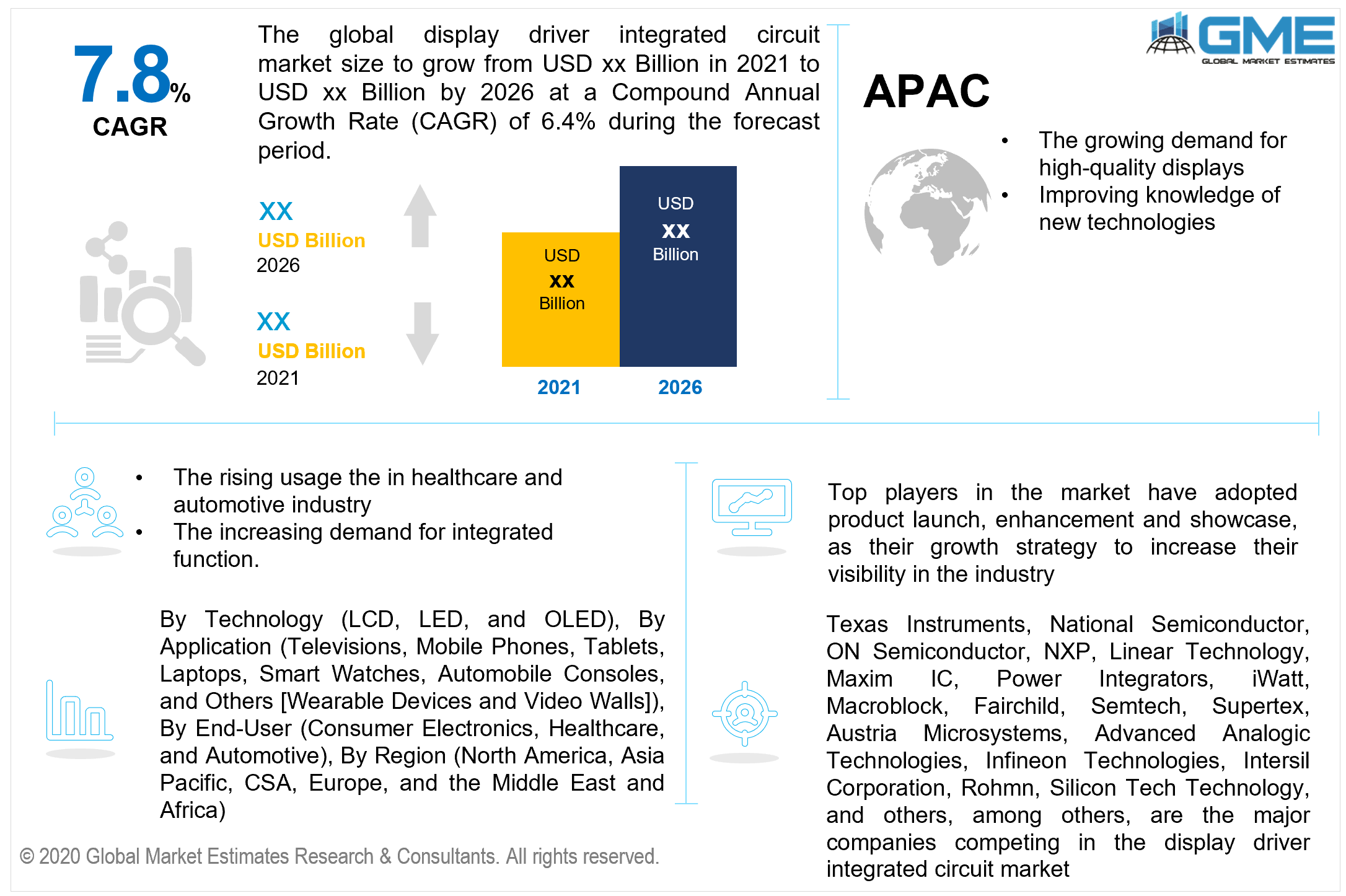

Global Display Driver Integrated Circuit Market Size, Trends, and Analysis - Forecasts To 2026 By Technology (LCD, LED, and OLED), By Application (Televisions, Mobile Phones, Tablets, Laptops, Smart Watches, Automobile Consoles, and Others [Wearable Devices and Video Walls]), By End-User (Consumer Electronics, Healthcare, and Automotive), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Substantial demand for consumer electronic devices such as televisions, computers, and smartphones are estimated to stimulate the global display driver IC market throughout the forecast period, as display driver ICs are employed in the triggering of pixels used in television, computer, and cellphone displays. With the rising use of smartphones globally, the need for touch and display controller interfacing is expected to skyrocket in the coming years. This is projected to boost the worldwide display driver integrated circuit market. To accommodate this increased demand, some display manufacturers have begun to acquire display driver integrated circuit producers.

Likewise, touchscreen displays are functional in terms of the duration necessary to execute a command and other on-demand activities, attributable to automation. As the global automotive display market continues to develop the need for high-quality display drivers is likely to rise throughout the forecast period. Also, the use of LCD-based display and OLED display driver’s devices is assumed to be progressively stretched to a broad variety of automotive applications including instrument panels, navigation systems, and vehicle multimedia displays.

In the forecast period, expensive software and solution pricing, as well as a scarcity of raw materials, would function as market bottlenecks for display driver integrated circuits (DDIC). Factors like the rising demand for LCD panels, growing need for effective and proficient medical treatment, increasing demand for integrated function, extensive technological advancements, increasing disposable income, growing demand for high-quality displays, and the emergence of the natural user interface, will lead to demand expansion.

High penetration of touch systems in consumer electronics, growing demand of electronic devices, rising usage in healthcare & automotive industry, the launch of innovative & advanced products, growing awareness of technology management, activating pixels of mobile phone screens, rising funding for research, growing geriatric population and rising demand for high-resolution display analysis are expected to increase demand for the display driver integrated circuit market.

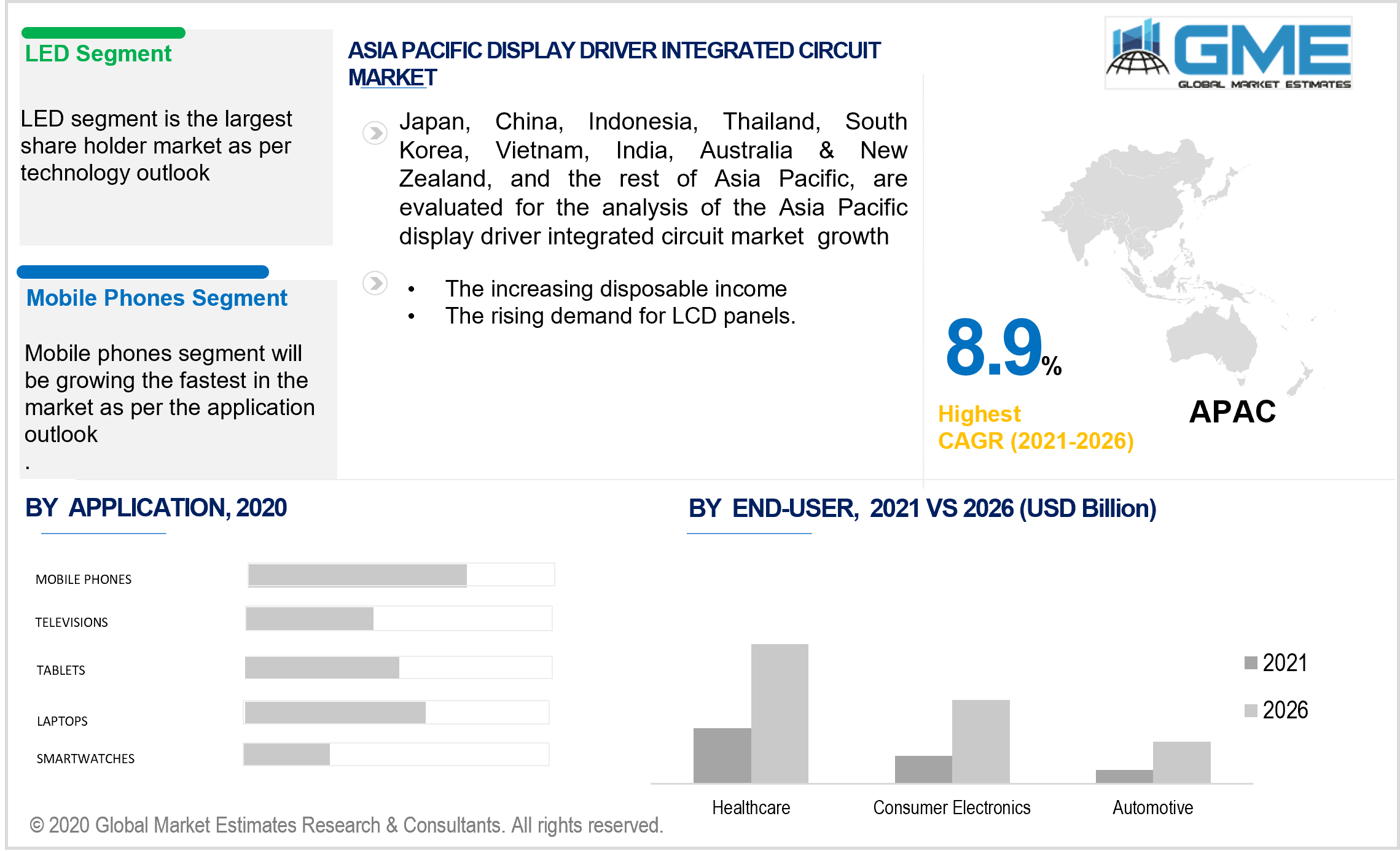

According to the technology, there are three categories which include LCD, LED, and OLED. The category of LED is the largest shareholder. Reduced costs, simplified scalability of the throughput mediums, no magnetics requisite, significant ripple suppression, improved electromagnetic interference (EMI) effectiveness, and the geometrical potential to position numerous circuits concurrently without a complicated preference of LED devices are all benefits of LED driver IC architecture. Moreover, they are extensively utilized in automotive lighting with a distinctive LED driver, 16 × 16 display for outdoor use, and smartphone backlighting.

According to the application analysis, the eight segments are televisions, mobile phones, tablets, laptops, smartwatches, and automobile consoles, others. Others include wearable devices and video walls. Mobile phones are likely to lead in the market. Consumer electronics, according to current trends, is boosting the display driver integrated circuit market. The requirement for compact and efficient touch-enabled screens in consumer electronics and gadgets is likely to increase. Mobile phones are the most popular applications in this sector, resulting in segment supremacy. Moreover, the display driver integrated circuit permits the incorporation of technologies to assist in wireless data transmission and the production of smaller mobile or smartphone devices.

According to the end-user analysis, the three segments are consumer electronics, healthcare, and automotive. Healthcare is predicted to be the largest shareholder in terms of revenue growth in the market due to increasing cases of diabetes, hypertension, and obesity, rising healthcare expenditure, increasing cases of surgical wounds, availability of advanced medical infrastructure, increasing incidence of burn injuries, increase in hospital visits of patients, and lowered insurance premiums. Moreover, the display driver integrated circuit enables remote monitoring which makes it highly preferred by patients and medical professionals.

However, the consumer electronics industry segment will be growing the fastest in the market due to the increasing availability of a wide range of products, the improved lifestyle of people, rising youth population, improved innovation & performance of smart electronic products, and enhanced consumer experience & superior device efficiency with display driver integrated circuit. The continuing phenomenon of BYOD (Bring Your Own Device) among corporations is projected to fuel the target market's growth. Furthermore, attractive packages and simple access to video-on-demand OTT services and content have resulted in a quick and large expansion in the customer base in recent years. This movement is expected to gain impetus as a consequence of COVID-19, resulting in higher demands for consumer electronics and a beneficial influence on targeted market growth.

As per the geographical analysis, the market of display driver integrated circuit can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to the high involvement of display panel producers in North America, it is likely to be the market leader in the display driver integrated circuit market. Furthermore, rising demand for laptops, smartphones, and other electronic gadgets amongst tech-savvy demographics, as well as increasing disposable income, are some additional variables expected to promote revenue development in the core demographic in this region. Throughout the forecast period, the Asia Pacific display driver IC market is expected to rise significantly. This is due to continuous technological developments in display driver technologies like QLED and OLED. Furthermore, the rapidly growing volume of smartphone users in emerging markets like India and China is likely to drive target market growth in this area. Improving knowledge of new technologies, as well as increased internet and smartphone adoption, are some other reasons that are expected to boost the targeted market's growth.

Texas Instruments, National Semiconductor, ON Semiconductor, NXP, Linear Technology, Maxim IC, Power Integrators, iWatt, Macroblock, Fairchild, Semtech, Supertex, Austria Microsystems, Advanced Analogic Technologies, Infineon Technologies, Intersil Corporation, Rohmn, Silicon Tech Technology among others, are the major companies competing in the display driver integrated circuit market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Display Driver Integrated Circuit Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Global Display Driver Integrated Circuit Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Demand for Electronic Devices

3.3.1.2 Growing Demand for Integration of Touch And Display Controllers

3.3.2 Industry Challenges

3.3.2.1 Lack of Sufficient Raw Materials

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Display Driver Integrated Circuit Market, By Technology

4.1 Technology Outlook

4.2 LCD

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 LED

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 OLED

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Display Driver Integrated Circuit Market, By Application

5.1 Application Outlook

5.2 Televisions

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Mobile Phones

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Tablets

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Laptops

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Smart Watches

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Automobile Consoles

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 Others

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Display Driver Integrated Circuit Market, By End-User

6.1 End-User Outlook

6.2 Consumer Electronics

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Healthcare

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Automotive

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Display Driver Integrated Circuit Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Technology, 2019-2026 (USD Million)

7.2.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.4 Market Size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Technology, 2019-2026 (USD Million)

7.3.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.4 Market Size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Technology, 2019-2026 (USD Million)

7.4.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.4 Market Size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.8.2 Market size, By Application, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Technology, 2019-2026 (USD Million)

7.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.4 Market Size, By End-User, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Technology, 2019-2026 (USD Million)

7.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.4 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Texas Instruments

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 National Semiconductor

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 ON Semiconductor

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 NXP

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Linear Technology

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Maxim IC

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Power Integrators

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 iWatt

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Macroblock

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Fairchild

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Semtech

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Supertex

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Austria Microsystems

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Advanced Analogic Technologies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Infineon Technologies

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 Intersil Corporation

8.17.1 Company Overview

8.17.2 Financial Analysis

8.17.3 Strategic Positioning

8.17.4 Info Graphic Analysis

8.18 Rohmn

8.18.1 Company Overview

8.18.2 Financial Analysis

8.18.3 Strategic Positioning

8.18.4 Info Graphic Analysis

8.19 Silicon Tech Technology

8.19.1 Company Overview

8.19.2 Financial Analysis

8.19.3 Strategic Positioning

8.19.4 Info Graphic Analysis

8.20 Other Companies

8.20.1 Company Overview

8.20.2 Financial Analysis

8.20.3 Strategic Positioning

8.20.4 Info Graphic Analysis

The Global Display Driver Integrated Circuit Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Display Driver Integrated Circuit Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS