Global Laboratory Proficiency Testing Market Size, Trends & Analysis - Forecasts to 2030 By Industry (Clinical Diagnostics [Clinical chemistry, Immunochemistry, Hematology, Oncology, Molecular Diagnostics, Coagulation, and Others], Pharmaceuticals [Biological Products and Others], Microbiology [Pathogen Testing, Sterility Testing, Endotoxin & Pyrogen Testing, Growth Promotion Testing, and Others], and Cannabis [Medical and Non-Medical]), By Technology (Cell Culture, Spectrometry, Polymerase Chain Reaction, Chromatography, Immunoassays, and Others), By End-use (Hospitals, Contract Research Organizations, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Laboratories), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

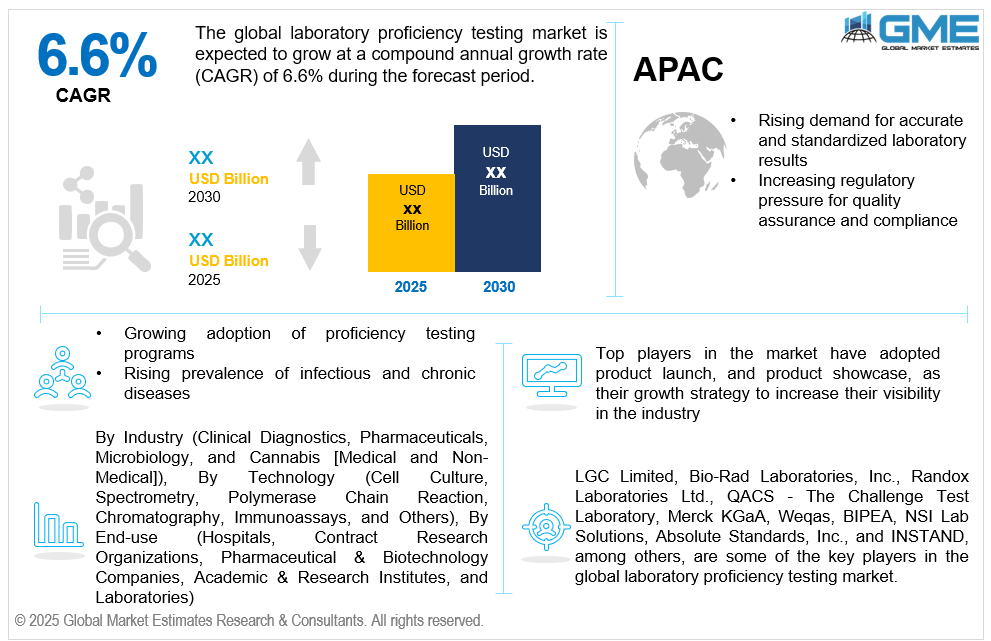

The global laboratory proficiency testing market is estimated to exhibit a CAGR of 6.6% from 2025 to 2030.

The primary factors propelling the market growth are the rising demand for accurate and standardized laboratory results and the increasing regulatory pressure for quality assurance and compliance. With increasing reliance on laboratory-based diagnostics across sectors such as healthcare, pharmaceuticals, food safety, environmental testing, and forensics, ensuring the accuracy and consistency of test results has become critical. Inaccurate or inconsistent data can lead to misdiagnosis, regulatory non-compliance, and compromised product safety, prompting organizations to adopt proficiency testing as a quality assurance measure. These initiatives assist labs in comparing their performance to industry norms, finding process flaws, and preserving certification from reputable organizations like ISO/IEC 17025. Additionally, global collaboration in scientific research and public health initiatives further necessitates harmonized testing practices, boosting the need for standardized proficiency assessments.

The market is expected to grow as a result of the increasing use of proficiency testing programs and the growing incidence of chronic and infectious diseases. As laboratories increasingly prioritize quality assurance and accreditation, proficiency testing (PT) programs have become essential tools for validating testing accuracy, identifying performance issues, and ensuring compliance with regulatory standards. Industries such as clinical diagnostics, pharmaceuticals, food and beverage, environmental monitoring, and forensic science are embracing PT programs to meet stringent quality and safety requirements imposed by national and international regulatory bodies. These programs enable laboratories to demonstrate their technical competence, boost credibility with clients, and maintain certifications such as ISO/IEC 17025 and ISO 15189. Furthermore, the rising number of laboratory accreditations and inter-laboratory comparisons is fostering greater demand for external quality assessments.

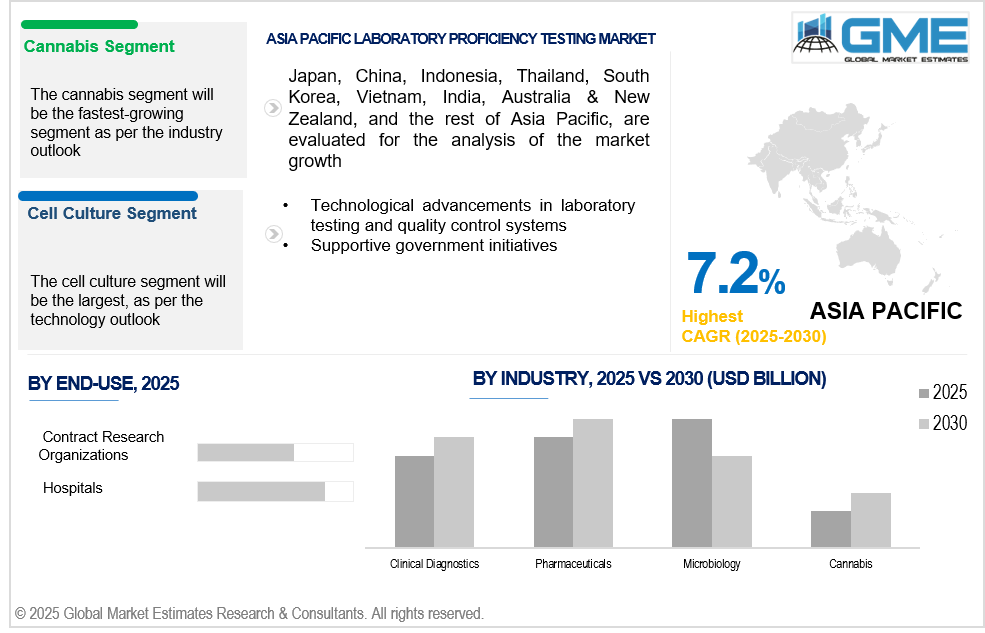

Technological advancements in laboratory testing and quality control systems, coupled with supportive government initiatives, propel market growth. Innovations such as automated analyzers, digital data management platforms, AI-driven diagnostic tools, and high-throughput screening technologies have enhanced the accuracy, efficiency, and speed of laboratory processes. As laboratories adopt these advanced tools, the need to validate their performance and ensure consistent results across upgraded systems becomes crucial. Proficiency testing programs are essential in assessing the effectiveness and reliability of new technologies, helping laboratories maintain compliance with evolving quality standards and regulatory frameworks. Moreover, modern quality control systems enable real-time monitoring, data tracking, and error detection, increasing the demand for comprehensive and technology-compatible PT programs.

Personalized proficiency testing in genomics and molecular diagnostics is made possible by the growth of personalized medicine. Labs involved in patient-specific treatments need highly specialized PT programs to ensure precision and compliance with evolving clinical guidelines. Additionally, the expansion of forensic applications in law enforcement and legal proceedings presents an opportunity to provide PT for DNA analysis, toxicology, and trace evidence testing. Accuracy and reliability are critical, creating a consistent need for quality checks. However, limited availability of customized PT programs and challenges in maintaining accreditation standards impede market growth.

The clinical diagnostics segment is expected to hold the largest share of the market over the forecast period. In clinical diagnostics, inaccurate results can directly impact patient treatment outcomes. To minimize diagnostic errors and improve patient safety, labs rely heavily on proficiency testing programs, which verify test reliability and build trust among healthcare professionals and patients.

The cannabis segment is expected to be the fastest-growing segment in the market from 2025 to 2030. Cannabis testing involves a wide range of parameters, including cannabinoid profiling, pesticide residue analysis, microbial contamination, and heavy metals. Proficiency testing helps validate methods across these areas, driving growth as labs seek to prove reliability in multifaceted testing scopes.

The cell culture segment is expected to hold the largest share of the market over the forecast period. Techniques for cell culture are essential for scientific research, vaccine development, and diagnostic testing. Their extensive use across healthcare and life sciences ensures a consistent need for quality validation through proficiency testing, reinforcing the segment’s leading position in the market.

The chromatography segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. Chromatography is increasingly used in biomarker discovery, metabolomics, and drug monitoring. As research applications expand, labs require regular proficiency testing to validate their methods and ensure reproducibility, driving demand for PT services in biomedical chromatography.

The hospitals segment is expected to hold the largest share of the market over the forecast period. Hospital laboratories are responsible for diagnosing life-threatening conditions. Patient safety might be at risk due to erroneous diagnosis and treatment brought on by inaccurate test results. Proficiency testing helps ensure the reliability and accuracy of results, which is critical in delivering safe healthcare.

The contract research organizations (CROs) segment is anticipated to be the fastest-growing segment in the market from 2025 to 2030. CROs play a significant role in preclinical and clinical testing as well as other early phases of drug development. Proficiency testing is vital in validating lab methods and results in these stages, ensuring the quality of data before progressing to human trials, and fostering market growth.

North America is expected to be the largest region in the global market. With a large number of hospitals, diagnostic labs, and research institutions, North America has one of the most sophisticated healthcare systems in the world. The need for consistent, high-quality diagnostic results across this infrastructure boosts the demand for proficiency testing, driving market growth in the region.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia-Pacific is home to a rapidly expanding pharmaceutical and biotechnology sector, particularly in China and India. The increasing number of clinical trials, drug testing, and vaccine development requires regular proficiency testing to ensure high-quality, accurate results, propelling market demand.

LGC Limited, Bio-Rad Laboratories, Inc., Randox Laboratories Ltd., QACS - The Challenge Test Laboratory, Merck KGaA, Weqas, BIPEA, NSI Lab Solutions, Absolute Standards, Inc., and INSTAND, among others, are some of the key players in the global laboratory proficiency testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2025, to offer top-notch External Quality Assessment (EQA) programs, Cormay Diagnostics teamed up with the Randox International Quality Assessment Scheme (RIQAS). Through this collaboration, more than 70,000 laboratories worldwide can evaluate Cormay Diagnostics' IVD products within one of the biggest EQA frameworks in the world.

In November 2024, a new Proficiency Testing (PT) report was launched by CAP for in vitro diagnostics (IVD) firms. To improve overall testing quality and accuracy in the diagnostic landscape, the project aims to better understand and satisfy client expectations.

REPORT CONTENT

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL LABORATORY PROFICIENCY TESTING MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LABORATORY PROFICIENCY TESTING MARKET, BY INDUSTRY

4.1 Introduction

4.2 Laboratory Proficiency Testing Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Clinical Diagnostics [Clinical chemistry, Immunochemistry, Hematology, Oncology, Molecular Diagnostics, Coagulation, and Others]

4.4.1 Clinical Diagnostics [Clinical chemistry, Immunochemistry, Hematology, Oncology, Molecular Diagnostics, Coagulation, and Others] Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Pharmaceuticals [Biological Products and Others]

4.5.1 Pharmaceuticals [Biological Products and Others] Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Microbiology [Pathogen Testing, Sterility Testing, Endotoxin & Pyrogen Testing, Growth Promotion Testing, and Others]

4.6.1 Microbiology [Pathogen Testing, Sterility Testing, Endotoxin & Pyrogen Testing, Growth Promotion Testing, and Others] Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Cannabis [Medical and Non-Medical]

4.7.1 Cannabis [Medical and Non-Medical] Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL LABORATORY PROFICIENCY TESTING MARKET, BY TECHNOLOGY

5.1 Introduction

5.2 Laboratory Proficiency Testing Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Cell Culture

5.4.1 Cell Culture Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Spectrometry

5.5.1 Spectrometry Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Polymerase Chain Reaction

5.6.1 Polymerase Chain Reaction Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Chromatography

5.7.1 Chromatography Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL LABORATORY PROFICIENCY TESTING MARKET, BY END-USE

6.1 Introduction

6.2 Laboratory Proficiency Testing Market: End-use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Hospitals

6.4.1 Hospitals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Contract Research Organizations

6.5.1 Contract Research Organizations Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Pharmaceutical & Biotechnology Companies

6.6.1 Pharmaceutical & Biotechnology Companies Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Academic & Research Institutes

6.7.1 Academic & Research Institutes Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Laboratories

6.8.1 Laboratories Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL LABORATORY PROFICIENCY TESTING MARKET, BY REGION

7.1 Introduction

7.2 North America Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Industry

7.2.2 By Technology

7.2.3 By End-use

7.2.4 By Country

7.2.4.1 U.S. Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Industry

7.2.4.1.2 By Technology

7.2.4.1.3 By End-use

7.2.4.2 Canada Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Industry

7.2.4.2.2 By Technology

7.2.4.2.3 By End-use

7.2.4.3 Mexico Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Industry

7.2.4.3.2 By Technology

7.2.4.3.3 By End-use

7.3 Europe Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Industry

7.3.2 By Technology

7.3.3 By End-use

7.3.4 By Country

7.3.4.1 Germany Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Industry

7.3.4.1.2 By Technology

7.3.4.1.3 By End-use

7.3.4.2 U.K. Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Industry

7.3.4.2.2 By Technology

7.3.4.2.3 By End-use

7.3.4.3 France Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Industry

7.3.4.3.2 By Technology

7.3.4.3.3 By End-use

7.3.4.4 Italy Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Industry

7.3.4.4.2 By Technology

7.2.4.4.3 By End-use

7.3.4.5 Spain Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Industry

7.3.4.5.2 By Technology

7.2.4.5.3 By End-use

7.3.4.6 Netherlands Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Industry

7.3.4.6.2 By Technology

7.2.4.6.3 By End-use

7.3.4.7 Rest of Europe Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Industry

7.3.4.7.2 By Technology

7.2.4.7.3 By End-use

7.4 Asia Pacific Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Industry

7.4.2 By Technology

7.4.3 By End-use

7.4.4 By Country

7.4.4.1 China Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Industry

7.4.4.1.2 By Technology

7.4.4.1.3 By End-use

7.4.4.2 Japan Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Industry

7.4.4.2.2 By Technology

7.4.4.2.3 By End-use

7.4.4.3 India Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Industry

7.4.4.3.2 By Technology

7.4.4.3.3 By End-use

7.4.4.4 South Korea Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Industry

7.4.4.4.2 By Technology

7.4.4.4.3 By End-use

7.4.4.5 Singapore Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Industry

7.4.4.5.2 By Technology

7.4.4.5.3 By End-use

7.4.4.6 Malaysia Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Industry

7.4.4.6.2 By Technology

7.4.4.6.3 By End-use

7.4.4.7 Thailand Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Industry

7.4.4.7.2 By Technology

7.4.4.7.3 By End-use

7.4.4.8 Indonesia Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Industry

7.4.4.8.2 By Technology

7.4.4.8.3 By End-use

7.4.4.9 Vietnam Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Industry

7.4.4.9.2 By Technology

7.4.4.9.3 By End-use

7.4.4.10 Taiwan Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Industry

7.4.4.10.2 By Technology

7.4.4.10.3 By End-use

7.4.4.11 Rest of Asia Pacific Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Industry

7.4.4.11.2 By Technology

7.4.4.11.3 By End-use

7.5 Middle East and Africa Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Industry

7.5.2 By Technology

7.5.3 By End-use

7.5.4 By Country

7.5.4.1 Saudi Arabia Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Industry

7.5.4.1.2 By Technology

7.5.4.1.3 By End-use

7.5.4.2 U.A.E. Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Industry

7.5.4.2.2 By Technology

7.5.4.2.3 By End-use

7.5.4.3 Israel Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Industry

7.5.4.3.2 By Technology

7.5.4.3.3 By End-use

7.5.4.4 South Africa Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Industry

7.5.4.4.2 By Technology

7.5.4.4.3 By End-use

7.5.4.5 Rest of Middle East and Africa Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Industry

7.5.4.5.2 By Technology

7.5.4.5.2 By End-use

7.6 Central and South America Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Industry

7.6.2 By Technology

7.6.3 By End-use

7.6.4 By Country

7.6.4.1 Brazil Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Industry

7.6.4.1.2 By Technology

7.6.4.1.3 By End-use

7.6.4.2 Argentina Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Industry

7.6.4.2.2 By Technology

7.6.4.2.3 By End-use

7.6.4.3 Chile Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Industry

7.6.4.3.2 By Technology

7.6.4.3.3 By End-use

7.6.4.4 Rest of Central and South America Laboratory Proficiency Testing Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Industry

7.6.4.4.2 By Technology

7.6.4.4.3 By End-use

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 LGC Limited

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Bio-Rad Laboratories, Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Randox Laboratories Ltd.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 QACS - The Challenge Test Laboratory

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Merck KGaA

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 WEQAS

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 BIPEA

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 NSI Lab Solutions

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Absolute Standards, Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 INSTAND

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

2 Clinical Diagnostics [Clinical chemistry, Immunochemistry, Hematology, Oncology, Molecular Diagnostics, Coagulation, and Others] Market, By Region, 2021-2029 (USD Million)

3 Pharmaceuticals [Biological Products and Others] Market, By Region, 2021-2029 (USD Million)

4 Microbiology [Pathogen Testing, Sterility Testing, Endotoxin & Pyrogen Testing, Growth Promotion Testing, and Others] Market, By Region, 2021-2029 (USD Million)

5 Cannabis [Medical and Non-Medical] Market, By Region, 2021-2029 (USD Million)

6 Global Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

7 Cell Culture Market, By Region, 2021-2029 (USD Million)

8 Spectrometry Market, By Region, 2021-2029 (USD Million)

9 Polymerase Chain Reaction Market, By Region, 2021-2029 (USD Million)

10 Chromatography Market, By Region, 2021-2029 (USD Million)

11 Others Market, By Region, 2021-2029 (USD Million)

12 Global Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

13 Hospitals Market, By Region, 2021-2029 (USD Million)

14 Contract Research Organizations Market, By Region, 2021-2029 (USD Million)

15 Pharmaceutical & Biotechnology Companies Market, By Region, 2021-2029 (USD Million)

16 Academic & Research Institutes Market, By Region, 2021-2029 (USD Million)

17 Laboratories Market, By Region, 2021-2029 (USD Million)

18 Regional Analysis, 2021-2029 (USD Million)

19 North America Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

20 North America Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

21 North America Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

22 North America Laboratory Proficiency Testing Market, By Country, 2021-2029 (USD Million)

23 U.S Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

24 U.S Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

25 U.S Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

26 Canada Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

27 Canada Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

28 Canada Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

29 Mexico Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

30 Mexico Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

31 Mexico Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

32 Europe Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

33 Europe Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

34 Europe Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

35 Europe Laboratory Proficiency Testing Market, By Country 2021-2029 (USD Million)

36 Germany Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

37 Germany Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

38 Germany Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

39 U.K Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

40 U.K Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

41 U.K Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

42 France Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

43 France Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

44 France Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

45 Italy Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

46 Italy Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

47 Italy Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

48 Spain Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

49 Spain Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

50 Spain Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

51 Netherlands Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

52 Netherlands Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

53 Netherlands Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

54 Rest Of Europe Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

55 Rest Of Europe Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

56 Rest of Europe Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

57 Asia Pacific Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

58 Asia Pacific Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

59 Asia Pacific Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

60 Asia Pacific Laboratory Proficiency Testing Market, By Country, 2021-2029 (USD Million)

61 China Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

62 China Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

63 China Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

64 India Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

65 India Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

66 India Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

67 Japan Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

68 Japan Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

69 Japan Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

70 South Korea Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

71 South Korea Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

72 South Korea Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

73 malaysia Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

74 malaysia Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

75 malaysia Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

76 Thailand Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

77 Thailand Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

78 Thailand Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

79 Indonesia Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

80 Indonesia Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

81 Indonesia Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

82 Vietnam Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

83 Vietnam Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

84 Vietnam Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

85 Taiwan Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

86 Taiwan Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

87 Taiwan Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

88 Rest of Asia Pacific Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

89 Rest of Asia Pacific Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

90 Rest of Asia Pacific Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

91 Middle East and Africa Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

92 Middle East and Africa Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

93 Middle East and Africa Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

94 Middle East and Africa Laboratory Proficiency Testing Market, By Country, 2021-2029 (USD Million)

95 Saudi Arabia Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

96 Saudi Arabia Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

97 Saudi Arabia Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

98 UAE Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

99 UAE Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

100 UAE Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

101 Israel Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

102 Israel Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

103 Israel Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

104 South Africa Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

105 South Africa Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

106 South Africa Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

107 Rest of Middle East and Africa Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

108 Rest of Middle East and Africa Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

110 Central and South America Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

111 Central and South America Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

112 Central and South America Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

113 Central and South America Laboratory Proficiency Testing Market, By Country, 2021-2029 (USD Million)

114 Brazil Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

115 Brazil Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

116 Brazil Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

117 Argentina Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

118 Argentina Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

119 Argentina Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

120 Chile Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

121 Chile Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

122 Chile Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

123 Rest of Central and South America Laboratory Proficiency Testing Market, By Industry, 2021-2029 (USD Million)

124 Rest of Central and South America Laboratory Proficiency Testing Market, By Technology, 2021-2029 (USD Million)

125 Rest of Central and South America Laboratory Proficiency Testing Market, By End-use, 2021-2029 (USD Million)

126 LGC Limited: Products & Services Offering

127 Bio-Rad Laboratories, Inc.: Products & Services Offering

128 Randox Laboratories Ltd.: Products & Services Offering

129 QACS - The Challenge Test Laboratory: Products & Services Offering

130 Merck KGaA: Products & Services Offering

131 WEQAS: Products & Services Offering

132 BIPEA: Products & Services Offering

133 NSI Lab Solutions: Products & Services Offering

134 Absolute Standards, Inc., Inc: Products & Services Offering

135 INSTAND: Products & Services Offering

136 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Laboratory Proficiency Testing Market Overview

2 Global Laboratory Proficiency Testing Market Value From 2021-2029 (USD Million)

3 Global Laboratory Proficiency Testing Market Share, By Industry (2023)

4 Global Laboratory Proficiency Testing Market Share, By Technology (2023)

5 Global Laboratory Proficiency Testing Market Share, By End-use (2023)

6 Global Laboratory Proficiency Testing Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Laboratory Proficiency Testing Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Laboratory Proficiency Testing Market

11 Impact Of Challenges On The Global Laboratory Proficiency Testing Market

12 Porter’s Five Forces Analysis

13 Global Laboratory Proficiency Testing Market: By Industry Scope Key Takeaways

14 Global Laboratory Proficiency Testing Market, By Industry Segment: Revenue Growth Analysis

15 Clinical Diagnostics [Clinical chemistry, Immunochemistry, Hematology, Oncology, Molecular Diagnostics, Coagulation, and Others] Market, By Region, 2021-2029 (USD Million)

16 Pharmaceuticals [Biological Products and Others] Market, By Region, 2021-2029 (USD Million)

17 Microbiology [Pathogen Testing, Sterility Testing, Endotoxin & Pyrogen Testing, Growth Promotion Testing, and Others] Market, By Region, 2021-2029 (USD Million)

18 Cannabis [Medical and Non-Medical] Market, By Region, 2021-2029 (USD Million)

19 Global Laboratory Proficiency Testing Market: By Technology Scope Key Takeaways

20 Global Laboratory Proficiency Testing Market, By Technology Segment: Revenue Growth Analysis

21 Cell Culture Market, By Region, 2021-2029 (USD Million)

22 Spectrometry Market, By Region, 2021-2029 (USD Million)

23 Polymerase Chain Reaction Market, By Region, 2021-2029 (USD Million)

24 Chromatography Market, By Region, 2021-2029 (USD Million)

25 Others Market, By Region, 2021-2029 (USD Million)

26 Global Laboratory Proficiency Testing Market: By End-use Scope Key Takeaways

27 Global Laboratory Proficiency Testing Market, By End-use Segment: Revenue Growth Analysis

28 Hospitals Market, By Region, 2021-2029 (USD Million)

29 Contract Research Organizations Market, By Region, 2021-2029 (USD Million)

30 Pharmaceutical & Biotechnology Companies Market, By Region, 2021-2029 (USD Million)

31 Academic & Research Institutes Market, By Region, 2021-2029 (USD Million)

32 Laboratories Market, By Region, 2021-2029 (USD Million)

33 Regional Segment: Revenue Growth Analysis

34 Global Laboratory Proficiency Testing Market: Regional Analysis

35 North America Laboratory Proficiency Testing Market Overview

36 North America Laboratory Proficiency Testing Market, By Industry

37 North America Laboratory Proficiency Testing Market, By Technology

38 North America Laboratory Proficiency Testing Market, By End-use

39 North America Laboratory Proficiency Testing Market, By Country

40 U.S. Laboratory Proficiency Testing Market, By Industry

41 U.S. Laboratory Proficiency Testing Market, By Technology

42 U.S. Laboratory Proficiency Testing Market, By End-use

43 Canada Laboratory Proficiency Testing Market, By Industry

44 Canada Laboratory Proficiency Testing Market, By Technology

45 Canada Laboratory Proficiency Testing Market, By End-use

46 Mexico Laboratory Proficiency Testing Market, By Industry

47 Mexico Laboratory Proficiency Testing Market, By Technology

48 Mexico Laboratory Proficiency Testing Market, By End-use

49 Four Quadrant Positioning Matrix

50 Company Market Share Analysis

51 LGC Limited: Company Snapshot

52 LGC Limited: SWOT Analysis

53 LGC Limited: Geographic Presence

54 Bio-Rad Laboratories, Inc.: Company Snapshot

55 Bio-Rad Laboratories, Inc.: SWOT Analysis

56 Bio-Rad Laboratories, Inc.: Geographic Presence

57 Randox Laboratories Ltd.: Company Snapshot

58 Randox Laboratories Ltd.: SWOT Analysis

59 Randox Laboratories Ltd.: Geographic Presence

60 QACS - The Challenge Test Laboratory: Company Snapshot

61 QACS - The Challenge Test Laboratory: Swot Analysis

62 QACS - The Challenge Test Laboratory: Geographic Presence

63 Merck KGaA: Company Snapshot

64 Merck KGaA: SWOT Analysis

65 Merck KGaA: Geographic Presence

66 WEQAS: Company Snapshot

67 WEQAS: SWOT Analysis

68 WEQAS: Geographic Presence

69 BIPEA : Company Snapshot

70 BIPEA : SWOT Analysis

71 BIPEA : Geographic Presence

72 NSI Lab Solutions: Company Snapshot

73 NSI Lab Solutions: SWOT Analysis

74 NSI Lab Solutions: Geographic Presence

75 Absolute Standards, Inc., Inc.: Company Snapshot

76 Absolute Standards, Inc., Inc.: SWOT Analysis

77 Absolute Standards, Inc., Inc.: Geographic Presence

78 INSTAND: Company Snapshot

79 INSTAND: SWOT Analysis

80 INSTAND: Geographic Presence

81 Other Companies: Company Snapshot

82 Other Companies: SWOT Analysis

83 Other Companies: Geographic Presence

The Global Laboratory Proficiency Testing Market has been studied from the year 2019 till 2030. However, the CAGR provided in the report is from the year 2025 to 2030. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Laboratory Proficiency Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS