Global Fintech Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Data Analytics, Robotic Process Automation (RPA), Biometrics, and Others), By Application (Payments & Funds Transfer, Loan, Insurance, Personal Finance, Compliance & Regulatory Support, KYC Verification, Fraud Monitoring, Wealth Management, and Others), By End-use (Bank, Financial Institutes & Insurance (BFSI), Retail and E-commerce, Healthcare, Education, Real Estate, Travel and Hospitality, Transportation and Logistics, Entertainment & Media, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

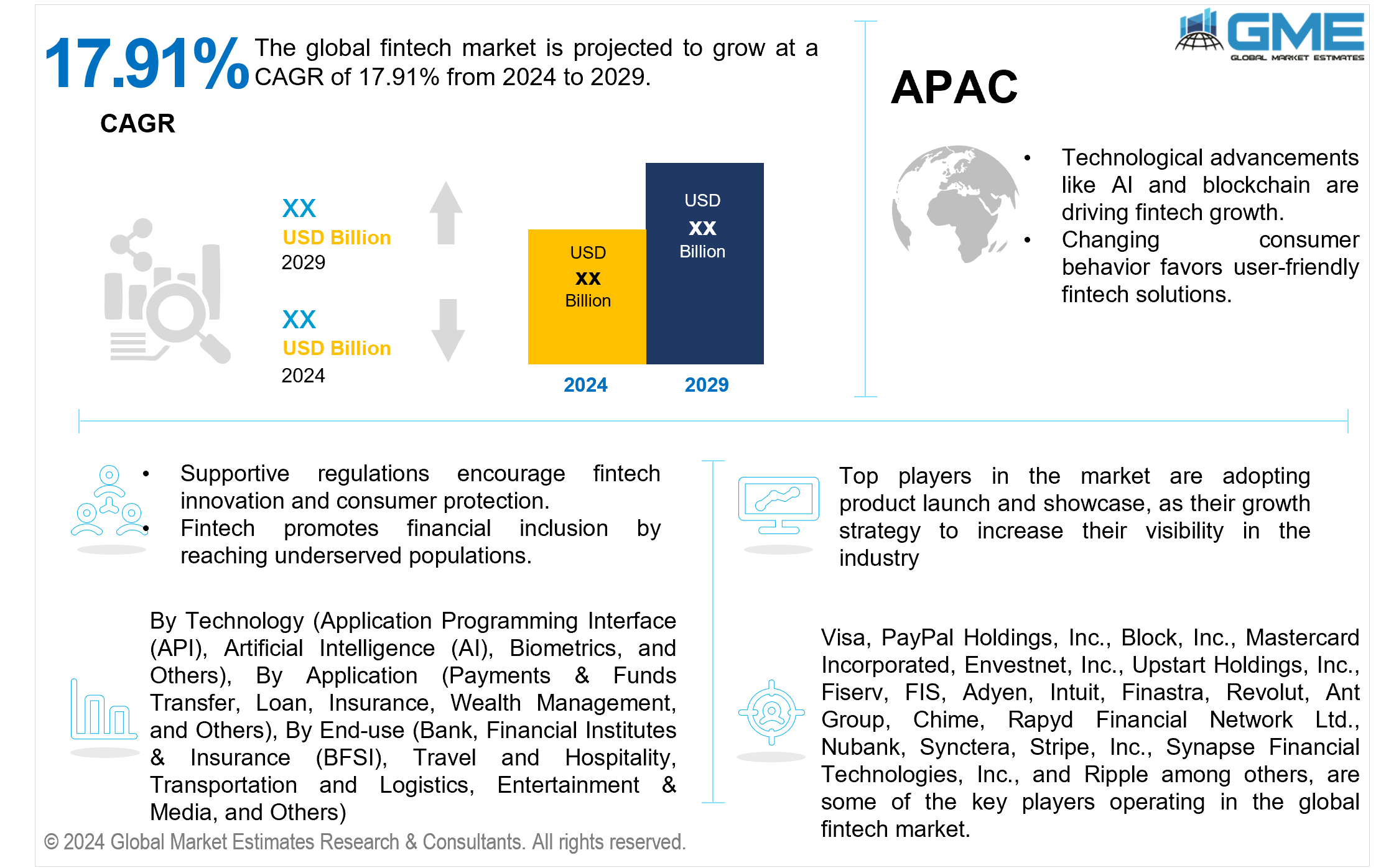

The global fintech market is projected to grow at a CAGR of 17.91% from 2024 to 2029.

AI, machine learning, blockchain, and big data analytics enable finance innovation. They improve efficiency, security, and accessibility in financial services. AI algorithms automate processes; machine learning models mine massive databases for insights; blockchain assures secure and transparent transactions, and significant data analytics power personalized financial solutions. These technologies transform banking, investing, and payment systems, fulfilling changing customer needs and regulatory requirements while encouraging fintech innovation.

According to the Google Cloud Gen AI Benchmarking Study (July 2023), globally, 82% of organizations considering or utilizing Gen AI anticipate it will either significantly change or transform their industries. This highlights the global adoption of AI for its potential to revolutionize various sectors.

The increased availability of smartphones and internet access has accelerated the adoption of digital financial services. Mobile banking, payment apps, and digital wallets are gaining popularity, particularly among young people. These technologies allow consumers to easily manage their finances, conduct transactions, and access financial services from anywhere. The broad availability of mobile devices reduces obstacles to financial access, boosting financial inclusion. This trend reflects shifting customer expectations for easy-to-use and seamless experiences, promoting the development of fintech solutions customized to the demands of digitally connected individuals.

According to the Datareportal "INTERNET USE IN 2024," in 2024, the global internet user population stands at 5.35 billion individuals, representing approximately 66.2% of the world's total population. Over the past year, internet usage has increased by 1.8%, with 97 million new users gaining online access for the first time during 2023.

Consumers want convenient and user-friendly financial products that provide seamless experiences. To cater to these needs, fintech firms offer services such as peer-to-peer lending, robo-advisors, and online investment platforms. However, the rising frequency of hacks poses substantial problems to fintech organizations in terms of protecting sensitive consumer data and preserving trust, which may hinder market growth over the forecast period.

The application programming interface (API) segment is expected to hold the largest share of the market. the segment dominance is due to its critical role in supporting smooth connection between various software systems, allowing for effective data interchange and functionality integration. Its adaptability and widespread acceptance across industries highlight its importance, resulting in expected market supremacy.

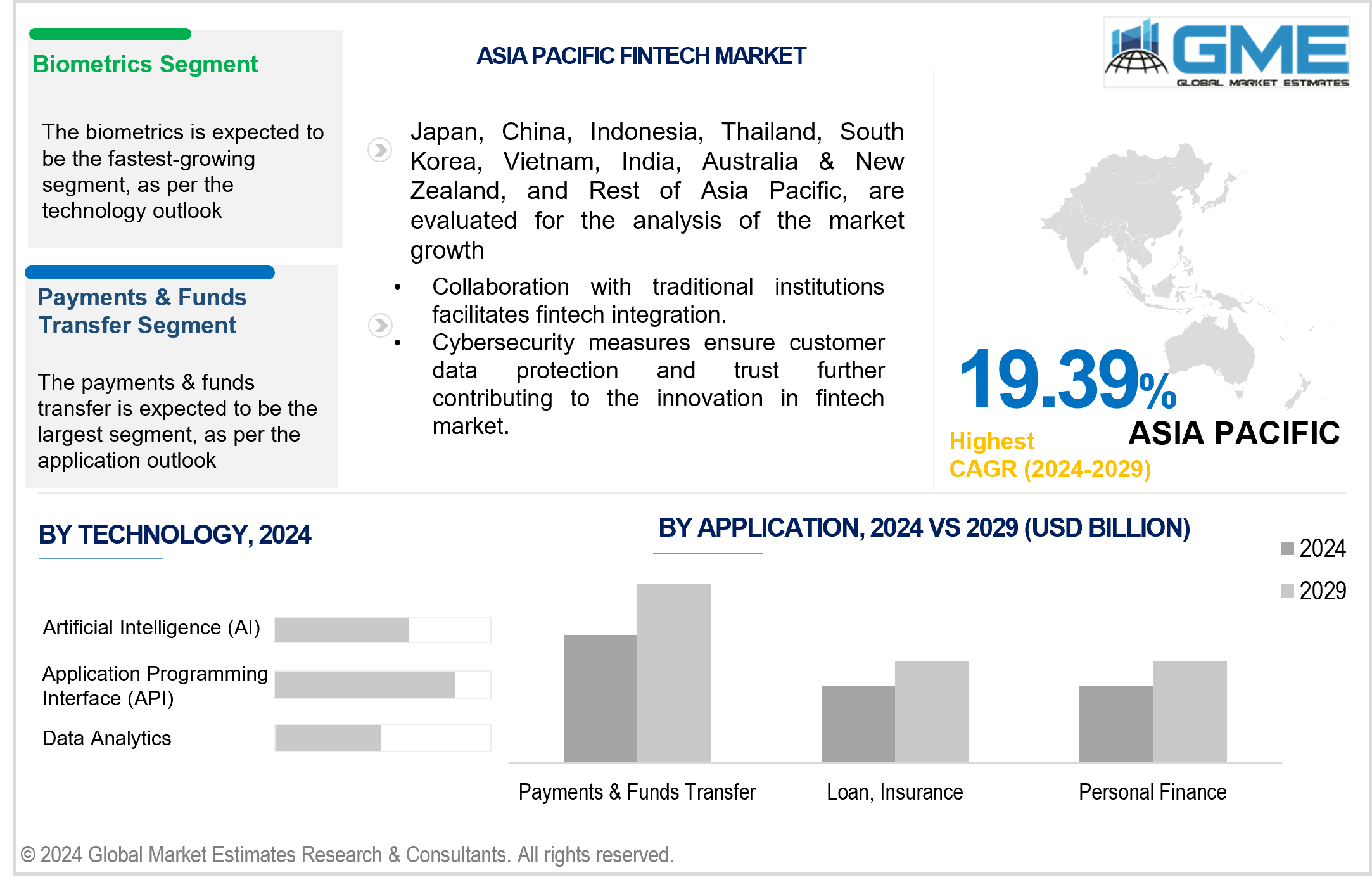

The biometrics segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Biometric technologies enable advanced authentication alternatives such as fingerprint scanning and facial recognition, which give greater security and user convenience than traditional methods like passwords. With an increased emphasis on security measures, demand for biometric solutions is likely to rise, leading to the segment's growth in the fintech industry.

The wealth management segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Rising global wealth levels and an expanding number of affluent individuals are driving demand for advanced wealth management solutions.

The payments & funds transfer segment is expected to hold the largest share of the market. The segment dominance is due to the increased use of digital payment methods and the demand for convenient and secure transactions. This area includes a wide range of services, such as mobile payments, peer-to-peer transfers, and online transactions, which cater to the changing needs of businesses and customers looking for efficient and seamless payment solutions.

The entertainment & media segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The segment growth is due to rising consumer demand for immersive digital experiences such as streaming services, gaming, and virtual reality. Technological innovations and creative content delivery techniques are likely to fuel significant expansion in this industry.

The bank, financial institutes & insurance (BFSI) segment holds the largest share of the market. This is due to its fundamental role in the financial landscape. These institutions cater to a diverse consumer base by offering important services such as banking, lending, insurance, and investing. Furthermore, their significant financial resources and regulatory compliance needs encourage them to employ fintech solutions.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include robust technological infrastructure, high levels of digital adoption, and significant investments in fintech innovation. Furthermore, the fintech market's expansion is being aided by the expansion of the American e-commerce industry. The United States is witnessing an increase in internet penetration from 75% in 2012 to 97.1% in 2024, which is further contributing to the growth of the North American fintech market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's enormous population, rising internet penetration, and growing middle class boost demand for fintech solutions. Furthermore, favorable government policies, increased technological investments, and expanding digital payments and mobile banking acceptance contribute to Asia Pacific's fintech market growth. Additionally, increasing digital payments in the region contributes to the fintech market growth. For example, China's transition to a cashless society has significantly driven Fintech growth. With platforms like Alipay and WeChat Pay leading the charge, digital payments have become deeply ingrained in Chinese consumer behavior, facilitating the growth of fintech in the payment sector.

Visa, PayPal Holdings, Inc., Block, Inc., Mastercard Incorporated, Envestnet, Inc., Upstart Holdings, Inc., Fiserv, FIS, Adyen, Intuit, Finastra, Revolut, Ant Group, Chime, Rapyd Financial Network Ltd., Nubank, Synctera, Stripe, Inc., Synapse Financial Technologies, Inc. and Ripple, among others, are some of the key players operating in the global fintech market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, PayPal and Venmo revealed six new innovations that they want to develop and launch this year to personalize transactions for both customers and merchants using artificial intelligence (AI).

In July 2023, Mastercard Incorporated introduced Mastercard Receivables Manager, a program designed to automate the integration of reconciliation data into suppliers' accounts receivable systems, thereby expediting the process by which suppliers receive virtual card payments.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL FINTECH MARKET, BY APPLICATION

4.1 Introduction

4.2 Fintech Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Payments & Funds Transfer

4.4.1 Payments & Funds Transfer Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Loan, Insurance, Personal Finance

4.5.1 Loan, Insurance, Personal Finance Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Compliance & Regulatory Support

4.6.1 Compliance & Regulatory Support Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 KYC Verification

4.7.1 KYC Verification Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Fraud Monitoring

4.8.1 Fraud Monitoring Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Wealth Management

4.9.1 Wealth Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL FINTECH MARKET, BY END-USE

5.1 Introduction

5.2 Fintech Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Bank, Financial Institutes & Insurance (BFSI)

5.4.1 Bank, Financial Institutes & Insurance (BFSI) Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Retail and E-commerce

5.5.1 Retail and E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Education

5.6.1 Education Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Healthcare

5.7.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Real Estate

5.8.1 Real Estate Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Travel and Hospitality

5.9.1 Travel and Hospitality Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Transportation and Logistics

5.10.1 Transportation and Logistics Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Entertainment & Media

5.11.1 Entertainment & Media Market Estimates and Forecast, 2021-2029 (USD Million)

5.12 Others

5.12.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL FINTECH MARKET, BY TECHNOLOGY

6.1 Introduction

6.2 Fintech Market: Technology Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Application Programming Interface (API)

6.4.1 Application Programming Interface (API) Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Artificial Intelligence (AI)

6.5.1 Artificial Intelligence (AI) Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Blockchain

6.6.1 Blockchain Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Data Analytics

6.7.1 Data Analytics Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Robotic Process Automation (RPA)

6.8.1 Robotic Process Automation (RPA) Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 Biometrics

6.9.1 Biometrics Market Estimates and Forecast, 2021-2029 (USD Million)

6.10 Others

6.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL FINTECH MARKET, BY REGION

7.1 Introduction

7.2 North America Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Application

7.2.2 By End-use

7.2.3 By Technology

7.2.4 By Country

7.2.4.1 U.S. Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Application

7.2.4.1.2 By End-use

7.2.4.1.3 By Technology

7.2.4.2 Canada Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Application

7.2.4.2.2 By End-use

7.2.4.2.3 By Technology

7.2.4.3 Mexico Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Application

7.2.4.3.2 By End-use

7.2.4.3.3 By Technology

7.3 Europe Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Application

7.3.2 By End-use

7.3.3 By Technology

7.3.4 By Country

7.3.4.1 Germany Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Application

7.3.4.1.2 By End-use

7.3.4.1.3 By Technology

7.3.4.2 U.K. Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Application

7.3.4.2.2 By End-use

7.3.4.2.3 By Technology

7.3.4.3 France Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Application

7.3.4.3.2 By End-use

7.3.4.3.3 By Technology

7.3.4.4 Italy Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Application

7.3.4.4.2 By End-use

7.2.4.4.3 By Technology

7.3.4.5 Spain Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Application

7.3.4.5.2 By End-use

7.2.4.5.3 By Technology

7.3.4.6 Netherlands Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Application

7.3.4.6.2 By End-use

7.2.4.6.3 By Technology

7.3.4.7 Lithuania Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Application

7.3.4.7.2 By End-use

7.2.4.7.3 By Technology

7.3.4.8 Estonia Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.8.1 By Application

7.3.4.8.2 By End-use

7.2.4.8.3 By Technology

7.3.4.9 Finland Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.9.1 By Application

7.3.4.9.2 By End-use

7.2.4.9.3 By Technology

7.3.4.10 Switzerland Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.10.1 By Application

7.3.4.10.2 By End-use

7.2.4.10.3 By Technology

7.3.4.11 Belgium Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.11.1 By Application

7.3.4.11.2 By End-use

7.2.4.11.3 By Technology

7.3.4.12 Poland Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.12.1 By Application

7.3.4.12.2 By End-use

7.2.4.12.3 By Technology

7.3.4.13 Ukraine Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.13.1 By Application

7.3.4.13.2 By End-use

7.2.4.13.3 By Technology

7.3.4.14 Sweden Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.14.1 By Application

7.3.4.14.2 By End-use

7.2.4.14.3 By Technology

7.3.4.15 Norway Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.15.1 By Application

7.3.4.15.2 By End-use

7.2.4.15.3 By Technology

7.3.4.16 Denmark Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.16.1 By Application

7.3.4.16.2 By End-use

7.2.4.16.3 By Technology

7.3.4.17 Rest of Europe Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.17.1 By Application

7.3.4.17.2 By End-use

7.2.4.17.3 By Technology

7.4 Asia Pacific Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Application

7.4.2 By End-use

7.4.3 By Technology

7.4.4 By Country

7.4.4.1 China Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Application

7.4.4.1.2 By End-use

7.4.4.1.3 By Technology

7.4.4.2 Japan Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Application

7.4.4.2.2 By End-use

7.4.4.2.3 By Technology

7.4.4.3 India Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Application

7.4.4.3.2 By End-use

7.4.4.3.3 By Technology

7.4.4.4 South Korea Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Application

7.4.4.4.2 By End-use

7.4.4.4.3 By Technology

7.4.4.5 Singapore Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Application

7.4.4.5.2 By End-use

7.4.4.5.3 By Technology

7.4.4.6 Malaysia Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Application

7.4.4.6.2 By End-use

7.4.4.6.3 By Technology

7.4.4.7 Thailand Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Application

7.4.4.7.2 By End-use

7.4.4.7.3 By Technology

7.4.4.8 Indonesia Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Application

7.4.4.8.2 By End-use

7.4.4.8.3 By Technology

7.4.4.9 Vietnam Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Application

7.4.4.9.2 By End-use

7.4.4.9.3 By Technology

7.4.4.10 Taiwan Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Application

7.4.4.10.2 By End-use

7.4.4.10.3 By Technology

7.4.4.11 Rest of Asia Pacific Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Application

7.4.4.11.2 By End-use

7.4.4.11.3 By Technology

7.5 Middle East and Africa Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Application

7.5.2 By End-use

7.5.3 By Technology

7.5.4 By Country

7.5.4.1 Saudi Arabia Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Application

7.5.4.1.2 By End-use

7.5.4.1.3 By Technology

7.5.4.2 U.A.E. Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Application

7.5.4.2.2 By End-use

7.5.4.2.3 By Technology

7.5.4.3 Israel Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Application

7.5.4.3.2 By End-use

7.5.4.3.3 By Technology

7.5.4.4 South Africa Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Application

7.5.4.4.2 By End-use

7.5.4.4.3 By Technology

7.5.4.5 Rest of Middle East and Africa Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Application

7.5.4.5.2 By End-use

7.5.4.5.2 By Technology

7.6 Central and South America Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Application

7.6.2 By End-use

7.6.3 By Technology

7.6.4 By Country

7.6.4.1 Brazil Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Application

7.6.4.1.2 By End-use

7.6.4.1.3 By Technology

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Application

7.6.4.2.2 By End-use

7.6.4.2.3 By Technology

7.6.4.3 Chile Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Application

7.6.4.3.2 By End-use

7.6.4.3.3 By Technology

7.6.4.4 Rest of Central and South America Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Application

7.6.4.4.2 By End-use

7.6.4.4.3 By Technology

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Visa

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 PayPal Holdings, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Block, Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Mastercard Incorporated

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Envestnet, Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Upstart Holdings, Inc.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Fiserv

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 FIS

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Adyen

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Intuit Inc.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Finastra

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

8.4.12 Revolut

8.4.12.1 Business Description & Financial Analysis

8.4.12.2 SWOT Analysis

8.4.12.3 Products & Services Offered

8.4.12.4 Strategic Alliances between Business Partners

8.4.13 Ant Group

8.4.13.1 Business Description & Financial Analysis

8.4.13.2 SWOT Analysis

8.4.13.3 Products & Services Offered

8.4.13.4 Strategic Alliances between Business Partners

8.4.14 Chime

8.4.14.1 Business Description & Financial Analysis

8.4.14.2 SWOT Analysis

8.4.14.3 Products & Services Offered

8.4.14.4 Strategic Alliances between Business Partners

8.4.15 Ripple

8.4.15.1 Business Description & Financial Analysis

8.4.15.2 SWOT Analysis

8.4.15.3 Products & Services Offered

8.4.15.4 Strategic Alliances between Business Partners

8.4.16 Rapyd Financial Network Ltd.

8.4.16.1 Business Description & Financial Analysis

8.4.16.2 SWOT Analysis

8.4.16.3 Products & Services Offered

8.4.16.4 Strategic Alliances between Business Partners

8.4.17 Nubank

8.4.17.1 Business Description & Financial Analysis

8.4.17.2 SWOT Analysis

8.4.17.3 Products & Services Offered

8.4.17.4 Strategic Alliances between Business Partners

8.4.18 Synctera

8.4.18.1 Business Description & Financial Analysis

8.4.18.2 SWOT Analysis

8.4.18.3 Products & Services Offered

8.4.18.4 Strategic Alliances between Business Partners

8.4.19 Stripe, Inc.

8.4.19.1 Business Description & Financial Analysis

8.4.19.2 SWOT Analysis

8.4.19.3 Products & Services Offered

8.4.19.4 Strategic Alliances between Business Partners

8.4.20 Synapse Financial Technologies, Inc.

8.4.20.1 Business Description & Financial Analysis

8.4.20.2 SWOT Analysis

8.4.20.3 Products & Services Offered

8.4.20.4 Strategic Alliances between Business Partners

8.4.21 Other Companies

8.4.21.1 Business Description & Financial Analysis

8.4.21.2 SWOT Analysis

8.4.21.3 Products & Services Offered

8.4.21.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Fintech Market, By Application , 2021-2029 (USD Mllion)

2 Payments & Funds Transfer Market, By Region, 2021-2029 (USD Mllion)

3 Loan, Insurance, Personal Finance Market, By Region, 2021-2029 (USD Mllion)

4 Compliance & Regulatory Support Market, By Region, 2021-2029 (USD Mllion)

5 KYC Verification Market, By Region, 2021-2029 (USD Mllion)

6 Fraud Monitoring Market, By Region, 2021-2029 (USD Mllion)

7 Wealth Management Market, By Region, 2021-2029 (USD Mllion)

8 Others Market, By Region, 2021-2029 (USD Mllion)

9 Global Fintech Market, By End-use, 2021-2029 (USD Mllion)

10 Bank, Financial Institutes & Insurance (BFSI) Market, By Region, 2021-2029 (USD Mllion)

11 Retail and E-commerce Market, By Region, 2021-2029 (USD Mllion)

12 Education Market, By Region, 2021-2029 (USD Mllion)

13 Healthcare Market, By Region, 2021-2029 (USD Mllion)

14 Real Estate Market, By Region, 2021-2029 (USD Mllion)

15 Travel and Hospitality Market, By Region, 2021-2029 (USD Mllion)

16 Transportation and Logistics Market, By Region, 2021-2029 (USD Mllion)

17 Entertainment & Media Market, By Region, 2021-2029 (USD Mllion)

18 Others Market, By Region, 2021-2029 (USD Mllion)

19 Global Fintech Market, By Technology, 2021-2029 (USD Mllion)

20 Application Programming Interface (API) Market, By Region, 2021-2029 (USD Mllion

21 Artificial Intelligence (AI) Market, By Region, 2021-2029 (USD Mllion)

22 Blockchain Market, By Region, 2021-2029 (USD Mllion)

23 Data Analytics Market, By Region, 2021-2029 (USD Mllion)

24 Robotic Process Automation (RPA) Market, By Region, 2021-2029 (USD Mllion)

25 Biometrics Market, By Region, 2021-2029 (USD Mllion)

26 Others Market, By Region, 2021-2029 (USD Mllion)

27 Regional Analysis, 2021-2029 (USD Mllion)

28 North America Fintech Market, By Application , 2021-2029 (USD Million)

29 North America Fintech Market, By End-use, 2021-2029 (USD Million)

30 North America Fintech Market, By Technology, 2021-2029 (USD Million)

31 North America Fintech Market, By Country, 2021-2029 (USD Million)

32 U.S Fintech Market, By Application , 2021-2029 (USD Million)

33 U.S Fintech Market, By End-use, 2021-2029 (USD Million)

34 U.S Fintech Market, By Technology, 2021-2029 (USD Million)

35 Canada Fintech Market, By Application , 2021-2029 (USD Million)

36 Canada Fintech Market, By End-use, 2021-2029 (USD Million)

37 Canada Fintech Market, By Technology, 2021-2029 (USD Million)

38 Mexico Fintech Market, By Application , 2021-2029 (USD Million)

39 Mexico Fintech Market, By End-use, 2021-2029 (USD Million)

40 Mexico Fintech Market, By Technology, 2021-2029 (USD Million)

41 Europe Fintech Market, By Application , 2021-2029 (USD Million)

42 Europe Fintech Market, By End-use, 2021-2029 (USD Million)

43 Europe Fintech Market, By Technology, 2021-2029 (USD Million)

44 Europe Fintech Market, By country, 2021-2029 (USD Million)

45 Germany Fintech Market, By Application , 2021-2029 (USD Million)

46 Germany Fintech Market, By End-use, 2021-2029 (USD Million)

47 Germany Fintech Market, By Technology, 2021-2029 (USD Million)

48 U.K. Fintech Market, By Application , 2021-2029 (USD Million)

49 U.K. Fintech Market, By End-use, 2021-2029 (USD Million)

50 U.K. Fintech Market, By Technology, 2021-2029 (USD Million)

51 France Fintech Market, By Application , 2021-2029 (USD Million)

52 France Fintech Market, By End-use, 2021-2029 (USD Million)

53 France Fintech Market, By Technology, 2021-2029 (USD Million)

54 Italy Fintech Market, By Application , 2021-2029 (USD Million)

55 Italy Fintech Market, By End-use , 2021-2029 (USD Million)

56 Italy Fintech Market, By Technology, 2021-2029 (USD Million)

57 Spain Fintech Market, By Application , 2021-2029 (USD Million)

58 Spain Fintech Market, By End-use, 2021-2029 (USD Million)

59 Spain Fintech Market, By technology , 2021-2029 (USD Million)

60 Lithuania Fintech Market, By Application, 2021-2029 (USD Million)

61 Lithuania Fintech Market, By end-use, 2021-2029 (USD Million)

62 Lithuania Fintech Market, By Technology, 2021-2029 (USD Million)

63 Estonia Fintech Market, By application, 2021-2029 (USD Million)

64 Estonia Fintech Market, By end-use, 2021-2029 (USD Million)

65 Estonia Fintech Market, By Technology, 2021-2029 (USD Million)

66 Finland Fintech Market, By application, 2021-2029 (USD Million)

67 Finland Fintech Market, By end-use, 2021-2029 (USD Million)

68 Finland Fintech Market, By Technology, 2021-2029 (USD Million)

69 Switzerland Fintech Market, By application, 2021-2029 (USD Million)

70 Switzerland Fintech Market, By end-use, 2021-2029 (USD Million)

71 Switzerland Fintech Market, By Technology, 2021-2029 (USD Million)

72 Belgium Fintech Market, By application, 2021-2029 (USD Million)

73 Belgium Fintech Market, By end-use, 2021-2029 (USD Million)

74 Belgium Fintech Market, By Technology, 2021-2029 (USD Million)

75 Poland Fintech Market, By application, 2021-2029 (USD Million)

76 Poland Fintech Market, By end-use, 2021-2029 (USD Million)

77 Poland Fintech Market, By Technology, 2021-2029 (USD Million)

78 Netherlands Fintech Market, By application, 2021-2029 (USD Million)

79 Netherlands Fintech Market, By end-use, 2021-2029 (USD Million)

80 Netherlands Fintech Market, By Technology, 2021-2029 (USD Million)

81 Ukraine Fintech Market, By application, 2021-2029 (USD Million)

82 Ukraine Fintech Market, By end-use, 2021-2029 (USD Million)

83 Ukraine Fintech Market, By Technology, 2021-2029 (USD Million)

84 Sweden Fintech Market, By application, 2021-2029 (USD Million)

85 Sweden Fintech Market, By end-use, 2021-2029 (USD Million)

86 Sweden Fintech Market, By Technology, 2021-2029 (USD Million)

87 Norway Fintech Market, By application, 2021-2029 (USD Million)

88 Norway Fintech Market, By end-use, 2021-2029 (USD Million)

89 Norway Fintech Market, By Technology, 2021-2029 (USD Million)

90 Denmark Fintech Market, By application, 2021-2029 (USD Million)

91 Denmark Fintech Market, By end-use, 2021-2029 (USD Million)

92 Denmark Fintech Market, By Technology, 2021-2029 (USD Million)

93 Rest Of Europe Fintech Market, By Application , 2021-2029 (USD Million)

94 Rest Of Europe Fintech Market, By End-use, 2021-2029 (USD Million)

95 Rest of Europe Fintech Market, By Technology, 2021-2029 (USD Million)

96 Asia Pacific Fintech Market, By Application , 2021-2029 (USD Million)

97 Asia Pacific Fintech Market, By End-use, 2021-2029 (USD Million)

98 Asia Pacific Fintech Market, By Technology, 2021-2029 (USD Million)

99 Asia Pacific Fintech Market, By Country, 2021-2029 (USD Million)

100 China Fintech Market, By Application , 2021-2029 (USD Million)

101 China Fintech Market, By End-use, 2021-2029 (USD Million)

102 China Fintech Market, By Technology, 2021-2029 (USD Million)

103 India Fintech Market, By Application , 2021-2029 (USD Million)

104 India Fintech Market, By End-use, 2021-2029 (USD Million)

105 India Fintech Market, By Technology, 2021-2029 (USD Million)

106 Japan Fintech Market, By Application , 2021-2029 (USD Million)

107 Japan Fintech Market, By End-use, 2021-2029 (USD Million)

108 Japan Fintech Market, By Technology, 2021-2029 (USD Million)

109 South Korea Fintech Market, By Application , 2021-2029 (USD Million)

110 South Korea Fintech Market, By End-use, 2021-2029 (USD Million)

111 South Korea Fintech Market, By Technology, 2021-2029 (USD Million)

112 Singapore Fintech Market, By Application , 2021-2029 (USD Million)

113 Singapore Fintech Market, By End-use, 2021-2029 (USD Million)

114 Singapore Fintech Market, By Technology, 2021-2029 (USD Million)

115 Malaysia Fintech Market, By Application , 2021-2029 (USD Million)

116 Malaysia Fintech Market, By End-use, 2021-2029 (USD Million)

117 Malaysia Fintech Market, By Technology, 2021-2029 (USD Million)

118 Thailand Fintech Market, By Application , 2021-2029 (USD Million)

119 Thailand Fintech Market, By End-use, 2021-2029 (USD Million)

120 Thailand Fintech Market, By Technology, 2021-2029 (USD Million)

121 Indonesia Fintech Market, By Application , 2021-2029 (USD Million)

122 Indonesia Fintech Market, By End-use, 2021-2029 (USD Million)

123 Indonesia Fintech Market, By Technology, 2021-2029 (USD Million)

124 Vietnam Fintech Market, By Application , 2021-2029 (USD Million)

125 Vietnam Fintech Market, By End-use, 2021-2029 (USD Million)

126 Vietnam Fintech Market, By Technology, 2021-2029 (USD Million)

127 Taiwan Fintech Market, By Application , 2021-2029 (USD Million)

128 Taiwan Fintech Market, By End-use, 2021-2029 (USD Million)

129 Taiwan Fintech Market, By Technology, 2021-2029 (USD Million)

130 Rest of Asia Pacific Fintech Market, By Application , 2021-2029 (USD Million)

131 Rest of Asia Pacific Fintech Market, By End-use, 2021-2029 (USD Million)

132 Rest of Asia Pacific Fintech Market, By Technology, 2021-2029 (USD Million)

133 Middle East and Africa Fintech Market, By Application , 2021-2029 (USD Million)

134 Middle East and Africa Fintech Market, By End-use, 2021-2029 (USD Million)

135 Middle East and Africa Fintech Market, By Technology, 2021-2029 (USD Million)

136 Middle East and Africa Fintech Market, By Country, 2021-2029 (USD Million)

137 Saudi Arabia Fintech Market, By Application , 2021-2029 (USD Million)

138 Saudi Arabia Fintech Market, By End-use, 2021-2029 (USD Million)

139 Saudi Arabia Fintech Market, By Technology, 2021-2029 (USD Million)

140 UAE Fintech Market, By Application , 2021-2029 (USD Million)

141 UAE Fintech Market, By End-use, 2021-2029 (USD Million)

142 UAE Fintech Market, By Technology, 2021-2029 (USD Million)

143 Israel Fintech Market, By Application , 2021-2029 (USD Million)

144 Israel Fintech Market, By End-use, 2021-2029 (USD Million)

145 Israel Fintech Market, By Technology, 2021-2029 (USD Million)

146 South Africa Fintech Market, By Application , 2021-2029 (USD Million)

147 South Africa Fintech Market, By End-use, 2021-2029 (USD Million)

148 South Africa Fintech Market, By Technology, 2021-2029 (USD Million)

149 Rest of Middle East and Africa Fintech Market, By Application , 2021-2029 (USD Million)

150 Rest of Middle East and Africa Fintech Market, By End-use, 2021-2029 (USD Million)

151 Rest of Middle East and Africa Fintech Market, By Technology, 2021-2029 (USD Million)

152 Central and South America Fintech Market, By Application , 2021-2029 (USD Million)

153 Central and South America Fintech Market, By End-use, 2021-2029 (USD Million)

154 Central and South America Fintech Market, By Technology, 2021-2029 (USD Million)

155 Central and South America Fintech Market, By Country, 2021-2029 (USD Million)

156 Brazil Fintech Market, By Application , 2021-2029 (USD Million)

157 Brazil Fintech Market, By End-use, 2021-2029 (USD Million)

158 Brazil Fintech Market, By Technology, 2021-2029 (USD Million)

159 Argentina Fintech Market, By Application , 2021-2029 (USD Million)

160 Argentina Fintech Market, By End-use, 2021-2029 (USD Million)

161 Argentina Fintech Market, By Technology, 2021-2029 (USD Million)

162 Chile Fintech Market, By Application , 2021-2029 (USD Million)

163 Chile Fintech Market, By End-use, 2021-2029 (USD Million)

164 Chile Fintech Market, By Technology, 2021-2029 (USD Million)

165 Rest of Central and South America Fintech Market, By Application , 2021-2029 (USD Million)

166 Rest of Central and South America Fintech Market, By End-use, 2021-2029 (USD Million)

167 Rest of Central and South America Fintech Market, By Technology, 2021-2029 (USD Million)

168 VISA: Products & Services Offering

169 PayPal Holdings, Inc.: Products & Services Offering

170 Block, Inc.: Products & Services Offering

171 Mastercard Incorporated: Products & Services Offering

172 Envestnet, Inc.: Products & Services Offering

173 UPSTART HOLDINGS, INC.: Products & Services Offering

174 FISERV : Products & Services Offering

175 FIS: Products & Services Offering

176 Adyen, Inc: Products & Services Offering

177 Intuit Inc.: Products & Services Offering

178 Finastra: Products & Services Offering

179 Revolut: Products & Services Offering

180 Ant Group: Products & Services Offering

181 Chime: Products & Services Offering

182 Ripple: Products & Services Offering

183 Rapyd Financial Network Ltd.: Products & Services Offering

184 Nubank: Products & Services Offering

185 Synctera: Products & Services Offering

186 Stripe, Inc.: Products & Services Offering

187 Synapse Financial Technologies, Inc.: Products & Services Offering

188 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Fintech Market Overview

2 Global Fintech Market Value From 2021-2029 (USD Mllion)

3 Global Fintech Market Share, By Application (2023)

4 Global Fintech Market Share, By End-use (2023)

5 Global Fintech Market Share, By Technology (2023)

6 Global Fintech Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Fintech Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Fintech Market

11 Impact Of Challenges On The Global Fintech Market

12 Porter’s Five Forces Analysis

13 Global Fintech Market: By Application Scope Key Takeaways

14 Global Fintech Market, By Application Segment: Revenue Growth Analysis

15 Payments & Funds Transfer Market, By Region, 2021-2029 (USD Mllion)

16 Loan, Insurance, Personal Finance Market, By Region, 2021-2029 (USD Mllion)

17 Compliance & Regulatory Support Market, By Region, 2021-2029 (USD Mllion)

18 KYC Verification Market, By Region, 2021-2029 (USD Mllion)

19 Fraud Monitoring Market, By Region, 2021-2029 (USD Mllion)

20 Wealth Management Market, By Region, 2021-2029 (USD Mllion)

21 Others Market, By Region, 2021-2029 (USD Mllion)

22 Global Fintech Market: By End-use Scope Key Takeaways

23 Global Fintech Market, By End-use Segment: Revenue Growth Analysis

24 Bank, Financial Institutes & Insurance (BFSI) Market, By Region, 2021-2029 (USD Mllion)

25 Retail and E-commerce Market, By Region, 2021-2029 (USD Mllion)

26 Education Market, By Region, 2021-2029 (USD Mllion)

27 Healthcare Market, By Region, 2021-2029 (USD Mllion)

28 Real Estate Market, By Region, 2021-2029 (USD Mllion)

29 Travel and Hospitality Market, By Region, 2021-2029 (USD Mllion)

30 Transportation and Logistics Market, By Region, 2021-2029 (USD Mllion)

31 Entertainment & Media Market, By Region, 2021-2029 (USD Mllion)

32 Others Market, By Region, 2021-2029 (USD Mllion)

33 Global Fintech Market: By Technology Scope Key Takeaways

34 Global Fintech Market, By Technology Segment: Revenue Growth Analysis

35 Application Programming Interface (API) Market, By Region, 2021-2029 (USD Mllion)

36 Artificial Intelligence (AI) Market, By Region, 2021-2029 (USD Mllion)

37 Blockchain Market, By Region, 2021-2029 (USD Mllion)

38 Data Analytics Market, By Region, 2021-2029 (USD Mllion)

39 Robotic Process Automation (RPA) Market, By Region, 2021-2029 (USD Mllion)

40 Biometrics Market, By Region, 2021-2029 (USD Mllion)

41 Others Market, By Region, 2021-2029 (USD Mllion)

42 Regional Segment: Revenue Growth Analysis

43 Global Fintech Market: Regional Analysis

44 North America Fintech Market, By Application , 2021-2029 (USD Million)

45 North America Fintech Market, By End-use, 2021-2029 (USD Million)

46 North America Fintech Market, By Technology, 2021-2029 (USD Million)

47 North America Fintech Market, By Country, 2021-2029 (USD Million)

48 U.S Fintech Market, By Application , 2021-2029 (USD Million)

49 U.S Fintech Market, By End-use, 2021-2029 (USD Million)

50 U.S Fintech Market, By Technology, 2021-2029 (USD Million)

51 Canada Fintech Market, By Application , 2021-2029 (USD Million)

52 Canada Fintech Market, By End-use, 2021-2029 (USD Million)

53 Canada Fintech Market, By Technology, 2021-2029 (USD Million)

54 Mexico Fintech Market, By Application , 2021-2029 (USD Million)

55 Mexico Fintech Market, By End-use, 2021-2029 (USD Million)

56 Mexico Fintech Market, By Technology, 2021-2029 (USD Million)

57 Europe Fintech Market, By Application , 2021-2029 (USD Million)

58 Europe Fintech Market, By End-use, 2021-2029 (USD Million)

59 Europe Fintech Market, By Technology, 2021-2029 (USD Million)

60 Europe Fintech Market, By country, 2021-2029 (USD Million)

61 Germany Fintech Market, By Application , 2021-2029 (USD Million)

62 Germany Fintech Market, By End-use, 2021-2029 (USD Million)

63 Germany Fintech Market, By Technology, 2021-2029 (USD Million)

64 U.K. Fintech Market, By Application , 2021-2029 (USD Million)

65 U.K. Fintech Market, By End-use, 2021-2029 (USD Million)

66 U.K. Fintech Market, By Technology, 2021-2029 (USD Million)

67 France Fintech Market, By Application , 2021-2029 (USD Million)

68 France Fintech Market, By End-use, 2021-2029 (USD Million)

69 France Fintech Market, By Technology, 2021-2029 (USD Million)

70 Italy Fintech Market, By Application , 2021-2029 (USD Million)

71 Italy Fintech Market, By End-use , 2021-2029 (USD Million)

72 Italy Fintech Market, By Technology, 2021-2029 (USD Million)

73 Spain Fintech Market, By Application , 2021-2029 (USD Million)

74 Spain Fintech Market, By End-use, 2021-2029 (USD Million)

75 Spain Fintech Market, By technology , 2021-2029 (USD Million)

76 Lithuania Fintech Market, By Application, 2021-2029 (USD Million)

77 Lithuania Fintech Market, By end-use, 2021-2029 (USD Million)

78 Lithuania Fintech Market, By Technology, 2021-2029 (USD Million)

79 Estonia Fintech Market, By application, 2021-2029 (USD Million)

80 Estonia Fintech Market, By end-use, 2021-2029 (USD Million)

81 Estonia Fintech Market, By Technology, 2021-2029 (USD Million)

82 Finland Fintech Market, By application, 2021-2029 (USD Million)

83 Finland Fintech Market, By end-use, 2021-2029 (USD Million)

84 Finland Fintech Market, By Technology, 2021-2029 (USD Million)

85 Switzerland Fintech Market, By application, 2021-2029 (USD Million)

86 Switzerland Fintech Market, By end-use, 2021-2029 (USD Million)

87 Switzerland Fintech Market, By Technology, 2021-2029 (USD Million)

88 Belgium Fintech Market, By application, 2021-2029 (USD Million)

89 Belgium Fintech Market, By end-use, 2021-2029 (USD Million)

90 Belgium Fintech Market, By Technology, 2021-2029 (USD Million)

91 Poland Fintech Market, By application, 2021-2029 (USD Million)

92 Poland Fintech Market, By end-use, 2021-2029 (USD Million)

93 Poland Fintech Market, By Technology, 2021-2029 (USD Million)

94 Netherlands Fintech Market, By application, 2021-2029 (USD Million)

95 Netherlands Fintech Market, By end-use, 2021-2029 (USD Million)

96 Netherlands Fintech Market, By Technology, 2021-2029 (USD Million)

97 Ukraine Fintech Market, By application, 2021-2029 (USD Million)

98 Ukraine Fintech Market, By end-use, 2021-2029 (USD Million)

99 Ukraine Fintech Market, By Technology, 2021-2029 (USD Million)

100 Sweden Fintech Market, By application, 2021-2029 (USD Million)

101 Sweden Fintech Market, By end-use, 2021-2029 (USD Million)

102 Sweden Fintech Market, By Technology, 2021-2029 (USD Million)

103 Norway Fintech Market, By application, 2021-2029 (USD Million)

104 Norway Fintech Market, By end-use, 2021-2029 (USD Million)

105 Norway Fintech Market, By Technology, 2021-2029 (USD Million)

106 Denmark Fintech Market, By application, 2021-2029 (USD Million)

107 Denmark Fintech Market, By end-use, 2021-2029 (USD Million)

108 Denmark Fintech Market, By Technology, 2021-2029 (USD Million)

109 Rest Of Europe Fintech Market, By Application , 2021-2029 (USD Million)

110 Rest Of Europe Fintech Market, By End-use, 2021-2029 (USD Million)

111 Rest of Europe Fintech Market, By Technology, 2021-2029 (USD Million)

112 Asia Pacific Fintech Market, By Application , 2021-2029 (USD Million)

113 Asia Pacific Fintech Market, By End-use, 2021-2029 (USD Million)

114 Asia Pacific Fintech Market, By Technology, 2021-2029 (USD Million)

115 Asia Pacific Fintech Market, By Country, 2021-2029 (USD Million)

116 China Fintech Market, By Application , 2021-2029 (USD Million)

117 China Fintech Market, By End-use, 2021-2029 (USD Million)

118 China Fintech Market, By Technology, 2021-2029 (USD Million)

119 India Fintech Market, By Application , 2021-2029 (USD Million)

120 India Fintech Market, By End-use, 2021-2029 (USD Million)

121 India Fintech Market, By Technology, 2021-2029 (USD Million)

122 Japan Fintech Market, By Application , 2021-2029 (USD Million)

123 Japan Fintech Market, By End-use, 2021-2029 (USD Million)

124 Japan Fintech Market, By Technology, 2021-2029 (USD Million)

125 South Korea Fintech Market, By Application , 2021-2029 (USD Million)

126 South Korea Fintech Market, By End-use, 2021-2029 (USD Million)

127 South Korea Fintech Market, By Technology, 2021-2029 (USD Million)

128 Singapore Fintech Market, By Application , 2021-2029 (USD Million)

129 Singapore Fintech Market, By End-use, 2021-2029 (USD Million)

130 Singapore Fintech Market, By Technology, 2021-2029 (USD Million)

131 Malaysia Fintech Market, By Application , 2021-2029 (USD Million)

132 Malaysia Fintech Market, By End-use, 2021-2029 (USD Million)

133 Malaysia Fintech Market, By Technology, 2021-2029 (USD Million)

134 Thailand Fintech Market, By Application , 2021-2029 (USD Million)

135 Thailand Fintech Market, By End-use, 2021-2029 (USD Million)

136 Thailand Fintech Market, By Technology, 2021-2029 (USD Million)

137 Indonesia Fintech Market, By Application , 2021-2029 (USD Million)

138 Indonesia Fintech Market, By End-use, 2021-2029 (USD Million)

139 Indonesia Fintech Market, By Technology, 2021-2029 (USD Million)

140 Vietnam Fintech Market, By Application , 2021-2029 (USD Million)

141 Vietnam Fintech Market, By End-use, 2021-2029 (USD Million)

142 Vietnam Fintech Market, By Technology, 2021-2029 (USD Million)

143 Taiwan Fintech Market, By Application , 2021-2029 (USD Million)

144 Taiwan Fintech Market, By End-use, 2021-2029 (USD Million)

145 Taiwan Fintech Market, By Technology, 2021-2029 (USD Million)

146 Rest of Asia Pacific Fintech Market, By Application , 2021-2029 (USD Million)

147 Rest of Asia Pacific Fintech Market, By End-use, 2021-2029 (USD Million)

148 Rest of Asia Pacific Fintech Market, By Technology, 2021-2029 (USD Million)

149 Middle East and Africa Fintech Market, By Application , 2021-2029 (USD Million)

150 Middle East and Africa Fintech Market, By End-use, 2021-2029 (USD Million)

151 Middle East and Africa Fintech Market, By Technology, 2021-2029 (USD Million)

152 Middle East and Africa Fintech Market, By Country, 2021-2029 (USD Million)

153 Saudi Arabia Fintech Market, By Application , 2021-2029 (USD Million)

154 Saudi Arabia Fintech Market, By End-use, 2021-2029 (USD Million)

155 Saudi Arabia Fintech Market, By Technology, 2021-2029 (USD Million)

156 UAE Fintech Market, By Application , 2021-2029 (USD Million)

157 UAE Fintech Market, By End-use, 2021-2029 (USD Million)

158 UAE Fintech Market, By Technology, 2021-2029 (USD Million)

159 Israel Fintech Market, By Application , 2021-2029 (USD Million)

160 Israel Fintech Market, By End-use, 2021-2029 (USD Million)

161 Israel Fintech Market, By Technology, 2021-2029 (USD Million)

162 South Africa Fintech Market, By Application , 2021-2029 (USD Million)

163 South Africa Fintech Market, By End-use, 2021-2029 (USD Million)

164 South Africa Fintech Market, By Technology, 2021-2029 (USD Million)

165 Rest of Middle East and Africa Fintech Market, By Application , 2021-2029 (USD Million)

166 Rest of Middle East and Africa Fintech Market, By End-use, 2021-2029 (USD Million)

167 Rest of Middle East and Africa Fintech Market, By Technology, 2021-2029 (USD Million)

168 Central and South America Fintech Market, By Application , 2021-2029 (USD Million)

169 Central and South America Fintech Market, By End-use, 2021-2029 (USD Million)

170 Central and South America Fintech Market, By Technology, 2021-2029 (USD Million)

171 Central and South America Fintech Market, By Country, 2021-2029 (USD Million)

172 Brazil Fintech Market, By Application , 2021-2029 (USD Million)

173 Brazil Fintech Market, By End-use, 2021-2029 (USD Million)

174 Brazil Fintech Market, By Technology, 2021-2029 (USD Million)

175 Argentina Fintech Market, By Application , 2021-2029 (USD Million)

176 Argentina Fintech Market, By End-use, 2021-2029 (USD Million)

177 Argentina Fintech Market, By Technology, 2021-2029 (USD Million)

178 Chile Fintech Market, By Application , 2021-2029 (USD Million)

179 Chile Fintech Market, By End-use, 2021-2029 (USD Million)

180 Chile Fintech Market, By Technology, 2021-2029 (USD Million)

181 Rest of Central and South America Fintech Market, By Application , 2021-2029 (USD Million)

182 Rest of Central and South America Fintech Market, By End-use, 2021-2029 (USD Million)

183 Rest of Central and South America Fintech Market, By Technology, 2021-2029 (USD Million)

184 Four Quadrant Positioning Matrix

185 Company Market Share Analysis

186 VISA: Company Snapshot

187 VISA: SWOT Analysis

188 VISA: Geographic Presence

189 PayPal Holdings, Inc.: Company Snapshot

190 PayPal Holdings, Inc.: SWOT Analysis

191 PayPal Holdings, Inc.: Geographic Presence

192 Block, Inc.: Company Snapshot

193 Block, Inc.: SWOT Analysis

194 Block, Inc.: Geographic Presence

195 Mastercard Incorporated: Company Snapshot

196 Mastercard Incorporated: Swot Analysis

197 Mastercard Incorporated: Geographic Presence

198 Envestnet, Inc.: Company Snapshot

199 Envestnet, Inc.: SWOT Analysis

200 Envestnet, Inc.: Geographic Presence

201 Upstart Holdings, Inc.: Company Snapshot

202 Upstart Holdings, Inc.: SWOT Analysis

203 Upstart Holdings, Inc.: Geographic Presence

204 Fiserv : Company Snapshot

205 Fiserv : SWOT Analysis

206 Fiserv : Geographic Presence

207 FIS: Company Snapshot

208 FIS: SWOT Analysis

209 FIS: Geographic Presence

210 Adyen, Inc.: Company Snapshot

211 Adyen, Inc.: SWOT Analysis

212 Adyen, Inc.: Geographic Presence

213 Synapse Financial Technologies, Inc.: Company Snapshot

214 Synapse Financial Technologies, Inc.: SWOT Analysis

215 Synapse Financial Technologies, Inc.: Geographic Presence

216 Intuit: Company Snapshot

217 Intuit: SWOT Analysis

218 Intuit: Geographic Presence

219 Finastra: Company Snapshot

220 Finastra: SWOT Analysis

221 Finastra: Geographic Presence

222 Revolut: Company Snapshot

223 Revolut: SWOT Analysis

224 Revolut: Geographic Presence

225 Ant Group: Company Snapshot

226 Ant Group: SWOT Analysis

227 Ant Group: Geographic Presence

228 Chime: Company Snapshot

229 Chime: SWOT Analysis

230 Chime: Geographic Presence

231 Ripple: Company Snapshot

232 Ripple: SWOT Analysis

233 Ripple: Geographic Presence

234 Rapyd Financial Network Ltd.: Company Snapshot

235 Rapyd Financial Network Ltd.: SWOT Analysis

236 Rapyd Financial Network Ltd.: Geographic Presence

237 Nubank: Company Snapshot

238 Nubank: SWOT Analysis

239 Nubank: Geographic Presence

240 Synctera: Company Snapshot

241 Synctera: SWOT Analysis

242 Synctera: Geographic Presence

243 Stripe, Inc.: Company Snapshot

244 Stripe, Inc.: SWOT Analysis

245 Stripe, Inc.: Geographic Presence

246 Other Companies: Company Snapshot

247 Other Companies: SWOT Analysis

248 Other Companies: Geographic Presence

The Global Fintech Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fintech Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS