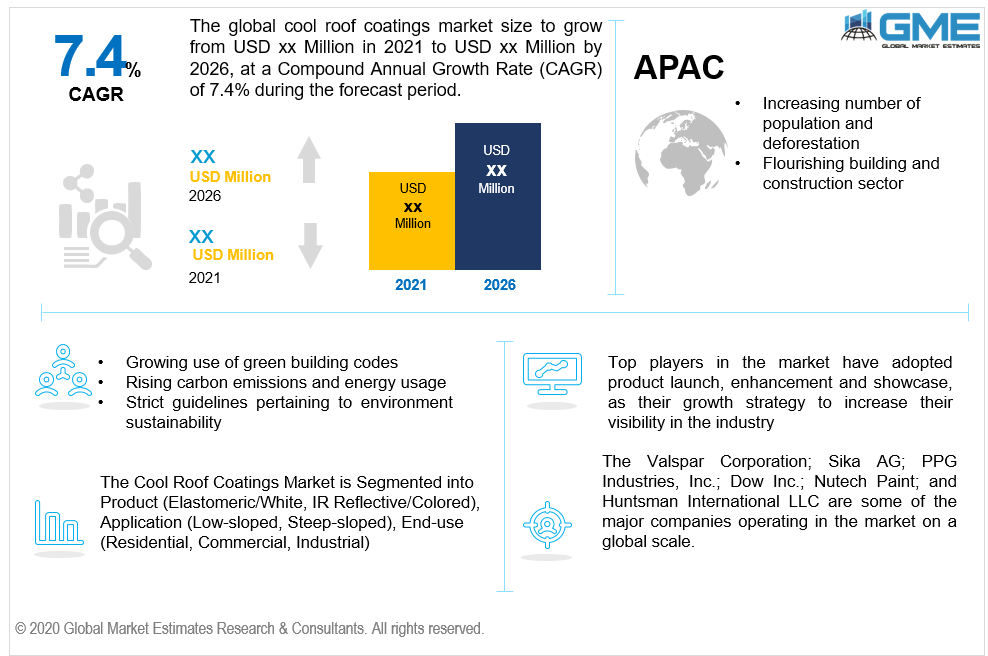

Global Cool Roof Coatings Market Size, Trends, and Analysis- Forecasts To 2026 By Product (Elastomeric/White, IR Reflective/Colored), By Application (Low-Sloped, Steep-Sloped), By End-Use (Residential, Commercial, Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Organic and inorganic chemicals are combined to create cool roof coatings that disperse, reflect, or absorb radiation. Property owners save money by using these coatings and they improve building durability. Internal temperatures are reduced by 6 to 10 degree Celsius, and roof surface temperatures are reduced by up to 60. As a result, cool roof technologies are commonly recognized as a cost-effective way to save electricity, particularly in hotter climates. Because of their rising popularity among customers, the cool roof coatings market is anticipated to expand at a rapid rate. The growing use of green building codes in developing markets around the world is expected to raise demand for cool roof coatings. Government agencies are enacting rules for environmentally responsible buildings in response to increasing worries about rising carbon emissions and energy usage

The reflective form of the sheet covering, tiles, and protective coating that allow roofs to stay cooler and thereby decrease the temperature of the building are all examples of cool roof coating. These coatings are made up of white paints or special reflective colorants that reflect sunlight and shield roof surfaces from chemical damage, UV rays, and water rusting. Cool roof coatings have a number of benefits, including low cost and high solar reflectivity, which helps to minimize heat build-up in industrial and residential spaces and eliminates the need for air conditioning, hence saving electricity and reducing emissions. Green building materials are expected to grow in popularity in the near future, owing to growing market interest in energy conservation and supportive government policies regarding tax benefits. Consumer preference is turning toward cost-effective and durable coatings over short-term, speedy options, according to industry trends. The lifecycle evaluation of cool roof coatings is being researched by property managers and capitalists. While less costly alternatives save money, the need to recoat after 3 to 5 years is significantly more expensive in terms of material, labor, and time. This element could pose a threat to growth in the coming years.

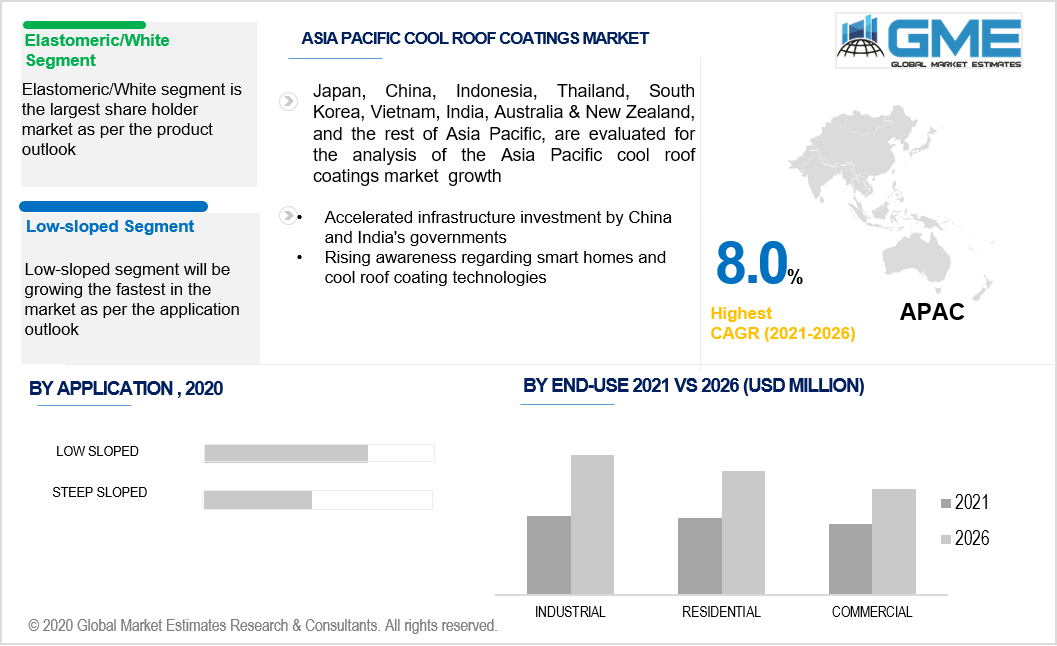

In the cool roof coatings market, elastomeric coatings appeared as the most popular product to gain the highest share in the market. These coatings are typically used during industrial and commercial applications. Over the forecast period, better product efficiency and increasing demand for energy-efficient roofing systems are anticipated to fuel demand. Because of the product's ability to maintain objects colder than traditional pigments, IR reflective coatings are expected to rise at the highest rate over the forecast period. The dark-colored IR reflective coatings' pleasing visual appeal gives this category a strategic advantage. For a property owner, visual attractiveness is important, since it is what generates product demand.

The cool roof coating industry is dominated by the low-sloped roof application category, which is expected to rise at a substantial CAGR over the forecast period due to benefits such as less build-up material and lower initial installation costs compared to the steep-sloped process. Increased penetration of low-sloped roofing systems has resulted from increased awareness of the value of green building construction, as well as strict requirements on roofing materials for commercial and industrial buildings. Because of their increasing use in residential buildings, especially in regions with heavy snowfall and rainfall, steep-sloped roofs are expected to rise at the fastest rate over the forecast period. Due to the structural benefit of shedding water quickly and reducing the chance of mold or mildew growth on the roof, steep-sloped roofs require less upkeep, resulting in reduced penetration of coating materials. However, due to the growing availability of quick-drying coatings and advanced methods, the market for cool coatings is projected to rise in the steep-sloped roof application category during the forecast period.

In 2020, industrial became the highest growing end-use market, with sales projected to rise at the fastest CAGR over the forecast period. The continuous development of the manufacturing sector, especially in Asian and North American countries such as the Canada, United States, and China, as a result of increased disposable income levels, is expected to boost the segment's development over the forecast period.

In terms of sales, the residential segment held the major market share in 2020. Residential applications are expected to grow as the use of colored enamels grows, aided by the growing acceptance of green building codes in emerging economies. Since these enamels can be added to almost any roofing material, they've become common in-home renovations. Green building codes for residential constructions and individual homes are expected to drive growth in the near future, especially in emerging economies.

In terms of sales, North America has the highest market share in 2020. The regional market for cool roof coatings is expected to be powered by the adoption of the Leadership in Energy and Environmental Design (LEED) green building certification program as well as increased awareness of building energy use. Because of the rising adoption of green building codes, Asia Pacific is predicted to be the fastest-growing region in the forecast period. The increasing construction sector in Asia Pacific's developing countries, as well as accelerated infrastructure investment by China and India's governments, are the main factors boosting product demand over the projected timeframe. China recently unveiled its 13th Five-Year Plan, which calls for the construction of more than 50 new civilian airports as well as the expansion of airports in Urumqi, Shenzhen, Xi'an, Kunming, Harbin, Chongqing, and Chengdu. Similarly, India's government announced its intention to construct 100 smart cities, which involves apartment buildings, hospitals, urban transportation, restaurants, retail, schools, office buildings, and sanitation. In the near future, these factors are anticipated to boost regional product demand.

The Valspar Corporation; Sika AG; PPG Industries, Inc.; Dow Inc.; Nutech Paint; and Huntsman International LLC are some of the major companies operating in the market on a global scale.

Please note: This is not an exhaustive list of companies profiled in the report.

Sika AG announced on March 17, 2020 that it would open a new production facility for the SikaProof solid waterproofing membrane at its current Sarnen, Switzerland location. This growth investment would boost production efficiency, enabling the firm to satisfy the increasingly rising demand.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cool Roof Coatings Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Cool Roof Coatings Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising trend and use of green building codes in developing regions

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated systems in developing nation cool roof coatings in low income countries

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cool Roof Coatings Market, By Product

4.1 Product Outlook

4.2 Elastomeric/White

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 IR Reflective/Colored

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Cool Roof Coatings Market, By Application Type

5.1 Application Type Outlook

5.2 Low-Sloped

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Steep-Sloped

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Cool Roof Coatings Market, By End-User

6.1 Residential

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Commercial

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Industrial

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Cool Roof Coatings Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Product, 2016-2026 (USD Million)

7.2.3 Market Size, By Application Type, 2016-2026 (USD Million)

7.2.4 Market Size, By End-User, 2016-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.4.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.2.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Product, 2016-2026 (USD Million)

7.3.3 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.4 Market Size, By End-User, 2016-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2016-2026 (USD Million)

7.3.11.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Product, 2016-2026 (USD Million)

7.4.3 Market Size, By Application Type, 2016-2026 (USD Million)

7.4.4 Market Size, By End-User, 2016-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.9.2 Market size, By Application Type, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2016-2026 (USD Million)

7.4.10.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Product, 2016-2026 (USD Million)

7.5.3 Market Size, By Application Type, 2016-2026 (USD Million)

7.5.4 Market Size, By End-User, 2016-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Product, 2016-2026 (USD Million)

7.6.3 Market Size, By Application Type, 2016-2026 (USD Million)

7.6.4 Market Size, By End-User, 2016-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 The Valspar Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Sika AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 PPG Industries, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Dow Inc

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Nutech Paint

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Huntsman International LLC

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Protexion

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 HEATISLAND

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Nouryon

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Cool Roof Coatings Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cool Roof Coatings Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS