Global Fortified Flour Market Size, Trends & Analysis - Forecasts to 2026 By Type (Wheat, Corn, Rice), By Fortification Ingredient (Iron, Vitamin, Mineral), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Food fortification is a practice to enrich the food with essential micronutrients such as minerals and vitamins to improve the overall nutrient content in the diet. The fortified flour offers an excellent nutrient to the human diet with minimal risk associated with health. Thus, driving the overall fortified flour market growth.

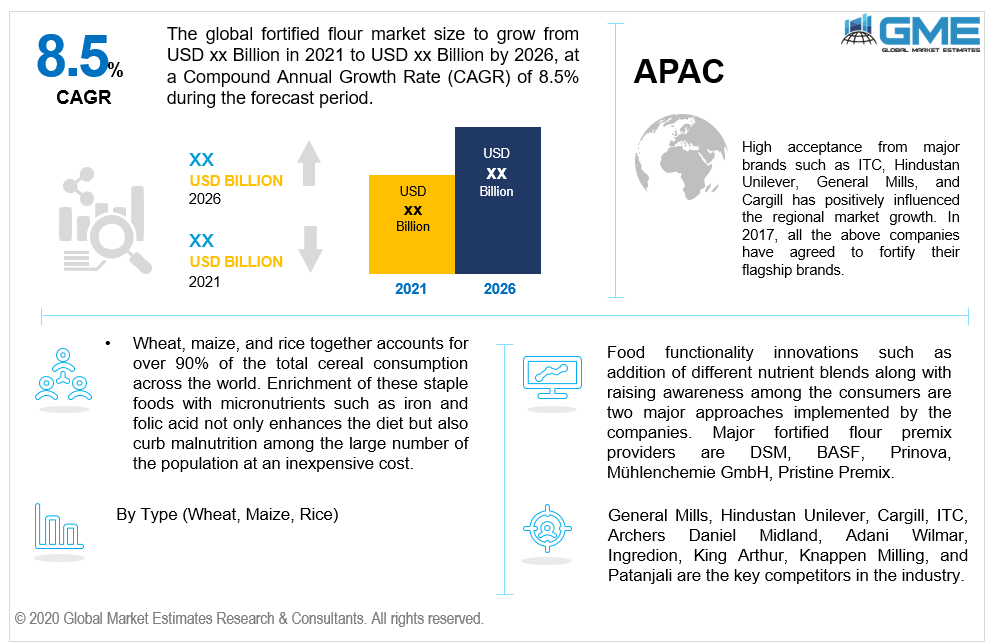

Wheat, maize, and rice together account for over 90% of the total cereal consumption across the world. Enrichment of these staple foods with micronutrients such as iron and folic acid not only enhances the diet but also curbs malnutrition among a large number of the population at an inexpensive cost.

As per the WHO recommendation, food fortification is a preventive method to provide healthy nutrients in the diet and also to overcome the mineral deficiencies among the middle and lower class population. Minimal adoption of dietary supplements and other nutraceuticals due to lack of knowledge and extra cost has influenced health organizations to impose wheat and maize fortification in the mills.

If instructed at the national level, flour fortification is projected to be a highly effective tool in uplifting public health standards and achieving worldwide health objectives. Decisions regarding which micronutrient to be added and in what quantity are directly dependent on the population of different regions. The needs are diversified depending on the deficiency level and eating habits of the public in different regions.

Appropriate Quality Assurance and Quality Control programs are required at the mill while including the micronutrients in the food. Steps and considerations to take while adding the optimum nutrient quantity to the food must be based on the number of co-factors such as nutritional need among the particular population, the consumption pattern, their aftereffect, and the cost.

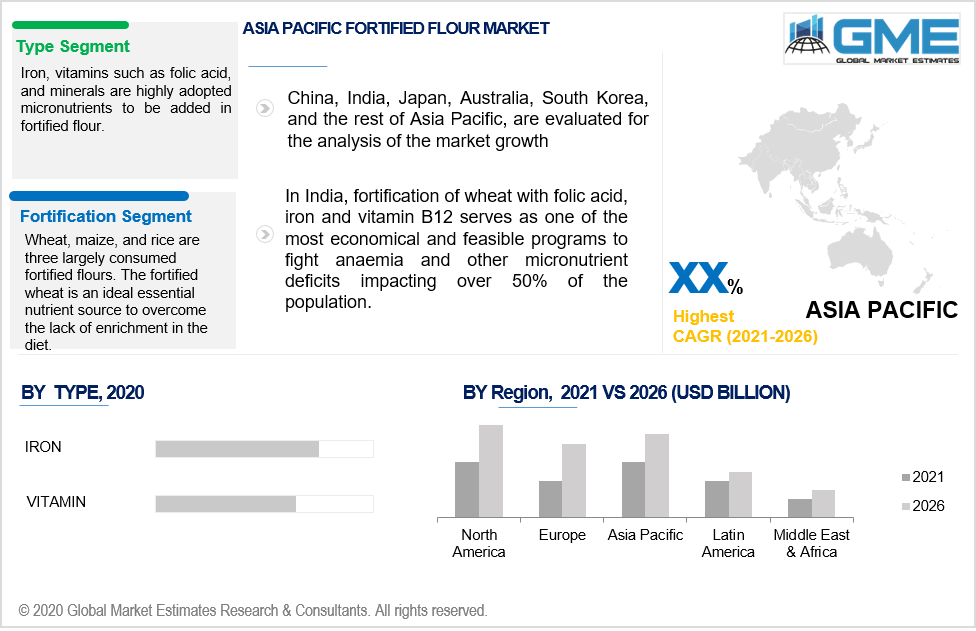

Wheat, maize, and rice are three largely consumed fortified flours. The fortified wheat is an ideal essential nutrient source to overcome the lack of enrichment in the diet. These functional foods provide additional advantages by providing antioxidants and also reduces heart risk and diabetes.

Fortified maize and corn are highly recommended in various American and African countries. Consumption of these staple foods with micronutrient ingredients such as iron and folic acids helps in preventing deficiency among children and women. These functional foods reduce the risk of neural tube defects among newborns.

Iron, vitamins such as folic acid and minerals are highly adopted micronutrients to be added in fortified flour. Enriching wheat, maize, and rice with essential minerals and vitamins is a cost-effective process to guarantee a sufficient micronutrient supply in the human body. These functional foods help to curb vitamin A deficiencies.

Vitamin A possesses a unique quality of offering high storage stability in the final product. It also contains high purity, excellent flowability, low dusting and easy applicability while practicing fortification. Since these staple foods and are consumed by a large population, it is wise to consider iron, folic acid, vitamin B1 and vitamin B2 in the overall fortification program.

The Asia Pacific fortified flour market will dominate the overall revenue share by 2026. High acceptance from major brands such as ITC, Hindustan Unilever, General Mills, and Cargill has positively influenced the regional market growth. In 2017, all the above companies have agreed to fortify their flagship brands.

In India, the fortification of wheat with folic acid, iron and vitamin B12 serves as one of the most economical and feasible programs to fight anemia and other micronutrient deficits impacting over 50% of the population. The country has high wheat consumption ranging from 200-250 grams a day per individual. FSSAI and AIBTM are offering technical support as well standardized processes to offer fortified flour in other by-products such as bakery.

North America's fortified flour demand is greatly influenced by the government intervention to introduce functional food in the region. Children and women are at high risk to develop diseases caused by malnutrition and deficiencies. The region is also facing high consumption of flour-based junk food. So it became essential to add nutritional premixes in the flour to avoid health problems.

Fortified Flour Market share is highly competitive owing to the presence of a large number of producers in the industry. General Mills, Hindustan Unilever, Cargill, ITC, Archers Daniel Midland, Adani Wilmar, Ingredion, King Arthur, Knappen Milling, and Patanjali are the key competitors in the industry. Major fortified flour premix providers are DSM, BASF, Prinova, Mühlenchemie GmbH, Pristine Premix, Morvel Formulations, GAIN, and Mirpain Food Ingredients.

Please note: This is not an exhaustive list of companies profiled in the report.

Food functionality innovations such as addition of different nutrient blends along with raising awareness among the consumers are two major approaches implemented by the companies. Associating with premix providers such as BASF, DSM, and Prinova to work on better products is also witnessed in the industry.

Other key players include Associated British Foods PLC, The Hain Celestial Group, Bunge Limited, The Scoular Company, Parrish and Heimbecker, The Caremoli Group, and GPA Foods Pvt Ltd.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Fortified Flour Market industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Fortification Ingredient overview

2.1.4 Regional overview

Chapter 3 Fortified Flour Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.1.1 Government intervention to fortify flour

3.3.1.2 Rising consumer preference for functional food

3.3.2 Industry challenges

3.3.2.1 Strict food guidelines

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.4.2 Ingredient growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Product innovation

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Fortified Flour Market, By Type

4.1 Type Outlook

4.2 Wheat

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Maize

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Rice

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Other

4.5.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Fortified Flour Market, By Fortification Ingredient

5.1 Fortification Ingredient Outlook

5.2 Iron

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Vitamin

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Mineral

5.4.1 Market size, by region, 2016-2026 (USD Million)

5.5 Others

5.5.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Fortified Flour Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2016-2026 (USD Million)

6.2.2 Market size, by type, 2016-2026 (USD Million)

6.2.3 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by type, 2016-2026 (USD Million)

6.2.4.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by type, 2016-2026 (USD Million)

6.2.5.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2016-2026 (USD Million)

6.3.2 Market size, by type, 2016-2026 (USD Million)

6.3.3 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by type, 2016-2026 (USD Million)

6.2.4.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by type, 2016-2026 (USD Million)

6.3.5.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by type, 2016-2026 (USD Million)

6.3.6.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by type, 2016-2026 (USD Million)

6.3.7.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by type, 2016-2026 (USD Million)

6.3.8.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by type, 2016-2026 (USD Million)

6.3.9.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2016-2026 (USD Million)

6.4.2 Market size, by type, 2016-2026 (USD Million)

6.4.3 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by type, 2016-2026 (USD Million)

6.4.4.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market size, by type, 2016-2026 (USD Million)

6.4.5.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market size, by type, 2016-2026 (USD Million)

6.4.6.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market size, by type, 2016-2026 (USD Million)

6.4.7.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by type, 2016-2026 (USD Million)

6.4.8.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2016-2026 (USD Million)

6.5.2 Market size, by type, 2016-2026 (USD Million)

6.5.3 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by type, 2016-2026 (USD Million)

6.5.4.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by type, 2016-2026 (USD Million)

6.5.5.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market size, by type, 2016-2026 (USD Million)

6.5.6.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2016-2026 (USD Million)

6.6.2 Market size, by type, 2016-2026 (USD Million)

6.6.3 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by type, 2016-2026 (USD Million)

6.6.4.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by type, 2016-2026 (USD Million)

6.6.5.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market size, by type, 2016-2026 (USD Million)

6.6.6.2 Market size, by fortification ingredient, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 General Mills

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Hindustan Unilever

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Cargill

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Patanjali

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 ITC

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Archer Daniels Midland Company

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Adani Wilmar Ltd.

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Associated British Foods PLC

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Ingredion Incorporated

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 The Hain Celestial Group

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Bunge Limited

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 The Scoular Company

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Parrish and Heimbecker

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Knappen Milling Co

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 The Caremoli Group

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 SunOpta

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

7.18 Limagrain

7.18.1 Company overview

7.18.2 Financial analysis

7.18.3 Strategic positioning

7.18.4 Info graphic analysis

7.19 AGRANA Beteiligungs-AG

7.19.1 Company overview

7.19.2 Financial analysis

7.19.3 Strategic positioning

7.19.4 Info graphic analysis

7.20 Unicorn Grain Specialties B.V.

7.20.1 Company overview

7.20.2 Financial analysis

7.20.3 Strategic positioning

7.20.4 Info graphic analysis

7.21 Natureland Organic Foods Pvt Ltd

7.21.1 Company overview

7.21.2 Financial analysis

7.21.3 Strategic positioning

7.21.4 Info graphic analysis

7.22 GPA Foods Pvt Ltd

7.22.1 Company overview

7.22.2 Financial analysis

7.22.3 Strategic positioning

7.22.4 Info graphic analysis

7.23 RAVIKAMAL ROLLER FLOUR MILLS PVT LTD

7.23.1 Company overview

7.23.2 Financial analysis

7.23.3 Strategic positioning

7.23.4 Info graphic analysis

7.24 NutroActive Industries Pvt. Ltd.

7.24.1 Company overview

7.24.2 Financial analysis

7.24.3 Strategic positioning

7.24.4 Info graphic analysis

7.25 King Arthur Flour

7.25.1 Company overview

7.25.2 Financial analysis

7.25.3 Strategic positioning

7.25.4 Info graphic analysis

7.26 Fortification Premix Providers

7.27 DSM

7.27.1 Company overview

7.27.2 Financial analysis

7.27.3 Strategic positioning

7.27.4 Info graphic analysis

7.28 BASF

7.28.1 Company overview

7.28.2 Financial analysis

7.28.3 Strategic positioning

7.28.4 Info graphic analysis

7.29 Mühlenchemie GmbH & Co. KG

7.29.1 Company overview

7.29.2 Financial analysis

7.29.3 Strategic positioning

7.29.4 Info graphic analysis

7.30 Pristine Premix

7.30.1 Company overview

7.30.2 Financial analysis

7.30.3 Strategic positioning

7.30.4 Info graphic analysis

7.31 Morvel Formulations

7.31.1 Company overview

7.31.2 Financial analysis

7.31.3 Strategic positioning

7.31.4 Info graphic analysis

7.32 GAIN

7.32.1 Company overview

7.32.2 Financial analysis

7.32.3 Strategic positioning

7.32.4 Info graphic analysis

7.33 Mirpain Food Ingredients

7.33.1 Company overview

7.33.2 Financial analysis

7.33.3 Strategic positioning

7.33.4 Info graphic analysis

7.34 Prinova Europe

7.34.1 Company overview

7.34.2 Financial analysis

7.34.3 Strategic positioning

7.34.4 Info graphic analysis

The Global Fortified Flour Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fortified Flour Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS