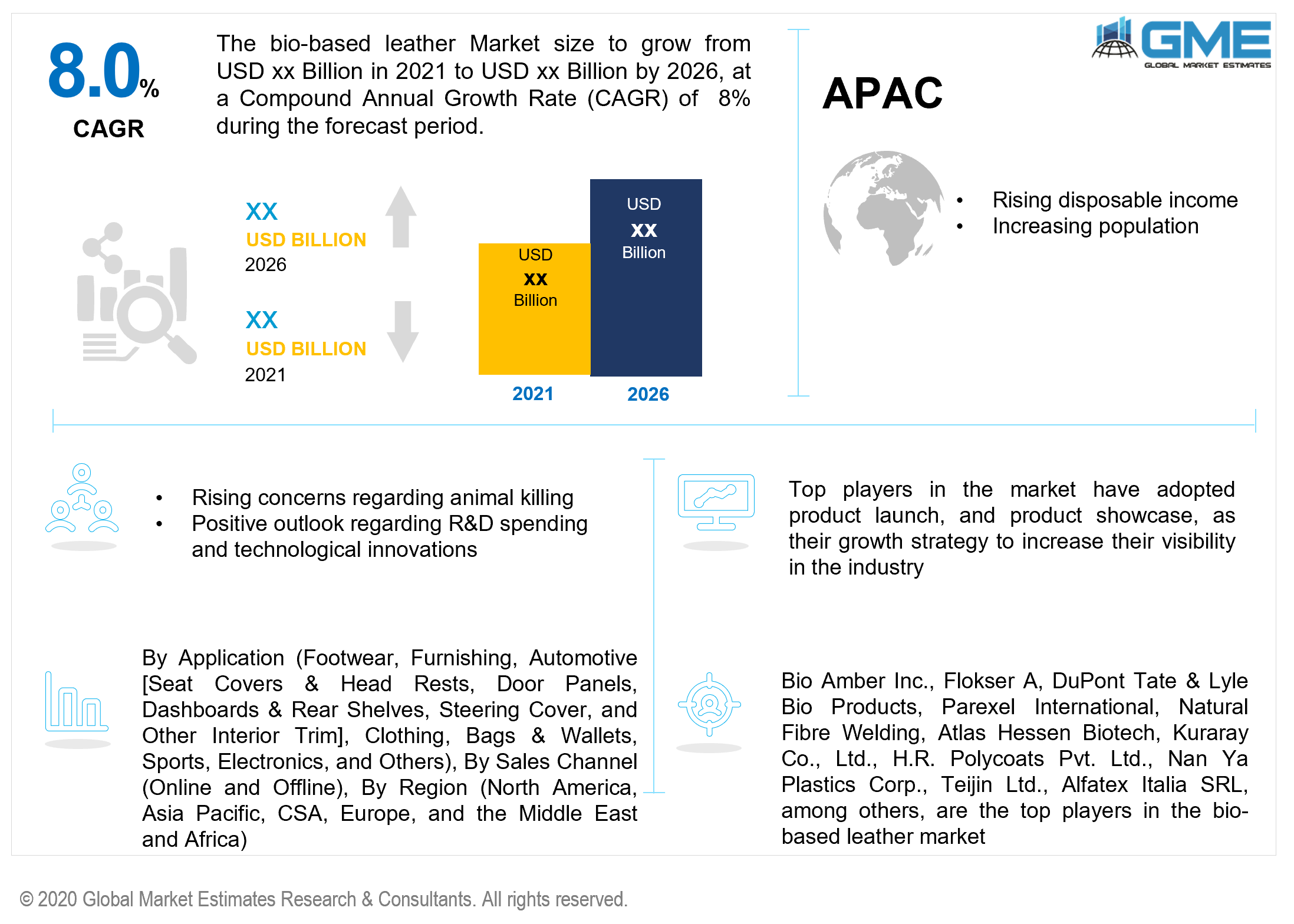

Global Bio-Based Leather Market Analysis - Forecasts to 2026 By Application (Footwear, Furnishing, Automotive [Seat Covers & Head Rests, Door Panels, Dashboards & Rear Shelves, Steering Cover, and Other Interior Trim], Clothing, Bags & Wallets, Sports, Electronics, and Others), By Sales Channel (Online and Offline), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Bio-based materials are in their infancy, with research and development efforts underway to greatly expand their use due to their green and eco-friendly properties. Bio-based goods are foreseen to rise rapidly in the forecast period. Polyester polyols derived from bio-based succinic acid and 1, 3-propanediol are used to make bio-based leather. Bio-based leather cloth contains 70% recycled material which provides increased durability and environmental protection.

In contrast to certain synthetic leather, bio-based leather is more scratch-resistant and has a smoother finish. Bio-based leather is phthalate-free leather; as a result, it has received clearance from different governments, is exempt from strict legislation, and contributes to a significant share of the overall synthetic leather market.

The trend toward environmentally friendly products, combined with stringent federal regulations on unsustainable products/leather, is expected to drive the global bio-based leather market throughout the forecast period People are becoming more knowledgeable about the style of footwear to wear for various purposes as their fashion consciousness grows. This leads to a surge in the usage of bio-based leather in such products. Furthermore, with a stable economy and convenient access to credit, consumers are able to buy new products in terms of expensive goods and cars, as shown by the consumer trust index. To meet this demand for leather-based goods, the global bio-based leather market is expanding at a rapid pace.

On the other hand, it is a problem with a precarious framework in many developed countries. Trade tariffs have consistently remained higher for chemicals rather than their equivalents in developed countries, including the prospect of exemptions in port transportation. As a result of certain obstacles – tariffs, import duty, port obligations, and so on – the high price of bio-based leather production is likely to stymie the global bio-based leather market throughout the forecast period.

Corporate groups are constantly developing environmentally sustainable materials. Cleaner and more efficient materials are becoming an indispensable research & development target field, and this has evolved as a core phenomenon for the global bio-based leather market. Increasing sales from the footwear industry, the absence of animal slaughter, superiority over pure leather, and rising preference for premium cars and electric vehicles would propel the bio-based leather market.

Depending on the application of bio-based leather, the market can be classified into footwear, furnishing, automotive, clothing, bags & wallets, sports, electronics, and others. The automotive segment is further classified as seat covers & headrests, door panels, dashboards & rear shelves, steering cover, and other interior trim.

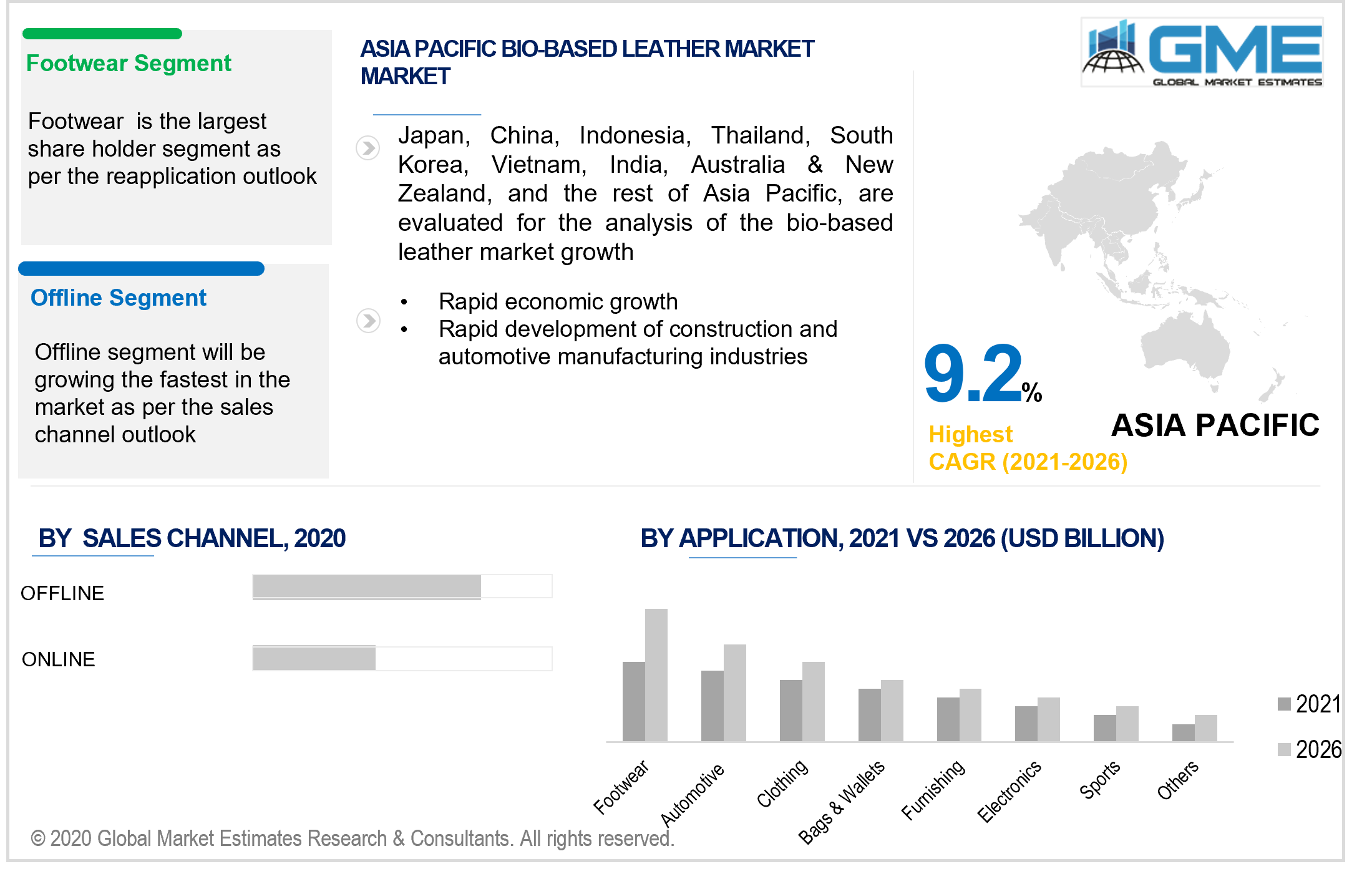

The footwear segment predominates in this market. Because of its outstanding characteristics and high longevity, bio-based leather is commonly employed to produce various forms of footwear. The growing market for footwear in both developed and developing economies is presumed to fuel demand for bio-based leather. Because of its low quality, bio-based leather is commonly used in the production of sportswear for a variety of games all over the world. Sports shoes produced from bio-based leather resemble those produced from pure leather and have additional characteristics such as resistance to water, humidity, and harsh environmental conditions. It is utilized to manufacture formal men's and women's footwear for business-specific purposes as well as boots for males and females in the fashion world and those residing in colder areas around the world. If subjected to ice and rain, good leather boots rip, but bio-based leather provides outstanding moisture and ice resistance. Thus, this aforementioned factor leads to this segment's supremacy.

The bio-based market can be divided into two categories based on the sales channel: online and offline. Due to the high price and consistency aspect of bio-based goods, offline retail is expected to be the largest contributor to demand growth. Consumers tend to conduct physical checks before investing such large sums of money on such items, which drives the offline channel market. Millennials and Generation Z are driving demand development, while younger consumers pursue a customized consumer experience that combines both online and offline channels. Offline stores are undergoing a radical transformation. Moreover, the availability of bio-based leather products in retail stores has a propensity to demonstrate its material to a wide number of customers. Thus, leading to the supremacy of this segment.

The Bio-Based Leather Market by region can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. APAC includes big developing economies namely China & India. As a result, most bio-based leather businesses have a lot of room to grow in the Asia Pacific region. The bio-based leather market is developing rapidly and provides prospects for a variety of manufacturers. The APAC region is home to approximately 61.0 percent of the global population, and the area's production and processing industries are expanding rapidly. The APAC region has the largest bio-based leather industry, with China being the most important market, and it is expected to expand dramatically in the coming years. Proliferating disposable incomes and augmented living standards in APAC's developing countries are the primary triggers of this market.

The region's growing population, along with the emergence of advanced technology and materials, is expected to make it an optimal location for the development of the bio-based leather market. Flourishing footwear and automobile markets, as well as advancements in-process production, are amongst the major contributors to the APAC market. Due to increased demand from the automobile industry, nations such as India, Indonesia, and China are likely to see rapid growth in the bio-based leather market. North America, stimulated by the bio-based leather market in the United States, can experience modest growth rates. Significant application forecasts in the clothing, furniture, and automobile industries are expected to accelerate regional development. Considerations over animal cruelty can reduce the usage of animal skins, favoring regional demand.

Bio Amber Inc., Flokser A, DuPont Tate & Lyle Bio Products, Parexel International, Natural Fibre Welding, Atlas Hessen Biotech, Kuraray Co., Ltd., H.R. Polycoats Pvt. Ltd., Nan Ya Plastics Corp., Teijin Ltd., Alfatex Italia SRL, among others, are the top players in the bio-based leather market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bio-Based Leather Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Sales Channel Overview

2.1.4 Regional Overview

Chapter 3 Bio-Based Leather Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Environmental Concerns

3.3.1.2 Rising Awareness Regarding Animal Safety

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Sales Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Bio-Based Leather Market, By Application

4.1 Application Outlook

4.2 Footwear

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Furnishing

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Automotive

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Clothing

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Bags & Wallets

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Sports

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

4.8 Electronics

4.8.1 Market Size, By Region, 2016-2026 (USD Million)

4.9 Others

4.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Bio-Based Leather Market, By Sales Channel

5.1 Sales Channel Outlook

5.2 Online

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Offline

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Bio-Based Leather Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Application, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Application, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2016-2026 (USD Million)

6.4.7.2 Market size, By Sales Channel, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Sales Channel, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Bio Amber Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Flokser A

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 DuPont Tate & Lyle Bio Products

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Parexel International

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Natural Fibre Welding

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Atlas Hessen Biotech

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Kuraray Co., Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 H.R. Polycoats Pvt. Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Parnell Pharmaceuticals, Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Nan Ya Plastics Corp.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Teijin Ltd.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Alfatex Italia SRL

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Other Companies

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

The Global Bio-Based Leather Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bio-Based Leather Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS