Global Oil Pipeline Infrastructure Market Size, Trends & Analysis - Forecasts to 2029 By Application (Onshore and Offshore), By Operation (Transmission and Gathering), By Diameter (?8 Inch, >8-24 Inch, and >24 Inch), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

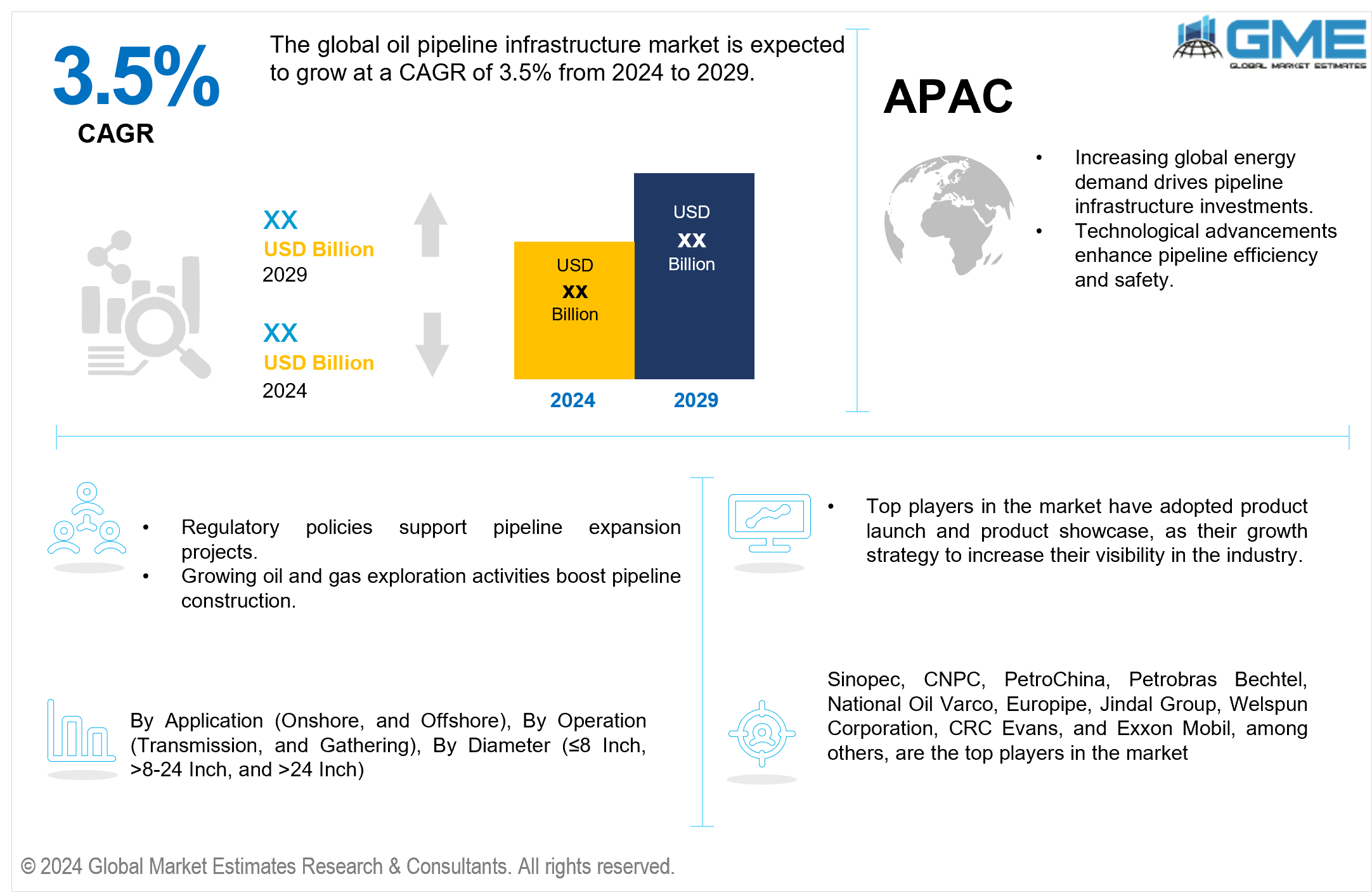

The global oil pipeline infrastructure market is expected to exhibit a CAGR of 3.5% from 2024 to 2029.

The oil pipeline construction and pipeline transportation market encompasses the pipeline network development, pipeline capacity expansion, and oil pipeline maintenance of crude oil pipelines worldwide. This sector witnesses significant pipeline infrastructure investment to enhance capacity and ensure safe and efficient oil and gas transportation. Key drivers include advancements in oil pipeline technology, such as pipeline monitoring systems and pipeline corrosion protection, to ensure pipeline integrity management and compliance with pipeline safety standards. The market also focuses on oil pipeline environmental impact mitigation, pipeline regulatory compliance, and strategic pipeline route planning for cross-country pipelines and offshore oil pipelines and other oil and gas pipelines. Pipeline project financing of pipeline projects remains crucial amid ongoing efforts to bolster energy transportation infrastructure and meet global energy demands efficiently.

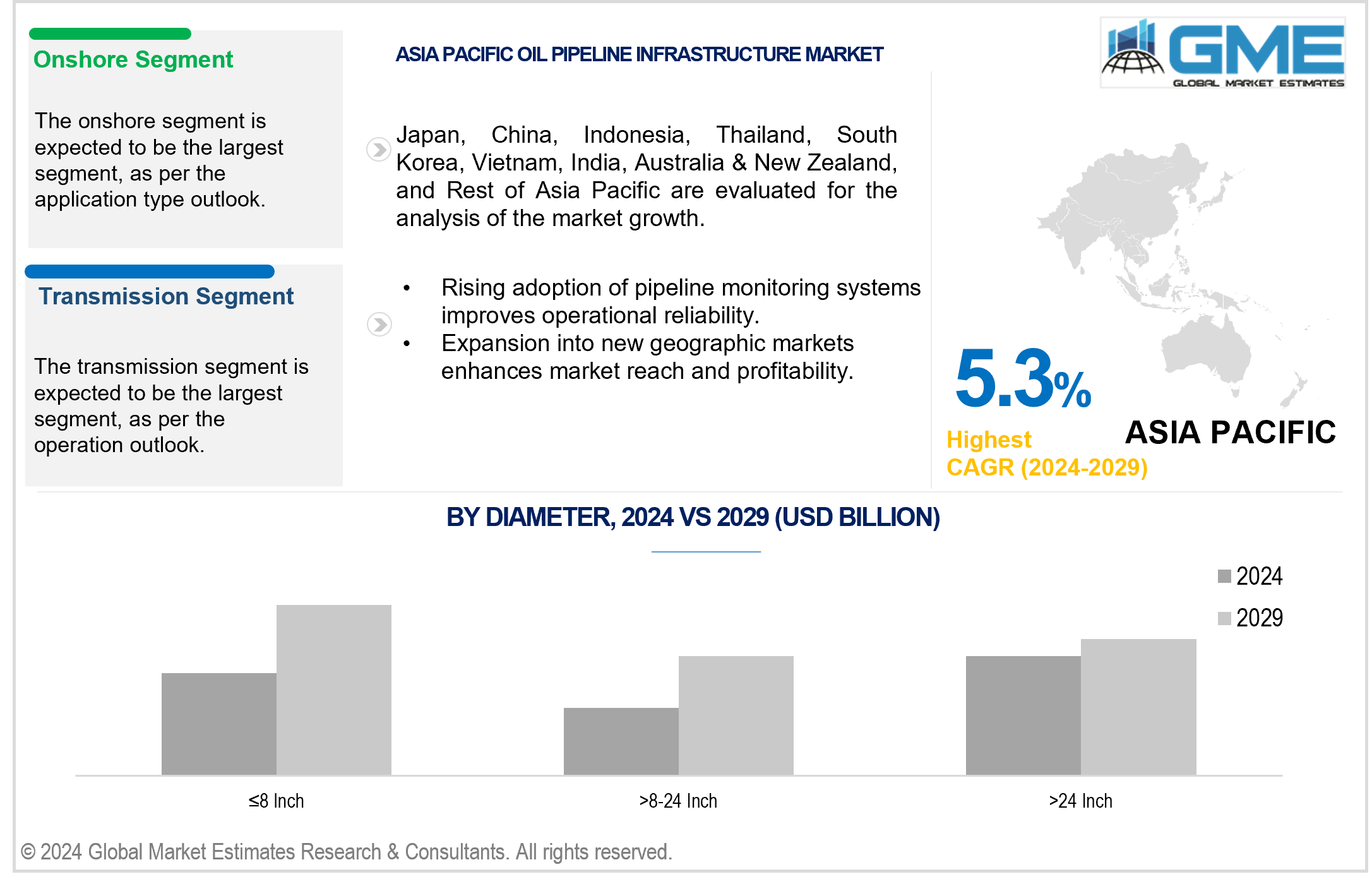

In the global oil pipeline market, the largest segment by application is expected to be the onshore pipelines. These pipelines are crucial for transporting crude oil from extraction sites to refineries or distribution centers over land. Onshore pipelines benefit from established infrastructure networks and lower operational complexities than offshore counterparts. They are vital for domestic energy supply chains and are pivotal in connecting oil-rich regions to major consumption centers worldwide. The demand for onshore pipelines is driven by the need for cost-effective and efficient transportation solutions, supported by continuous investments in pipeline infrastructure and regulatory compliance measures.

Conversely, the fastest-growing segment in the global oil pipeline market is the offshore pipelines segment. These pipelines are essential for transporting crude oil from offshore oil fields located beneath oceans or seas to onshore facilities or directly to marine terminals. Offshore pipelines are witnessing rapid growth due to increasing exploration and production activities in offshore oil fields, especially in regions like the Gulf of Mexico, North Sea, and deepwater basins. Advances in offshore pipeline technology, including enhanced corrosion resistance, subsea monitoring systems, and deepwater installation capabilities, are facilitating the expansion of this segment. Moreover, offshore pipelines contribute to global energy security by enabling the development of untapped offshore oil reserves and reducing dependency on land-based transportation routes.

In the global oil pipeline market, the largest segment by operation is transmission pipelines. These pipelines are designed to transport large volumes of crude oil over long distances from production areas to refineries, export terminals, or distribution points. Transmission pipelines form the backbone of the oil transportation infrastructure, ensuring efficient and continuous flow of crude oil across vast geographical regions. They are characterized by high-capacity pipelines and sophisticated pumping stations that maintain the pressure and flow rates necessary for uninterrupted oil supply. Transmission pipelines play a critical role in global energy logistics, connecting major oil production centers with key consumption markets.

Conversely, offshore pipelines are the fastest-growing segment in the global oil pipeline market. These pipelines are essential for transporting crude oil from offshore oil fields beneath oceans or seas to onshore facilities or directly to marine terminals. Offshore pipelines are witnessing rapid growth due to increasing exploration and production activities in offshore oil fields, especially in regions like the Gulf of Mexico, the North Sea, and deepwater basins. Advances in offshore pipeline technology, including enhanced corrosion resistance, subsea monitoring systems, and deepwater installation capabilities, are facilitating the expansion of this segment. Moreover, offshore pipelines contribute to global energy security by enabling the development of untapped offshore oil reserves and reducing dependency on land-based transportation routes .

The largest segment by diameter in the global oil pipeline market is the >24 Inch category. These pipelines are designed to handle large volumes of crude oil, providing high capacity for long-range transportation. They are critical for major oil transportation routes, including cross-country and international pipelines that connect major production centers with refineries and export terminals. The >24 Inch pipelines are characterized by their ability to efficiently transport significant quantities of crude oil efficiently, ensuring reliable supply to meet global energy demands.

Furthermore, the fastest-growing segment in the global oil pipeline market by diameter is the ≤8 Inch category. These pipelines are often used in gathering systems and for transporting smaller volumes of crude oil over shorter distances. The growth in ≤8 Inch pipelines is driven by increased exploration and production activities in smaller oil fields and remote areas where smaller diameter pipelines are sufficient to transport oil to processing facilities or larger transmission pipelines. The expansion of ≤8 Inch pipelines is supported by advancements in pipeline technology, such as improved corrosion protection and monitoring systems, as well as regulatory efforts to enhance safety and environmental compliance in oil transportation infrastructure.

In the global oil pipeline market, North America stands out as the largest region due to its extensive pipeline infrastructure supporting the transportation of crude oil across vast distances. The region's dominance is underscored by major pipeline networks in the United States and Canada, which connect prolific oil production regions like the Permian Basin and Alberta's oil sands to refineries and export terminals. These pipelines, characterized by their robust capacity and extensive coverage, play a pivotal role in ensuring a reliable supply of crude oil to domestic and international markets, solidifying North America's position as a key region in the global oil pipeline industry.

Conversely, the Asia Pacific (APAC) is the fastest-growing region in the global oil pipeline market. APAC's rapid growth is fueled by increasing energy demand, economic development, and expanding oil and gas infrastructure across countries like China, India, and Southeast Asian nations. The region's investment in pipeline infrastructure is driven by efforts to enhance energy security, support industrial growth, and meet burgeoning oil consumption needs. With significant investments in new pipeline projects, including cross-border pipelines and expansions of existing networks, APAC is poised to significantly expand its oil pipeline capacity, thereby facilitating efficient crude oil transportation and contributing to the region's dynamic economic growth.

Sinopec, CNPC, PetroChina, Petrobras Bechtel, National Oil Varco, Europipe, Jindal Group, Welspun Corporation, CRC Evans, and Exxon Mobil, among others, are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2024, PetroChina International announced the lifting of a spot cargo of LNG from Papua New Guinea's PNG LNG project, marking the first sale by Kumul Petroleum Holdings Limited (KPHL), Papua New Guinea's national oil company. The 144,000-cubic-meter cargo was procured through a tender awarded to PetroChina International (PCI) in February, with the LNG loaded onto the Wudang LNG tanker funded by PetroChina at Caution Bay on Wednesday. PCI Singapore's General Manager, Li Shaolin, highlighted that this transaction signals the start of increased LNG trade between Papua New Guinea and China under both spot and long-term agreements.

In 2022, Welspun Corp Ltd (WCL), a leading manufacturer of Welded Line Pipes and a flagship of the Welspun Group, secured a significant order valued at approximately INR 706 crore from Indian Oil Corporation Limited (IOCL). This order, totaling around 48,000 MT, is slated for completion within the current financial year. WCL is renowned for its expertise in manufacturing critical line pipes and is poised to enter the DI Pipes segment to cater to domestic potable water needs, reflecting its commitment to innovation and customer-centric solutions. The latest project underscores WCL's strong focus on technical excellence and operational capabilities.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL OIL PIPELINE INFRASTRUCTURE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Operation Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL OIL PIPELINE INFRASTRUCTURE MARKET, BY APPLICATION

4.1 Introduction

4.2 Oil Pipeline Infrastructure Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Onshore

4.4.1 Onshore Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Offshore

4.5.1 Offshore Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL OIL PIPELINE INFRASTRUCTURE MARKET, BY OPERATION

5.1 Introduction

5.2 Oil Pipeline Infrastructure Market: Operation Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Transmission

5.4.1 Transmission Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Gathering

5.5.1 Gathering Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL OIL PIPELINE INFRASTRUCTURE MARKET, BY DIAMETER

6.1 Introduction

6.2 Oil Pipeline Infrastructure Market: Diameter Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 ≤8 Inch

6.4.1 ≤8 Inch Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 >8-24 Inch

6.5.1 >8-24 Inch Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 >24 Inch

6.6.1 >24 Inch Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL OIL PIPELINE INFRASTRUCTURE MARKET, BY REGION

7.1 Introduction

7.2 North America Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Application

7.2.2 By Operation

7.2.3 By Diameter

7.2.4 By Country

7.2.4.1 U.S. Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Application

7.2.4.1.2 By Operation

7.2.4.1.3 By Diameter

7.2.4.2 Canada Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Application

7.2.4.2.2 By Operation

7.2.4.2.3 By Diameter

7.2.4.3 Mexico Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Application

7.2.4.3.2 By Operation

7.2.4.3.3 By Diameter

7.3 Europe Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Application

7.3.2 By Operation

7.3.3 By Diameter

7.3.4 By Country

7.3.4.1 Germany Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Application

7.3.4.1.2 By Operation

7.3.4.1.3 By Diameter

7.3.4.2 U.K. Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Application

7.3.4.2.2 By Operation

7.3.4.2.3 By Diameter

7.3.4.3 France Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Application

7.3.4.3.2 By Operation

7.3.4.3.3 By Diameter

7.3.4.4 Italy Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Application

7.3.4.4.2 By Operation

7.2.4.4.3 By Diameter

7.3.4.5 Spain Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Application

7.3.4.5.2 By Operation

7.2.4.5.3 By Diameter

7.3.4.6 Netherlands Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Application

7.3.4.6.2 By Operation

7.2.4.6.3 By Diameter

7.3.4.7 Rest of Europe Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Application

7.3.4.7.2 By Operation

7.2.4.7.3 By Diameter

7.4 Asia Pacific Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Application

7.4.2 By Operation

7.4.3 By Diameter

7.4.4 By Country

7.4.4.1 China Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Application

7.4.4.1.2 By Operation

7.4.4.1.3 By Diameter

7.4.4.2 Japan Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Application

7.4.4.2.2 By Operation

7.4.4.2.3 By Diameter

7.4.4.3 India Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Application

7.4.4.3.2 By Operation

7.4.4.3.3 By Diameter

7.4.4.4 South Korea Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Application

7.4.4.4.2 By Operation

7.4.4.4.3 By Diameter

7.4.4.5 Singapore Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Application

7.4.4.5.2 By Operation

7.4.4.5.3 By Diameter

7.4.4.6 Malaysia Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Application

7.4.4.6.2 By Operation

7.4.4.6.3 By Diameter

7.4.4.7 Thailand Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Application

7.4.4.7.2 By Operation

7.4.4.7.3 By Diameter

7.4.4.8 Indonesia Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Application

7.4.4.8.2 By Operation

7.4.4.8.3 By Diameter

7.4.4.9 Vietnam Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Application

7.4.4.9.2 By Operation

7.4.4.9.3 By Diameter

7.4.4.10 Taiwan Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Application

7.4.4.10.2 By Operation

7.4.4.10.3 By Diameter

7.4.4.11 Rest of Asia Pacific Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Application

7.4.4.11.2 By Operation

7.4.4.11.3 By Diameter

7.5 Middle East and Africa Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Application

7.5.2 By Operation

7.5.3 By Diameter

7.5.4 By Country

7.5.4.1 Saudi Arabia Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Application

7.5.4.1.2 By Operation

7.5.4.1.3 By Diameter

7.5.4.2 U.A.E. Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Application

7.5.4.2.2 By Operation

7.5.4.2.3 By Diameter

7.5.4.3 Israel Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Application

7.5.4.3.2 By Operation

7.5.4.3.3 By Diameter

7.5.4.4 South Africa Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Application

7.5.4.4.2 By Operation

7.5.4.4.3 By Diameter

7.5.4.5 Rest of Middle East and Africa Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Application

7.5.4.5.2 By Operation

7.5.4.5.2 By Diameter

7.6 Central and South America Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Application

7.6.2 By Operation

7.6.3 By Diameter

7.6.4 By Country

7.6.4.1 Brazil Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Application

7.6.4.1.2 By Operation

7.6.4.1.3 By Diameter

7.6.4.2 Argentina Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Application

7.6.4.2.2 By Operation

7.6.4.2.3 By Diameter

7.6.4.3 Chile Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Application

7.6.4.3.2 By Operation

7.6.4.3.3 By Diameter

7.6.4.4 Rest of Central and South America Oil Pipeline Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Application

7.6.4.4.2 By Operation

7.6.4.4.3 By Diameter

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Sinopec

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 CNPC

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 PetroChina

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Petrobras Bechtel

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 National Oil Varco

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Europipe

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Jindal Group

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Welspun Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 CRC Evans

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Exxon Mobil

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential ApplicationSales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Mllion)

2 Onshore Market, By Region, 2021-2029 (USD Mllion)

3 Offshore Market, By Region, 2021-2029 (USD Mllion)

4 Global Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Mllion)

5 Transmission Market, By Region, 2021-2029 (USD Mllion)

6 Gathering Market, By Region, 2021-2029 (USD Mllion)

7 Global Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Mllion)

8 ≤8 Inch Market, By Region, 2021-2029 (USD Mllion)

9 >8-24 Inch Market, By Region, 2021-2029 (USD Mllion)

10 >24 Inch Market, By Region, 2021-2029 (USD Mllion)

11 Regional Analysis, 2021-2029 (USD Mllion)

12 North America Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

13 North America Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

14 North America Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

15 North America Oil Pipeline Infrastructure Market, By Country, 2021-2029 (USD Million)

16 U.S Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

17 U.S Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

18 U.S Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

19 Canada Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

20 Canada Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

21 Canada Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

22 Mexico Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

23 Mexico Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

24 Mexico Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

25 Europe Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

26 Europe Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

27 Europe Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

28 Europe Oil Pipeline Infrastructure Market, By Country 2021-2029 (USD Million)

29 Germany Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

30 Germany Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

31 Germany Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

32 U.K Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

33 U.K Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

34 U.K Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

35 France Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

36 France Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

37 France Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

38 Italy Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

39 Italy Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

40 Italy Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

41 Spain Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

42 Spain Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

43 Spain Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

44 Netherlands Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

45 Netherlands Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

46 Netherlands Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

47 Rest Of Europe Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

48 Rest Of Europe Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

49 Rest of Europe Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

50 Asia Pacific Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

51 Asia Pacific Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

52 Asia Pacific Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

53 Asia Pacific Oil Pipeline Infrastructure Market, By Country, 2021-2029 (USD Million)

54 China Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

55 China Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

56 China Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

57 India Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

58 India Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

59 India Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

60 Japan Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

61 Japan Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

62 Japan Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

63 South Korea Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

64 South Korea Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

65 South Korea Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

66 malaysia Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

67 malaysia Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

68 malaysia Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

69 Thailand Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

70 Thailand Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

71 Thailand Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

72 Indonesia Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

73 Indonesia Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

74 Indonesia Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

75 Vietnam Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

76 Vietnam Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

77 Vietnam Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

78 Taiwan Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

79 Taiwan Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

80 Taiwan Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

81 Rest of Asia Pacific Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

82 Rest of Asia Pacific Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

83 Rest of Asia Pacific Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

84 Middle East and Africa Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

85 Middle East and Africa Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

86 Middle East and Africa Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

87 Middle East and Africa Oil Pipeline Infrastructure Market, By Country, 2021-2029 (USD Million)

88 Saudi Arabia Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

89 Saudi Arabia Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

90 Saudi Arabia Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

91 UAE Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

92 UAE Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

93 UAE Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

94 Israel Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

95 Israel Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

96 Israel Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

97 South Africa Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

98 South Africa Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

99 South Africa Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

100 Rest of Middle East and Africa Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

101 Rest of Middle East and Africa Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

103 Central and South America Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

104 Central and South America Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

105 Central and South America Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

106 Central and South America Oil Pipeline Infrastructure Market, By Country, 2021-2029 (USD Million)

107 Brazil Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

108 Brazil Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

109 Brazil Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

110 Argentina Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

111 Argentina Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

112 Argentina Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

113 Chile Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

114 Chile Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

115 Chile Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

116 Rest of Central and South America Oil Pipeline Infrastructure Market, By Application, 2021-2029 (USD Million)

117 Rest of Central and South America Oil Pipeline Infrastructure Market, By Operation, 2021-2029 (USD Million)

118 Rest of Central and South America Oil Pipeline Infrastructure Market, By Diameter, 2021-2029 (USD Million)

119 Sinopec: Products & Services Offering

120 CNPC: Products & Services Offering

121 PetroChina: Products & Services Offering

122 Petrobras Bechtel: Products & Services Offering

123 National Oil Varco: Products & Services Offering

124 Europipe: Products & Services Offering

125 Jindal Group: Products & Services Offering

126 Welspun Corporation: Products & Services Offering

127 CRC Evans, Inc: Products & Services Offering

128 Exxon Mobil: Products & Services Offering

129 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Oil Pipeline Infrastructure Market Overview

2 Global Oil Pipeline Infrastructure Market Value From 2021-2029 (USD Mllion)

3 Global Oil Pipeline Infrastructure Market Share, By Application (2023)

4 Global Oil Pipeline Infrastructure Market Share, By Operation (2023)

5 Global Oil Pipeline Infrastructure Market Share, By Diameter (2023)

6 Global Oil Pipeline Infrastructure Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Oil Pipeline Infrastructure Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Oil Pipeline Infrastructure Market

11 Impact Of Challenges On The Global Oil Pipeline Infrastructure Market

12 Porter’s Five Forces Analysis

13 Global Oil Pipeline Infrastructure Market: By ApplicationScope Key Takeaways

14 Global Oil Pipeline Infrastructure Market, By Application Segment: Revenue Growth Analysis

15 Onshore Market, By Region, 2021-2029 (USD Mllion)

16 Offshore Market, By Region, 2021-2029 (USD Mllion)

17 Global Oil Pipeline Infrastructure Market: By Operation Scope Key Takeaways

18 Global Oil Pipeline Infrastructure Market, By Operation Segment: Revenue Growth Analysis

19 Transmission Market, By Region, 2021-2029 (USD Mllion)

20 Gathering Market, By Region, 2021-2029 (USD Mllion)

21 Global Oil Pipeline Infrastructure Market: By Diameter Scope Key Takeaways

22 Global Oil Pipeline Infrastructure Market, By Diameter Segment: Revenue Growth Analysis

23 ≤8 Inch Market, By Region, 2021-2029 (USD Mllion)

24 >8-24 Inch Market, By Region, 2021-2029 (USD Mllion)

25 >24 Inch Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Oil Pipeline Infrastructure Market: Regional Analysis

28 North America Oil Pipeline Infrastructure Market Overview

29 North America Oil Pipeline Infrastructure Market, By Application

30 North America Oil Pipeline Infrastructure Market, By Operation

31 North America Oil Pipeline Infrastructure Market, By Diameter

32 North America Oil Pipeline Infrastructure Market, By Country

33 U.S. Oil Pipeline Infrastructure Market, By Application

34 U.S. Oil Pipeline Infrastructure Market, By Operation

35 U.S. Oil Pipeline Infrastructure Market, By Diameter

36 Canada Oil Pipeline Infrastructure Market, By Application

37 Canada Oil Pipeline Infrastructure Market, By Operation

38 Canada Oil Pipeline Infrastructure Market, By Diameter

39 Mexico Oil Pipeline Infrastructure Market, By Application

40 Mexico Oil Pipeline Infrastructure Market, By Operation

41 Mexico Oil Pipeline Infrastructure Market, By Diameter

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 Sinopec: Company Snapshot

45 Sinopec: SWOT Analysis

46 Sinopec: Geographic Presence

47 CNPC: Company Snapshot

48 CNPC: SWOT Analysis

49 CNPC: Geographic Presence

50 PetroChina: Company Snapshot

51 PetroChina: SWOT Analysis

52 PetroChina: Geographic Presence

53 Petrobras Bechtel: Company Snapshot

54 Petrobras Bechtel: Swot Analysis

55 Petrobras Bechtel: Geographic Presence

56 National Oil Varco: Company Snapshot

57 National Oil Varco: SWOT Analysis

58 National Oil Varco: Geographic Presence

59 Europipe: Company Snapshot

60 Europipe: SWOT Analysis

61 Europipe: Geographic Presence

62 Jindal Group : Company Snapshot

63 Jindal Group : SWOT Analysis

64 Jindal Group : Geographic Presence

65 Welspun Corporation: Company Snapshot

66 Welspun Corporation: SWOT Analysis

67 Welspun Corporation: Geographic Presence

68 CRC Evans, Inc.: Company Snapshot

69 CRC Evans, Inc.: SWOT Analysis

70 CRC Evans, Inc.: Geographic Presence

71 Exxon Mobil: Company Snapshot

72 Exxon Mobil: SWOT Analysis

73 Exxon Mobil: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Oil Pipeline Infrastructure Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oil Pipeline Infrastructure Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS