Global Insulated Ceramic Fibers & Bricks Market Size, Trends & Analysis - Forecasts to 2026 By Product (Fibers, Bricks), By End-Use (Mining & Metal Processing, Chemical & Petrochemical, Manufacturing, Power Generation), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

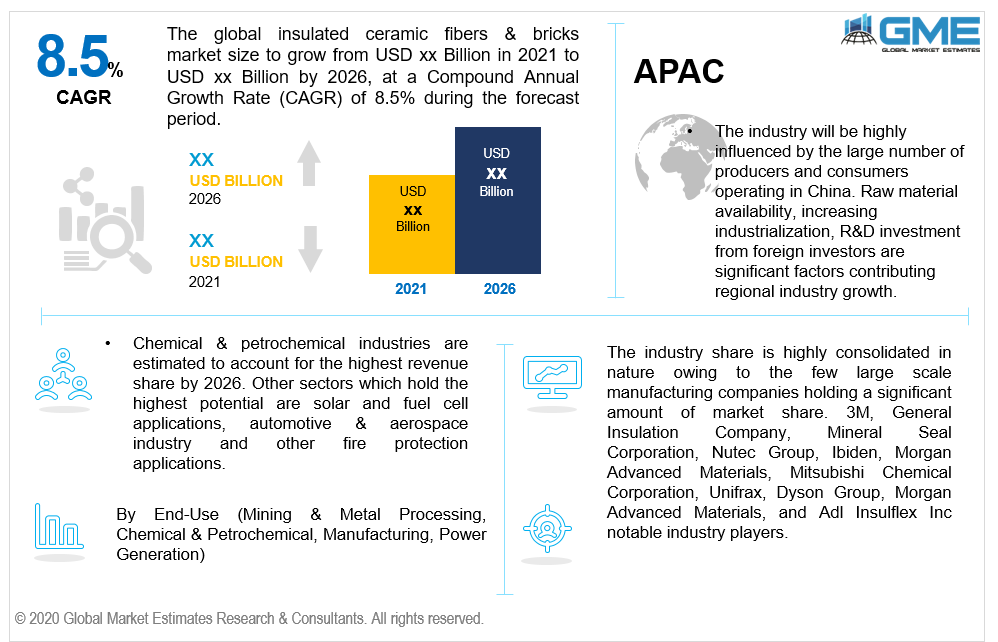

Improved thermal efficiency in ceramic fiber products along with rising demand for environment-friendly materials as compared to traditional insulation material will drive the insulated ceramic fibers & bricks market growth. The overall industry is expected to witness over 8.5% growth up to 2026.

Insulated Ceramic Fibers & Bricks are triggered to be a better alternative in the industrial sector. Increasing preference for low bio-persistent solutions which are less toxic and non-carcinogenic has positively influenced the product demand in the petrochemical and power generation industries.

These materials are lightweight and less conductive which results in saving approximately 20% of the energy and improving cost efficiency. Higher wear resistance, chemical stability, and high-temperature strength as compared to the conventional substitutes will stimulate the insulated ceramic fibers & bricks market growth. Glass and metals are two conventional substitutes in the industry. Though, due to their non-efficiency during the high-temperature processes, the industry manufacturers prefer to use insulated ceramic fibers and bricks in kilns, boilers, and furnaces. It is witnessed that over 1200 degrees celcius temperature, the gas becomes polluted owing to the overheat which results in a melted glass component.

Aerospace and alternative energy are among the two promising industries which hold the most potential for the Insulated Ceramic Fibers & Bricks market. Lightweight and high-temperature resistance are key attributing factors inculcating material adoption in solar, geothermal, fuel cells, biofuels and aerospace industry.

Insulated Ceramic fiber materials, due to their high-temperature resistance, are being used in new applications, such as aerospace and alternative energy. Fuel cells, solar, geothermal, biofuels, and waste incinerators are other promising applications in the alternative energy segment. Ceramic fiber, which is very strong and moisture resistant as well as lightweight, is slowly revolutionizing the aerospace industry.

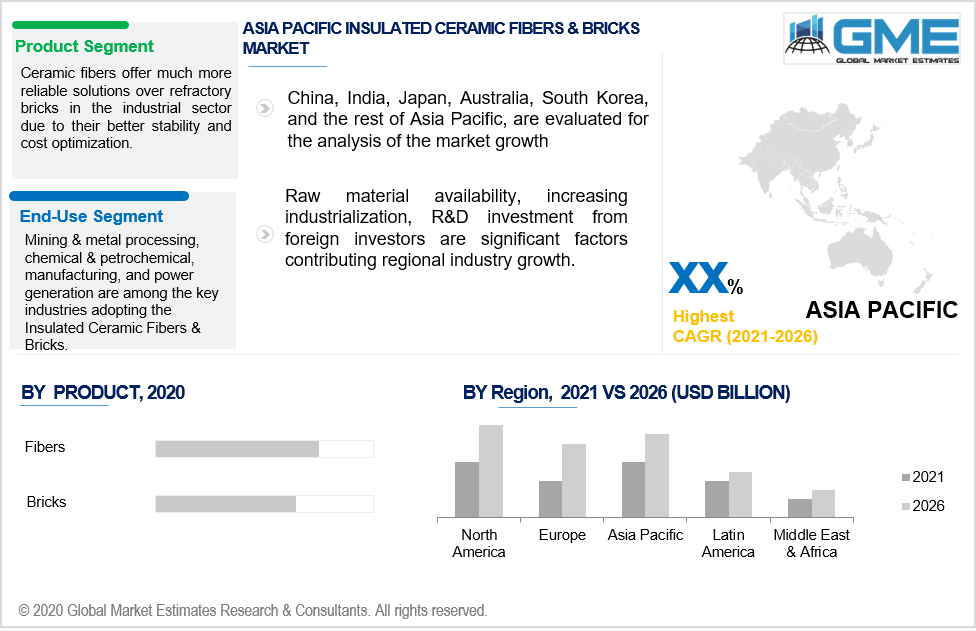

Fibers and bricks are two commercialized products available in the Insulated Ceramic Fibers & Bricks Market. Ceramic fibers offer much more reliable solutions over refractory bricks in the industrial sector due to their better stability and cost optimization.

For instance, while doing a procedure at high temperature, the thermal shock may break the refractory material. This can cause an unnecessary reduction in operation efficiency and threat to the workers. To overcome these hazardous situations these insulated ceramic fibers & bricks are used during the shuttle furnaces operation.

The other major benefit associated with these materials is their optimized gas consumption. A high and large amount of energy is needed to get the optimum temperature to complete the process. Hence, in this place, thermal ceramics are used which do not require large amounts of energy to heat due to their lightweight properties.

Mining & metal processing, chemical & petrochemical, manufacturing, and power generation are among the key industries adopting Insulated Ceramic Fibers & Bricks. The material is an excellent solution for industries requiring high-temperature insulation products as they offer the best quality in terms of heat loss prevention and reducing greenhouse gas emissions. The product is also highly demanded in automotive production and other fire protection applications due to its less energy consumption features.

The Chemical & petrochemical industries are estimated to account for the highest revenue share by 2026. Other sectors which hold the highest potential are solar and fuel cell applications, automotive & aerospace industry and other fire protection applications. Rising awareness regarding energy cost reduction and minimizing greenhouse emissions are major factors drawing attention towards these environment-friendly thermal materials.

The Asia Pacific insulated ceramic fibers & bricks market is projected to witness the highest gains during the forecast period. The industry will be highly influenced by a large number of producers and consumers operating in China. Raw material availability, increasing industrialization, R&D investment from foreign investors are significant factors contributing to regional industry growth.

North America insulated ceramic fibers & bricks demand is highly inclined by the government imposition towards the more safe and less energy-consuming chemicals & materials. Manufacturing industry expansion along with heavy investment in solar energy will influence the regional demand.

The industry share is highly consolidated in nature owing to the few large-scale manufacturing companies holding a significant amount of market share. 3M, General Insulation Company, Mineral Seal Corporation, Nutec Group, Ibiden, Morgan Advanced Materials, Mitsubishi Chemical Corporation, Unifrax, Dyson Group, and Adl Insulflex Inc notable industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Other key industry players include Almatis Gmbh, Cellaris Ltd, Cotronics Corp., Luyang Energy-Saving Materials, Ets Schaefer Corp, Isolite Insulating Products, RHI Magnesita N.V., Hi-Temp Insulation, Inc., Insulcon Group, Isolite Insulating Products, Bnz Materials, Pyrotek, Promat International, Par Group, and Zircar Products Inc.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Insulated Ceramic Fibers & Bricks Market industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Product overview

2.1.3 End-Use overview

2.1.4 Regional overview

Chapter 3 Insulated Ceramic Fibers & Bricks Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Material growth scenario

3.4.2 End-Use growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Product innovation

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Insulated Ceramic Fibers & Bricks Market, By Product

4.1 Product Outlook

4.2 Fibers

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Bricks

4.3.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Insulated Ceramic Fibers & Bricks Market, By End-Use

5.1 End-Use Outlook

5.2 Mining & Metal Processing

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Chemical & Petrochemical

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Manufacturing

5.4.1 Market size, by region, 2016-2026 (USD Million)

5.5 Power Generation

5.5.1 Market size, by region, 2016-2026 (USD Million)

5.6 Others

5.6.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Insulated Ceramic Fibers & Bricks Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2016-2026 (USD Million)

6.2.2 Market size, by product, 2016-2026 (USD Million)

6.2.3 Market size, by end-use, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by product, 2016-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by product, 2016-2026 (USD Million)

6.2.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2016-2026 (USD Million)

6.3.2 Market size, by product, 2016-2026 (USD Million)

6.3.3 Market size, by end-use, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by product, 2016-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by product, 2016-2026 (USD Million)

6.3.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by product, 2016-2026 (USD Million)

6.3.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by product, 2016-2026 (USD Million)

6.3.7.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by product, 2016-2026 (USD Million)

6.3.8.2 Market size, by end-use, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by product, 2016-2026 (USD Million)

6.3.9.2 Market size, by end-use, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2016-2026 (USD Million)

6.4.2 Market size, by product, 2016-2026 (USD Million)

6.4.3 Market size, by end-use, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by product, 2016-2026 (USD Million)

6.4.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market size, by product, 2016-2026 (USD Million)

6.4.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market size, by product, 2016-2026 (USD Million)

6.4.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market size, by product, 2016-2026 (USD Million)

6.4.7.2 Market size, by end-use, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by product, 2016-2026 (USD Million)

6.4.8.2 Market size, by end-use, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2016-2026 (USD Million)

6.5.2 Market size, by product, 2016-2026 (USD Million)

6.5.3 Market size, by end-use, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by product, 2016-2026 (USD Million)

6.5.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by product, 2016-2026 (USD Million)

6.5.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market size, by product, 2016-2026 (USD Million)

6.5.6.2 Market size, by end-use, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2016-2026 (USD Million)

6.6.2 Market size, by product, 2016-2026 (USD Million)

6.6.3 Market size, by end-use, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by product, 2016-2026 (USD Million)

6.6.4.2 Market size, by end-use, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by product, 2016-2026 (USD Million)

6.6.5.2 Market size, by end-use, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market size, by product, 2016-2026 (USD Million)

6.6.6.2 Market size, by end-use, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 3M

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Mitsubishi Chemical Corporation

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Dyson Group

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 General Insulation Company

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Mineral Seal Corporation

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Nutec Group

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Morgan Advanced Materials

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Adl Insulflex Inc

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Almatis Gmbh

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Cellaris Ltd

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Unifrax

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Cotronics Corp.

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Luyang Energy-Saving Materials

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Ets Schaefer Corp

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 Isolite Insulating Products

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 RHI Magnesita N.V.

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

7.18 Hi-Temp Insulation, Inc.

7.18.1 Company overview

7.18.2 Financial analysis

7.18.3 Strategic positioning

7.18.4 Info graphic analysis

7.19 Ibiden

7.19.1 Company overview

7.19.2 Financial analysis

7.19.3 Strategic positioning

7.19.4 Info graphic analysis

7.20 Insulcon Group

7.20.1 Company overview

7.20.2 Financial analysis

7.20.3 Strategic positioning

7.20.4 Info graphic analysis

7.21 Isolite Insulating Products Company Ltd

7.21.1 Company overview

7.21.2 Financial analysis

7.21.3 Strategic positioning

7.21.4 Info graphic analysis

7.22 M.E. Schupp Gmbh

7.22.1 Company overview

7.22.2 Financial analysis

7.22.3 Strategic positioning

7.22.4 Info graphic analysis

7.23 Pacor Inc.

7.23.1 Company overview

7.23.2 Financial analysis

7.23.3 Strategic positioning

7.23.4 Info graphic analysis

7.24 Rath Inc.

7.24.1 Company overview

7.24.2 Financial analysis

7.24.3 Strategic positioning

7.24.4 Info graphic analysis

7.25 Yeso Insulating Products

7.25.1 Company overview

7.25.2 Financial analysis

7.25.3 Strategic positioning

7.25.4 Info graphic analysis

7.26 Bnz Materials

7.26.1 Company overview

7.26.2 Financial analysis

7.26.3 Strategic positioning

7.26.4 Info graphic analysis

7.27 Pyrotek

7.27.1 Company overview

7.27.2 Financial analysis

7.27.3 Strategic positioning

7.27.4 Info graphic analysis

7.28 Promat International

7.28.1 Company overview

7.28.2 Financial analysis

7.28.3 Strategic positioning

7.28.4 Info graphic analysis

7.29 Par Group

7.29.1 Company overview

7.29.2 Financial analysis

7.29.3 Strategic positioning

7.29.4 Info graphic analysis

7.30 Prairie Ceramic Corp.

7.30.1 Company overview

7.30.2 Financial analysis

7.30.3 Strategic positioning

7.30.4 Info graphic analysis

7.31 Sheffield Refractories Ltd

7.31.1 Company overview

7.31.2 Financial analysis

7.31.3 Strategic positioning

7.31.4 Info graphic analysis

7.32 Uniceram Advanced Materials Inc

7.32.1 Company overview

7.32.2 Financial analysis

7.32.3 Strategic positioning

7.32.4 Info graphic analysis

7.33 Zircar Products Inc. (Zircar Refractory Composites Inc)

7.33.1 Company overview

7.33.2 Financial analysis

7.33.3 Strategic positioning

7.33.4 Info graphic analysis

The Global Insulated Ceramic Fibers & Bricks Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Insulated Ceramic Fibers & Bricks Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS