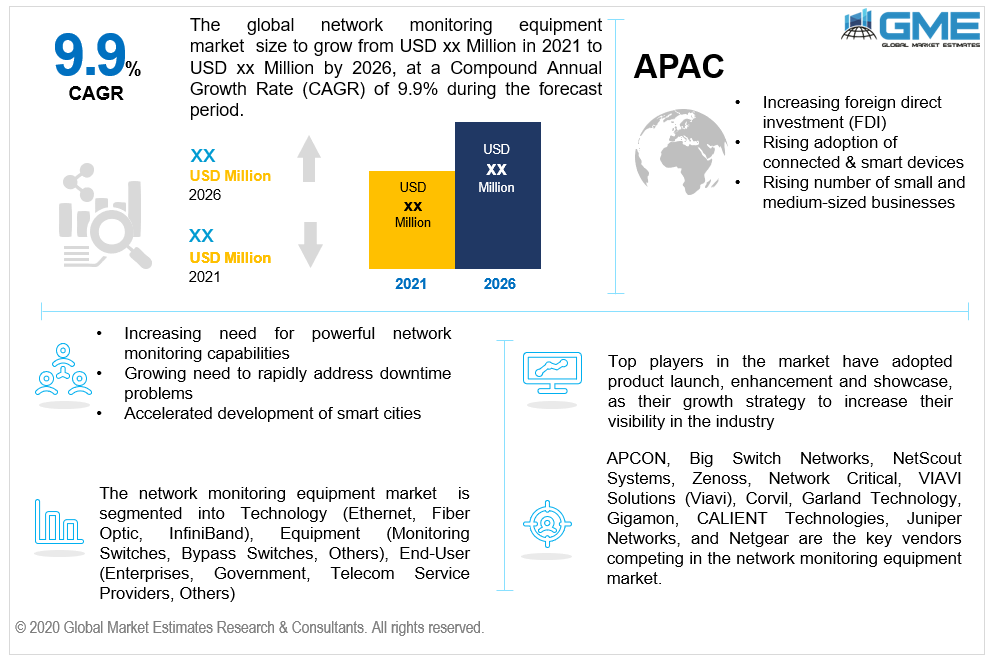

Global Network Monitoring Equipment Market Size, Trends, and Analysis - Forecasts To 2026 By Technology (Ethernet, Fiber Optic and InfiniBand), By Equipment (Monitoring Switches, Bypass Switches, Others), By End-User (Enterprises, Government, Telecom Service Providers, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Preliminary 5G network penetration and technology breakthroughs throughout the world are altering the telecom infrastructure. Globally, internet service providers are in the midst of a rapid growth era due to increased demand for high-speed internet. The need for such elevated speed internet is emerging not only from businesses but increasingly from households. As a result of such reasons, the global need for network monitoring equipment is increasing.

Furthermore, significant expenditure by telecommunication service providers in modulated bandwidth and higher frequency together with the implementation of 5G technologies, is likely to fuel the growth of the network monitoring equipment market in the majority of emerging and established countries. Due to latent networking transparency, which makes network architecture more stable and robust, network monitoring equipment has seen a favorable perspective from the world.

During the forecast period, the demand for network monitoring equipment is booming due to the requirement for comprehensive network monitoring tools to maintain the seamless functioning of core crucial network infrastructure and the requirement to promptly fix breakdown situations. The network monitoring market is also booming due to the huge demand for constant monitoring as a result of increased network complexity and security issues. In addition, the growing need to rapidly address downtime problems is positively affecting business growth. Moreover, the growing proliferation of SaaS-based network monitoring solutions, as well as the widespread acceptance of IoT and BYOD devices, and the rising demand for long-lasting network monitoring systems to rapidly address downtime problems, are all contributing to the market's expansion. But apart from that, the accelerated development of smart cities is boosting the demand for network monitoring.

However, in the forecast period, the easy availability of free network traffic tools, compatibility problems, and large initial investments given the prevalence of legacy systems will be the main restraints on network monitoring development. In the forthcoming years, the management of large network performance data could pose a challenge to the network monitoring market's development. Nevertheless, the growing volume of equipment linked to the internet for communication objectives along with a diversity of network architectures employed by service providers has resulted in very convoluted networks establishing a great need for network monitoring and propelling the network monitoring market forward. Similarly, the growing software-defined networking market and underlying prospects in small and medium-sized enterprises, as well as the optimization of business activities mostly through network management tools, will provide sufficient growth avenues for the network monitoring market to expand.

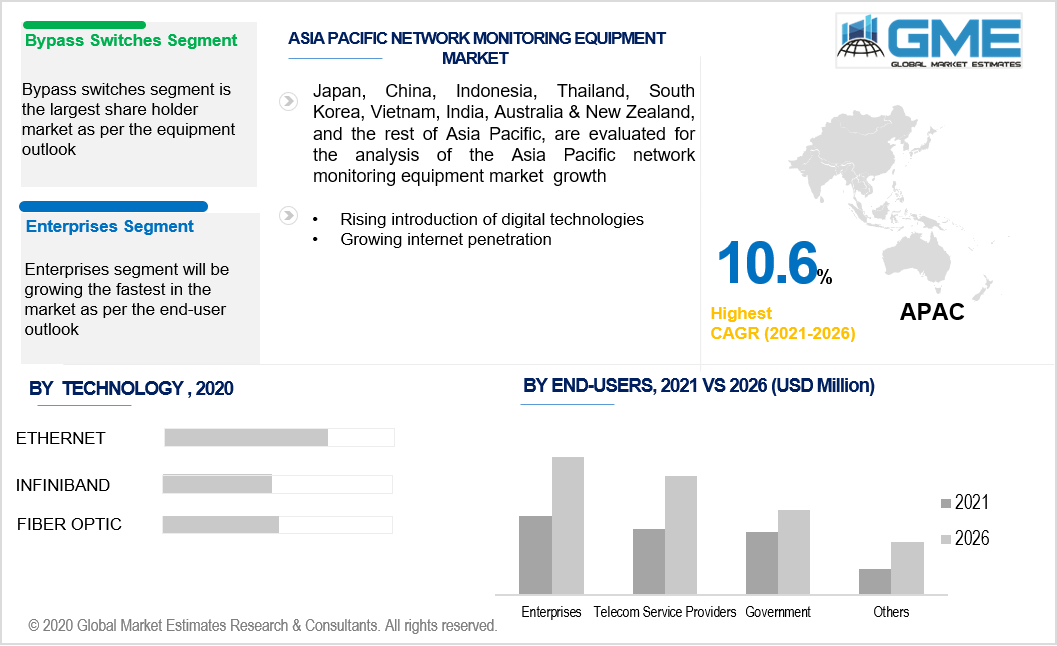

On the basis of the technology, the market has been categorized into ethernet, fiber optic, and InfiniBand. Ethernet is foreseen to report the largest share of the market. Increased demand for network monitoring equipment with higher bandwidths is being driven by the growth of data centers and the introduction of virtualization technologies. Ethernet-based networks have more flexibility, low-latency solutions for greater scalability. With Ethernet technology, switching from low to high bandwidth is not only cost-effective but also painless. As a result, it is extensively used for data sharing in a variety of sectors, which fuels the rise of Ethernet-based networking equipment.

On the basis of the equipment, the market has been categorized into monitoring switches, bypass switches, and others. Among them, bypass switches are foreseen to lead. A bypass switch aims to eliminate the "single point of failure." The bypass switch is placed between network equipment and in front of security software such as an intrusion prevention system (IPS) or next-generation firewall. A Bypass switch can maintain the link flowing until a redundant route is enabled if an active tool fails, whether due to a power loss, hardware failure, or software problem. It serves as a fail-safe point of access for inline network monitoring in this manner.

On the basis of the end-user, the market has been categorized into enterprises, government, telecom service providers, others. Due to high technical advancement across numerous industries, large quantities of data have been generated, and complexities within IT infrastructure encourage enterprises to implement virtualization technologies, and hence enterprises would hold the biggest share of the network monitoring market. Customer interaction, internal cooperation, and the proliferation of new goods and technologies all rely on a high-quality network technology, which is currently only possible with enterprise network equipment. Network information and market intelligence can be used to convert a network into a monetization asset. As a result, the business network no longer functions as a commodity, but rather as a key aspect of progress in the client area. Enterprise network equipment is quickly becoming the linked company's strategic edge over its competitors. Retailers, for instance, are increasingly attempting to provide differentiated in-store experiences to their customers, who rely on fast and stable business networks to deliver on the promise of an experience. These cases, which are linked to business outcomes, continue to highlight the relevance of enterprise network equipment to the business.

Regionally, North America is anticipated to provide network monitoring equipment producers with new sales opportunities and revenue models. The global network monitoring equipment market in North America is foreseen to expand due to continuing technical developments in the area and the dynamical turnaround of various business dimensions in the United States and Canada. Besides that, North America is a leader in the adoption of industrial revolution 4.0 technologies and applications, which is fuelling demand for network monitoring equipment.

Furthermore, the network monitoring equipment industry has a large market opportunity due to the presence of multinational automobile firms in Europe, which is projected to generate significant growth opportunities for network monitoring equipment manufacturing companies.

Moreover, Asian countries like China, Japan, and India are promoting foreign direct investment and creating attractive market environments for investors. Such factors are assisting the demand for network monitoring equipment in the Asia Pacific to expand. The surging volume of small and medium-sized businesses, as well as the introduction of digital technologies, are all augmenting demand for network monitoring. Furthermore, the region's rising internet penetration and internet user base generate a massive amount of data, which drives demand for cloud-based services.

APCON, Big Switch Networks, NetScout Systems, Zenoss, Network Critical, VIAVI Solutions (Viavi), Corvil, Garland Technology, Gigamon, CALIENT Technologies, Juniper Networks, and Netgear are the key vendors competing in the network monitoring equipment market.

Arbor Threat Analytics (ATA), the industry's initial network-based threat detection and analytics platform was launched in July 2019 by NETSCOUT to offer a complete insight into today's multi-cloud environments.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Network Monitoring Equipment Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Equipment Overview

2.1.4 End-Users Overview

2.1.5 Regional Overview

Chapter 3 Global Network Monitoring Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Network Complexity and Security Issues

3.3.1.2 Growing Proliferation of SaaS-Based Network Monitoring Solutions

3.3.2 Industry Challenges

3.3.2.1 Large Initial Investments

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Equipment Growth Scenario

3.4.3 End-Users Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Network Monitoring Equipment Market, By Technology

4.1 Technology Outlook

4.2 Ethernet

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Fiber Optic

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 InfiniBand

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Network Monitoring Equipment Market, By Equipment

5.1 End Users Outlook

5.2 Monitoring Switches

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Bypass Switches

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Network Monitoring Equipment Market, By Equipment

6.1 End Users Outlook

6.2 Enterprises

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Government

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Telecom Service Providers

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Quantum Dot Display Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Technology, 2019-2026 (USD Million)

7.2.3 Market Size, By Equipment, 2019-2026 (USD Million)

7.2.4 Market Size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Technology, 2019-2026 (USD Million)

7.3.3 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.4 Market Size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Technology, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Technology, 2019-2026 (USD Million)

7.4.3 Market Size, By Equipment, 2019-2026 (USD Million)

7.4.4 Market Size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.8.2 Market size, By Equipment, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Technology, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Technology, 2019-2026 (USD Million)

7.5.3 Market Size, By Equipment, 2019-2026 (USD Million)

7.5.4 Market Size, By End-User, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Technology, 2019-2026 (USD Million)

7.6.3 Market Size, By Equipment, 2019-2026 (USD Million)

7.6.4 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Technology, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Equipment, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 APCON

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Big Switch Networks

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 NetScout Systems

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Zenoss

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Network Critical

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 VIAVI Solutions (Viavi)

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Corvil

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Garland Technology

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Gigamon

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 CALIENT Technologies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Juniper Networks

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Netgear

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Network Monitoring Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Network Monitoring Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS