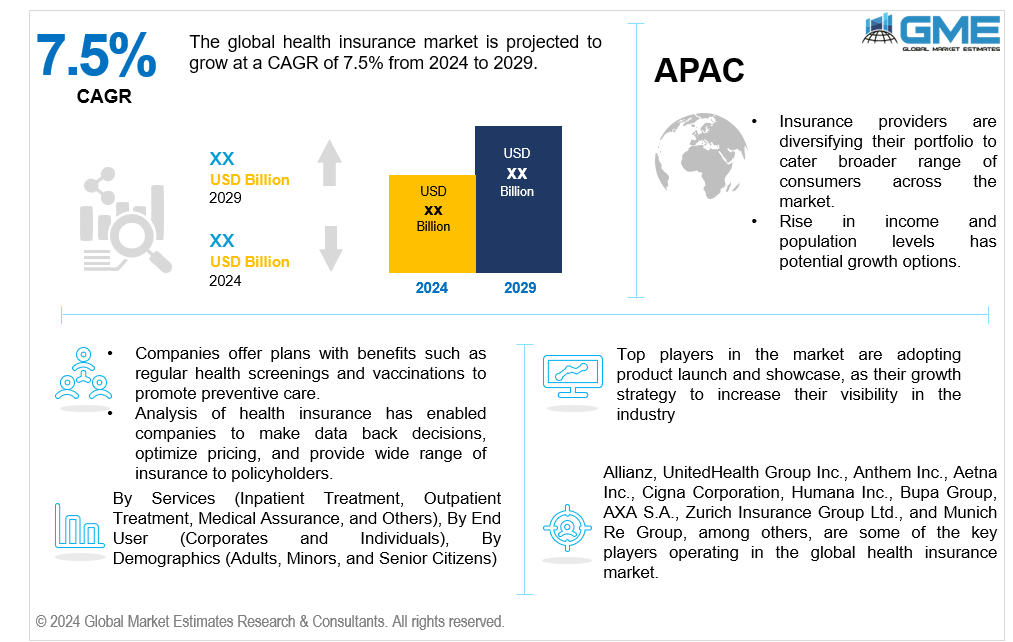

Global Health Insurance Market Size, Trends & Analysis - Forecasts to 2029 By Services (Inpatient Treatment, Outpatient Treatment, Medical Assurance, and Others), By End User (Corporates and Individuals), By Demographics (Adults, Minors, and Senior Citizens), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global health insurance market is projected to grow at a CAGR of 7.5% from 2024 to 2029.

Health insurance coverage serves as a safeguard against potential financial hardship brought on by medical emergencies. The market is being driven heavily by the increasing prevalence of chronic diseases and the increasing costs of treatment. Health insurance companies compete to provide innovative solutions that enable policyholders to access high-quality care while confidently navigating intricate healthcare systems.

By offering contactless facilities at partnered hospitals, health insurance benefits are simplifying administrative procedures for users and allowing access to easy health insurance claims. Health insurance comparisons from different providers help customers select the most appropriate health insurance plans based on premiums and perks across their network hospitals. Health insurance companies are indispensable in the marketplace because they provide consumers with diverse coverage options and allow them to compare health insurance policies. The manner in which individuals’ access and manage their health insurance has been transformed by technology. Convenient and user-friendly experiences for researching, comparing, and purchasing insurance plans are provided by online platforms and mobile applications.

Health insurance regulations guarantee that insurers comply with industry standards that safeguard consumers and promote equitable market practices. However, the health insurance market's expansion is hindered by the rise in health insurance costs and the dearth of awareness regarding the coverages included in health insurance policies.

The inpatient treatment segment is expected to hold the largest share of the market during the forecast period. Health insurance typically covers inpatient treatments that entail several phases of treatment. When an insured person requires being hospitalized, they initially consult with a doctor who assesses the necessity of admission based on medical necessity. The hospital or healthcare facility commences the treatment and care process by verifying the patient's insurance coverage upon admission. If the hospital is a member of the insurer's network, policyholders frequently benefit from a cashless facility. This implies that the insurance company directly settles the hospital's expenses, provided the treatment falls within the policy's coverage limits and terms.

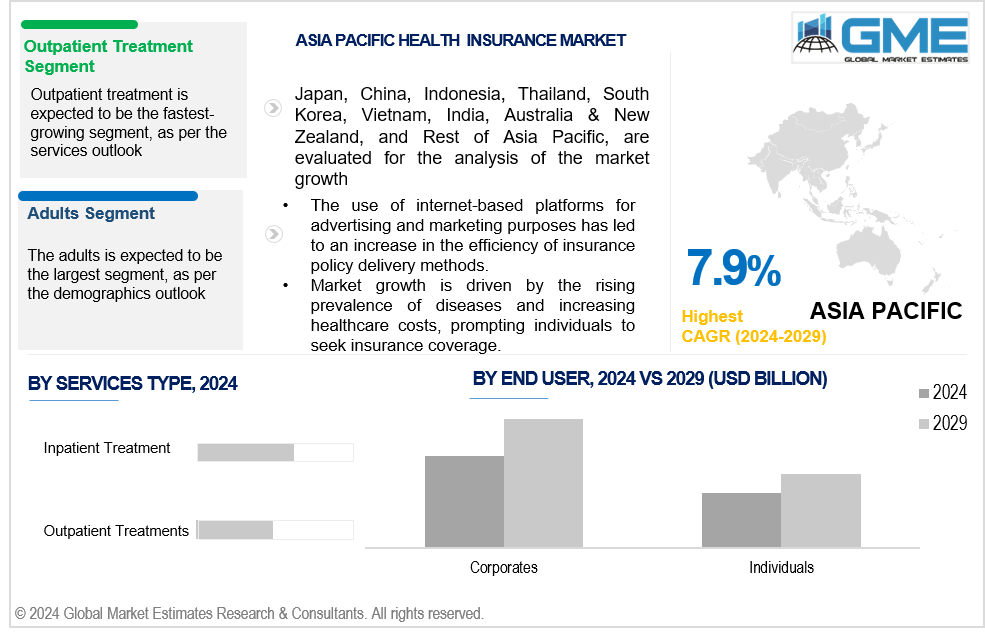

The outpatient treatment segment is analyzed to be the fastest-growing segment in the market from 2024 to 2029. Consultations, testing, prescription drugs, and appointments with specialists are all covered by health insurance, which improves outpatient treatments across the segment. Policies frequently incorporate cost-sharing features, such as copays and coinsurance, making healthcare more affordable. Health insurance providers provide discounts and simplify billing to guarantee that healthcare services are accessible without incurring significant out-of-pocket expenses. This comprehensive coverage facilitates the effective management of health requirements outside of hospital settings and encourages timely medical interventions.

The corporates segment is analyzed to hold the largest market share from 2024 to 2029. Health insurance enrollment for corporate employees ensures that they receive the necessary medical care and financial support, thereby protecting them from illnesses, accidents, and other health issues. There is a 2- to 4-year waiting period before pre-existing conditions are covered under a standard health plan. Specific health insurance policies and benefits are subject to a processing period that can benefit the user more at maturity. However, the most significant benefit of a Group Health Plan is that the insured members receive insurance coverage from the moment they enroll.

The individuals segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. Individual health insurance operates by providing coverage directly to people and their families, independent of employer-sponsored policies. The cost and coverage of policies are subject to change, enabling consumers to select the plans that are most suitable for their budget and requirements. They typically provide coverage for healthcare services, such as emergency care, medicines, and doctor visits.

The adults segment is analyzed to hold the largest market share of the market from 2024 to 2029. In the medical insurance market, adults are the primary users. Compared to infants and young adults, they frequently exhibit higher medical care, necessitating more comprehensive coverage. Employer-sponsored health insurance plans are accessible to most adults as they are employed, which drives the growth in this segment.

The senior citizens segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. According to a health insurance market analysis, senior citizens are highly interested in coverage for specialized care, medications, and hospitalization that are not entirely covered by government programs such as Medicare. Numerous chronic diseases, such as joint pain, heart problems, cancer, and diabetes, impact the older adults significantly. Consequently, the demand for health insurance policies among this demographic has increased. Insurance plans that are specifically designed for seniors frequently include benefits such as access to a diverse network of healthcare providers, dental and vision coverage, and long-term care benefits.

North America is expected to be the largest region in the global market. The health insurance industry in the region is primarily funded by a combination of public health insurance programs and private health insurance, with private sector healthcare facilities providing the majority of the coverage. The aggregate expenditure on healthcare in the region exceeds that of all other nations. The necessity of comprehensive insurance coverage is further underscored by the aging population and the prevalence of chronic diseases, which contribute to increased healthcare utilization.

Asia Pacific is predicted to witness rapid growth during the forecast period. The health insurance market trends in Asia suggest that consumers incur substantial expenses when they visit hospitals and clinics. These expenses are typically borne by patients who lack health insurance coverage. As a result of their substantial scope in distribution, health insurance enrollment has become a significant business line for life insurers, specifically. Currently, health-focused products are among the fastest-growing Medicaid insurance product lines and account for approximately 25–35% of the total volume of health insurance premiums.

Allianz, UnitedHealth Group Inc., Anthem Inc., Aetna Inc., Cigna Corporation, Humana Inc., Bupa Group, AXA S.A., Zurich Insurance Group Ltd., and Munich Re Group, among others, are some of the key players operating in the global health insurance market.

Please note: This is not an exhaustive list of companies profiled in the report.

On July 1, 2024, German InsurTech startup Feather, which aims to simplify health insurance for expatriates, has successfully raised USD 6.4 million. The company offers a range of insurance products, including health, life, pet, automotive, and personal liability insurance, all designed to meet the specific needs of expats.

On April 23, 2024, Munich Re Life US & Clareto unveiled a new digital solution called Automated EHR Summarizer, which is set to ensure efficient and accurate use of Electronic Health Record (EHR) data for automated and programmatic life insurance underwriting.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL HEALTH INSURANCE MARKET, BY SERVICES

4.1 Introduction

4.2 Health Insurance Market : Services Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Inpatient Treatment

4.4.1 Inpatient Treatment Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Outpatient Treatment

4.5.1 Outpatient Treatment Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Medical Assurance

4.6.1 Medical Assurance Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL HEALTH INSURANCE MARKET, BY END USER

5.1 Introduction

5.2 Health Insurance Market : End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Corporates

5.4.1 Corporates Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Individuals

5.5.1 Individuals Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

6.1 Introduction

6.2 Health Insurance Market : Demographics Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Adults

6.4.1 Adults Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Minors

6.5.1 Minors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Senior Citizens

6.5.1 Senior Citizens Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL HEALTH INSURANCE MARKET, BY REGION

7.1 Introduction

7.2 North America Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Services

7.2.2 By End User

7.2.3 By Demographics

7.2.4 By Country

7.2.4.1 U.S. Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Services

7.2.4.1.2 By End User

7.2.4.1.3 By Demographics

7.2.4.2 Canada Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Services

7.2.4.2.2 By End User

7.2.4.2.3 By Demographics

7.2.4.3 Mexico Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Services

7.2.4.3.2 By End User

7.2.4.3.3 By Demographics

7.3 Europe Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Services

7.3.2 By End User

7.3.3 By Demographics

7.3.4 By Country

7.3.4.1 Germany Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Services

7.3.4.1.2 By End User

7.3.4.1.3 By Demographics

7.3.4.2 U.K. Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Services

7.3.4.2.2 By End User

7.3.4.2.3 By Demographics

7.3.4.3 France Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Services

7.3.4.3.2 By End User

7.3.4.3.3 By Demographics

7.3.4.4 Italy Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Services

7.3.4.4.2 By End User

7.2.4.4.3 By Demographics

7.3.4.5 Spain Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Services

7.3.4.5.2 By End User

7.2.4.5.3 By Demographics

7.3.4.6 Netherlands Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Services

7.3.4.6.2 By End User

7.2.4.6.3 By Demographics

7.3.4.7 Rest of Europe Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Services

7.3.4.7.2 By End User

7.2.4.7.3 By Demographics

7.4 Asia Pacific Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Services

7.4.2 By End User

7.4.3 By Demographics

7.4.4 By Country

7.4.4.1 China Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Services

7.4.4.1.2 By End User

7.4.4.1.3 By Demographics

7.4.4.2 Japan Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Services

7.4.4.2.2 By End User

7.4.4.2.3 By Demographics

7.4.4.3 India Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Services

7.4.4.3.2 By End User

7.4.4.3.3 By Demographics

7.4.4.4 South Korea Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Services

7.4.4.4.2 By End User

7.4.4.4.3 By Demographics

7.4.4.5 Singapore Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Services

7.4.4.5.2 By End User

7.4.4.5.3 By Demographics

7.4.4.6 Malaysia Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Services

7.4.4.6.2 By End User

7.4.4.6.3 By Demographics

7.4.4.7 Thailand Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Services

7.4.4.7.2 By End User

7.4.4.7.3 By Demographics

7.4.4.8 Indonesia Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Services

7.4.4.8.2 By End User

7.4.4.8.3 By Demographics

7.4.4.9 Vietnam Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Services

7.4.4.9.2 By End User

7.4.4.9.3 By Demographics

7.4.4.10 Taiwan Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Services

7.4.4.10.2 By End User

7.4.4.10.3 By Demographics

7.4.4.11 Rest of Asia Pacific Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Services

7.4.4.11.2 By End User

7.4.4.11.3 By Demographics

7.5 Middle East and Africa Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Services

7.5.2 By End User

7.5.3 By Demographics

7.5.4 By Country

7.5.4.1 Saudi Arabia Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Services

7.5.4.1.2 By End User

7.5.4.1.3 By Demographics

7.5.4.2 U.A.E. Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Services

7.5.4.2.2 By End User

7.5.4.2.3 By Demographics

7.5.4.3 Israel Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Services

7.5.4.3.2 By End User

7.5.4.3.3 By Demographics

7.5.4.4 South Africa Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Services

7.5.4.4.2 By End User

7.5.4.4.3 By Demographics

7.5.4.5 Rest of Middle East and Africa Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Services

7.5.4.5.2 By End User

7.5.4.5.2 By Demographics

7.6 Central and South America Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Services

7.6.2 By End User

7.6.3 By Demographics

7.6.4 By Country

7.6.4.1 Brazil Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Services

7.6.4.1.2 By End User

7.6.4.1.3 By Demographics

7.6.4.2 Argentina Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Services

7.6.4.2.2 By End User

7.6.4.2.3 By Demographics

7.6.4.3 Chile Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Services

7.6.4.3.2 By End User

7.6.4.3.3 By Demographics

7.6.4.4 Rest of Central and South America Health Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Services

7.6.4.4.2 By End User

7.6.4.4.3 By Demographics

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Allianz

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 UnitedHealth Group Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Anthem Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Aetna Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Cigna Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Humana Inc.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Bupa Group

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 AXA S.A.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Zurich Insurance Group Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Munich Re Group

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Health Insurance Market, By Services, 2021-2029 (USD MILLION)

2 Inpatient Treatment Market, By Region, 2021-2029 (USD MILLION)

3 Outpatient Treatment Market, By Region, 2021-2029 (USD MILLION)

4 Medical Assurance Market, By Region, 2021-2029 (USD MILLION)

5 Others Market, By Region, 2021-2029 (USD MILLION)

6 Global Health Insurance Market, By End User, 2021-2029 (USD MILLION)

7 Corporates Market, By Region, 2021-2029 (USD MILLION)

8 Individuals Market, By Region, 2021-2029 (USD MILLION)

9 Global Health Insurance Market, By Demographics, 2021-2029 (USD MILLION)

10 Adults Market, By Region, 2021-2029 (USD MILLION)

11 Minors Market, By Region, 2021-2029 (USD MILLION)

12 Senior Citizens Market, By Region, 2021-2029 (USD MILLION)

13 Regional Analysis, 2021-2029 (USD MILLION)

14 North America Health Insurance Market, By Services, 2021-2029 (USD Million)

15 North America Health Insurance Market, By End User, 2021-2029 (USD Million)

16 North America Health Insurance Market, By Demographics, 2021-2029 (USD Million)

17 North America Health Insurance Market, By Country, 2021-2029 (USD Million)

18 U.S. Health Insurance Market, By Services, 2021-2029 (USD Million)

19 U.S. Health Insurance Market, By End User, 2021-2029 (USD Million)

20 U.S. Health Insurance Market, By Demographics, 2021-2029 (USD Million)

21 Canada Health Insurance Market, By Services, 2021-2029 (USD Million)

22 Canada Health Insurance Market, By End User, 2021-2029 (USD Million)

23 Canada Health Insurance Market, By Demographics, 2021-2029 (USD Million)

24 Mexico Health Insurance Market, By Services, 2021-2029 (USD Million)

25 Mexico Health Insurance Market, By End User, 2021-2029 (USD Million)

26 Mexico Health Insurance Market, By Demographics, 2021-2029 (USD Million)

27 Europe Health Insurance Market, By Services, 2021-2029 (USD Million)

28 Europe Health Insurance Market, By End User, 2021-2029 (USD Million)

29 Europe Health Insurance Market, By Demographics, 2021-2029 (USD Million)

30 Europe Health Insurance Market, By COUNTRY, 2021-2029 (USD Million)

31 Germany Health Insurance Market, By Services, 2021-2029 (USD Million)

32 Germany Health Insurance Market, By End User, 2021-2029 (USD Million)

33 Germany Health Insurance Market, By Demographics, 2021-2029 (USD Million)

34 U.K. Health Insurance Market, By Services, 2021-2029 (USD Million)

35 U.K. Health Insurance Market, By End User, 2021-2029 (USD Million)

36 U.K. Health Insurance Market, By Demographics, 2021-2029 (USD Million)

37 France Health Insurance Market, By Services, 2021-2029 (USD Million)

38 France Health Insurance Market, By End User, 2021-2029 (USD Million)

39 France Health Insurance Market, By Demographics, 2021-2029 (USD Million)

40 Italy Health Insurance Market, By Services, 2021-2029 (USD Million)

41 Italy Health Insurance Market, By End Use , 2021-2029 (USD Million)

42 Italy Health Insurance Market, By Demographics, 2021-2029 (USD Million)

43 Spain Health Insurance Market, By Services, 2021-2029 (USD Million)

44 Spain Health Insurance Market, By End User, 2021-2029 (USD Million)

45 Spain Health Insurance Market, By Demographics, 2021-2029 (USD Million)

46 Rest Of Europe Health Insurance Market, By Services, 2021-2029 (USD Million)

47 Rest Of Europe Health Insurance Market, By End User, 2021-2029 (USD Million)

48 Rest of Europe Health Insurance Market, By Demographics, 2021-2029 (USD Million)

49 Asia Pacific Health Insurance Market, By Services, 2021-2029 (USD Million)

50 Asia Pacific Health Insurance Market, By End User, 2021-2029 (USD Million)

51 Asia Pacific Health Insurance Market, By Demographics, 2021-2029 (USD Million)

52 Asia Pacific Health Insurance Market, By Country, 2021-2029 (USD Million)

53 China Health Insurance Market, By Services, 2021-2029 (USD Million)

54 China Health Insurance Market, By End User, 2021-2029 (USD Million)

55 China Health Insurance Market, By Demographics, 2021-2029 (USD Million)

56 India Health Insurance Market, By Services, 2021-2029 (USD Million)

57 India Health Insurance Market, By End User, 2021-2029 (USD Million)

58 India Health Insurance Market, By Demographics, 2021-2029 (USD Million)

59 Japan Health Insurance Market, By Services, 2021-2029 (USD Million)

60 Japan Health Insurance Market, By End User, 2021-2029 (USD Million)

61 Japan Health Insurance Market, By Demographics, 2021-2029 (USD Million)

62 South Korea Health Insurance Market, By Services, 2021-2029 (USD Million)

63 South Korea Health Insurance Market, By End User, 2021-2029 (USD Million)

64 South Korea Health Insurance Market, By Demographics, 2021-2029 (USD Million)

65 Singapore Health Insurance Market, By Services, 2021-2029 (USD Million)

66 Singapore Health Insurance Market, By End User, 2021-2029 (USD Million)

67 Singapore Health Insurance Market, By Demographics, 2021-2029 (USD Million)

68 Malaysia Health Insurance Market, By Services, 2021-2029 (USD Million)

69 Malaysia Health Insurance Market, By End User, 2021-2029 (USD Million)

70 Malaysia Health Insurance Market, By Demographics, 2021-2029 (USD Million)

71 Thailand Health Insurance Market, By Services, 2021-2029 (USD Million)

72 Thailand Health Insurance Market, By End User, 2021-2029 (USD Million)

73 Thailand Health Insurance Market, By Demographics, 2021-2029 (USD Million)

74 Indonesia Health Insurance Market, By Services, 2021-2029 (USD Million)

75 Indonesia Health Insurance Market, By End User, 2021-2029 (USD Million)

76 Indonesia Health Insurance Market, By Demographics, 2021-2029 (USD Million)

77 Vietnam Health Insurance Market, By Services, 2021-2029 (USD Million)

78 Vietnam Health Insurance Market, By End User, 2021-2029 (USD Million)

79 Vietnam Health Insurance Market, By Demographics, 2021-2029 (USD Million)

80 Taiwan Health Insurance Market, By Services, 2021-2029 (USD Million)

81 Taiwan Health Insurance Market, By End User, 2021-2029 (USD Million)

82 Taiwan Health Insurance Market, By Demographics, 2021-2029 (USD Million)

83 Rest of Asia Pacific Health Insurance Market, By Services, 2021-2029 (USD Million)

84 Rest of Asia Pacific Health Insurance Market, By End User, 2021-2029 (USD Million)

85 Rest of Asia Pacific Health Insurance Market, By Demographics, 2021-2029 (USD Million)

86 Middle East and Africa Health Insurance Market, By Services, 2021-2029 (USD Million)

87 Middle East and Africa Health Insurance Market, By End User, 2021-2029 (USD Million)

88 Middle East and Africa Health Insurance Market, By Demographics, 2021-2029 (USD Million)

89 Middle East and Africa Health Insurance Market, By Country, 2021-2029 (USD Million)

90 Saudi Arabia Health Insurance Market, By Services, 2021-2029 (USD Million)

91 Saudi Arabia Health Insurance Market, By End User, 2021-2029 (USD Million)

92 Saudi Arabia Health Insurance Market, By Demographics, 2021-2029 (USD Million)

93 UAE Health Insurance Market, By Services, 2021-2029 (USD Million)

94 UAE Health Insurance Market, By End User, 2021-2029 (USD Million)

95 UAE Health Insurance Market, By Demographics, 2021-2029 (USD Million)

96 Israel Health Insurance Market, By Services, 2021-2029 (USD Million)

97 Israel Health Insurance Market, By End User, 2021-2029 (USD Million)

98 Israel Health Insurance Market, By Demographics, 2021-2029 (USD Million)

99 South Africa Health Insurance Market, By Services, 2021-2029 (USD Million)

100 South Africa Health Insurance Market, By End User, 2021-2029 (USD Million)

101 South Africa Health Insurance Market, By Demographics, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Health Insurance Market, By Services, 2021-2029 (USD Million)

103 Rest of Middle East and Africa Health Insurance Market, By End User, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Health Insurance Market, By Demographics, 2021-2029 (USD Million)

105 Central and South America Health Insurance Market, By Services, 2021-2029 (USD Million)

106 Central and South America Health Insurance Market, By End User, 2021-2029 (USD Million)

107 Central and South America Health Insurance Market, By Demographics, 2021-2029 (USD Million)

108 Central and South America Health Insurance Market, By Country, 2021-2029 (USD Million)

109 Brazil Health Insurance Market, By Services, 2021-2029 (USD Million)

110 Brazil Health Insurance Market, By End User, 2021-2029 (USD Million)

111 Brazil Health Insurance Market, By Demographics, 2021-2029 (USD Million)

112 Argentina Health Insurance Market, By Services, 2021-2029 (USD Million)

113 Argentina Health Insurance Market, By End User, 2021-2029 (USD Million)

114 Argentina Health Insurance Market, By Demographics, 2021-2029 (USD Million)

115 Chile Health Insurance Market, By Services, 2021-2029 (USD Million)

116 Chile Health Insurance Market, By End User, 2021-2029 (USD Million)

117 Chile Health Insurance Market, By Demographics, 2021-2029 (USD Million)

118 Rest of Central and South America Health Insurance Market, By Services, 2021-2029 (USD Million)

119 Rest of Central and South America Health Insurance Market, By End User, 2021-2029 (USD Million)

120 Rest of Central and South America Health Insurance Market, By Demographics, 2021-2029 (USD Million)

121 Allianz: Products & Services Offering

122 UnitedHealth Group Inc.: Products & Services Offering

123 Anthem Inc.: Products & Services Offering

124 Aetna Inc.: Products & Services Offering

125 Cigna Corporation: Products & Services Offering

126 HUMANA INC.: Products & Services Offering

127 Bupa Group: Products & Services Offering

128 AXA S.A.: Products & Services Offering

129 Zurich Insurance Group Ltd.: Products & Services Offering

130 Munich Re Group: Products & Services Offering

131 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Health Insurance Market Overview

2 Global Health Insurance Market Value From 2021-2029 (USD MILLION)

3 Global Health Insurance Market Share, By Services (2023)

4 Global Health Insurance Market Share, By End User (2023)

5 Global Health Insurance Market Share, By Demographics (2023)

6 Global Health Insurance Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Health Insurance Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Health Insurance Market

11 Impact Of Challenges On The Global Health Insurance Market

12 Porter’s Five Forces Analysis

13 Global Health Insurance Market: By Services Scope Key Takeaways

14 Global Health Insurance Market, By Services Segment: Revenue Growth Analysis

15 Inpatient Treatment Market, By Region, 2021-2029 (USD MILLION)

16 Outpatient Treatment Market, By Region, 2021-2029 (USD MILLION)

17 Medical Assurance Market, By Region, 2021-2029 (USD MILLION)

18 Others Market, By Region, 2021-2029 (USD MILLION)

19 Global Health Insurance Market: By End User Scope Key Takeaways

20 Global Health Insurance Market, By End User Segment: Revenue Growth Analysis

21 Corporates Market, By Region, 2021-2029 (USD MILLION)

22 Individuals Market, By Region, 2021-2029 (USD MILLION)

23 Global Health Insurance Market: By Demographics Scope Key Takeaways

24 Global Health Insurance Market, By Demographics Segment: Revenue Growth Analysis

25 Adults Market, By Region, 2021-2029 (USD MILLION)

26 Minors Market, By Region, 2021-2029 (USD MILLION)

27 Senior Citizens Market, By Region, 2021-2029 (USD MILLION)

28 Regional Segment: Revenue Growth Analysis

29 Global Health Insurance Market: Regional Analysis

30 North America Health Insurance Market Overview

31 North America Health Insurance Market, By Services

32 North America Health Insurance Market, By End User

33 North America Health Insurance Market, By Demographics

34 North America Health Insurance Market, By Country

35 U.S. Health Insurance Market, By Services

36 U.S. Health Insurance Market, By End User

37 U.S. Health Insurance Market, By Demographics

38 Canada Health Insurance Market, By Services

39 Canada Health Insurance Market, By End User

40 Canada Health Insurance Market, By Demographics

41 Mexico Health Insurance Market, By Services

42 Mexico Health Insurance Market, By End User

43 Mexico Health Insurance Market, By Demographics

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Allianz: Company Snapshot

47 Allianz: SWOT Analysis

48 Allianz: Geographic Presence

49 UnitedHealth Group Inc.: Company Snapshot

50 UnitedHealth Group Inc.: SWOT Analysis

51 UnitedHealth Group Inc.: Geographic Presence

52 Anthem Inc.: Company Snapshot

53 Anthem Inc.: SWOT Analysis

54 Anthem Inc.: Geographic Presence

55 Aetna Inc.: Company Snapshot

56 Aetna Inc.: Swot Analysis

57 Aetna Inc.: Geographic Presence

58 Cigna Corporation: Company Snapshot

59 Cigna Corporation: SWOT Analysis

60 Cigna Corporation: Geographic Presence

61 Humana Inc.: Company Snapshot

62 Humana Inc.: SWOT Analysis

63 Humana Inc.: Geographic Presence

64 Bupa Group: Company Snapshot

65 Bupa Group: SWOT Analysis

66 Bupa Group: Geographic Presence

67 AXA S.A.: Company Snapshot

68 AXA S.A.: SWOT Analysis

69 AXA S.A.: Geographic Presence

70 Zurich Insurance Group Ltd.: Company Snapshot

71 Zurich Insurance Group Ltd.: SWOT Analysis

72 Zurich Insurance Group Ltd.: Geographic Presence

73 Munich Re Group: Company Snapshot

74 Munich Re Group: SWOT Analysis

75 Munich Re Group: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Health Insurance Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Health Insurance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS