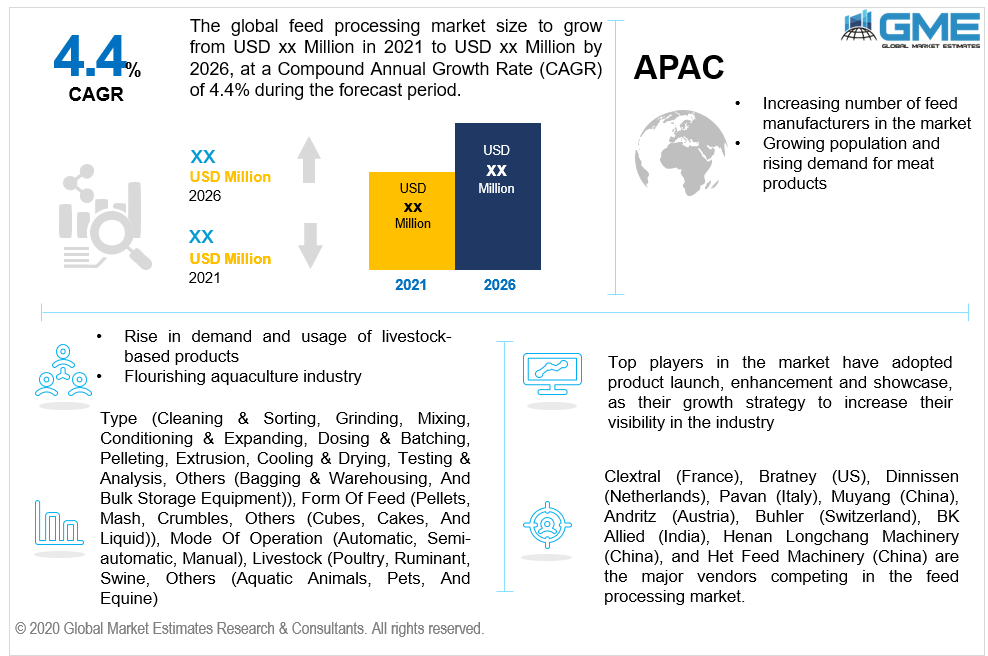

Global Feed Processing Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Cleaning & Sorting, Grinding, Mixing, Conditioning & Expanding, Dosing & Batching, Pelleting, Extrusion, Cooling & Drying, Testing & Analysis, Others (Bagging & Warehousing, And Bulk Storage Equipment)), By Form Of Feed (Pellets, Mash, Crumbles, Others (Cubes, Cakes, And Liquid)), By Mode Of Operation (Automatic, Semi-Automatic, Manual), By Livestock (Poultry, Ruminant, Swine, Others (Aquatic Animals, Pets, And Equine)), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The most essential and determining factor in animal development is nutrition. In addition to enhancing the mixing and stability of their diet, feed processing requires grinding down the physical structure of the feed items in such a manner that it results in optimal use by animals. When compared to coarse or whole feed products, the finely processed feed particles are faster digested. This process aims to increase feed digestibility and bioavailability. Feed processing not only improves the quality of the feed but also minimizes feed degradation. Improved feed conversion or production, improved carcass quality or yield grade, faster average daily benefit, decreased feed waste, increased feed consumption, and several other goals are popular in feed processing. Compared to the number of techniques used for ruminant feeds, the feed preparatory processes used for swine and poultry are comparatively basic and limited.

It is anticipated that the rise in demand and usage of livestock-based products such as beef, eggs, dairy, and dairy products would push the market for feed among farm animals.Global meat production is expected to increase by 2025, as per FAO numbers. Because of its high demand, low production costs, and lower commodity rates in both developed and developing economies, poultry meat is the main factor boosting global meat production growth.

Among the aquafeed producers worldwide, the growth of aquaculture has also drawn a lot of interest. The availability of nutrient and feed inputs will have to rise at a comparable pace for the aquaculture sector to sustain its existing growth rate, while the supply of aquatic materials remains stagnant and other sectors compete for the same feed supplies.The stable growth of aquaculture, as well as the demand for some more feed, especially for tilapia and catfish, attracted attention among most local suppliers in processing their feeds instead of buying a full fish feed. This, in essence, allows small-scale farmers to build equipment for feed processing. Feed processing machinery demand is growing in the country as compounded feed costs increase and farmers become more aware of the advantages of using feed processing equipment.

Market consolidation, on the other hand, is a significant limiting factor for the feed processing sector, as prominent feed processors are implementing inorganic strategic initiatives, which is the primary cause of market consolidation.

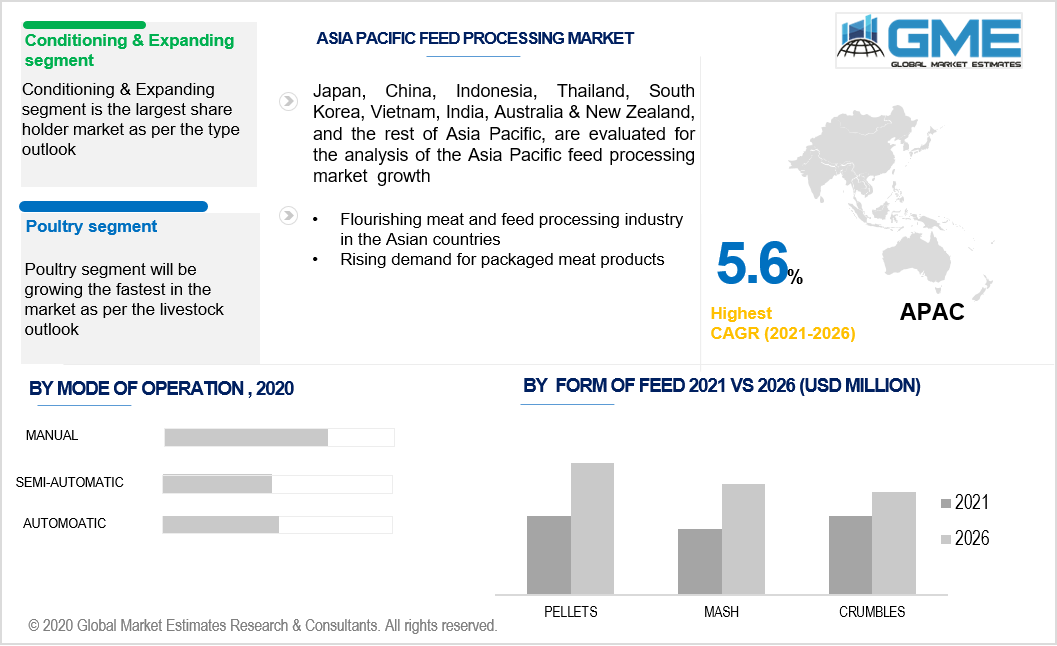

Based on type, the market is categorized into pelleting, mixing, conditioning & expanding, cleaning & sorting, grinding, dosing & batching, cooling & drying, testing & analysis, extrusion, and others (bulk storage equipment and bagging & warehousing). The highest market share was accounted for by conditioning & expanding in 2020. Most animals have a poor ability to digest starch, but ripe starch can be digested to a significant extent. The degree of gelatinization of starch increases significantly when a hydrothermal through conditioner is used. Around the same period, the thermal denaturation of protein in a product is encouraged. Conditioning food items at a certain amount of temperature will destroy bacteria like Salmonella and ensure the consistency of feed hygiene. Low cost, pollution-free, no drug residual, and fewer side effects than drug-disease control are just a few of the advantages that have enhanced the implementation of conditioning and expanding machinery.

Based on the form of feed, the market has been categorizedintocrumbles, mash, pellets, and others (liquid, cakes, and cubes). The maximum market share in 2020 was accounted for by pellets. The advantages of pelleted feed, such as improved feed intake and animal weight gain, are driving the market for feed pelletizing. Pellet production is increasing considerably as a result of the growing demand for nutritional feed, which is also enhancing company investments in the animal feed pellet processing sector. Besides, minimizing wastage during the feeding process, supplying overall mixed nutrients in each pellet, improving storage space, reducing shipping costs, and improving feed handling are some of the advantages that have spurred animal pallet adoption.Furthermore, growing knowledge of the product's performance in emerging regions has provided an incentive for market expansion.

Based onthe mode of operation, the market is segregated into manual, semi-automatic, and automatic. In 2020, the manual had the highest market share. The manually operated feed pelleting machines are planned and manufactured with readily sourced materials, making them very cheap. No highly specialized know-how is required for the manual mode of operation.The extrusion barrel, hopper, sprout (gravity chute) knife cutter,bearing housing, pulley,crankarm, compression plate, flat die, screw auger, and supporting frame are the key components of the device. Parameters such as percentage of mechanical damage, pelleting efficiency, throughput capacity, percentage of feed loss, decide the productivity of the manually operated system.

Based on livestock, the market is bifurcatedintoswine, ruminant, poultry, others (pets, aquatic animals, and equine). In 2020, the poultry segment dominated for the greatest market share. Amongst others, poultry meat is one of the largest, such as pork, beef, and fish meat. In the poultry feed market, thus, a huge opportunity lies. Companies are making big investments in the manufacture of advanced feed equipment technology for the processing of high-quality poultry feed in different types.The manufacturing method of poultry feed is typically divided into phases such as the receiving and washing of feed raw materials, the grinding, batching, blending, pelleting, and packing of final feed products.

Over the projection timeframe, the Asia Pacific region is predicted to have the biggest proportion of the feed processing market revenue, followed by Europe. Several of the top-10 feed-producing nations are based in Asia-Pacific, including Japan, India, and China. China retains its status as the world's top feed manufacturer, with a 10-million-metric-ton advantage over the United States.

The Asia Pacific retained its strong position in the global feed processing machinery industry, owing to the region's leading feed producing countries and a huge proportion of feed manufacturers. Because of a rise in economic growth and rapid progress, China remains the primary feed producer and consumer of feed processing machinery.The increasing attention of domestic feed processing machinery firms, technical advances, and government incentives for mechanization due to the growing population are the main drivers for the market.

There are three nations in North America: the USA, Canada, and Mexico.This region's stability is a product of its closely developed economies. In terms of revenue, the industry is showing steady growth. The United States controls the economy of the North American region due to its widely diversified manufacturing industry.

Bratney (US), Clextral (France), Het Feed Machinery (China) Dinnissen (Netherlands), Muyang (China), Pavan (Italy), Andritz (Austria), BK Allied (India), Buhler (Switzerland), and Henan Longchang Machinery (China) are the major vendors competing in the feed processing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 ReportOutlook

2.1 Feed Processing Industry Overview, 2016-2026

2.1.1 IndustryOverview

2.1.2 TypeOverview

2.1.3 Form of FeedOverview

2.1.4 Mode of OperationOverview

2.1.5 Type of Livestock Overview

2.1.6 Regional Overview

Chapter 3 Feed Processing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 MarketKey Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Demand of Livestock Based Products

3.3.2 Industry Challenges

3.3.2.1 Lack of Adequate Infrastructure and Automated Systems in Developing Nationsfor Feed Processing

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Form of FeedGrowth Scenario

3.4.3 Mode of Operation Growth Scenario

3.4.4 Type of Livestock Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Type of Livestock Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Feed Processing Market, By Type

4.1 Type Outlook

4.2 Cleaning & Sorting

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Grinding, Mixing

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Conditioning & Expanding

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Dosing & Batching

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Pelleting

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Extrusion

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

4.8 Cooling & Drying

4.8.1 Market Size, By Region, 2016-2026 (USD Million)

4.9 Testing & Analysis

4.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Feed Processing Market, By Form of Feed

5.1 Form of Feed Outlook

5.2 Pellets

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Mash

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Crumbles

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Feed Processing Market, By Mode of Operation

6.1 Automatic

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Semi-Automatic

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Manual

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Feed Processing Market, By Type of Livestock

7.1 Poultry

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Ruminant

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Swine

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Others

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Feed Processing Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.2.4 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.2.5 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.2.4.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.4 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.5 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.4.4 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.5 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Form of Feed, 2016-2026 (USD Million)

8.4.9.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.5.4 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.5.5 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.6.4 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.6.5 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Form of Feed, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Mode of Operation, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Type of Livestock, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Bratney (US)

9.2.1 CompanyOverview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Clextral (France)

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Het Feed Machinery (China)

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Dinnissen (Netherlands)

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Muyang (China)

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Pavan (Italy)

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Andritz (Austria)

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 BK Allied (India)

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

The Global Feed Processing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Feed Processing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS