Global Automotive Protective Coatings Market Size, Trends & Analysis - Forecasts to 2026 By Product (Epoxy, Polyurethane, Acrylic, Polyester, Alkyd), By Formulation (Water-Borne, Solvent-Borne, Powder Based), By Application (Exterior, Interior), By End-Use (OEM, Aftermarket), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Automotive industry expansion along with the rising demand for high-performance finishes will drive the Automotive Protective Coatings Market growth. Increased competition among car manufacturers to provide high-quality vehicles along with creating a point of difference in the product has positively induced industrial expansion. Properties such as anti-corrosive, anti-microbial, prevention from erosion, abrasion, and chemical attack will stimulate the Automotive Protective Coatings adoption.

The rising need to proliferate the vehicle life cycle and attaining efficiency in the components has propelled the coating manufacturers to develop advanced finishes which are sustainable and also enhances vehicle appearance. Introduction of various protective coatings with different formulations such as water-borne, solvent-borne, or powder-based depending on the vehicle need and requirement will result in product reach in diversified applications.

Stringent regulations pertaining to the emissions produced by conventional finishes have imposed a mandatory shift towards sustainable resources. In Automotive Protective Coatings, the organic compound is the major raw material used in technical applications. Thus, it became necessary to deploy environment-friendly composites to curb the carbon emission caused by the transportation industry.

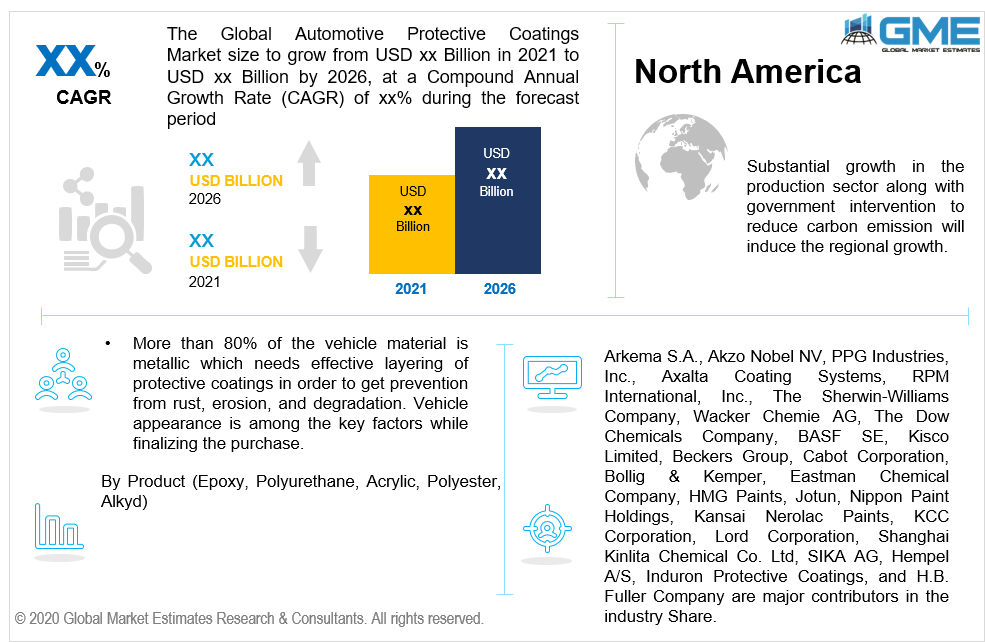

More than 80% of the vehicle material is metallic which needs effective layering of protective coatings in order to get prevention from rust, erosion, and degradation. Vehicle appearance is among the key factors while finalizing the purchase. Also, shifting consumer preference towards minimal maintenance cars along with an inclination for high aesthetic appeal will promote the Automotive Protective Coatings Market growth. These finishes enhance the overall color of the vehicles and improve the surface shine by providing glaze.

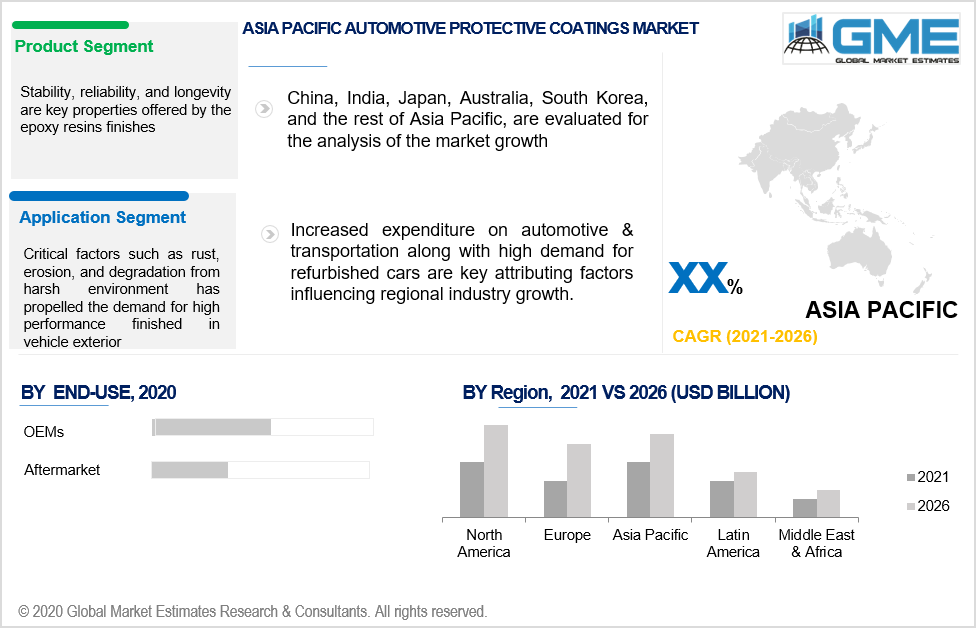

Epoxy, polyurethane, acrylic, polyester, and alkyd are major products involved in the Automotive Protective Coatings market. Epoxy is among the major contributor in the product segment followed by polyurethane. Stability, reliability, and longevity are key properties offered by the epoxy resin finishes. Another major product is alkyd due to its high performance in the overall vehicle components. Economical pricing as compared to conventional sources along with wide availability are key attributing factors driving demand.

Water-borne, solvent-borne, and powder base are major identified formulations in the industry. Increasing preference for lighter-weight composites along with resistance from corrosion will influence the demand for the solvent-borne compound. Stringent regulations to reduce VOC emissions along with the wide presence of bio-solvents have positively influenced the industrial growth for solvent-borne finishes. Powder formulations will witness the highest gains in the comings years due to their high efficiency in the exterior finishes and glaze appearance.

Interior and exterior are two application areas to apply the Automotive Protective Coatings. Critical factors such as rust, erosion, and degradation from the harsh environment have propelled the demand for high-performance finisheson the vehicle exterior. Thus, exterior applications will lead to the overall demand in the coming years. The interior finishes are highly influenced by the efficiency factors such as enhanced lifespan, protection from microbes and fouls, and corrosion.

The industry witnesses a high inclination towards exterior finishes due to the appearance factor and preference for fewer maintenance vehicles. The renovation and repair can cause a huge financial burden on the buyer. Thus, in an economic vehicle, it is effective to provide high-performance finishes.

Original equipment manufacturers or OEMs will lead the end-use segment in the coming years. Vehicle industry expansion along with an increasing number of vehicle production to meet growing demand has influenced growth in this segment. The new technologically updated vehicle production has adopted these high-performance finishes in their production process.

The aftermarket will witness the highest growth during the forecast period. In the transportation sector, the after-sale service holds a major share in the industry. The cars need consistent maintenance or repair which may be caused due to accidental damage, harsh environmental impact, or vehicle age. These high-performance finishes works wonder on the cars by improving their functionality, appearance, and elongated component life.

Asia Pacific Automotive Protective Coatings Market will hold the largest share during the forecast period. Increased expenditure on automotive & transportation along with high demand for refurbished cars are key attributing factors influencing regional industry growth. China, India, and South Korea are major countries in the production segment. Increasing foreign investors to set up a plant in Asian countries will also enhance the regional demand.

North America will witness significant gains in the coming years. Substantial growth in the production sector along with government intervention to reduce carbon emission will induce regional growth. Europe industrial growth will be highly inclined towards compounds innovation and meeting regulatory requirements by adopting sustainable high-performance finishes. High funding in eco-friendly solvents along with the presence of major industry players will flourish the regional industry growth.

Arkema S.A., Akzo Nobel NV, PPG Industries, Inc., Axalta Coating Systems, RPM International, Inc., The Sherwin-Williams Company, Wacker Chemie AG, The Dow Chemicals Company, BASF SE, Kisco Limited, Beckers Group, Cabot Corporation, Bollig & Kemper, Eastman Chemical Company, HMG Paints, Jotun, Nippon Paint Holdings, Kansai Nerolac Paints, KCC Corporation, Lord Corporation, Shanghai Kinlita Chemical Co. Ltd, SIKA AG, Hempel A/S, Induron Protective Coatings, and H.B. Fuller Company are major contributors to the industry share.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automotive protective coatings industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Product overview

2.1.3 Formulation overview

2.1.4 Application overview

2.1.5 End-Use overview

2.1.6 Regional overview

Chapter 3 Automotive Protective Coatings Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Protective coatings production technology overview

3.10.1 Formulation

3.10.2 End-Use

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Automotive Protective Coatings Market, By Product

4.1 Product Outlook

4.2 Epoxy

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Polyurethane

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Acrylic

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Polyester

4.5.1 Market size, by region, 2016-2026 (USD Million)

4.6 Alkyd

4.6.1 Market size, by region, 2016-2026 (USD Million)

4.7 Others

4.7.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Automotive Protective Coatings Market, By Form

5.1 Formulation Outlook

5.2 Water-Borne

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Solvent-Borne

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Powder Based

5.4.1 Market size, by region, 2016-2026 (USD Million)

5.5 Others

5.5.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Automotive Protective Coatings Market, By Application

6.1 Application Outlook

6.2 Exterior

6.2.1 Market size, by region, 2016-2026 (USD Million)

6.3 Interior

6.3.1 Market size, by region, 2016-2026 (USD Million)

Chapter 7 Automotive Protective Coatings Market, By End-Use

7.1 End-Use Outlook

7.2 OEM

7.2.1 Market size, by region, 2016-2026 (USD Million)

7.3 Aftermarket

7.3.1 Market size, by region, 2016-2026 (USD Million)

Chapter 8 Automotive Protective Coatings Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market size, by country 2016-2026 (USD Million)

8.2.2 Market size, by product, 2016-2026 (USD Million)

8.2.3 Market size, by formulation, 2016-2026 (USD Million)

8.2.4 Market size, by application, 2016-2026 (USD Million)

8.2.5 Market size, by end-use, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market size, by product, 2016-2026 (USD Million)

8.2.6.2 Market size, by formulation, 2016-2026 (USD Million)

8.2.6.3 Market size, by application, 2016-2026 (USD Million)

8.2.6.4 Market size, by end-use, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market size, by product, 2016-2026 (USD Million)

8.2.7.2 Market size, by formulation, 2016-2026 (USD Million)

8.2.7.3 Market size, by application, 2016-2026 (USD Million)

8.2.7.4 Market size, by end-use, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market size, by country 2016-2026 (USD Million)

8.3.2 Market size, by product, 2016-2026 (USD Million)

8.3.3 Market size, by formulation, 2016-2026 (USD Million)

8.3.4 Market size, by application, 2016-2026 (USD Million)

8.3.5 Market size, by end-use, 2016-2026 (USD Million)

8.3.6 Germany

8.2.6.1 Market size, by product, 2016-2026 (USD Million)

8.2.6.2 Market size, by formulation, 2016-2026 (USD Million)

8.2.6.3 Market size, by application, 2016-2026 (USD Million)

8.2.6.4 Market size, by end-use, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market size, by product, 2016-2026 (USD Million)

8.3.7.2 Market size, by formulation, 2016-2026 (USD Million)

8.3.7.3 Market size, by application, 2016-2026 (USD Million)

8.3.7.4 Market size, by end-use, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market size, by product, 2016-2026 (USD Million)

8.3.8.2 Market size, by formulation, 2016-2026 (USD Million)

8.3.8.3 Market size, by application, 2016-2026 (USD Million)

8.3.8.4 Market size, by end-use, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market size, by product, 2016-2026 (USD Million)

8.3.9.2 Market size, by formulation, 2016-2026 (USD Million)

8.3.9.3 Market size, by application, 2016-2026 (USD Million)

8.3.9.4 Market size, by end-use, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market size, by product, 2016-2026 (USD Million)

8.3.10.2 Market size, by formulation, 2016-2026 (USD Million)

8.3.10.3 Market size, by application, 2016-2026 (USD Million)

8.3.10.4 Market size, by end-use, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market size, by product, 2016-2026 (USD Million)

8.3.11.2 Market size, by formulation, 2016-2026 (USD Million)

8.3.11.3 Market size, by application, 2016-2026 (USD Million)

8.3.11.4 Market size, by end-use, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market size, by country 2016-2026 (USD Million)

8.4.2 Market size, by product, 2016-2026 (USD Million)

8.4.3 Market size, by formulation, 2016-2026 (USD Million)

8.4.4 Market size, by application, 2016-2026 (USD Million)

8.4.5 Market size, by end-use, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market size, by product, 2016-2026 (USD Million)

8.4.6.2 Market size, by formulation, 2016-2026 (USD Million)

8.4.6.3 Market size, by application, 2016-2026 (USD Million)

8.4.6.4 Market size, by end-use, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market size, by product, 2016-2026 (USD Million)

8.4.7.2 Market size, by formulation, 2016-2026 (USD Million)

8.4.7.3 Market size, by application, 2016-2026 (USD Million)

8.4.7.4 Market size, by end-use, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market size, by product, 2016-2026 (USD Million)

8.4.8.2 Market size, by formulation, 2016-2026 (USD Million)

8.4.8.3 Market size, by application, 2016-2026 (USD Million)

8.4.8.4 Market size, by end-use, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market size, by product, 2016-2026 (USD Million)

8.4.9.2 Market size, by formulation, 2016-2026 (USD Million)

8.4.9.3 Market size, by application, 2016-2026 (USD Million)

8.4.9.4 Market size, by end-use, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market size, by product, 2016-2026 (USD Million)

8.4.10.2 Market size, by formulation, 2016-2026 (USD Million)

8.4.10.3 Market size, by application, 2016-2026 (USD Million)

8.4.10.4 Market size, by end-use, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market size, by country 2016-2026 (USD Million)

8.5.2 Market size, by product, 2016-2026 (USD Million)

8.5.3 Market size, by formulation, 2016-2026 (USD Million)

8.5.4 Market size, by application, 2016-2026 (USD Million)

8.5.5 Market size, by end-use, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market size, by product, 2016-2026 (USD Million)

8.5.6.2 Market size, by formulation, 2016-2026 (USD Million)

8.5.6.3 Market size, by application, 2016-2026 (USD Million)

8.5.6.4 Market size, by end-use, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market size, by product, 2016-2026 (USD Million)

8.5.7.2 Market size, by formulation, 2016-2026 (USD Million)

8.5.7.3 Market size, by application, 2016-2026 (USD Million)

8.5.7.4 Market size, by end-use, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market size, by product, 2016-2026 (USD Million)

8.5.8.2 Market size, by formulation, 2016-2026 (USD Million)

8.5.8.3 Market size, by application, 2016-2026 (USD Million)

8.5.8.4 Market size, by end-use, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market size, by country 2016-2026 (USD Million)

8.6.2 Market size, by product, 2016-2026 (USD Million)

8.6.3 Market size, by formulation, 2016-2026 (USD Million)

8.6.4 Market size, by application, 2016-2026 (USD Million)

8.6.5 Market size, by end-use, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market size, by product, 2016-2026 (USD Million)

8.6.6.2 Market size, by formulation, 2016-2026 (USD Million)

8.6.6.3 Market size, by application, 2016-2026 (USD Million)

8.6.6.4 Market size, by end-use, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market size, by product, 2016-2026 (USD Million)

8.6.7.2 Market size, by formulation, 2016-2026 (USD Million)

8.6.7.3 Market size, by application, 2016-2026 (USD Million)

8.6.7.4 Market size, by end-use, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market size, by product, 2016-2026 (USD Million)

8.6.8.2 Market size, by formulation, 2016-2026 (USD Million)

8.6.8.3 Market size, by application, 2016-2026 (USD Million)

8.6.8.4 Market size, by end-use, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2 Arkema S.A.

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3 Akzo Nobel NV

9.3.1 Company overview

9.3.2 Financial analysis

9.3.3 Strategic positioning

9.3.4 Info graphic analysis

9.4 PPG Industries, Inc.

9.4.1 Company overview

9.4.2 Financial analysis

9.4.3 Strategic positioning

9.4.4 Info graphic analysis

9.5 Axalta Coating Systems

9.5.1 Company overview

9.5.2 Financial analysis

9.5.3 Strategic positioning

9.5.4 Info graphic analysis

9.6 RPM International, Inc.

9.6.1 Company overview

9.6.2 Financial analysis

9.6.3 Strategic positioning

9.6.4 Info graphic analysis

9.7 The Sherwin-Williams Company

9.7.1 Company overview

9.7.2 Financial analysis

9.7.3 Strategic positioning

9.7.4 Info graphic analysis

9.8 Wacker Chemie AG

9.8.1 Company overview

9.8.2 Financial analysis

9.8.3 Strategic positioning

9.8.4 Info graphic analysis

9.9 The Dow Chemicals Company

9.9.1 Company overview

9.9.2 Financial analysis

9.9.3 Strategic positioning

9.9.4 Info graphic analysis

9.10 BASF SE

9.10.1 Company overview

9.10.2 Financial analysis

9.10.3 Strategic positioning

9.10.4 Info graphic analysis

9.11 Kisco Limited

9.11.1 Company overview

9.11.2 Financial analysis

9.11.3 Strategic positioning

9.11.4 Info graphic analysis

9.12 Beckers Group

9.12.1 Company overview

9.12.2 Financial analysis

9.12.3 Strategic positioning

9.12.4 Info graphic analysis

9.13 Bollig & Kemper

9.13.1 Company overview

9.13.2 Financial analysis

9.13.3 Strategic positioning

9.13.4 Info graphic analysis

9.14 Cabot Corporation

9.14.1 Company overview

9.14.2 Financial analysis

9.14.3 Strategic positioning

9.14.4 Info graphic analysis

9.15 Eastman Chemical Company

9.15.1 Company overview

9.15.2 Financial analysis

9.15.3 Strategic positioning

9.15.4 Info graphic analysis

9.16 HMG Paints Limited

9.16.1 Company overview

9.16.2 Financial analysis

9.16.3 Strategic positioning

9.16.4 Info graphic analysis

9.17 Jotun

9.17.1 Company overview

9.17.2 Financial analysis

9.17.3 Strategic positioning

9.17.4 Info graphic analysis

9.18 Kansai Nerolac Paints Limited

9.18.1 Company overview

9.18.2 Financial analysis

9.18.3 Strategic positioning

9.18.4 Info graphic analysis

9.19 KCC Corporation

9.19.1 Company overview

9.19.2 Financial analysis

9.19.3 Strategic positioning

9.19.4 Info graphic analysis

9.20 Lord Corporation

9.20.1 Company overview

9.20.2 Financial analysis

9.20.3 Strategic positioning

9.20.4 Info graphic analysis

9.21 Nippon Paint Holdings Co. Ltd

9.21.1 Company overview

9.21.2 Financial analysis

9.21.3 Strategic positioning

9.21.4 Info graphic analysis

9.22 Shanghai Kinlita Chemical Co. Ltd

9.22.1 Company overview

9.22.2 Financial analysis

9.22.3 Strategic positioning

9.22.4 Info graphic analysis

9.23 SIKA AG

9.23.1 Company overview

9.23.2 Financial analysis

9.23.3 Strategic positioning

9.23.4 Info graphic analysis

9.24 Hempel A/S

9.24.1 Company overview

9.24.2 Financial analysis

9.24.3 Strategic positioning

9.24.4 Info graphic analysis

9.25 Induron Protective Coatings

9.25.1 Company overview

9.25.2 Financial analysis

9.25.3 Strategic positioning

9.25.4 Info graphic analysis

9.26 H.B. Fuller Company

9.26.1 Company overview

9.26.2 Financial analysis

9.263 Strategic positioning

9.26.4 Info graphic analysis

The Global Automotive Protective Coatings Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Protective Coatings Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS