Global Natural Fiber Biocomposites Market Size, Trends & Analysis - Forecasts to 2028 By Type (Flax, Kenaf, Hemp, and Others), By Resin Type (PP, PE, PA, and Others), By Manufacturing Process (Injection Molding, Compression Molding, and Others), By End-use Industry (Automotive, Building & Construction, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

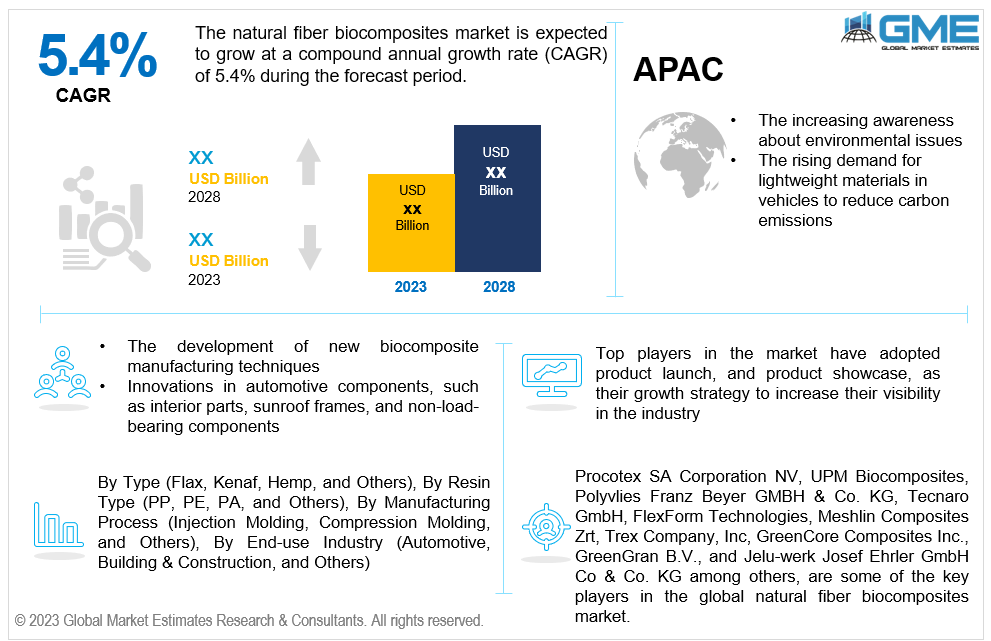

The global natural fiber biocomposites market is estimated to exhibit a CAGR of 5.4% from 2023 to 2028.

The primary factors propelling the market growth are the increasing awareness about environmental issues and the rising demand for lightweight materials in vehicles to reduce carbon emissions. To reduce the amount of carbon emissions from automobiles, governments all over the world are putting stringent regulations and norms in place. Automakers must follow these rules, and lightweight components like natural fiber biocomposites provide a practical approach to lightening vehicles, increasing fuel economy, and cutting emissions. Moreover, more environmentally friendly and fuel-efficient vehicles are becoming increasingly popular with consumers. In order to improve the marketability of their goods, automakers are reacting to this need by adding natural fiber biocomposites into their designs. For instance, according to a study from the European Environment Agency, transport contributed to around 25% of the EU's overall CO2 emissions in 2019, with road transport accounting for 71.7% of those emissions.

The development of new biocomposite manufacturing techniques and innovations in automotive components, such as interior parts, sunroof frames, and non-load-bearing components, are expected to support market growth during the forecast period. Natural fiber biocomposites offer a distinctive, organic look and can be moulded into various forms. This can be used in the design of interior components to give the inside of the car a touch of refinement and originality, thereby boosting consumer attractiveness. Furthermore, composites made of natural fibers are frequently more affordable than conventional materials like carbon fiber. The total production cost of the vehicle could benefit from the lower cost of producing interior components and non-load-bearing sections utilizing these materials. For instance, in 2016, FiberFrame, a natural fiber sunroof structure was launched by International Automotive Components (IAC) and BASF for the 2017 Mercedes-Benz E-class. This is the first automobile with a fully nonwoven nuclear fuel complex (NFC) sunroof frame.

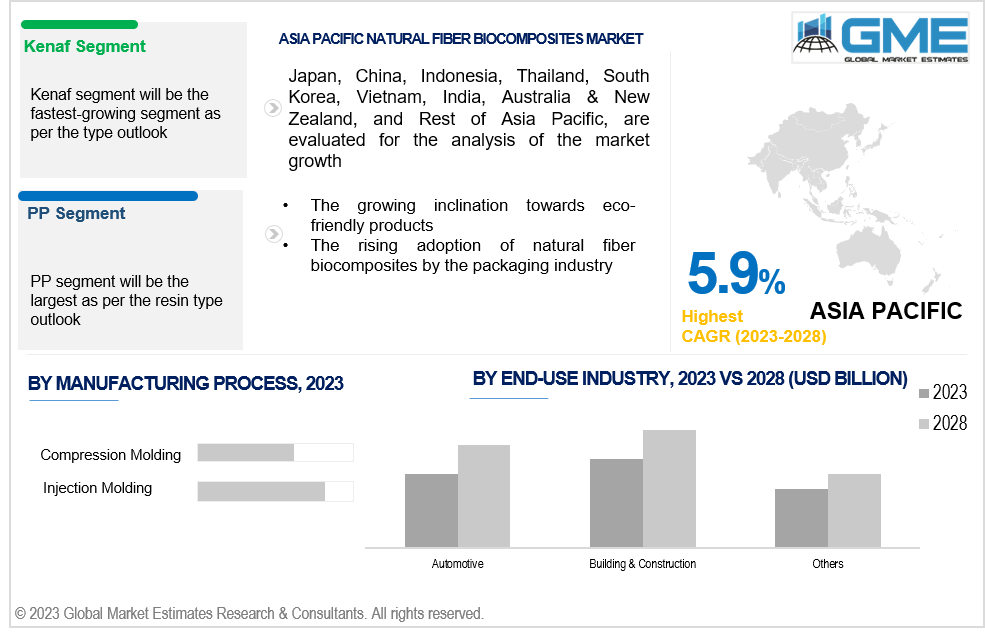

The growing inclination towards eco-friendly products such as NFC-based interior panels and trim and the rising adoption of natural fiber biocomposites by the packaging industry are propelling the market growth. Companies can use natural fiber biocomposites instead of conventional plastics for packaging. This lessens the environmental effect and conforms to shifting customer requirements for environmentally friendly and sustainable packaging materials. Natural fiber biocomposites are adaptable to the unique needs of different packaging items. They can be formed into various shapes and sizes, making them appropriate for multiple packaging applications.

The need for sustainable packaging materials and the rising public awareness of plastic pollution present an enormous opportunity for the natural fiber biocomposites market. Companies are looking into using these materials to replace standard plastics in packaging. Additionally, construction components like panels, boards, and even concrete reinforcement can be made from natural fiber biocomposites. Growing demand for environmentally friendly building materials in the construction sector can offer lucrative growth opportunities in the market. However, the moisture sensitivity of these composites and the lack of awareness about various applications of natural fiber biocomposites among end users are hampering the market growth.

The flax segment is expected to hold the largest share of the market. This is due to its excellent mechanical properties, biodegradability, and growing adoption in various industries including construction, aerospace, and others, which align with the prevailing biocomposites industry trends. Compared to the production of synthetic fibers, flax growing has a comparatively low environmental effect. it has a carbon-neutral profile since the CO2 absorbed during growth offsets the CO2 emitted during manufacture. This is in line with the rising need for environmentally friendly, sustainable materials in biocomposites.

The kenaf segment is expected to be the fastest-growing segment in the market from 2023-2028 due to the increasing global demand for eco-friendly composites and the unique advantages of kenaf as a natural fiber reinforcement in composites. By creating policies and providing incentives that encourage sustainability, several governments throughout the world are encouraging the use of natural fibers like kenaf in biocomposites. This support contributes to the rapid growth of kenaf-based biocomposites.

The PP resin type segment is expected to hold the largest share of the market. Ongoing research and development efforts have led to advancements in biocomposite technology, which has also improved the compatibility of natural fibers with PP resins. As a result, material characteristics have improved, and application flexibility has risen. Polypropylene (PP) has a smaller carbon impact than other thermoplastics and is recyclable. The eco-friendliness of PP-based composites makes them appealing for applications like crack control, fire resistance, void filling, and others as the construction industry increasingly embraces green building materials and biocomposites.

The PE resin type segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to its applicability to the automotive industry and biocomposite materials and its ability to utilize agricultural waste in biocomposite production. High strength and durability are found in PE-based biocomposites, essential for automotive applications where materials must survive various loads and environmental conditions.

The injection molding segment is expected to hold the largest share of the market over the forecast period. Injection molding aligns with the sustainability and environmental impact of biocomposites. Compared to conventional plastics, biocomposites, constructed from natural fibers and recyclable or biodegradable polymers, have a smaller carbon impact. These green materials can be mass-produced using injection molding. Additionally, injection molding is adaptable for several sectors since it can be used to create a variety of goods, from packaging materials to automobile components.

The compression molding segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Compression molding reduces material waste as it requires precisely shaping materials under pressure. This waste reduction function is highly appealing for enterprises looking to lessen their influence on the environment and material prices. Moreover, compression molding works well for making parts with complicated geometries, which is helpful for sectors like aerospace and automotive, where complex and specialized components are needed.

The building & construction segment is expected to hold the largest share of the market. The construction industry increasingly integrates sustainable building methods to lessen its environmental impact. Natural fiber biocomposites are eco-friendly materials that align with these sustainable construction goals. Biocomposites made of natural fibers are strong and lightweight. These qualities make them appropriate for various building uses, including wall panels, roofing, and cladding.

The automotive segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The increasing use of sustainable materials in the automobile sector is driven by more stringent environmental restrictions, including emissions limits and recycling obligations. Natural fiber biocomposites comply with these regulations due to their environmental friendliness and biodegradability.

North America is expected to be the largest region in the global market. Natural fiber biocomposites are in compliance with environmental regulations, green building standards, and other rules since they are biodegradable and environmentally friendly. As more end-use industries, such as the automotive, building, and packaging sectors, require ecologically friendly and sustainable materials, the market for natural fiber biocomposites in this region is growing. Due to the increased need for lightweight materials in the automotive sector, the U.S. is the largest market in North America for natural fiber composites. For instance, according to the National Automobile Dealers Association, in 2022, light-vehicle sales in North America topped 13.7 million units.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Natural fiber biocomposites are widely used in the Asia Pacific automotive sector for both interior and exterior components. The use of these materials in the automobile industry is expanding due to a growing emphasis on lightweight vehicles, increased fuel economy, and less emissions. For instance, according to the International Energy Agency (IEA) excluding China, emerging market and developing economy emissions from Asia increased by 4.2% or 206 Mt CO2 in 2022 from 2021, outpacing emissions from all other regions.

Procotex SA Corporation NV, UPM Biocomposites, Polyvlies Franz Beyer GMBH & Co. KG, Tecnaro GmbH, FlexForm Technologies, Meshlin Composites Zrt, Trex Company, Inc, GreenCore Composites Inc., GreenGran B.V., and Jelu-werk Josef Ehrler GmbH Co & Co. KG, among others, are some of the key players in the global natural fiber biocomposites market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL NATURAL FIBER BIOCOMPOSITES MARKET, BY TYPE

4.2 Natural Fiber Biocomposites Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Flax Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Kenaf Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Hemp Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL NATURAL FIBER BIOCOMPOSITES MARKET, BY RESIN TYPE

5.2 Natural Fiber Biocomposites Market: Resin Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 PP Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 PE Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 PA Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL NATURAL FIBER BIOCOMPOSITES MARKET, BY MANUFACTURING PROCESS

6.2 Natural Fiber Biocomposites Market: Manufacturing Process Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Injection Molding Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 Compression Molding Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL NATURAL FIBER BIOCOMPOSITES MARKET, BY END-USE INDUSTRY

7.2 Natural Fiber Biocomposites Market: End-use Industry Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Automotive Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.1 Building & Construction Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL NATURAL FIBER BIOCOMPOSITES MARKET, BY REGION

8.2 North America Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.3 By Manufacturing Process

8.2.5.1 U.S. Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.1.3 By Manufacturing Process

8.2.5.2 Canada Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.2.3 By Manufacturing Process

8.2.5.3 Mexico Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.3.3 By Manufacturing Process

8.3 Europe Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.3 By Manufacturing Process

8.3.5.1 Germany Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.1.3 By Manufacturing Process

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.2.3 By Manufacturing Process

8.3.5.3 France Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.3.3 By Manufacturing Process

8.3.5.4 Italy Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.4.3 By Manufacturing Process

8.3.5.5 Spain Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.5.3 By Manufacturing Process

8.3.5.6.3 By Manufacturing Process

8.3.5.7.3 By Manufacturing Process

8.4 Asia Pacific Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.3 By Manufacturing Process

8.4.5.1 China Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.1.3 By Manufacturing Process

8.4.5.2 Japan Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.2.3 By Manufacturing Process

8.4.5.3 India Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.3.3 By Manufacturing Process

8.4.5.4.3 By Manufacturing Process

8.4.5.5 Singapore Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.5.3 By Manufacturing Process

8.4.5.6 Malaysia Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.6.3 By Manufacturing Process

8.4.5.7 Thailand Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.7.3 By Manufacturing Process

8.4.5.8 Indonesia Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.8.3 By Manufacturing Process

8.4.5.9 Vietnam Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.9.3 By Manufacturing Process

8.4.5.10 Taiwan Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.10.3 By Manufacturing Process

8.4.5.10.4 By End-use Industry

8.4.5.11.3 By Manufacturing Process

8.4.5.11.4 By End-use Industry

8.5.3 By Manufacturing Process

8.5.5.1.3 By Manufacturing Process

8.5.5.2 U.A.E. Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.2.3 By Manufacturing Process

8.5.5.3 Israel Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.4.3.3 By Manufacturing Process

8.5.5.4.3 By Manufacturing Process

8.5.5.5.2 By Manufacturing Process

8.6.3 By Manufacturing Process

8.6.5.1 Brazil Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.1.3 By Manufacturing Process

8.6.5.2 Argentina Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.2.3 By Manufacturing Process

8.6.5.3 Chile Natural Fiber Biocomposites Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.3.3 By Manufacturing Process

8.6.5.4.3 By Manufacturing Process

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1 Procotex SA Corporation NV

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Polyvlies Franz Beyer GMBH & Co. KG

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 GreenCore Composites Inc.

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Jelu-werk Josef Ehrler GmbH Co & Co. KG

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

2 Flax Market, By Region, 2020-2028 (USD Billion)

3 Kenaf Market, By Region, 2020-2028 (USD Billion)

4 Hemp Market, By Region, 2020-2028 (USD Billion)

5 Others Market, By Region, 2020-2028 (USD Billion)

6 Global Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

7 PP Market, By Region, 2020-2028 (USD Billion)

8 PE Market, By Region, 2020-2028 (USD Billion)

9 PA Market, By Region, 2020-2028 (USD Billion)

10 Others Market, By Region, 2020-2028 (USD Billion)

11 Global Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

12 Injection Molding Market, By Region, 2020-2028 (USD Billion)

13 Compression Molding Market, By Region, 2020-2028 (USD Billion)

14 Others Market, By Region, 2020-2028 (USD Billion)

15 Global Natural Fiber Biocomposites Market, By END-USE INDUSTRY, 2020-2028 (USD Billion)

16 Automotive Market, By Region, 2020-2028 (USD Billion)

17 Building & Construction Market, By Region, 2020-2028 (USD Billion)

18 Others Market, By Region, 2020-2028 (USD Billion)

19 Regional Analysis, 2020-2028 (USD Billion)

20 North America Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

21 North America Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

22 North America Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

23 North America Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

24 North America Natural Fiber Biocomposites Market, By Country, 2020-2028 (USD Billion)

25 U.S Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

26 U.S Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

27 U.S Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

28 U.S Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

29 Canada Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

30 Canada Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

31 Canada Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

32 CANADA Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

33 Mexico Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

34 Mexico Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

35 Mexico Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

36 mexico Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

37 Europe Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

38 Europe Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

39 Europe Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

40 europe Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

41 Germany Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

42 Germany Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

43 Germany Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

44 germany Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

45 UK Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

46 UK Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

47 UK Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

48 U.kNatural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

49 France Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

50 France Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

51 France Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

52 france Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

53 Italy Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

54 Italy Natural Fiber Biocomposites Market, By T Resin Type Type, 2020-2028 (USD Billion)

55 Italy Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

56 italy Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

57 Spain Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

58 Spain Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

59 Spain Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

60 spain Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

61 Rest Of Europe Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

62 Rest Of Europe Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

63 Rest of Europe Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

64 REST OF EUROPE Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

65 Asia Pacific Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

66 Asia Pacific Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

67 Asia Pacific Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

68 asia Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

69 Asia Pacific Natural Fiber Biocomposites Market, By Country, 2020-2028 (USD Billion)

70 China Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

71 China Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

72 China Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

73 china Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

74 India Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

75 India Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

76 India Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

77 india Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

78 Japan Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

79 Japan Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

80 Japan Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

81 japan Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

82 South Korea Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

83 South Korea Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

84 South Korea Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

85 south korea Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

86 Middle East and Africa Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

87 Middle East and Africa Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

88 Middle East and Africa Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

89 MIDDLE EAST AND AFRICA Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

90 Middle East and Africa Natural Fiber Biocomposites Market, By Country, 2020-2028 (USD Billion)

91 Saudi Arabia Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

92 Saudi Arabia Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

93 Saudi Arabia Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

94 saudi arabia Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

95 UAE Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

96 UAE Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

97 UAE Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

98 uae Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

99 Central and South America Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

100 Central and South America Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

101 Central and South America Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

102 CENTRAL AND SOUTH AMERICA Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

103 Central and South America Natural Fiber Biocomposites Market, By Country, 2020-2028 (USD Billion)

104 Brazil Natural Fiber Biocomposites Market, By Type, 2020-2028 (USD Billion)

105 Brazil Natural Fiber Biocomposites Market, By Resin Type, 2020-2028 (USD Billion)

106 Brazil Natural Fiber Biocomposites Market, By Manufacturing Process, 2020-2028 (USD Billion)

107 brazil Natural Fiber Biocomposites Market, By End-use Industry, 2020-2028 (USD Billion)

108 Procotex SA Corporation NV: Products & Services Offering

109 UPM Biocomposites: Products & Services Offering

110 Polyvlies Franz Beyer GMBH & Co. KG: Products & Services Offering

111 Tecnaro GmbH: Products & Services Offering

112 FlexForm Technologies: Products & Services Offering

113 MESHLIN COMPOSITES ZRT: Products & Services Offering

114 Trex Company, Inc : Products & Services Offering

115 GreenCore Composites Inc.: Products & Services Offering

116 GreenGran B.V., Inc: Products & Services Offering

117 Jelu-werk Josef Ehrler GmbH Co & Co. KG: Products & Services Offering

118 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Natural Fiber Biocomposites Market Overview

2 Global Natural Fiber Biocomposites Market Value From 2020-2028 (USD Billion)

3 Global Natural Fiber Biocomposites Market Share, By Type (2022)

4 Global Natural Fiber Biocomposites Market Share, By Resin Type (2022)

5 Global Natural Fiber Biocomposites Market Share, By Manufacturing Process (2022)

6 Global Natural Fiber Biocomposites Market Share, By End-use Industry (2022)

7 Global Natural Fiber Biocomposites Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Natural Fiber Biocomposites Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Natural Fiber Biocomposites Market

12 Impact Of Challenges On The Global Natural Fiber Biocomposites Market

13 Porter’s Five Forces Analysis

14 Global Natural Fiber Biocomposites Market: By Type Scope Key Takeaways

15 Global Natural Fiber Biocomposites Market, By Type Segment: Revenue Growth Analysis

16 Flax Market, By Region, 2020-2028 (USD Billion)

17 Kenaf Market, By Region, 2020-2028 (USD Billion)

18 Hemp Market, By Region, 2020-2028 (USD Billion)

19 Others Market, By Region, 2020-2028 (USD Billion)

20 Global Natural Fiber Biocomposites Market: By Resin Type Scope Key Takeaways

21 Global Natural Fiber Biocomposites Market, By Resin Type Segment: Revenue Growth Analysis

22 PP Market, By Region, 2020-2028 (USD Billion)

23 PE Market, By Region, 2020-2028 (USD Billion)

24 PA Market, By Region, 2020-2028 (USD Billion)

25 Others Market, By Region, 2020-2028 (USD Billion)

26 Global Natural Fiber Biocomposites Market: By Manufacturing Process Scope Key Takeaways

27 Global Natural Fiber Biocomposites Market, By Manufacturing Process Segment: Revenue Growth Analysis

28 Injection Molding Market, By Region, 2020-2028 (USD Billion)

29 Compression Molding Market, By Region, 2020-2028 (USD Billion)

30 Others Market, By Region, 2020-2028 (USD Billion)

31 Global Natural Fiber Biocomposites Market: By End-use Industry Scope Key Takeaways

32 Global Natural Fiber Biocomposites Market, By End-use Industry Segment: Revenue Growth Analysis

33 Automotive Market, By Region, 2020-2028 (USD Billion)

34 Building & Construction Market, By Region, 2020-2028 (USD Billion)

35 Others Market, By Region, 2020-2028 (USD Billion)

36 Regional Segment: Revenue Growth Analysis

37 Global Natural Fiber Biocomposites Market: Regional Analysis

38 North America Natural Fiber Biocomposites Market Overview

39 North America Natural Fiber Biocomposites Market, By Type

40 North America Natural Fiber Biocomposites Market, By Resin Type

41 North America Natural Fiber Biocomposites Market, By Manufacturing Process

42 North America Natural Fiber Biocomposites Market, By End-use Industry

43 North America Natural Fiber Biocomposites Market, By Country

44 U.S. Natural Fiber Biocomposites Market, By Type

45 U.S. Natural Fiber Biocomposites Market, By Resin Type

46 U.S. Natural Fiber Biocomposites Market, By Manufacturing Process

47 U.S. Natural Fiber Biocomposites Market, By End-use Industry

48 Canada Natural Fiber Biocomposites Market, By Type

49 Canada Natural Fiber Biocomposites Market, By Resin Type

50 Canada Natural Fiber Biocomposites Market, By Manufacturing Process

51 Canada Natural Fiber Biocomposites Market, By End-use Industry

52 Mexico Natural Fiber Biocomposites Market, By Type

53 Mexico Natural Fiber Biocomposites Market, By Resin Type

54 Mexico Natural Fiber Biocomposites Market, By Manufacturing Process

55 Mexico Natural Fiber Biocomposites Market, By End-use Industry

56 Four Quadrant Positioning Matrix

57 Company Market Share Analysis

58 Procotex SA Corporation NV: Company Snapshot

59 Procotex SA Corporation NV: SWOT Analysis

60 Procotex SA Corporation NV: Geographic Presence

61 UPM Biocomposites: Company Snapshot

62 UPM Biocomposites: SWOT Analysis

63 UPM Biocomposites: Geographic Presence

64 Polyvlies Franz Beyer GMBH & Co. KG: Company Snapshot

65 Polyvlies Franz Beyer GMBH & Co. KG: SWOT Analysis

66 Polyvlies Franz Beyer GMBH & Co. KG: Geographic Presence

67 Tecnaro GmbH: Company Snapshot

68 Tecnaro GmbH: Swot Analysis

69 Tecnaro GmbH: Geographic Presence

70 FlexForm Technologies: Company Snapshot

71 FlexForm Technologies: SWOT Analysis

72 FlexForm Technologies: Geographic Presence

73 MESHLIN COMPOSITES ZRT: Company Snapshot

74 MESHLIN COMPOSITES ZRT: SWOT Analysis

75 MESHLIN COMPOSITES ZRT: Geographic Presence

76 Trex Company, Inc : Company Snapshot

77 Trex Company, Inc : SWOT Analysis

78 Trex Company, Inc : Geographic Presence

79 GreenCore Composites Inc.: Company Snapshot

80 GreenCore Composites Inc.: SWOT Analysis

81 GreenCore Composites Inc.: Geographic Presence

82 GreenGran B.V., Inc.: Company Snapshot

83 GreenGran B.V., Inc.: SWOT Analysis

84 GreenGran B.V., Inc.: Geographic Presence

85 Jelu-werk Josef Ehrler GmbH Co & Co. KG: Company Snapshot

86 Jelu-werk Josef Ehrler GmbH Co & Co. KG: SWOT Analysis

87 Jelu-werk Josef Ehrler GmbH Co & Co. KG: Geographic Presence

88 Other Companies: Company Snapshot

89 Other Companies: SWOT Analysis

90 Other Companies: Geographic Presence

The Global Natural Fiber Biocomposites Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Natural Fiber Biocomposites Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS