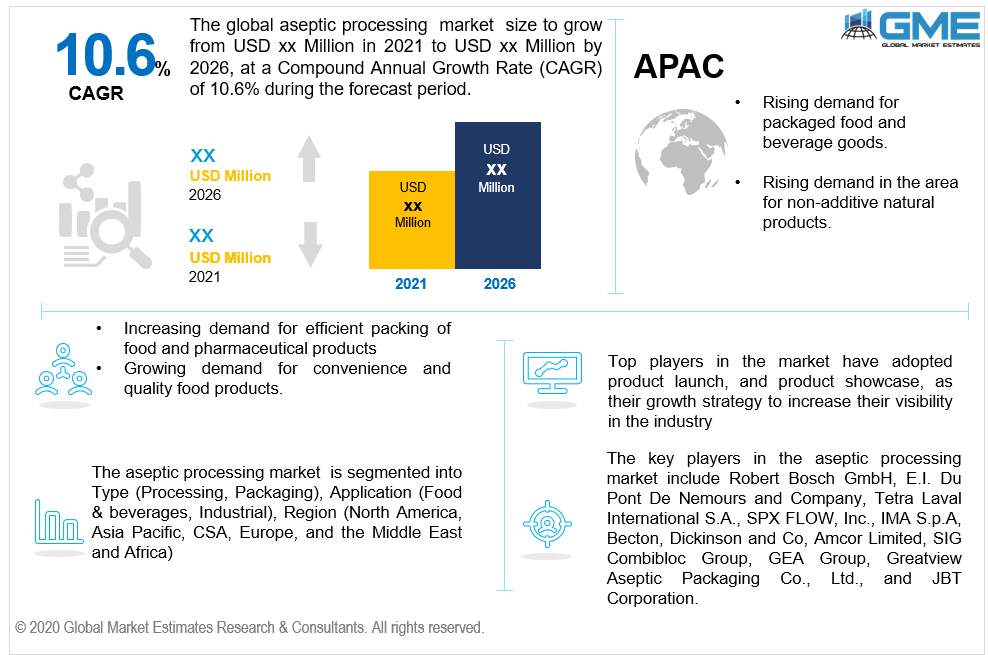

Global Aseptic Processing Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Processing and Packaging), By Application (Food & Beverages and Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

As a result of the augmenting consumption of pharmaceutical supplies, the market for aseptic processing is gaining momentum. Numerous advancements, including a rising movement towards food preservatives and an increase in demand for eco-friendly packaging, are also assisting the market's growth. Furthermore, a surge in the use of self-administered medications, as well as advancements in technology and equipment, would generate new and abundant potential for the market. Due to the increasing demand for efficient packing of food products, the global aseptic processing market is expected to expand rapidly throughout the forecast period.

Rising demand for packaged foods, including dairy products, cake mixes, frozen meals, ready-to-eat meals, and snack foods, is expected to have a strong effect on the growth of the market. Also, the need for refrigeration is reduced with this form of packaging, which makes it easier for on-the-go customers. However, over the projected timeframe, the greater initial costs associated with the technology compared to traditional processes are likely to restrict development.

The use of blow-fill-seal technology in aseptic processing has significantly decreased the danger of microbiological contamination. This technique is widely employed in liquid pharmaceutical applications and is slowly making its way into biological drugs. Because it is fully automated, the adoption of this technology streamlines the production process. Furthermore, using this process to fill polymeric containers decreases the possibility of breakage or glass-particulate contamination. This technological advancement has expanded market integration of the overall aseptic processing market, hence promoting its growth.

Aseptic packing is extensively used to extend the shelf life of goods. It is foreseen to increase market demand in the foreseeable years. In addition, increased demand from the food and beverage sector is assumed to fuel the growth of the market throughout the forecast period. The pharmaceutical sector is foreseen to develop at an unprecedented rate in the next years. Strengthening the establishment of these solutions is expected to propel the market even further on its upward progression. Growing consumer concern for the environment is projected to augment demand for bio-based, product-specific, and recyclable aseptic packaging. As a result, the main factors influencing buyer decisions are anticipated to be cost competitiveness, product innovation, and development.

The substantial volumes of initial capital expenditure and the intricacies of the manufacturing processes have been important restricting factors for the sector. However, in addition to the drivers, several obstacles will limit the market's progress. Considerations including paucity of trained personnel and significant capital expenditure may impede market expansion. Nevertheless, one of the major reasons fueling the expansion of the overall aseptic processing market is an improvement in demand for eco-friendly packaging. This is due to increased environmental awareness and rigorous environmental legislation.

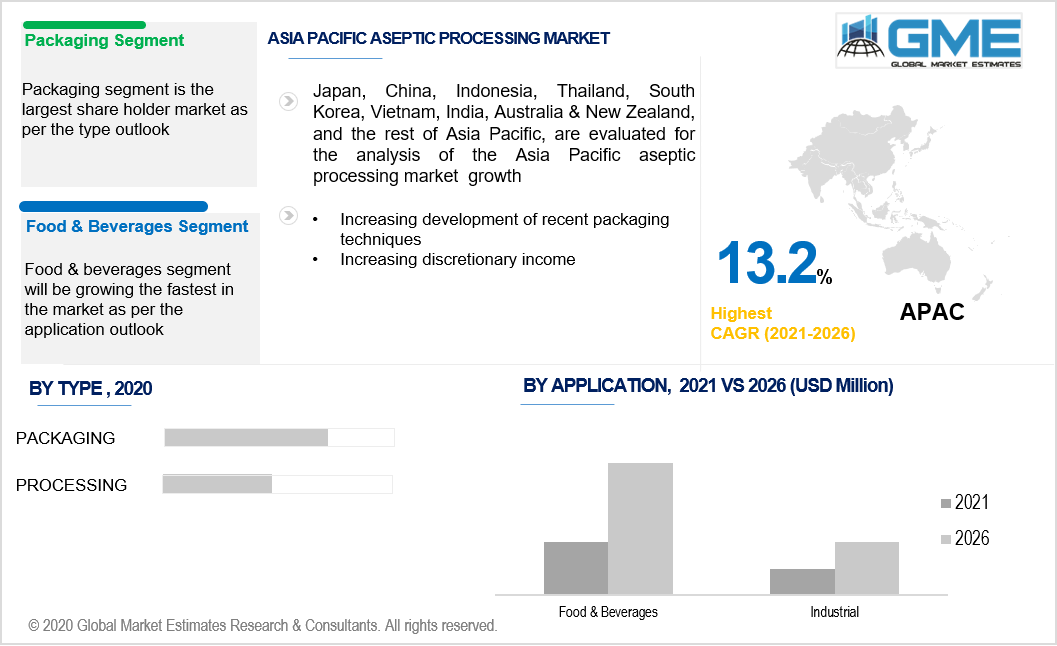

Depending on the type, the market is categorized as processing and packaging. Packaging is foreseen to predominate due to the growing demand for pre-cut vegetables, packed food, dairy products, and baby food. Aseptic packaging is widely used in foodservice operations across the world as a safe and high-quality packaging alternative. The increasing importance of packaging machines and demand for integrated filling machines is also anticipated to propel the market for packaging. Growth in the high availability of advanced aseptic packaging solutions, health awareness, cost-effectiveness, and convenient alternatives by aseptic packaging is leading to this segment’s supremacy. Moreover, the pharmaceutical sector has seen a surge in the packaging of several liquid medications in sterilized containers which are further aiding in the segment’s growth.

Depending on the type, the market is categorized as food & beverages and industrial. Aseptic food & beverage processing is a method of industrial sterilization of products like dairy & soy drinks, vegetables & fruit juices, creams, and smoothies. For the protection and enhancement of the shelf life of food & beverage products, aseptic processing and packing are performed. The aseptic manufacturing market is strongly influenced by government laws and legislation. Governments are similarly concerned with the health and hygiene of the population at the present scenario; whether it be advanced or emerging nations. With economic development, consumers are shifting to convenience food & beverages. The packaged food & beverage industry is benefiting from this; nevertheless, protection is the cause of concern here. Manufacturers have therefore accepted aseptic processing to improve the protection factor and prolong the shelf life (ESL) of goods. The rising importance of shelf-life extension and a growing tendency of manufacturers towards aseptic processing is projected to lead to market development.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). North America is presumed to lead in the aseptic processing market. This region's expansion is also due to an increase in demand for processed goods and the emergence of innovative packaging solutions. Furthermore, rising discretionary income and the development of novel pharmaceuticals have aided in the market's progress.

The Asia Pacific is projected to be the fastest-growing region for aseptic processing because of the speedy growth of the food and beverage industry. Expanding need for packaged food and beverage goods is prophesied to benefit the aseptic packaging equipment business as a result of changing consumer lifestyles and improving spending power amongst Asian shoppers. To cope with increasing end-user demand, producers from developing economies are expected to move their manufacturing facilities within the country.

The key players in the aseptic processing market include Robert Bosch GmbH, E.I. Du Pont De Nemours and Company, Tetra Laval International S.A., SPX FLOW, Inc., IMA S.p.A, Becton, Dickinson and Co, Amcor Limited, SIG Combibloc Group, GEA Group, Greatview Aseptic Packaging Co., Ltd., and JBT Corporation.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Aseptic Processing Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Aseptic Processing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Demand for Eco-Friendly Packages

3.3.1.2 Increasing Expansion in The Food & Beverages and Pharmaceutical Industry

3.3.2 Industry Challenges

3.3.2.1 Substantial Volumes of Initial Capital Expenditure

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Aseptic Processing Market, By Type

4.1 Type Outlook

4.2 Processing

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Packaging

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Aseptic Processing Market, By Application

5.1 Application Outlook

5.2 Food & Beverages

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Industrial

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Aseptic Processing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Type, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Type, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Type, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Type, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Type, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Robert Bosch GmbH

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 E.I. Du Pont De Nemours and Company

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Tetra Laval International S.A.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 SPX FLOW, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 IMA S.p.A

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Becton

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Dickinson and Co.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Amcor Limited

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 SIG Combibloc Group

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 GEA Group

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Greatview Aseptic Packaging Co., Ltd.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 JBT Corporation

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Other Companies

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

The Global Aseptic Processing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aseptic Processing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS