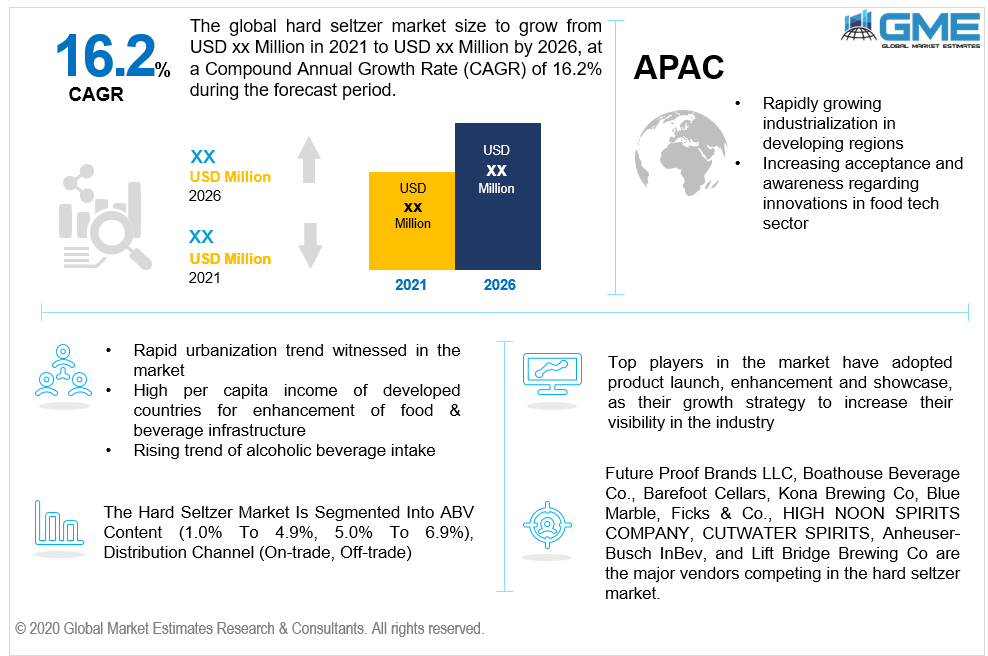

Global Hard Seltzer Market Size, Trends, and Analysis- Forecasts To 2026 By ABV Content (1.0% To 4.9%, 5.0% To 6.9%), By Distribution Channel (On-trade, Off-trade), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Hard seltzer is a low-calorie, low-carb alcoholic drink fermented with sugar. Rapid urbanization, shifting habits, high per capita income, rising alcoholic beverage intake patterns, and a growing trend of hard seltzer among the younger generation are all factors driving hard seltzer production. The global hard seltzer market has seen a rise in customer demand for flavored alcoholic beverages as a result of the growing prevalence of alcoholic drinks among millennials and the younger generation. The launch of new technology for fermentation method by innovative players, as well as the emergence of new innovative flavors incorporating sugar, sour, and fruity taste, are the main factors responsible for the global hard seltzer market's growth. Flavored hard seltzer drinks have gained popularity among the youth generation and millennials. During the forecast period, the global hard seltzer market is projected to expand at a modest single-digit CAGR.

Due to factors such as increasing economic growth, tourism and travel sector, increasing online sales of alcohol, and café & bar outlets, the hard seltzer market is projected to expand significantly. The global hard seltzer market is expected to rise due to the growing influence of western society, rapid urbanization, evolving customer views of alcoholic beverage intake, and changing consumer preferences in emerging economies. The growing trend of alcoholic beverage consumption among the younger population and millennials as a result of evolving customer tastes, increasing spending power, and peer influence among consumers are projected to boost demand for the global hard seltzer market. Since hard seltzer drinks are available with better flavor and a broader variety of options for health-conscious customers, there has been a substantial spike in revenue and demand for low-alcohol drinks, which is driving the global hard seltzer market's expansion.

Hard seltzer, a low-calorie, low-alcohol, and health-conscious beverage, has achieved traction in a market segment historically untapped by the alcoholic beverage industry. Furthermore, hard seltzers meet the need for fresh flavors, as well as the need for a variety of cocktail combos and the ease of use provided by environment-friendly sustainable cans. Due to these factors, companies are trying to gain an advantage from this fast-growing trend. Companies are attempting to benefit from this rapid trend as a result of these factors. Companies incur losses as a result of the government's stringent guidelines on the use of water supplies and waste control, which hampered the development of the global hard seltzer market. Furthermore, higher excise and customs tariffs, as well as tax policy on export and import, as well as on local producers, impede the global hard seltzer market's growth.

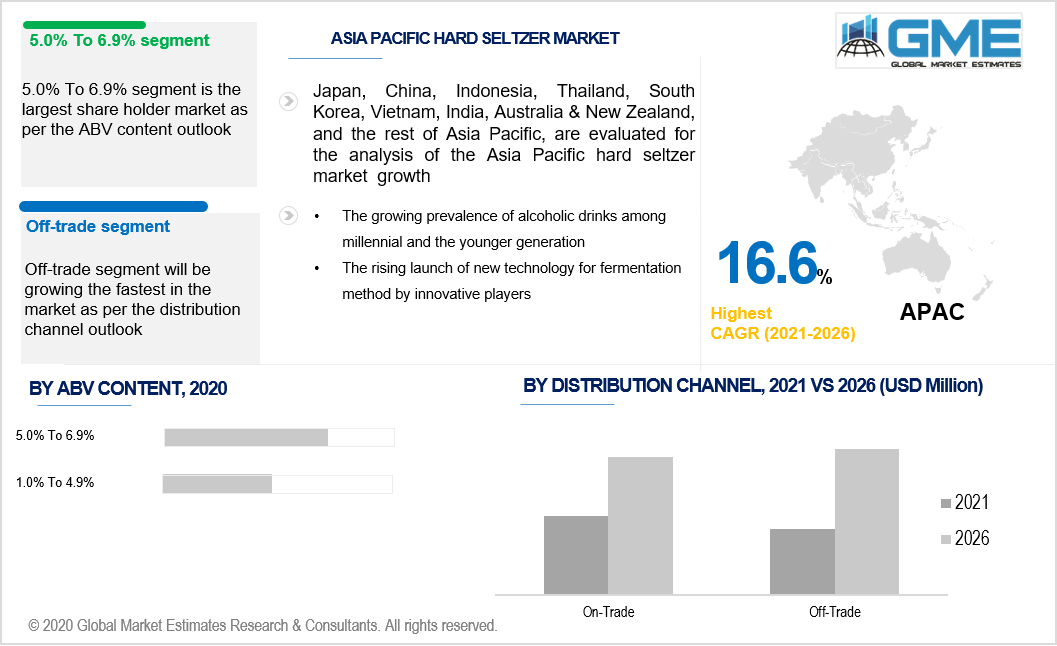

In 2020, hard seltzer with an alcohol by volume (ABV) of 5.0 to 6.9% added the most to global sales. This is largely due to a change in market preference away from alcoholic drinks such as spirits, beer, and wine towards hard seltzer with an ABV of even more than 5 percent. Moreover, hard seltzer with a 5 percent alcohol by volume (ABV) is the most common proportion of ingredients provided by producers. Canteen, Lift Bridge, Cutwater Spirits, Ficks, Pompette, Seekout, Bud Light, Brizzy, Truly, Vive, Arctic Summer, Kona Spiked, White Claw, Wild Basin, Bluemarble Pure Love, and NATRAL are some of the famous brands that make hard seltzers with the above alcohol level. The hard seltzer from CANTEEN is made of authentic vodka, sparkling water, and all-natural flavors. It was first released in March of 2020.

During the forecast period, hard seltzer with an ABV of 1.0 percent to 4.9 percent is predicted to rise at the highest pace. The development of this market is aided by a consumer population that prefers low-alcohol beverages. Press, Bon and Viv, Narwater, Two Roads, Henry's, Willie's Superbrew, Barefoot, High Noon, Omission, Pulp Culture, Smirnoff, and Crook and Marker are some of the major labels that sell these products.

In 2020, off-trade accounted for the majority of global sales in the hard seltzer market. Convenience stores, kiosks, hypermarkets, mini markets, wine, supermarkets, and spirits shops are all offering hard seltzers in growing numbers. Alcoholic beverages, such as hard seltzers, have been increasingly offered across online platforms. Taffer's Mixologist collaborated with Thirstie, an e-commerce platform that provides direct-to-consumer (DTC) sales for alcohol products, in May 2020 to enable customers to purchase hard seltzer through online platforms. During the forecast period, on-trade is projected to rise at the fastest pace. The growing number of people who drink hard seltzers in bars and restaurants has created a huge market for the product. Hard seltzers have wreaked havoc on the on-premises market in the United States. When they're not at home, many people prefer seltzers over beer or cocktails.

North America is predicted to bring the dominant in the market in 2020, and its domination is expected to last during the forecast period. Consumer demands for calories, low alcohol content, and gluten-free drinks are propelling the development of the hard seltzer market in the region. Millennials are now becoming more interested in flavoured alcoholic drinks, which would fuel demand for hard seltzer over the forecast period. Product releases have been important in growing the market in the region.

Asia Pacific is the rapidly growing market for hard seltzer, with the highest CAGR forecast. As a result of the demand in emerging economies such as South Korea and Australia, the market is projected to see significant growth. As a result, businesses have been introducing new offerings in order to reach out to their customers.

Future Proof Brands LLC, Boathouse Beverage Co., Barefoot Cellars, Kona Brewing Co, Blue Marble, Ficks & Co., High Noon Spirits Company, Cutwater Sspirits, Anheuser-Busch InBev, and Lift Bridge Brewing Co are the major vendors competing in the hard seltzer market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Hard Seltzer Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 ABV Content Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Hard Seltzer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rise in customer demand for flavoured alcoholic beverages

3.3.1.2 The growing prevalence of alcoholic drinks among millennial and the younger generation

3.3.2 Industry Challenges

3.3.2.1 Higher excise and customs tariffs, tax policy on export and import, as well as on local producers

3.4 Prospective Growth Scenario

3.4.1 ABV Content Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Hard Seltzer Market, By ABV Content

4.1 ABV Content Outlook

4.2 1.0% To 4.9%

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 5.0% To 6.9%

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Hard Seltzer Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Off-Trade

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 On-Trade

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Hard Seltzer Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By ABV Content, 2016-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By ABV Content, 2016-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By ABV Content, 2016-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By ABV Content, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Future Proof Brands LLC

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Boathouse Beverage Co.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Barefoot Cellars

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Kona Brewing Co

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Blue Marble, Ficks & Co.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 High Noon Spirits Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Cutwater Spirits

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Anheuser-Busch

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Lift Bridge Brewing Co

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Hard Seltzer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hard Seltzer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS