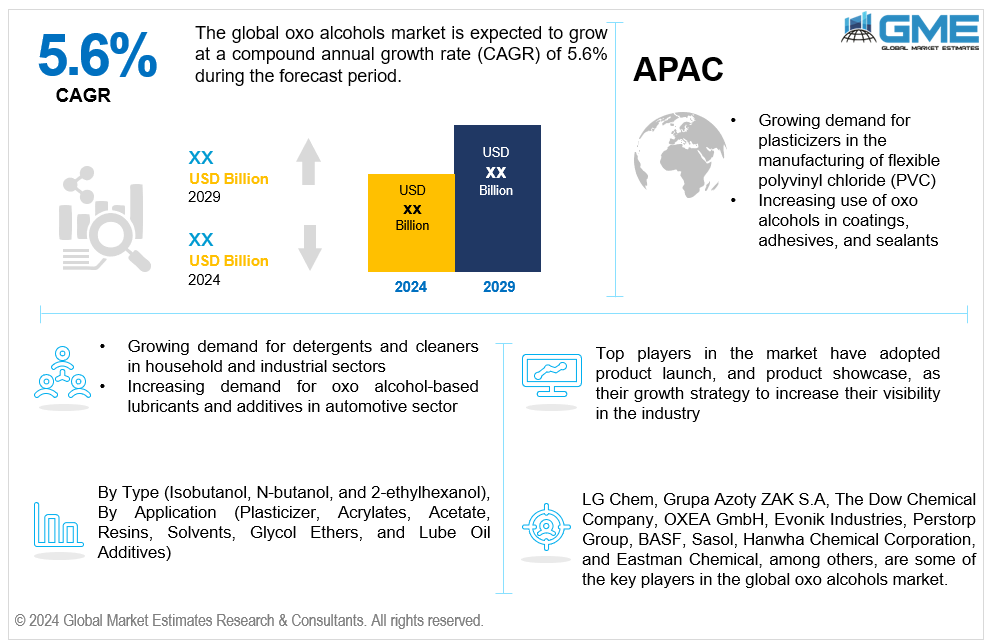

Global Oxo Alcohols Market Size, Trends & Analysis - Forecasts to 2029 By Type (Isobutanol, N-butanol, and 2-ethylhexanol), By Application (Plasticizer, Acrylates, Acetate, Resins, Solvents, Glycol Ethers, and Lube Oil Additives), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global oxo alcohols market is estimated to exhibit a CAGR of 5.6% from 2024 to 2029.

The primary factors propelling the market growth are the growing demand for plasticizers in the manufacturing of flexible polyvinyl chloride (PVC) and the increasing use of oxo alcohols in coatings, adhesives, and sealants. The oxo alcohol manufacturing process involves hydroformylation, followed by hydrogenation, producing key compounds such as n-butanol and 2-ethylhexanol, essential in plasticizer production. The rise in oxo alcohol production correlates with increasing applications in coatings, adhesives, and lubricants. Diverse oxo alcohol applications further include as versatile solvents in coatings, plasticizers, and detergents. Analyzing oxo alcohol market trends reveals a shift towards eco-friendly production methods. The surging oxo alcohol demand is evident in regions with burgeoning construction and automotive sectors. Lastly, oxo alcohol pricing is influenced by feedstock costs, regulatory policies, and supply-demand dynamics. The overall market growth reflects these interconnected factors, indicating a robust expansion trajectory.

The growing demand for detergents and cleaners in household and industrial sectors, along with the increasing demand for oxo alcohol-based lubricants and additives in the automotive sector, are expected to support the oxo alcohol market growth. The production of detergents relies heavily on oxo alcohol derivatives like linear alcohols, which are key ingredients in surfactants. As oxo alcohol consumption increases with the rising need for effective cleaning solutions, there is a notable shift in oxo alcohol supply chain dynamics to meet this demand. Oxo alcohol market analysis highlights how these trends drive expansion in production capacity and innovation. Oxo alcohol trade dynamics also reflect the global trade flow adjustments to align with increasing consumption. Observing oxo alcohol industry trends reveals advancements in formulations and eco-friendly options. The oxo alcohol market forecast suggests continued growth driven by these factors, underscoring the crucial role of oxo alcohols in meeting the evolving demands of the cleaning industry.

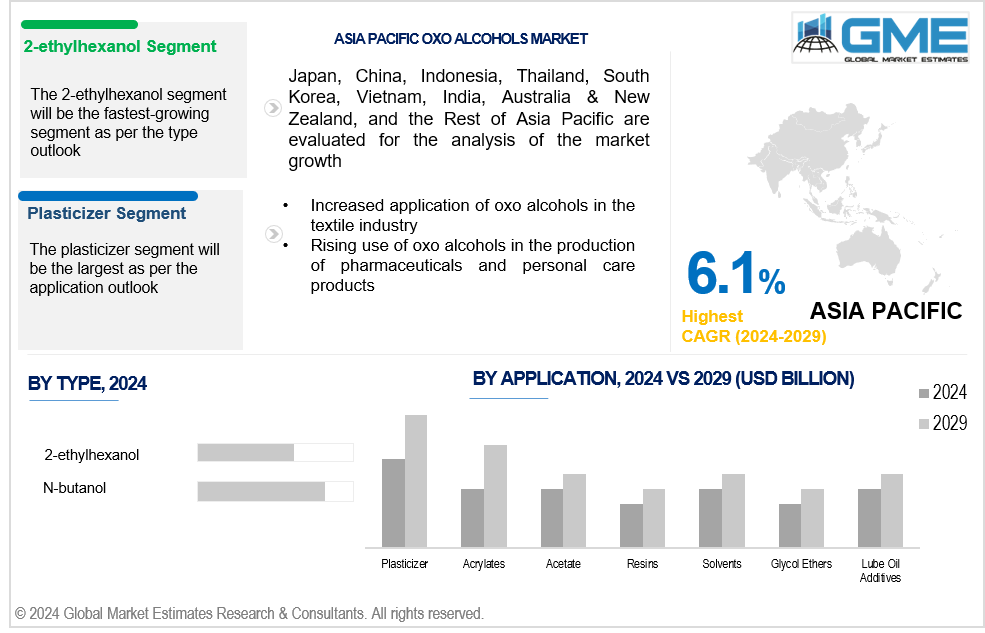

Increased application of oxo alcohols in the textile industry, coupled with the rising use of oxo alcohols in the production of pharmaceuticals and personal care products, propel market growth. Pharmaceuticals and personal care products require high-purity oxo alcohols, which are essential for formulating active ingredients and additives. Increased demand in these oxo alcohol end-use sectors is stimulating growth in oxo alcohol plant capacity to meet the needs of the pharmaceutical and personal care industries. The oxo alcohol raw materials used in these sectors include n-butanol and isobutanol, which are key to creating effective formulations. Additionally, managing oxo alcohol by-products efficiently is crucial to maintaining sustainability. The oxo alcohol export-import dynamics reflect this growing demand, influencing global trade patterns. Comprehensive oxo alcohol global market analysis shows an upward trend in market growth due to these factors, with advancements in production technologies driving future expansion.

There is a growing focus on sustainable and eco-friendly chemical processes, including the production of oxo alcohols. This trend opens up new product opportunities in the industry and aligns with global environmental aims. Additionally, novel and high-performing oxo alcohol derivatives can be made possible by developments in formulation technology. These developments can meet changing demands in the personal care and pharmaceutical industries.

However, stringent environmental regulations and sustainability mandates and the fluctuations in the prices of raw materials like propylene and syngas may impede market growth.

The n-butanol segment is expected to hold the largest share of the market over the forecast period. Several sectors, such as adhesives, coatings, and medicines, employ n-butanol extensively. Its dominance in the oxo alcohols industry can be attributed to its adaptability and efficacy in a range of applications.

The 2-ethylhexanol segment is expected to be the fastest-growing segment in the market from 2024 to 2029. 2-ethylhexanol is a key component in creating plasticizers, which are required to produce flexible PVC. The 2-ethylhexanol market is expanding quickly due to the growing usage of flexible materials in automotive and construction applications.

The plasticizer segment is expected to hold the largest share of the market over the forecast period. Plasticizers are essential to producing flexible polyvinyl chloride (PVC), especially those generated from oxo alcohols. Since PVC is widely used in consumer products, automobiles, and construction, plasticizers will continue to dominate the market.

The acrylates segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Oxo alcohols are the source of acrylates, which are employed in adhesives increasingly due to their strong bonding abilities and adaptability. The construction and packaging industries are driving the adhesive industry, which is expanding and supporting the acrylates segment's rapid growth.

North America is expected to be the largest region in the global market. The region benefits from sophisticated infrastructure and chemical industrial technology. This capacity supports the expansion of the oxo alcohol industry in North America by improving production efficiency and innovation in formulations.

Asia Pacific is anticipated to witness rapid growth during the forecast period. With so many residential and infrastructural projects, the Asia Pacific region's construction sector is witnessing rapid expansion, which drives up demand for oxo alcohols, which are utilized in adhesives, coatings, and building materials.

LG Chem, Grupa Azoty ZAK S.A, The Dow Chemical Company, OXEA GmbH, Evonik Industries, Perstorp Group, BASF, Sasol, Hanwha Chemical Corporation, and Eastman Chemical, among others, are some of the key players in the global oxo alcohols market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL OXO ALCOHOLS MARKET, BY Type

4.1 Introduction

4.2 Oxo Alcohols Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Isobutanol

4.4.1 Isobutanol Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 N-butanol

4.5.1 N-butanol Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 2-ethylhexanol

4.6.1 2-ethylhexanol Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL OXO ALCOHOLS MARKET, BY APPLICATION

5.1 Introduction

5.2 Oxo Alcohols Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Plasticizer

5.4.1 Plasticizer Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Acrylates

5.5.1 Acrylates Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Acetate

5.6.1 Acetate Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Resins

5.7.1 Resins Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Solvents

5.8.1 Solvents Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Glycol Ethers

5.9.1 Glycol Ethers Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Lube Oil Additives

5.10.1 Lube Oil Additives Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL OXO ALCOHOLS MARKET, BY REGION

6.1 Introduction

6.2 North America Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Oxo Alcohols Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 LG Chem

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Grupa Azoty ZAK S.A

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 The Dow Chemical Company

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 OXEA GmbH

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Evonik Industries

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 PERSTORP GROUP

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 BASF

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Sasol

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Hanwha Chemical Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Eastman Chemical

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

2 Isobutanol Market, By Region, 2021-2029 (USD Mllion)

3 N-butanol Market, By Region, 2021-2029 (USD Mllion)

4 2-ethylhexanol Market, By Region, 2021-2029 (USD Mllion)

5 Global Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

6 Plasticizer Market, By Region, 2021-2029 (USD Mllion)

7 Acrylates Market, By Region, 2021-2029 (USD Mllion)

8 Acetate Market, By Region, 2021-2029 (USD Mllion)

9 Resins Market, By Region, 2021-2029 (USD Mllion)

10 Solvents Market, By Region, 2021-2029 (USD Mllion)

11 Glycol Ethers Market, By Region, 2021-2029 (USD Mllion)

12 Lube Oil Additives Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

15 North America Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

16 North America Oxo Alcohols Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

18 U.S. Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

19 Canada Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

20 Canada Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

21 Mexico Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

22 Mexico Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

23 Europe Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

24 Europe Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

25 EUROPE Oxo Alcohols Market, By COUNTRY, 2021-2029 (USD Mllion)

26 Germany Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

27 Germany Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

28 U.K. Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

29 U.K. Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

30 France Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

31 France Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

32 Italy Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

33 Italy Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

34 Spain Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

35 Spain Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

36 Netherlands Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

37 Netherlands Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

38 Rest Of Europe Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

39 Rest Of Europe Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

40 Asia Pacific Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

41 Asia Pacific Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

42 ASIA PACIFIC Oxo Alcohols Market, By COUNTRY, 2021-2029 (USD Mllion)

43 China Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

44 China Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

45 Japan Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

46 Japan Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

47 India Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

48 India Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

49 South Korea Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

50 South Korea Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

51 Singapore Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

52 Singapore Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

53 Thailand Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

54 Thailand Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

55 Malaysia Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

56 Malaysia Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

57 Indonesia Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

58 Indonesia Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

59 Vietnam Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

60 Vietnam Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

61 Taiwan Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

62 Taiwan Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

63 Rest of APAC Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

64 Rest of APAC Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

65 Middle East and Africa Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

66 Middle East and Africa Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

67 MIDDLE EAST & AFRICA Oxo Alcohols Market, By COUNTRY, 2021-2029 (USD Mllion)

68 Saudi Arabia Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

69 Saudi Arabia Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

70 UAE Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

71 UAE Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

72 Israel Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

73 Israel Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

74 South Africa Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

75 South Africa Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

78 Central and South America Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

79 Central and South America Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

80 CENTRAL AND SOUTH AMERICA Oxo Alcohols Market, By COUNTRY, 2021-2029 (USD Mllion)

81 Brazil Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

82 Brazil Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

83 Chile Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

84 Chile Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

85 Argentina Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

86 Argentina Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Oxo Alcohols Market, By Type, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Oxo Alcohols Market, By Application, 2021-2029 (USD Mllion)

89 LG Chem: Products & Services Offering

90 Grupa Azoty ZAK S.A: Products & Services Offering

91 The Dow Chemical Company: Products & Services Offering

92 OXEA GmbH: Products & Services Offering

93 Evonik Industries: Products & Services Offering

94 PERSTORP GROUP: Products & Services Offering

95 BASF: Products & Services Offering

96 Sasol: Products & Services Offering

97 Hanwha Chemical Corporation, Inc: Products & Services Offering

98 Eastman Chemical: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Oxo Alcohols Market Overview

2 Global Oxo Alcohols Market Value From 2021-2029 (USD Mllion)

3 Global Oxo Alcohols Market Share, By Type (2023)

4 Global Oxo Alcohols Market Share, By Application (2023)

5 Global Oxo Alcohols Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Oxo Alcohols Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Oxo Alcohols Market

10 Impact Of Challenges On The Global Oxo Alcohols Market

11 Porter’s Five Forces Analysis

12 Global Oxo Alcohols Market: By Type Scope Key Takeaways

13 Global Oxo Alcohols Market, By Type Segment: Revenue Growth Analysis

14 Isobutanol Market, By Region, 2021-2029 (USD Mllion)

15 N-butanol Market, By Region, 2021-2029 (USD Mllion)

16 2-ethylhexanol Market, By Region, 2021-2029 (USD Mllion)

17 Global Oxo Alcohols Market: By Application Scope Key Takeaways

18 Global Oxo Alcohols Market, By Application Segment: Revenue Growth Analysis

19 Plasticizer Market, By Region, 2021-2029 (USD Mllion)

20 Acrylates Market, By Region, 2021-2029 (USD Mllion)

21 Acetate Market, By Region, 2021-2029 (USD Mllion)

22 Resins Market, By Region, 2021-2029 (USD Mllion)

23 Solvents Market, By Region, 2021-2029 (USD Mllion)

24 Glycol Ethers Market, By Region, 2021-2029 (USD Mllion)

25 Lube Oil Additives Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Oxo Alcohols Market: Regional Analysis

28 North America Oxo Alcohols Market Overview

29 North America Oxo Alcohols Market, By Type

30 North America Oxo Alcohols Market, By Application

31 North America Oxo Alcohols Market, By Country

32 U.S. Oxo Alcohols Market, By Type

33 U.S. Oxo Alcohols Market, By Application

34 Canada Oxo Alcohols Market, By Type

35 Canada Oxo Alcohols Market, By Application

36 Mexico Oxo Alcohols Market, By Type

37 Mexico Oxo Alcohols Market, By Application

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 LG Chem: Company Snapshot

41 LG Chem: SWOT Analysis

42 LG Chem: Geographic Presence

43 Grupa Azoty ZAK S.A: Company Snapshot

44 Grupa Azoty ZAK S.A: SWOT Analysis

45 Grupa Azoty ZAK S.A: Geographic Presence

46 The Dow Chemical Company: Company Snapshot

47 The Dow Chemical Company: SWOT Analysis

48 The Dow Chemical Company: Geographic Presence

49 OXEA GmbH: Company Snapshot

50 OXEA GmbH: Swot Analysis

51 OXEA GmbH: Geographic Presence

52 Evonik Industries: Company Snapshot

53 Evonik Industries: SWOT Analysis

54 Evonik Industries: Geographic Presence

55 PERSTORP GROUP: Company Snapshot

56 PERSTORP GROUP: SWOT Analysis

57 PERSTORP GROUP: Geographic Presence

58 BASF : Company Snapshot

59 BASF : SWOT Analysis

60 BASF : Geographic Presence

61 Sasol: Company Snapshot

62 Sasol: SWOT Analysis

63 Sasol: Geographic Presence

64 Hanwha Chemical Corporation, Inc.: Company Snapshot

65 Hanwha Chemical Corporation, Inc.: SWOT Analysis

66 Hanwha Chemical Corporation, Inc.: Geographic Presence

67 Eastman Chemical: Company Snapshot

68 Eastman Chemical: SWOT Analysis

69 Eastman Chemical: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Oxo Alcohols Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Oxo Alcohols Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS