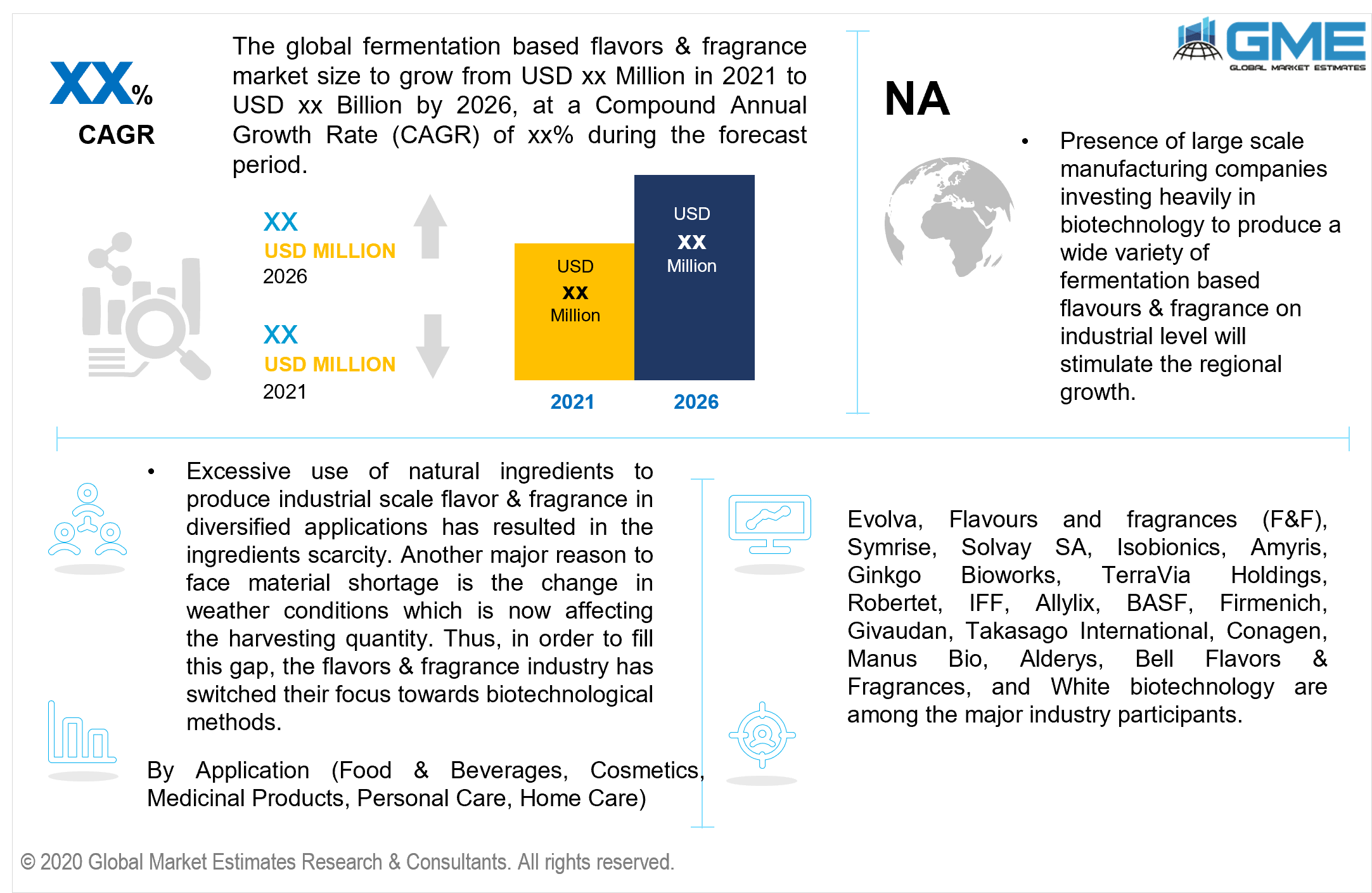

Global Fermentation Based Flavors & Fragrance Market Size, Trends & Analysis - Forecasts to 2026 By Source (Enzymes, Yeast, Microalgae), By Product (Flavor, Fragrance), By Application (Food & Beverages, Cosmetics, Medicinal Products, Personal Care, Home Care), By Region (North America, Asia Pacific, Europe, CSA, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Excessive use of natural ingredients to produce industrial-scale flavor & fragrance in diversified applications has resulted in ingredients scarcity. Another major reason to face material shortage is the change in weather conditions which is now affecting the harvesting quantity. Thus, to fill this gap, the flavors & fragrance industry have switched its focus towards biotechnological methods.

Fermentation, being the major potential solution for most companies owing to its easy harvesting, extraction, and high turnaround amount. Traditional manufacturing companies are now investing and partnering with biotech companies to work on more specific and long-lasting products. However, the high cost associated with some material extraction along with strict regulatory guidelines and approvals to meet may hinder the market growth.

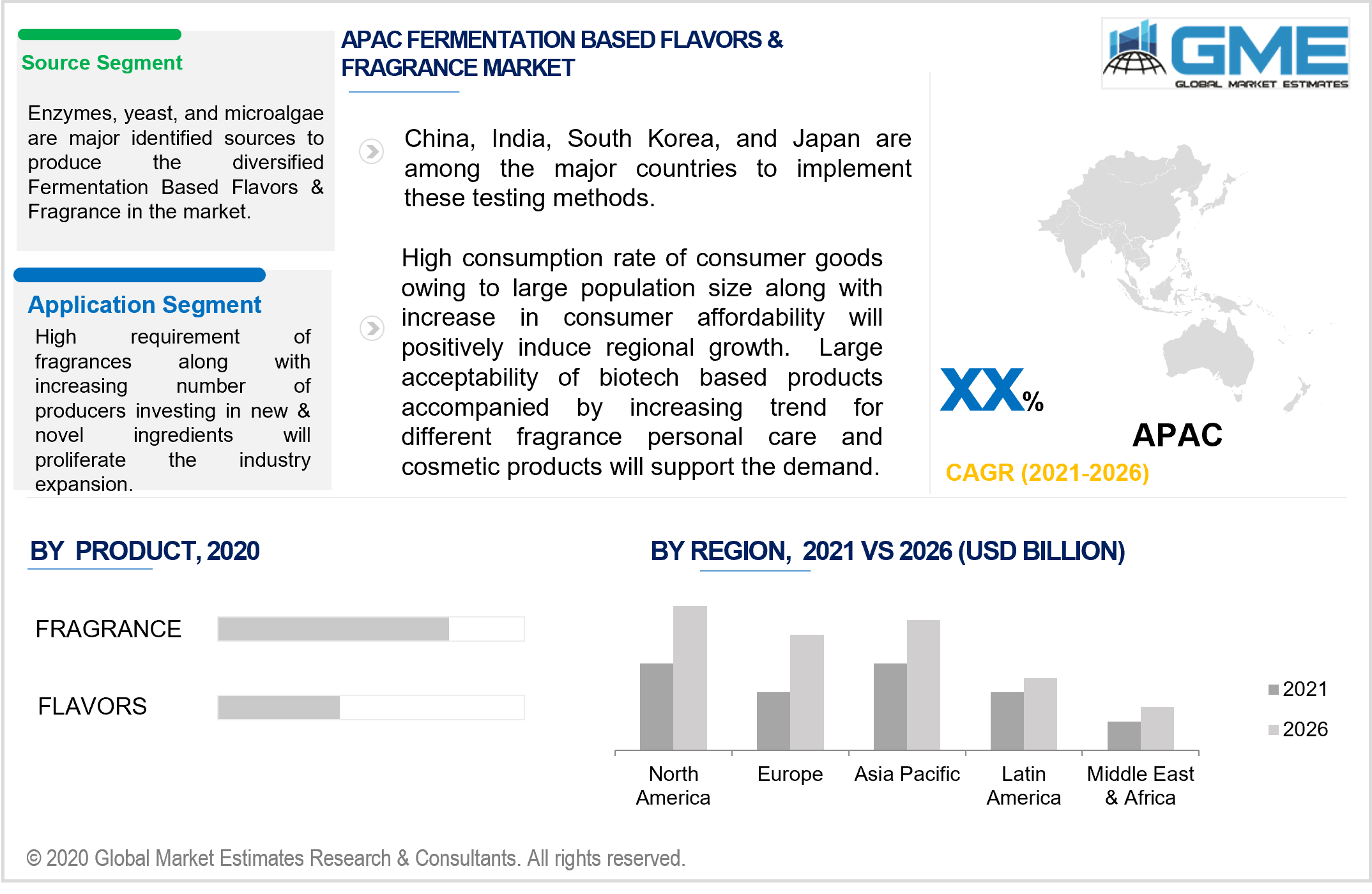

Enzymes, yeast, and microalgae are major identified sources to produce the diversified fermentation-based flavors & fragrances in the market. Each year, more companies are coming into the business to produce biotechnology-based alternatives. The high consumption rate and limited availability of natural sources have induced the companies to capitalize more on biotechnological production techniques. These methods are proven to be efficient and effective in nature to fill the demand and supply gap.

The technology is not new, it has been used for decades to produce bio vanillin. However, the advancement and exploration in the industry made the industry more attractive for new entrants to invest in. The innovation and development also resulted in the usage of different enzymes, yeast, and microalgae to produce the products.

By product, the market is divided into flavors and fragrance. The fragrances are expected to dominate the market revenue during the forecast period. High application scope along with more options to explore diversified scents will positively fuel the demand in this segment. Regulatory approvals accompanied by agreements with backward integrated companies to gain maximum share will result in high market penetration.

Flavors are observing high gains in the industry. This segment is at a mature and constant stage due to limited options availability abided by different rules & regulations. Therefore, the accomplishment of these products depends on the introduction of new product varieties sourced from novel materials.

By application, the industry is grouped into food & beverages, cosmetics & perfumery, medicinal products, personal care, and home care. Cosmetics & perfumery will dominate the application segment over the forecast period. High requirement of fragrances along with an increasing number of producers investing in new & novel ingredients will proliferate the industry expansion. Home care products will witness significant gains in the coming years owing to the high demand for fragrance-induced detergents and floor cleaners.

Another promising application in the market is the food & beverages segment. A high consumption rate along with the necessity to meet the increasing demand will support the demand in this segment. The introduction of various beverage types has encouraged manufacturers to advance their products with new flavors.

North America Fermentation Based Flavors & Fragrance will dominate the global revenue share during the forecast period. The presence of large-scale manufacturing companies investing heavily in biotechnology to produce a wide variety of fermentation-based flavors & fragrances on the industrial level will stimulate regional growth. Support and clear guidelines from FDA pertaining to source, raw materials, and technology methods will induce the production.

Asia Pacific will observe the highest growth up to 2026. The high consumption rate of consumer goods owing to the large population size along with an increase in consumer affordability will positively induce regional growth. China, India, and South Korea are among the key contributing nations in the region. The large acceptability of biotech-based products accompanied by increasing trends for different fragrance personal care and cosmetic products will support the demand.

European Fermentation Based Flavors & Fragrance market will be encouraged by the introduction of sustainable and biobased products in the consumer goods application. Regular efforts by the authorities to work more efficiently and ecologically will result in the high adoption of these biobased products. Italy, Germany, the UK, and France are key countries to adopt these production methods.

Global Fermentation Based Flavors & Fragrance Company Market Share is partly consolidated in nature. As few companies hold the maximum share in the industry, the possibility of new market entrants through acquisitions, partnerships, and product innovation make the industry more dynamic. Certification from the respective regulatory authorities in different regions to commercialize the product and ensure no breach in raw material and production technique makes the market challenging for companies with limited sources.

Evolva, Flavours and fragrances (F&F), Symrise, Solvay SA, Isobionics, Amyris, Ginkgo Bioworks, TerraVia Holdings, Robertet, IFF, Allylix, BASF, Firmenich, Givaudan, Takasago International, Conagen, Manus Bio, Alderys, Bell Flavors & Fragrances, and White biotechnology are among the major industry participants.

Please note: This is not an exhaustive list of companies profiled in the report.

Strategic partnerships and acquisitions are key strategies witnessed in the industry. For instance, in 2015, Ginkgo Bioworks and Robertet came into a collaboration agreement to produce fragrance using yeast for cosmetic, perfumery, and personal care applications.

Report Content

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Fermentation based flavour & fragrance industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Source overview

2.1.3 Product overview

2.1.4 Application overview

2.1.5 Regional overview

Chapter 3 Fermentation Based Flavors & Fragrance Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Fermentation Based Flavors & Fragrance Market, By Source

4.1 Source Outlook

4.2 Enzymes

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Yeast

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Microalgae

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Others

4.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Fermentation Based Flavors & Fragrance Market, By Product

5.1 Product Outlook

5.2 Flavor

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Fragrance

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Fermentation Based Flavors & Fragrance Market, By Application

6.1 Application Outlook

6.2 Food & beverages

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Cosmetics

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Medicinal products

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Personal care

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Home care

6.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Fermentation Based Flavors & Fragrance Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by source, 2019-2026 (USD Million)

7.2.3 Market size, by product, 2019-2026 (USD Million)

7.2.4 Market size, by application, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by source, 2019-2026 (USD Million)

7.2.5.2 Market size, by product, 2019-2026 (USD Million)

7.2.5.3 Market size, by application, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by source, 2019-2026 (USD Million)

7.2.6.2 Market size, by product, 2019-2026 (USD Million)

7.2.6.3 Market size, by application, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by source, 2019-2026 (USD Million)

7.3.3 Market size, by product, 2019-2026 (USD Million)

7.3.4 Market size, by application, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by source, 2019-2026 (USD Million)

7.2.5.2 Market size, by product, 2019-2026 (USD Million)

7.2.5.3 Market size, by application, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by source, 2019-2026 (USD Million)

7.3.6.2 Market size, by product, 2019-2026 (USD Million)

7.3.6.3 Market size, by application, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by source, 2019-2026 (USD Million)

7.3.7.2 Market size, by product, 2019-2026 (USD Million)

7.3.7.3 Market size, by application, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by source, 2019-2026 (USD Million)

7.3.8.2 Market size, by product, 2019-2026 (USD Million)

7.3.8.3 Market size, by application, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by source, 2019-2026 (USD Million)

7.4.3 Market size, by product, 2019-2026 (USD Million)

7.4.4 Market size, by application, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by source, 2019-2026 (USD Million)

7.4.5.2 Market size, by product, 2019-2026 (USD Million)

7.4.5.3 Market size, by application, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by source, 2019-2026 (USD Million)

7.4.6.2 Market size, by product, 2019-2026 (USD Million)

7.4.6.3 Market size, by application, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by source, 2019-2026 (USD Million)

7.4.7.2 Market size, by product, 2019-2026 (USD Million)

7.4.7.3 Market size, by application, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by source, 2019-2026 (USD Million)

7.4.8.2 Market size, by product, 2019-2026 (USD Million)

7.4.8.3 Market size, by application, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by source, 2019-2026 (USD Million)

7.4.9.2 Market size, by product, 2019-2026 (USD Million)

7.4.9.3 Market size, by application, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by source, 2019-2026 (USD Million)

7.5.3 Market size, by product, 2019-2026 (USD Million)

7.5.4 Market size, by application, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by source, 2019-2026 (USD Million)

7.5.5.2 Market size, by product, 2019-2026 (USD Million)

7.5.5.3 Market size, by application, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by source, 2019-2026 (USD Million)

7.5.6.2 Market size, by product, 2019-2026 (USD Million)

7.5.6.3 Market size, by application, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by source, 2019-2026 (USD Million)

7.6.3 Market size, by product, 2019-2026 (USD Million)

7.6.4 Market size, by application, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by source, 2019-2026 (USD Million)

7.6.5.2 Market size, by product, 2019-2026 (USD Million)

7.6.5.3 Market size, by application, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by source, 2019-2026 (USD Million)

7.6.6.2 Market size, by product, 2019-2026 (USD Million)

7.6.6.3 Market size, by application, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by source, 2019-2026 (USD Million)

7.6.7.2 Market size, by product, 2019-2026 (USD Million)

7.6.7.3 Market size, by application, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Evolva

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Flavours and fragrances (F&F)

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Symrise

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Solvay SA

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Isobionics

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Amyris

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Ginkgo Bioworks

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 TerraVia Holdings

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Robertet

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 IFF

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Allylix

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 BASF

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Firmenich

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Givaudan

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Takasago International

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Conagen

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 Manus Bio

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 Alderys

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 Bell Flavors & Fragrances

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 White biotechnology

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

The Global Fermentation Based Flavors & Fragrance Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fermentation Based Flavors & Fragrance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS