphic analysis

9.17. Thales Group

9.17.1. Company overview

9.17.2. Financial analysis

9.17.3. Strategic positioning

9.17.4. Info graphic analysis

9.18. The Boeing Company

9.18.1. Company overview

9.18.2. Financial analysis

9.18.3. Strategic positioning

9.18.4. Info graphic analysis

The Global Anti-Drone Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Anti-Drone Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS