Global Biosimilars Market Size, Trends & Analysis - Forecasts to 2029 By Drug Class (Monoclonal Antibodies, Insulin, Granulocyte Colony-Stimulating Factor, Erythropoietin, Interferons, Anticoagulants, and Other Drug Class), By Indication (Oncology, Inflammatory & Autoimmune Disorders, Chronic Diseases, Blood Disorders, and Other Indications), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

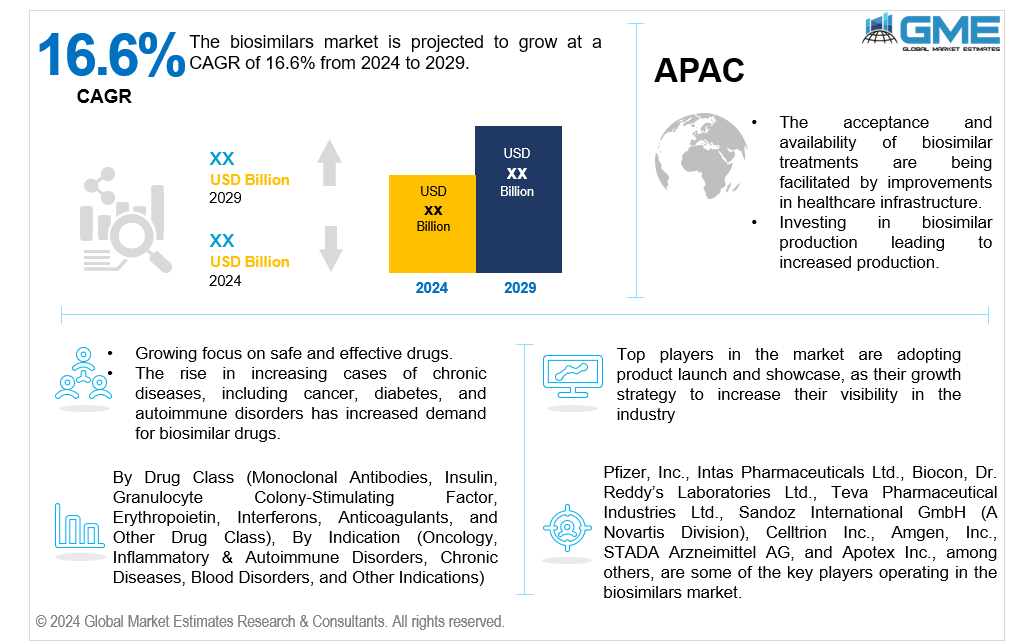

The global biosimilars market is projected to grow at a CAGR of 16.6% from 2024 to 2029.

As healthcare systems worldwide seek cost-effective solutions, the demand for biosimilars is increasing, driven by patent expirations of major biologic drugs and growing prevalence of chronic diseases. Biosimilars cost-effectiveness are making treatments more accessible to patients while maintaining similar safety and efficacy profiles. The production of biosimilars has become a primary focus for numerous pharmaceutical companies as they endeavour to capitalize on the opportunity to offer cost-effective alternatives to costly biologics. Advancements in biotechnology and biosimilars manufacturing have facilitated the production of high-quality biosimilars that satisfy rigorous regulatory requirements, thereby supporting the growth of the market.

Currently, the clinical data requirements of the European Union and the United States are distinct. However, both require randomized biosimilar clinical trials to demonstrate equivalent safety and efficacy in the short term. In June 2024, the U.S. Food and Drug Administration (FDA) approved Ahzantive, a biosimilar product, for the treatment of age-related neovascular (wet) macular degeneration (nAMD), and other severe retinal diseases, such as diabetic macular edema, diabetic retinopathy, and macular edema following retinal vein occlusion.

The safety, efficacy, and quality of biosimilars are guaranteed by the establishment of rigorous guidelines by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These frameworks offer a transparent process for the biosimilars production and approval, which in turn motivates additional companies to enter the market. The global biosimilar market trend is showing further expansion as a result of the convergence of a robust product biosimilar pipeline, robust manufacturing capabilities, and a supportive biosimilar regulatory landscape. However, biosimilar pricing, immunogenicity, a lack of treatment awareness, and the extension of indications for the disease in the market are just a few of the challenges manufacturers face in the market. In this rapidly expanding sector, comprehensive biosimilar market analysis exposes key trends and competitive strategies, emphasizing the major players and their endeavors to capture market share.

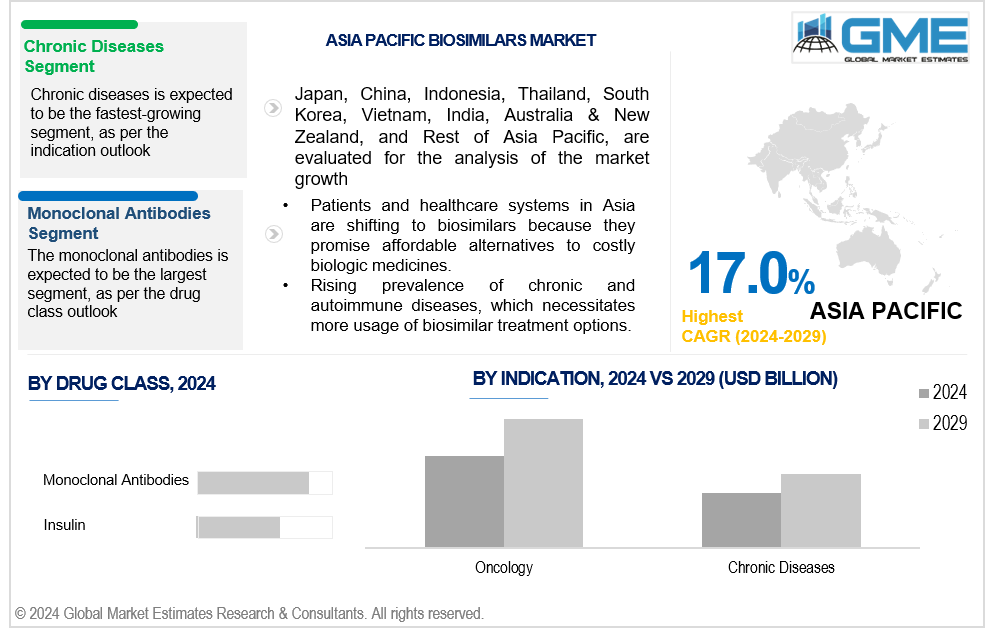

The monoclonal antibodies segment is expected to hold the largest share of the market during the forecast period. The monoclonal antibodies segment is expanding at a rapid pace as a result of the growing demand in biosimilar oncology, autoimmune disorders, and infectious diseases. Genetic engineering and biotechnology advancements have enhanced the research and production of monoclonal antibodies. The increasing prevalence of chronic diseases, robust R&D investments, and regulatory support for innovative treatments are the primary factors that are driving biosimilars market growth. Furthermore, the growth of the monoclonal antibodies segment is further fueled by the growing applications of these products in personalized medicine and diagnostics.

The insulin segment is analyzed to be the fastest-growing segment in the market from 2024 to 2029. Biosimilar insulin is a biological replication of the original insulin, and there is a growing interest in insulin production its development and utilization. The National Health Service (NHS) is presented with opportunities regarding the cost of care and availability of care due to the fact that biosimilar insulins are less expensive than original products. A biosimilar insulin may be less expensive than its brand-name equivalent. The safety and efficacy of biosimilar products have been assessed through the rigorous FDA biosimilar approval process. Additional studies are necessary for a drug company that is testing a new biosimilar, as it is not necessary to repeat the extensive clinical tests that were necessary for the initial drug.

The oncology segment is analyzed to hold the largest market share from 2024 to 2029. The oncology field is fueling the expansion of the biosimilars market by meeting the increasing need for affordable cancer therapies. Biosimilar monoclonal antibody drugs and other oncology treatments are enhancing the availability and affordability of advanced cancer care for patients. This biosimilars development is particularly prominent in oncology, where the need for cost-effective cancer treatments is driving significant market growth. The biosimilars are expensive to make but still cheaper than the original biological medicine used in the treatment for cancer patients.

The chronic diseases segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. The aging population, lifestyle changes, and the rising prevalence of conditions like diabetes and many others have resulted in chronic diseases being the most rapidly expanding health concern on a global scale. The biologic drug market growth in this segment has been facilitated by the certain biosimilar manufacturers have received from the FDA for the treatment of chronic diseases. The reference product can be replaced with these biosimilars at the pharmacy, and the patient can consult with their doctor to determine the efficacy of the treatment using the biosimilar.

North America is expected to be the largest region in the global market. One of the primary factors driving market growth is the emergence of new biosimilars that offer cost-effective treatment alternatives to expensive biologic therapies with increasing prevalence of chronic diseases. Biosimilars for autoimmune diseases are gaining appeal because they can offer effective and cost-effective treatment options compared to original biologic treatments in the region.

Asia Pacific is predicted to witness rapid growth during the forecast period. The increasing demand for quality healthcare in the region, the increasing geriatric population base, the rise in medical tourism, and the development of research activities in the region are driving the growth in the market for biosimilars. According to the latest biosimilars market forecast, the market is set to experience robust growth, fueled by increasing demand, particularly in the Asia Pacific region. This growth is driven by a rising prevalence of chronic and autoimmune diseases, which necessitates more affordable treatment options. Pharmaceutical companies are being compelled to innovate and improve cost-efficiency to provide more affordable treatment options as a result of the intensifying biosimilar competition.

Pfizer, Inc., Intas Pharmaceuticals Ltd., Biocon, Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Sandoz International GmbH (A Novartis Division), Celltrion Inc., Amgen, Inc., STADA Arzneimittel AG, and Apotex Inc., among others, are some of the key players operating in the global biosimilars market.

Please note: This is not an exhaustive list of companies profiled in the report.

On July 3, 2024, the European Commission (EC) granted marketing authorization for Omlyclo (omalizumab)/Celltrion's biosimilar. This drug is used to treat asthma, nasal polyps, and chronic idiopathic urticaria (itchy rash).

On June 26, 2024, China's National Medical Products Administration (NMPA) approved the cetuximab beta injection (Enlituo), which is a recombinant EGFR monoclonal antibody independently developed in China that was designed to effectively avoid glycosylation modification leading to hypersensitivity in patients receiving the biosimilar drug.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BIOSIMILARS MARKET, BY DRUG CLASS

4.1 Introduction

4.2 Biosimilars Market: Drug Class Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Monoclonal Antibodies

4.4.1 Monoclonal Antibodies Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Insulin

4.5.1 Insulin Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Granulocyte Colony-Stimulating Factor

4.6.1 Granulocyte Colony-Stimulating Factor Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Erythropoietin

4.7.1 Erythropoietin Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Interferons

4.8.1 Interferons Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Anticoagulants

4.9.1 Anticoagulants Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Other Drug Class

4.10.1 Other Drug Class Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BIOSIMILARS MARKET, BY INDICATION

5.1 Introduction

5.2 Biosimilars Market: Indication Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Oncology

5.4.1 Oncology Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Inflammatory & Autoimmune Disorders

5.5.1 Inflammatory & Autoimmune Disorders Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Chronic Diseases

5.6.1 Chronic Diseases Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Blood Disorders

5.7.1 Blood Disorders Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Other Indications

5.8.1 Other Indications Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BIOSIMILARS MARKET, BY REGION

6.1 Introduction

6.2 North America Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Drug Class

6.2.2 By Indication

6.2.3 By Country

6.2.3.1 U.S. Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Drug Class

6.2.3.1.2 By Indication

6.2.3.2 Canada Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Drug Class

6.2.3.2.2 By Indication

6.2.3.3 Mexico Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Drug Class

6.2.3.3.2 By Indication

6.3 Europe Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Drug Class

6.3.2 By Indication

6.3.3 By Country

6.3.3.1 Germany Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Drug Class

6.3.3.1.2 By Indication

6.3.3.2 U.K. Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Drug Class

6.3.3.2.2 By Indication

6.3.3.3 France Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Drug Class

6.3.3.3.2 By Indication

6.3.3.4 Italy Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Drug Class

6.3.3.4.2 By Indication

6.3.3.5 Spain Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Drug Class

6.3.3.5.2 By Indication

6.3.3.6 Netherlands Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Drug Class

6.3.3.6.2 By Indication

6.3.3.7 Rest of Europe Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Drug Class

6.3.3.6.2 By Indication

6.4 Asia Pacific Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Drug Class

6.4.2 By Indication

6.4.3 By Country

6.4.3.1 China Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Drug Class

6.4.3.1.2 By Indication

6.4.3.2 Japan Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Drug Class

6.4.3.2.2 By Indication

6.4.3.3 India Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Drug Class

6.4.3.3.2 By Indication

6.4.3.4 South Korea Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Drug Class

6.4.3.4.2 By Indication

6.4.3.5 Singapore Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Drug Class

6.4.3.5.2 By Indication

6.4.3.6 Malaysia Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Drug Class

6.4.3.6.2 By Indication

6.4.3.7 Thailand Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Drug Class

6.4.3.6.2 By Indication

6.4.3.8 Indonesia Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Drug Class

6.4.3.7.2 By Indication

6.4.3.9 Vietnam Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Drug Class

6.4.3.8.2 By Indication

6.4.3.10 Taiwan Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Drug Class

6.4.3.10.2 By Indication

6.4.3.11 Rest of Asia Pacific Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Drug Class

6.4.3.11.2 By Indication

6.5 Middle East and Africa Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Drug Class

6.5.2 By Indication

6.5.3 By Country

6.5.3.1 Saudi Arabia Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Drug Class

6.5.3.1.2 By Indication

6.5.3.2 U.A.E. Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Drug Class

6.5.3.2.2 By Indication

6.5.3.3 Israel Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Drug Class

6.5.3.3.2 By Indication

6.5.3.4 South Africa Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Drug Class

6.5.3.4.2 By Indication

6.5.3.5 Rest of Middle East and Africa Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Drug Class

6.5.3.5.2 By Indication

6.6 Central and South America Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Drug Class

6.6.2 By Indication

6.6.3 By Country

6.6.3.1 Brazil Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Drug Class

6.6.3.1.2 By Indication

6.6.3.2 Argentina Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Drug Class

6.6.3.2.2 By Indication

6.6.3.3 Chile Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Drug Class

6.6.3.3.2 By Indication

6.6.3.3 Rest of Central and South America Biosimilars Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Drug Class

6.6.3.3.2 By Indication

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Pfizer, Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Intas Pharmaceuticals Ltd.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Biocon

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Dr. Reddy’s Laboratories Ltd.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Teva Pharmaceutical Industries Ltd.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION)

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Celltrion Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Amgen, Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 STADA Arzneimittel AG

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Apotex Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

2 Monoclonal Antibodies Market, By Region, 2021-2029 (USD MILLION)

3 Insulin Market, By Region, 2021-2029 (USD MILLION)

4 Granulocyte Colony-Stimulating Factor Market, By Region, 2021-2029 (USD MILLION)

5 Erythropoietin Market, By Region, 2021-2029 (USD MILLION)

6 Interferons Market, By Region, 2021-2029 (USD MILLION)

7 Anticoagulants Market, By Region, 2021-2029 (USD MILLION)

8 Other Drug Class Market, By Region, 2021-2029 (USD MILLION)

9 Global Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

10 Oncology Market, By Region, 2021-2029 (USD MILLION)

11 Inflammatory & Autoimmune Disorders Market, By Region, 2021-2029 (USD MILLION)

12 Chronic Diseases Market, By Region, 2021-2029 (USD MILLION)

13 Blood Disorders Market, By Region, 2021-2029 (USD MILLION)

14 Other Indications Market, By Region, 2021-2029 (USD MILLION)

15 Regional Analysis, 2021-2029 (USD MILLION)

16 North America Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

17 North America Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

18 North America Biosimilars Market, By COUNTRY, 2021-2029 (USD MILLION)

19 U.S. Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

20 U.S. Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

21 Canada Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

22 Canada Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

23 Mexico Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

24 Mexico Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

25 Europe Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

26 Europe Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

27 Europe Biosimilars Market, By Country, 2021-2029 (USD MILLION)

28 Germany Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

29 Germany Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

30 U.K. Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

31 U.K. Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

32 France Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

33 France Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

34 Italy Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

35 Italy Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

36 Spain Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

37 Spain Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

38 Netherlands Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

39 Netherlands Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

40 Rest Of Europe Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

41 Rest Of Europe Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

42 Asia Pacific Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

43 Asia Pacific Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

44 Asia Pacific Biosimilars Market, By Country, 2021-2029 (USD MILLION)

45 China Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

46 China Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

47 Japan Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

48 Japan Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

49 India Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

50 India Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

51 South Korea Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

52 South Korea Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

53 Singapore Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

54 Singapore Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

55 Thailand Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

56 Thailand Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

57 Malaysia Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

58 Malaysia Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

59 Indonesia Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

60 Indonesia Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

61 Vietnam Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

62 Vietnam Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

63 Taiwan Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

64 Taiwan Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

65 Rest of APAC Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

66 Rest of APAC Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

67 Middle East and Africa Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

68 Middle East and Africa Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

69 Middle East and Africa Biosimilars Market, By Country, 2021-2029 (USD MILLION)

70 Saudi Arabia Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

71 Saudi Arabia Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

72 UAE Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

73 UAE Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

74 Israel Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

75 Israel Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

76 South Africa Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

77 South Africa Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

78 Rest Of Middle East and Africa Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

79 Rest Of Middle East and Africa Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

80 Central and South America Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

81 Central and South America Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

82 Central and South America Biosimilars Market, By Country, 2021-2029 (USD MILLION)

83 Brazil Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

84 Brazil Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

85 Chile Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

86 Chile Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

87 Argentina Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

88 Argentina Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

89 Rest Of Central and South America Biosimilars Market, By Drug Class, 2021-2029 (USD MILLION)

90 Rest Of Central and South America Biosimilars Market, By Indication, 2021-2029 (USD MILLION)

91 Pfizer, Inc.: Products & Services Offering

92 Intas Pharmaceuticals Ltd.: Products & Services Offering

93 Biocon: Products & Services Offering

94 Dr. Reddy’s Laboratories Ltd.: Products & Services Offering

95 Teva Pharmaceutical Industries Ltd.: Products & Services Offering

96 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION): Products & Services Offering

97 Celltrion Inc.: Products & Services Offering

98 Amgen, Inc.: Products & Services Offering

99 STADA Arzneimittel AG: Products & Services Offering

100 Apotex Inc.: Products & Services Offering

101 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Biosimilars Market Overview

2 Global Biosimilars Market Value From 2021-2029 (USD MILLION)

3 Global Biosimilars Market Share, By Drug Class (2023)

4 Global Biosimilars Market Share, By Indication (2023)

5 Global Biosimilars Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Biosimilars Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Biosimilars Market

10 Impact Of Challenges On The Global Biosimilars Market

11 Porter’s Five Forces Analysis

12 Global Biosimilars Market: By Drug Class Scope Key Takeaways

13 Global Biosimilars Market, By Drug Class Segment: Revenue Growth Analysis

14 Monoclonal Antibodies Market, By Region, 2021-2029 (USD MILLION)

15 Insulin Market, By Region, 2021-2029 (USD MILLION)

16 Granulocyte Colony-Stimulating Factor Market, By Region, 2021-2029 (USD MILLION)

17 Erythropoietin Market, By Region, 2021-2029 (USD MILLION)

18 Interferons Market, By Region, 2021-2029 (USD MILLION)

19 Anticoagulants Market, By Region, 2021-2029 (USD MILLION)

20 Other Drug Class Market, By Region, 2021-2029 (USD MILLION)

21 Global Biosimilars Market: By Indication Scope Key Takeaways

22 Global Biosimilars Market, By Indication Segment: Revenue Growth Analysis

23 Oncology Market, By Region, 2021-2029 (USD MILLION)

24 Inflammatory & Autoimmune Disorders Market, By Region, 2021-2029 (USD MILLION)

25 Chronic Diseases Market, By Region, 2021-2029 (USD MILLION)

26 Blood Disorders Market, By Region, 2021-2029 (USD MILLION)

27 Other Indications Market, By Region, 2021-2029 (USD MILLION)

28 Regional Segment: Revenue Growth Analysis

29 Global Biosimilars Market: Regional Analysis

30 North America Biosimilars Market Overview

31 North America Biosimilars Market, By Drug Class

32 North America Biosimilars Market, By Indication

33 North America Biosimilars Market, By Country

34 U.S. Biosimilars Market, By Drug Class

35 U.S. Biosimilars Market, By Indication

36 Canada Biosimilars Market, By Drug Class

37 Canada Biosimilars Market, By Indication

38 Mexico Biosimilars Market, By Drug Class

39 Mexico Biosimilars Market, By Indication

40 Four Quadrant Positioning Matrix

41 Company Market Share Analysis

42 Pfizer, Inc.: Company Snapshot

43 Pfizer, Inc.: SWOT Analysis

44 Pfizer, Inc.: Geographic Presence

45 Intas Pharmaceuticals Ltd.: Company Snapshot

46 Intas Pharmaceuticals Ltd.: SWOT Analysis

47 Intas Pharmaceuticals Ltd.: Geographic Presence

48 Biocon: Company Snapshot

49 Biocon: SWOT Analysis

50 Biocon: Geographic Presence

51 Dr. Reddy’s Laboratories Ltd.: Company Snapshot

52 Dr. Reddy’s Laboratories Ltd.: Swot Analysis

53 Dr. Reddy’s Laboratories Ltd.: Geographic Presence

54 Teva Pharmaceutical Industries Ltd.: Company Snapshot

55 Teva Pharmaceutical Industries Ltd.: SWOT Analysis

56 Teva Pharmaceutical Industries Ltd.: Geographic Presence

57 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION): Company Snapshot

58 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION): SWOT Analysis

59 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION): Geographic Presence

60 Celltrion Inc.: Company Snapshot

61 Celltrion Inc.: SWOT Analysis

62 Celltrion Inc.: Geographic Presence

63 Amgen, Inc.: Company Snapshot

64 Amgen, Inc.: SWOT Analysis

65 Amgen, Inc.: Geographic Presence

66 STADA Arzneimittel AG: Company Snapshot

67 STADA Arzneimittel AG: SWOT Analysis

68 STADA Arzneimittel AG: Geographic Presence

69 Apotex Inc.: Company Snapshot

70 Apotex Inc.: SWOT Analysis

71 Apotex Inc.: Geographic Presence

72 Other Companies: Company Snapshot

73 Other Companies: SWOT Analysis

74 Other Companies: Geographic Presence

The Global Biosimilars Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biosimilars Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS