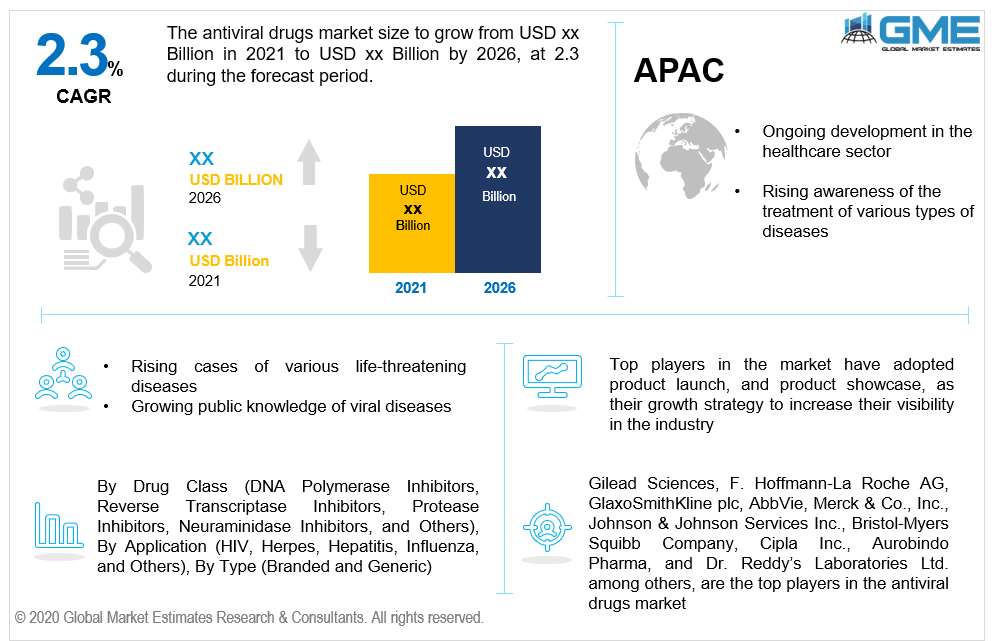

Global Antiviral Drugs Market Size, Trends & Analysis - Forecasts to 2026 By Drug Class (DNA Polymerase Inhibitors, Reverse Transcriptase Inhibitors, Protease Inhibitors, Neuraminidase Inhibitors, and Others), By Application (HIV, Herpes, Hepatitis, Influenza, and Others), By Type (Branded and Generic), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Anti-viral medications reduce the potential for viruses to replicate. These medications penetrate virus-infected cells, interfering with the virus's capacity to attach to the cell and stimulating the host's immune response. Anti-viral medicines are treatments used to cure infectious diseases such as HIV, measles, and influenza, among others. These prescription medications come in the form of tablets, injectable solutions, liquids, and ingested powder form. These are employed in the treatment of viral strains in the body. The FDA has licensed a range of anti-viral therapeutic agents to reduce the highest prevalence of rising infectious diseases globally.

Pharmaceutical firms' substantial spending on drug discovery and development would provide the market with enormous growth opportunities in the forecast period. The government as well as other non-profit organizations have launched public information campaigns on the medications effective for sexually transmitted infections. Through the use of anti-viral medications, the demand is expected to expand dramatically throughout the forecast period. For example, according to Clinical Trials.gov, there were 1,126 clinical trials for anti-viral therapeutic agents underway as of February 3rd, 2020. These studies are primarily motivated by the rising prevalence of infectious diseases in demographics.

Antiviral drug growth is being hampered by considerations including the market dynamics and a decrease in the cost of U.S. Medicare. Furthermore, rising prevention steps and knowledge about the accessibility of vaccinations for viral diseases serve as a restriction on antiviral drug market development. However, UNAIDS projected that by June 2020, 26.0 million individuals will have exposure to antiretroviral therapy, while in 2019, 25.4 million individuals received antiretroviral therapy, increasing from 6.4 million in 2009. This data indicated that accessibility to antiviral treatment medicines is steadily growing, which is the primary trend driving market development.

The unexpected emergence of the COVID-19 epidemic has had a positive impact on the global antiviral therapy demand expansion. The high rapid expansion of the demand attributed to COVID-19 is primarily linked to the growing attention of the key market participants to COVID-19 drug production. Furthermore, the key players' solid research & development initiatives, combined with growing product releases, are primary factors in the antiviral therapeutic agent’s market expansion.

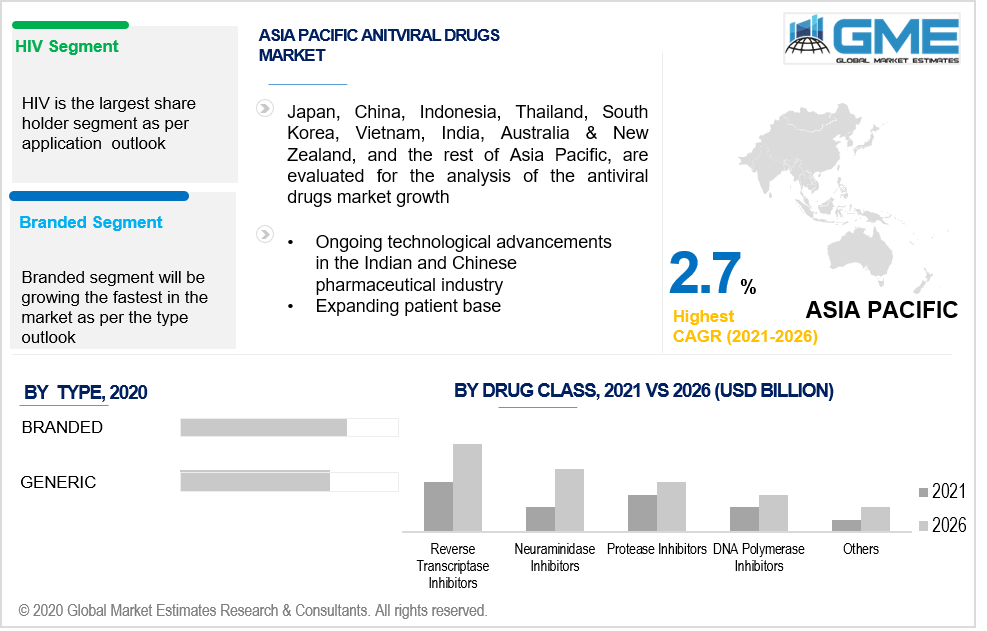

Based on the class of drugs, the market can be segregated into DNA polymerase inhibitors, reverse transcriptase inhibitors, protease inhibitors, neuraminidase inhibitors, and others. The reverse transcriptase inhibitors segment of the antiviral drugs market accounted for a substantial sales share, owing to their accessibility and minimal biological impediments; they are one of the most widely prescribed medicines in resource-limited areas. As a successful therapy to minimize the rising number of HIV cases globally anti-viral medications focused on this drug class will see comparatively greater growth in the forthcoming years.

Based on application, the antiviral drugs market can be segregated into HIV, herpes, hepatitis, influenza, and others. HIV treatment has the highest application of antiviral drugs. Due to the current exponential increase in the proliferation of HIV infection, the HIV segment accounted for the largest market share. Additionally, enhanced HIV care regimens and favorable insurance plans for antiretroviral therapy in many countries are expected to boost the development of this segment. As a result, it is expected to have a favorable effect on the industry in the near future. The involvement of governments in developed countries in promoting virology awareness and addressing the unaddressed requirements for impactful antiviral targeted therapies, particularly for HIV infection, is enhancing participatory antiviral drug development. Furthermore, WHO's establishment of detailed guidance on HIV-preventive medications and assessment of HIV preventive capability of opioid treatment providers is expected to boost the market for HIV drugs throughout the forecast period.

Based on the type of antiviral drugs, the market can be segregated into branded and generics. The branded antiviral drugs are the dominating segment owing to its big name, higher costs, and big market presence. Due to the general misconception that branded drugs are better to use than generic drugs, the branded segment monopolized the market. Rising research and, development costs, along with rapid FDA approval, add to consumer demand. Moreover, the rising prevalence of infectious diseases, combined with the widespread use of marketed drugs in HIV/AIDS care, would drive segment development throughout the forecast period.

As per the geographical analysis, the market of antiviral drugs can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. North America is dominating this market owing to the highest number of cases of various viral diseases along with the best pharmaceutical industry working on inventions for bringing out the best cure for maximum diseases. Furthermore, the region's supremacy is due to the participation of major players, the provision of advanced healthcare facilities, and growing public knowledge of viral diseases. Europe follows North America, as Europe has been engaged in research and development projects to develop medicines for the novel as well as existing viruses. The Asia Pacific is the fastest-growing market owing to the manufacturing capability of the region along with the technological advancements in the Indian and Chinese pharmaceutical industries. Furthermore, an expanding patient base, improved economic sustainability and the existence of a large and developing prescription medication market in South Asian nations are some of the main factors expected to create development prospects for the Asia Pacific region.

Gilead Sciences, F. Hoffmann-La Roche AG, GlaxoSmithKline plc, AbbVie, Merck & Co., Inc., Johnson & Johnson Services Inc., Bristol-Myers Squibb Company, Cipla Inc., Aurobindo Pharma, and Dr. Reddy’s Laboratories Ltd. among others, are the top players in the antiviral drugs market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Antiviral Drugs Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Drug Class Overview

2.1.3 Application Method Overview

2.1.4 Type Overview

2.1.5 Regional Overview

Chapter 3 Antiviral Drugs Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Inception of novel viruses driving both, the

medical industry and the government

3.3.1.2 Rising FDA approval of both generic and branded drugs

3.3.2 Industry Challenges

3.3.2.1 Side effects of the drugs

3.4 Prospective Growth Scenario

3.4.1 Drug Class Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Antiviral Drugs Market, By Drug

4.1 Drug Class Outlook

4.2 DNA Polymerase Inhibitors

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Reverse Transcriptase Inhibitors

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Protease Inhibitors

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Neuraminidase Inhibitors

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Antiviral Drugs Market, By Application

5.1 Application Outlook

5.2 HIV

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Herpes

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Hepatitis

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Influenza

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Antiviral Drugs Market, By Type

6.1 Type Outlook

6.2 Branded

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Generic

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Antiviral Drugs Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Drug Class, 2016-2026 (USD Million)

7.2.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.4 Market Size, By Type, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.4 Market Size, By Type, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Type, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Type, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.4 Market Size, By Type, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.8.2 Market size, By Application, 2016-2026 (USD Million)

7.4.8.3 Market Size, By Type, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Type, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Drug Class, 2016-2026 (USD Million)

7.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.4 Market Size, By Type, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Type, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Drug Class, 2016-2026 (USD Million)

7.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.4 Market Size, By Type, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Type, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Type, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Drug Class, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Type, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Gilead Sciences

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 F. Hoffmann-La Roche AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 GlaxoSmithKline plc

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 AbbVie

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Merck & Co. Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Johnson & Johnson Services Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Bristol-Myers Squibb Company

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Cipla Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Aurobindo Pharma

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Dr. Reddy’s Laboratories Ltd.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Antiviral Drugs Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Antiviral Drugs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS