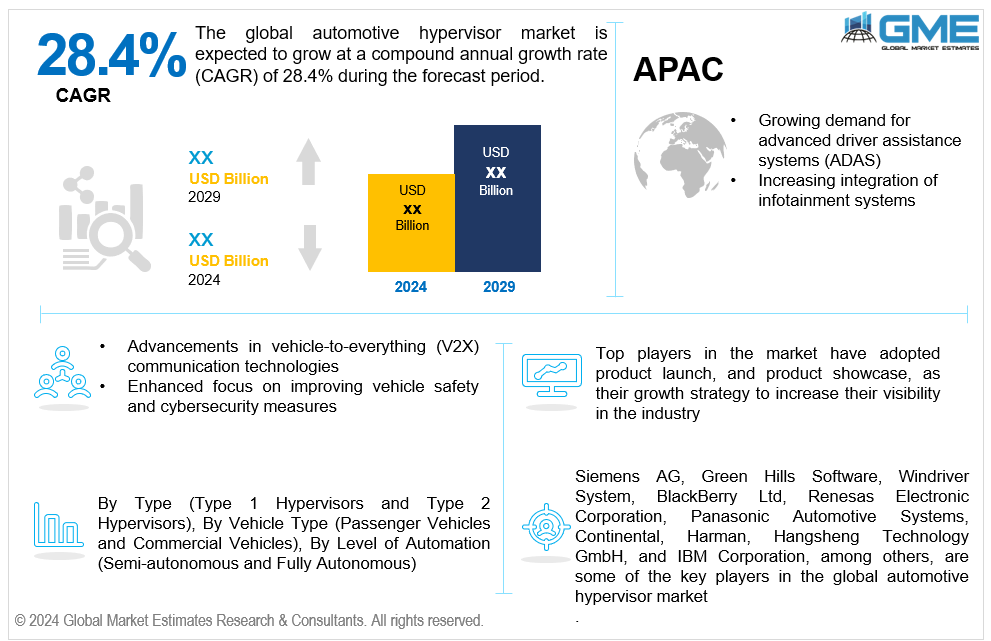

Global Automotive Hypervisor Market Size, Trends & Analysis - Forecasts to 2029 By Type (Type 1 Hypervisors and Type 2 Hypervisors), By Vehicle Type (Passenger Vehicles and Commercial Vehicles), By Level of Automation (Semi-autonomous and Fully Autonomous), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global automotive hypervisor market is estimated to exhibit a CAGR of 28.4% from 2024 to 2029.

The primary factors propelling the market growth are the growing demand for advanced driver assistance systems (ADAS) and the increasing integration of infotainment systems. ADAS requires sophisticated computing resources and seamless integration of multiple in-car applications, making automotive hypervisor technology essential. In-vehicle virtualization allows the consolidation of different systems onto a single hardware platform, enhancing efficiency and performance. Hypervisor software for cars enables the isolation and secure management of these applications, ensuring reliability and safety. Automotive virtualization solutions are crucial in supporting the complex functionalities of ADAS, such as real-time data processing and decision-making. As hypervisors in connected cars become more prevalent, they facilitate seamless communication between ADAS and other connected vehicle systems. Automotive hypervisor market trends indicate a strong growth trajectory, driven by the need for robust and scalable solutions. Overall, virtualization in the automotive industry is pivotal in meeting the technological demands of modern ADAS, propelling the market growth. For instance, according to the Highway Loss Data Institute, 50% or more registered vehicles will have three ADAS systems globally by 2027.

Advancements in vehicle-to-everything (V2X) communication technologies, enhanced focus on improving vehicle safety, and cybersecurity measures are expected to support the automotive hypervisor market growth. Hypervisor for autonomous vehicles plays a critical role in managing the complex data exchanges and processing requirements of V2X systems, ensuring reliable and real-time communication. Embedded hypervisor technology enables the integration of multiple applications on a single hardware platform, which is crucial for efficient V2X operations. Automotive OS virtualization supports the seamless running of diverse operating systems needed for V2X communication. Hypervisor for infotainment systems ensures that infotainment and critical V2X applications can coexist securely and efficiently. The emphasis on automotive safety and security is further enhanced by hypervisors, which provide isolation and protection against cyber threats. Leading automotive hypervisor vendors are continuously innovating to meet the demands of V2X advancements, driving market growth as vehicles become more connected and intelligent.

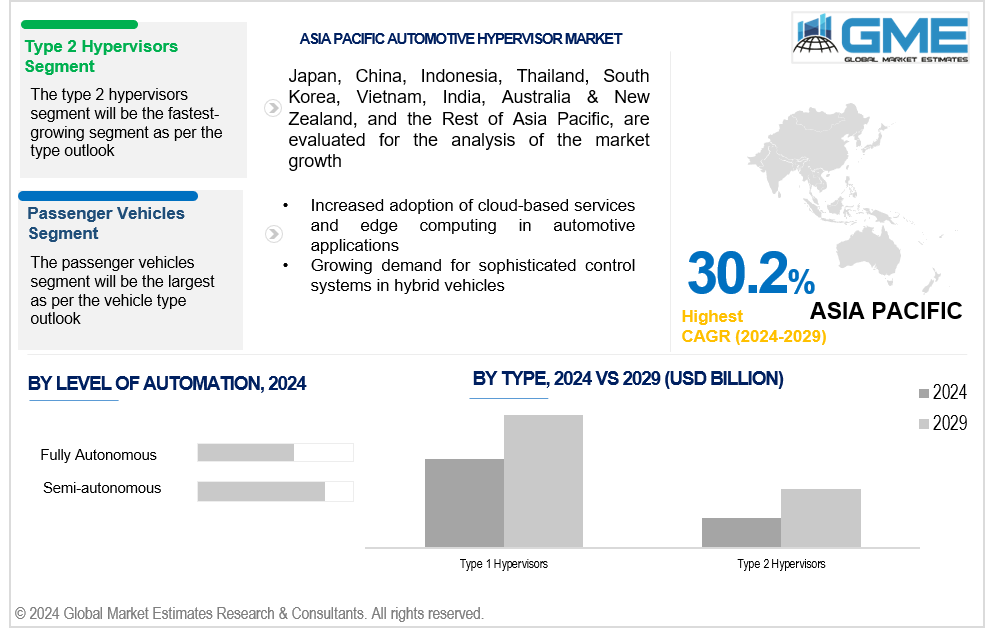

Increased adoption of cloud-based services and edge computing in automotive applications and the growing demand for sophisticated control systems in hybrid vehicles propel market growth. Multi-OS environments in cars are becoming more common, necessitating hypervisors to manage different operating systems efficiently. Real-time operating systems (RTOS) are essential for critical automotive functions, and hypervisors facilitate their integration and operation alongside other applications. The rise of electric vehicles (EVs) further fuels this trend, with hypervisor for electric vehicles ensuring efficient resource allocation and management of various EV-specific applications. Automotive software integration benefits from hypervisors, as they provide a seamless platform for combining cloud-based services and edge computing with in-car systems.

As more people switch to electric cars, hypervisors will have more opportunities to oversee and improve the several specialized systems needed for battery management, charging infrastructure, and EV performance. Additionally, the increasing interconnectedness of cars has made it necessary to implement stronger cybersecurity measures, which allows hypervisor technology to offer safe and secure settings for some vital vehicle operations.

However, limited awareness and understanding of the benefits of hypervisor technology and hardware compatibility concerns may impede market growth over the forecast period.

The type 1 hypervisors segment is expected to hold the largest share of the market over the forecast period. By physically separating various virtual machines (VMs), Type 1 hypervisors provide improved security features. In automobile applications, isolation plays a significant role in protecting infotainment and advanced driver assistance systems (ADAS) from possible vulnerabilities.

The type 2 hypervisors segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Type 2 hypervisors enable fast prototyping and testing of new apps and features without requiring significant hardware modifications, which is advantageous for automotive companies that prioritize innovation and fast development cycles.

The passenger vehicles segment is expected to hold the largest share of the market over the forecast period. Infotainment systems, networking features, and advanced driver assistance systems (ADAS) are being installed in passenger cars at an increasing rate. Hypervisors are becoming increasingly popular in this market since they are necessary for effectively administering these sophisticated applications.

The commercial vehicles segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The expansion of ride-sharing, delivery services, and logistics industries is driving the need for sophisticated fleet management systems. By facilitating the effective functioning of tracking, telematics, and real-time data analytics, hypervisors assist these solutions.

The semi-autonomous segment is expected to hold the largest share of the market over the forecast period. Modern cars are increasingly equipped with semi-autonomous functions like automated emergency braking, adaptive cruise control, and lane-keeping assistance. The adoption of these functionalities is accelerated by the smooth integration and administration made possible by hypervisors.

The fully autonomous segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The development of completely autonomous cars is propelled by notable developments in sensor technology, machine learning, and artificial intelligence (AI). Hypervisors are crucial for managing the complex and high-performance computing requirements of these technologies.

North America is expected to be the largest region in the global market. The market is growing due to the high demand for cutting-edge safety technologies in cars, such as lane-keeping assistance and automated emergency braking. Additionally, major North American automotive and technology companies have made significant investments in autonomous vehicle research and development, which has fueled the adoption of hypervisor technology to handle the complex processing requirements of fully driverless cars.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Some of the biggest automobile markets in the world, including China and India, are located in this region. Hypervisor technology is becoming more widely used to control infotainment and advanced driver assistance systems (ADAS) in the automobile sector, which is seeing rapid growth.

Global Automotive Hypervisor Market Share and Competitor Analysis

Siemens AG, Green Hills Software, Windriver System, BlackBerry Ltd, Renesas Electronic Corporation, Panasonic Automotive Systems, Continental, Harman, Hangsheng Technology GmbH, and IBM Corporation, among others, are some of the key players in the global Automotive Hypervisor market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, a High-Performance Compute (HPC) system was introduced by Panasonic Automotive Systems. This invention, called Neuron, takes care of the quickly changing mobility requirements that are expected for developments in software-defined vehicles.

In January 2023, the development of VERZEUSE for Virtualization Extensions, a virtualization security breakthrough to control cyber-attacks against next-generation car cockpit systems, was announced by Panasonic Automotive Systems Co., Ltd.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL AUTOMOTIVE HYPERVISOR MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AUTOMOTIVE HYPERVISOR MARKET, BY TYPE

4.1 Introduction

4.2 Automotive Hypervisor Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Type 1 Hypervisors

4.4.1 Type 1 Hypervisors Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Type 2 Hypervisors

4.5.1 Type 2 Hypervisors Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE

5.1 Introduction

5.2 Automotive Hypervisor Market: Vehicle Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Passenger Vehicles

5.4.1 Passenger Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Commercial Vehicles

5.5.1 Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AUTOMOTIVE HYPERVISOR MARKET, BY LEVEL OF AUTOMATION

6.1 Introduction

6.2 Automotive Hypervisor Market: Level of Automation Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Semi-autonomous

6.4.1 Semi-autonomous Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Fully Autonomous

6.5.1 Fully Autonomous Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL AUTOMOTIVE HYPERVISOR MARKET, BY REGION

7.1 Introduction

7.2 North America Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By Vehicle Type

7.2.3 By Level of Automation

7.2.4 By Country

7.2.4.1 U.S. Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Vehicle Type

7.2.4.1.3 By Level of Automation

7.2.4.2 Canada Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Vehicle Type

7.2.4.2.3 By Level of Automation

7.2.4.3 Mexico Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Vehicle Type

7.2.4.3.3 By Level of Automation

7.3 Europe Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By Vehicle Type

7.3.3 By Level of Automation

7.3.4 By Country

7.3.4.1 Germany Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Vehicle Type

7.3.4.1.3 By Level of Automation

7.3.4.2 U.K. Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Vehicle Type

7.3.4.2.3 By Level of Automation

7.3.4.3 France Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Vehicle Type

7.3.4.3.3 By Level of Automation

7.3.4.4 Italy Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Vehicle Type

7.2.4.4.3 By Level of Automation

7.3.4.5 Spain Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By Vehicle Type

7.2.4.5.3 By Level of Automation

7.3.4.6 Netherlands Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By Vehicle Type

7.2.4.6.3 By Level of Automation

7.3.4.7 Rest of Europe Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By Vehicle Type

7.2.4.7.3 By Level of Automation

7.4 Asia Pacific Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By Vehicle Type

7.4.3 By Level of Automation

7.4.4 By Country

7.4.4.1 China Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By Vehicle Type

7.4.4.1.3 By Level of Automation

7.4.4.2 Japan Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By Vehicle Type

7.4.4.2.3 By Level of Automation

7.4.4.3 India Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By Vehicle Type

7.4.4.3.3 By Level of Automation

7.4.4.4 South Korea Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By Vehicle Type

7.4.4.4.3 By Level of Automation

7.4.4.5 Singapore Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By Vehicle Type

7.4.4.5.3 By Level of Automation

7.4.4.6 Malaysia Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By Vehicle Type

7.4.4.6.3 By Level of Automation

7.4.4.7 Thailand Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By Vehicle Type

7.4.4.7.3 By Level of Automation

7.4.4.8 Indonesia Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By Vehicle Type

7.4.4.8.3 By Level of Automation

7.4.4.9 Vietnam Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By Vehicle Type

7.4.4.9.3 By Level of Automation

7.4.4.10 Taiwan Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By Vehicle Type

7.4.4.10.3 By Level of Automation

7.4.4.11 Rest of Asia Pacific Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By Vehicle Type

7.4.4.11.3 By Level of Automation

7.5 Middle East and Africa Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By Vehicle Type

7.5.3 By Level of Automation

7.5.4 By Country

7.5.4.1 Saudi Arabia Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By Vehicle Type

7.5.4.1.3 By Level of Automation

7.5.4.2 U.A.E. Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By Vehicle Type

7.5.4.2.3 By Level of Automation

7.5.4.3 Israel Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By Vehicle Type

7.5.4.3.3 By Level of Automation

7.5.4.4 South Africa Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By Vehicle Type

7.5.4.4.3 By Level of Automation

7.5.4.5 Rest of Middle East and Africa Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By Vehicle Type

7.5.4.5.2 By Level of Automation

7.6 Central and South America Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By Vehicle Type

7.6.3 By Level of Automation

7.6.4 By Country

7.6.4.1 Brazil Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By Vehicle Type

7.6.4.1.3 By Level of Automation

7.6.4.2 Argentina Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By Vehicle Type

7.6.4.2.3 By Level of Automation

7.6.4.3 Chile Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By Vehicle Type

7.6.4.3.3 By Level of Automation

7.6.4.4 Rest of Central and South America Automotive Hypervisor Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By Vehicle Type

7.6.4.4.3 By Level of Automation

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Siemens AG

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Green Hills Software

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Windriver System

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 BlackBerry Ltd

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Renesas Electronic Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 PANASONIC AUTOMOTIVE SYSTEMS

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Continental

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Harman

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Hangsheng Technology GmbH

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 IBM Corporation

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Automotive Hypervisor Market, By Type, 2021-2029 (USD Mllion)

2 Type 1 Hypervisors Market, By Region, 2021-2029 (USD Mllion)

3 Type 2 Hypervisors Market, By Region, 2021-2029 (USD Mllion)

4 Global Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Mllion)

5 Passenger Vehicles Market, By Region, 2021-2029 (USD Mllion)

6 Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

7 Global Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Mllion)

8 Semi-autonomous Market, By Region, 2021-2029 (USD Mllion)

9 Fully Autonomous Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

12 North America Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

13 North America Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

14 North America Automotive Hypervisor Market, By Country, 2021-2029 (USD Million)

15 U.S. Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

16 U.S. Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

17 U.S. Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

18 Canada Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

19 Canada Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

20 Canada Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

21 Mexico Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

22 Mexico Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

23 Mexico Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

24 Europe Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

25 Europe Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

26 Europe Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

27 Europe Automotive Hypervisor Market, By Country 2021-2029 (USD Million)

28 Germany Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

29 Germany Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

30 Germany Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

31 U.K. Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

32 U.K. Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

33 U.K. Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

34 France Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

35 France Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

36 France Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

37 Italy Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

38 Italy Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

39 Italy Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

40 Spain Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

41 Spain Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

42 Spain Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

43 Netherlands Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

44 Netherlands Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

45 Netherlands Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

46 Rest Of Europe Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

47 Rest Of Europe Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

48 Rest of Europe Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

49 Asia Pacific Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

50 Asia Pacific Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

51 Asia Pacific Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

52 Asia Pacific Automotive Hypervisor Market, By Country, 2021-2029 (USD Million)

53 China Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

54 China Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

55 China Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

56 India Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

57 India Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

58 India Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

59 Japan Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

60 Japan Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

61 Japan Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

62 South Korea Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

63 South Korea Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

64 South Korea Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

65 malaysia Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

66 malaysia Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

67 malaysia Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

68 Thailand Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

69 Thailand Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

70 Thailand Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

71 Indonesia Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

72 Indonesia Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

73 Indonesia Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

74 Vietnam Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

75 Vietnam Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

76 Vietnam Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

77 Taiwan Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

78 Taiwan Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

79 Taiwan Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

80 Rest of Asia Pacific Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

81 Rest of Asia Pacific Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

82 Rest of Asia Pacific Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

83 Middle East and Africa Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

84 Middle East and Africa Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

85 Middle East and Africa Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

86 Middle East and Africa Automotive Hypervisor Market, By Country, 2021-2029 (USD Million)

87 Saudi Arabia Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

88 Saudi Arabia Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

89 Saudi Arabia Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

90 UAE Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

91 UAE Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

92 UAE Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

93 Israel Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

94 Israel Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

95 Israel Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

96 South Africa Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

97 South Africa Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

98 South Africa Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

99 Rest of Middle East and Africa Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

100 Rest of Middle East and Africa Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

101 Rest of Middle East and Africa Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

102 Central and South America Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

103 Central and South America Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

104 Central and South America Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

105 Central and South America Automotive Hypervisor Market, By Country, 2021-2029 (USD Million)

106 Brazil Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

107 Brazil Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

108 Brazil Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

109 Argentina Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

110 Argentina Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

111 Argentina Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

112 Chile Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

113 Chile Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

114 Chile Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

115 Rest of Central and South America Automotive Hypervisor Market, By Type, 2021-2029 (USD Million)

116 Rest of Central and South America Automotive Hypervisor Market, By Vehicle Type, 2021-2029 (USD Million)

117 Rest of Central and South America Automotive Hypervisor Market, By Level of Automation, 2021-2029 (USD Million)

118 Siemens AG: Products & Services Offering

119 Green Hills Software: Products & Services Offering

120 Windriver System: Products & Services Offering

121 BlackBerry Ltd: Products & Services Offering

122 Renesas Electronic Corporation: Products & Services Offering

123 PANASONIC AUTOMOTIVE SYSTEMS: Products & Services Offering

124 Continental: Products & Services Offering

125 Harman: Products & Services Offering

126 Hangsheng Technology GmbH, Inc: Products & Services Offering

127 IBM Corporation: Products & Services Offering

128 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Automotive Hypervisor Market Overview

2 Global Automotive Hypervisor Market Value From 2021-2029 (USD Mllion)

3 Global Automotive Hypervisor Market Share, By Type (2023)

4 Global Automotive Hypervisor Market Share, By Vehicle Type (2023)

5 Global Automotive Hypervisor Market Share, By Level of Automation (2023)

6 Global Automotive Hypervisor Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Automotive Hypervisor Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Automotive Hypervisor Market

11 Impact Of Challenges On The Global Automotive Hypervisor Market

12 Porter’s Five Forces Analysis

13 Global Automotive Hypervisor Market: By Type Scope Key Takeaways

14 Global Automotive Hypervisor Market, By Type Segment: Revenue Growth Analysis

15 Type 1 Hypervisors Market, By Region, 2021-2029 (USD Mllion)

16 Type 2 Hypervisors Market, By Region, 2021-2029 (USD Mllion)

17 Global Automotive Hypervisor Market: By Vehicle Type Scope Key Takeaways

18 Global Automotive Hypervisor Market, By Vehicle Type Segment: Revenue Growth Analysis

19 Passenger Vehicles Market, By Region, 2021-2029 (USD Mllion)

20 Global Automotive Hypervisor Market: By Level of Automation Scope Key Takeaways

21 Global Automotive Hypervisor Market, By Level of Automation Segment: Revenue Growth Analysis

22 Semi-autonomous Market, By Region, 2021-2029 (USD Mllion)

23 Fully Autonomous Market, By Region, 2021-2029 (USD Mllion)

24 Regional Segment: Revenue Growth Analysis

25 Global Automotive Hypervisor Market: Regional Analysis

26 North America Automotive Hypervisor Market Overview

27 North America Automotive Hypervisor Market, By Type

28 North America Automotive Hypervisor Market, By Vehicle Type

29 North America Automotive Hypervisor Market, By Level of Automation

30 North America Automotive Hypervisor Market, By Country

31 U.S. Automotive Hypervisor Market, By Type

32 U.S. Automotive Hypervisor Market, By Vehicle Type

33 U.S. Automotive Hypervisor Market, By Level of Automation

34 Canada Automotive Hypervisor Market, By Type

35 Canada Automotive Hypervisor Market, By Vehicle Type

36 Canada Automotive Hypervisor Market, By Level of Automation

37 Mexico Automotive Hypervisor Market, By Type

38 Mexico Automotive Hypervisor Market, By Vehicle Type

39 Mexico Automotive Hypervisor Market, By Level of Automation

40 Four Quadrant Positioning Matrix

41 Company Market Share Analysis

42 Siemens AG: Company Snapshot

43 Siemens AG: SWOT Analysis

44 Siemens AG: Geographic Presence

45 Green Hills Software: Company Snapshot

46 Green Hills Software: SWOT Analysis

47 Green Hills Software: Geographic Presence

48 Windriver System: Company Snapshot

49 Windriver System: SWOT Analysis

50 Windriver System: Geographic Presence

51 BlackBerry Ltd: Company Snapshot

52 BlackBerry Ltd: Swot Analysis

53 BlackBerry Ltd: Geographic Presence

54 Renesas Electronic Corporation: Company Snapshot

55 Renesas Electronic Corporation: SWOT Analysis

56 Renesas Electronic Corporation: Geographic Presence

57 PANASONIC AUTOMOTIVE SYSTEMS: Company Snapshot

58 PANASONIC AUTOMOTIVE SYSTEMS: SWOT Analysis

59 PANASONIC AUTOMOTIVE SYSTEMS: Geographic Presence

60 Continental : Company Snapshot

61 Continental : SWOT Analysis

62 Continental : Geographic Presence

63 Harman: Company Snapshot

64 Harman: SWOT Analysis

65 Harman: Geographic Presence

66 Hangsheng Technology GmbH, Inc.: Company Snapshot

67 Hangsheng Technology GmbH, Inc.: SWOT Analysis

68 Hangsheng Technology GmbH, Inc.: Geographic Presence

69 IBM Corporation: Company Snapshot

70 IBM Corporation: SWOT Analysis

71 IBM Corporation: Geographic Presence

72 Other Companies: Company Snapshot

73 Other Companies: SWOT Analysis

74 Other Companies: Geographic Presence

The Global Automotive Hypervisor Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Hypervisor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS