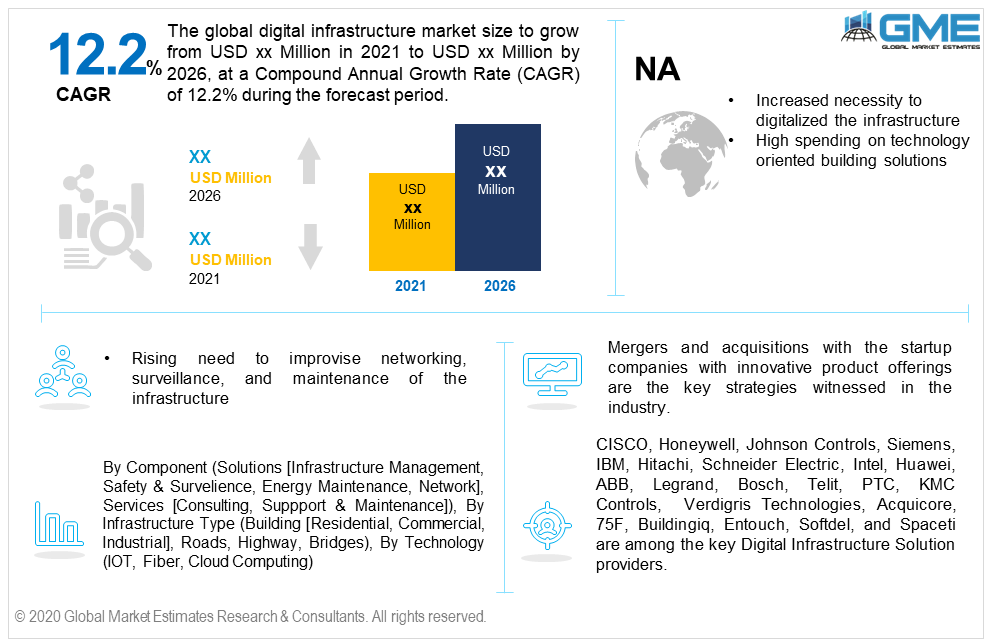

Global Digital Infrastructure Market Size, Trends & Analysis - Forecasts to 2026 By Component (Solutions [Infrastructure Management, Safety & Surveillance, Energy Maintenance, Network], Services [Consulting, Support & Maintenance]), By Infrastructure Type (Building [Residential, Commercial, Industrial], Roads, Highway, Bridges), By Technology (IOT, Fiber, Cloud Computing), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The rising need to improvise the overall IT experience in the residential, commercial, and industrial buildings has positively influenced the digital infrastructure market growth. The industry is also gaining high attention from non-building applications such as roads, highways, and bridges. In non-building applications, the main focus is on connectivity, surveillance, and maintenance. The updated technologies help in keeping the track of the bridges, roads, and highways condition to avoid accidents and other mishaps.

Solutions and services are the two major components in the Digital Infrastructure Market. Annually, IT companies and other MNCs spend huge amounts of money on internal networking, connectivity, surveillance, and energy efficiency solutions. The major aim of these companies is to enhance the overall experience and streamline their business with the latest technologies. Solutions are further sub-segmented into infrastructure management, safety & surveillance, energy maintenance, network, and others. Safety & surveillance is among the highly adopted solutions in various buildings and non-building construction types. The other major solution is the network which will witness high growth during the forecast period.

The components of the services include but are not limited to consulting, support & maintenance, and others. The services segment is mainly implemented and adopted in commercial building products.

By infrastructure type, the market is segmented into buildings, roads, highways, and bridges. The buildings segment is later sub-segmented into residential, commercial, and industrial. The building segment will lead the market owing to its early and wide implementation and adoption. Commercial buildings are witnessing the highest adoption in the previous years. Increasing dependency on the internet integrated environment and the need for better connectivity & networking led to the growth in this segment. Industrial buildings have also started investing in these Digital Infrastructure solutions to enhance the overall manufacturing process. Automation in manufacturing is taking place at a rapid pace. Thus, making the segment highly potential in nature.

Other key segments to witness high growth are the highways and bridges. The increasing need to improve the connectivity and surveillance of these places to focus on safety and better reach are the major factors to drive adoption in these segments.

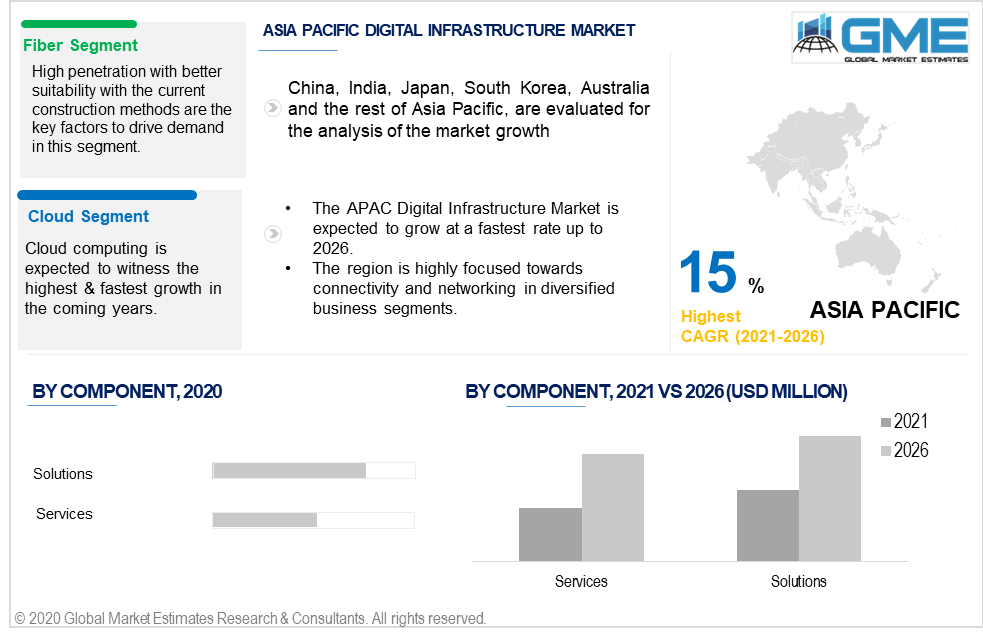

By technology, the market is categorized into IOT, fiber, cloud, and others. Fiber led the overall technology segment revenue in 2019. High penetration and adoption of networking solutions along with better suitability with the current construction methods are the key factors to drive demand in this segment. The technology is well trusted and has the long-term capability. Thus, making it a suitable solution in diversified business segments.

IOT witnessed notable growth in the previous years and is expected to continue this growth during the forecast period. Better reach, suitability, and compatibility with the end-user are the key success factors to proliferate demand in this segment. Cloud computing is expected to witness the highest & fastest growth in the coming years. In most of the developed countries, IT companies and institutions have already adopted this technology for better IT solutions. In the U.S. more than 50% of the companies are dependent on cloud computing.

The North America Digital Infrastructure market will dominate the industry and hold the largest revenue share in 2019. High spending capacity on technology-oriented building solutions along with rising trends of smart building or digitalized ceilings is promoting the implementation of the Digital Infrastructure in commercial and industrial constructions. The presence of major market providers along with the capacity to invest in these technology-focused building products will influence the regional industry growth.

The European Digital Infrastructure market will observe a significant CAGR in the coming years. Rising demand among IT companies and other institutional buildings to improve their IT solutions in day-to-day life has positively induced the demand in this region. Large scale companies, hotels, hospitals, and other institutions are focusing to improvise the overall building experience in terms of maintenance, surveillance, energy maintenance, networking, and other connectivity solutions.

The APAC Digital Infrastructure Market is expected to grow at the fastest rate up to 2026. China, Singapore, South Korea, Japan, and India will be the major contributing nations in the coming years. The aforementioned countries are highly spending and investing in IT Infrastructure solutions and smart building solutions. The region is highly focused towards connectivity and networking in diversified business segments.

Global Digital Infrastructure Market Share is highly concentrated and competitive in nature. Very few Information Technology Solutions companies hold the maximum market share. However, changing consumer requirements along with the introduction of new solutions and technology oriented products will offer lucrative opportunities to the tech startup companies.

CISCO, Honeywell, Johnson Controls, Siemens, IBM, Hitachi, Schneider Electric, Intel, Huawei, ABB, Legrand, Bosch, Telit, PTC, KMC Controls, Verdigris Technologies, Acquicore, 75F, Buildingiq, Entouch, Softdel, and Spaceti are among the key Digital Infrastructure Solution providers.

Please note: This is not an exhaustive list of companies profiled in the report.

Mergers and acquisitions with startup companies with innovative product offerings are the key strategies witnessed in the industry. MNCs are investing and capitalizing on new technologies to enhance the overall consumer experience.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digital infrastructure industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Component overview

2.1.3 Infrastructure type overview

2.1.4 Technology overview

2.1.5 Regional overview

Chapter 3 Digital Infrastructure Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Digital Infrastructure Market, By Component

4.1 Component Outlook

4.2 Solutions

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.2.2 Infrastructure management

4.2.2.1 Market size, by region, 2019-2026 (USD Million)

4.2.3 Safety & surveillance

4.2.3.1 Market size, by region, 2019-2026 (USD Million)

4.2.4 Energy maintenance

4.2.4.1 Market size, by region, 2019-2026 (USD Million)

4.2.5 Network

4.2.5.1 Market size, by region, 2019-2026 (USD Million)

4.2.6 Others

4.2.6.1 Market size, by region, 2019-2026 (USD Million)

4.3 Services

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.3.2 Consulting

4.3.2.1 Market size, by region, 2019-2026 (USD Million)

4.3.2 Support & maintenance

4.3.2.1 Market size, by region, 2019-2026 (USD Million)

4.3.3 Others

4.3.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Digital Infrastructure Market, By Infrastructure Type

5.1 Infrastructure Type Outlook

5.2 Building

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.2 Residential

5.2.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.3 Commercial

5.2.3.1 Market size, by region, 2019-2026 (USD Million)

5.2.4 Industrial

5.2.4.1 Market size, by region, 2019-2026 (USD Million)

5.3 Roads

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Highways

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Bridges

5.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Digital Infrastructure Market, By Technology

6.1 Technology Outlook

6.2 IOT

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Fiber

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Cloud

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Digital Infrastructure Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by component, 2019-2026 (USD Million)

7.2.3 Market size, by infrastructure type, 2019-2026 (USD Million)

7.2.4 Market size, by technology, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by component, 2019-2026 (USD Million)

7.2.5.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.2.5.3 Market size, by technology, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by component, 2019-2026 (USD Million)

7.2.6.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.2.6.3 Market size, by technology, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by component, 2019-2026 (USD Million)

7.3.3 Market size, by infrastructure type, 2019-2026 (USD Million)

7.3.4 Market size, by technology, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by component, 2019-2026 (USD Million)

7.2.5.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.2.5.3 Market size, by technology, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by component, 2019-2026 (USD Million)

7.3.6.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.3.6.3 Market size, by technology, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by component, 2019-2026 (USD Million)

7.3.7.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.3.7.3 Market size, by technology, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by component, 2019-2026 (USD Million)

7.3.8.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.3.8.3 Market size, by technology, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by component, 2019-2026 (USD Million)

7.4.3 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.4 Market size, by technology, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by component, 2019-2026 (USD Million)

7.4.5.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.5.3 Market size, by technology, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by component, 2019-2026 (USD Million)

7.4.6.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.6.3 Market size, by technology, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by component, 2019-2026 (USD Million)

7.4.7.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.7.3 Market size, by technology, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by component, 2019-2026 (USD Million)

7.4.8.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.8.3 Market size, by technology, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by component, 2019-2026 (USD Million)

7.4.9.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.4.9.3 Market size, by technology, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by component, 2019-2026 (USD Million)

7.5.3 Market size, by infrastructure type, 2019-2026 (USD Million)

7.5.4 Market size, by technology, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by component, 2019-2026 (USD Million)

7.5.5.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.5.5.3 Market size, by technology, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by component, 2019-2026 (USD Million)

7.5.6.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.5.6.3 Market size, by technology, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by component, 2019-2026 (USD Million)

7.6.3 Market size, by infrastructure type, 2019-2026 (USD Million)

7.6.4 Market size, by technology, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by component, 2019-2026 (USD Million)

7.6.5.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.6.5.3 Market size, by technology, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by component, 2019-2026 (USD Million)

7.6.6.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.6.6.3 Market size, by technology, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by component, 2019-2026 (USD Million)

7.6.7.2 Market size, by infrastructure type, 2019-2026 (USD Million)

7.6.7.3 Market size, by technology, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 CISCO

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 JOHNSON CONTROLS

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 HONEYWELL

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 IBM

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 SIEMENS

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 HITACHI

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 SCHNEIDER ELECTRIC

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 HUAWEI

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 INTEL

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 LEGRAND

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 ABB

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 BOSCH

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 LEGRAND

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 PTC

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 TELIT

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 VERDIGRIS TECHNOLOGIES

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 SOFTDEL

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 SPACETI

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

The Global Digital Infrastructure Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Infrastructure Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS