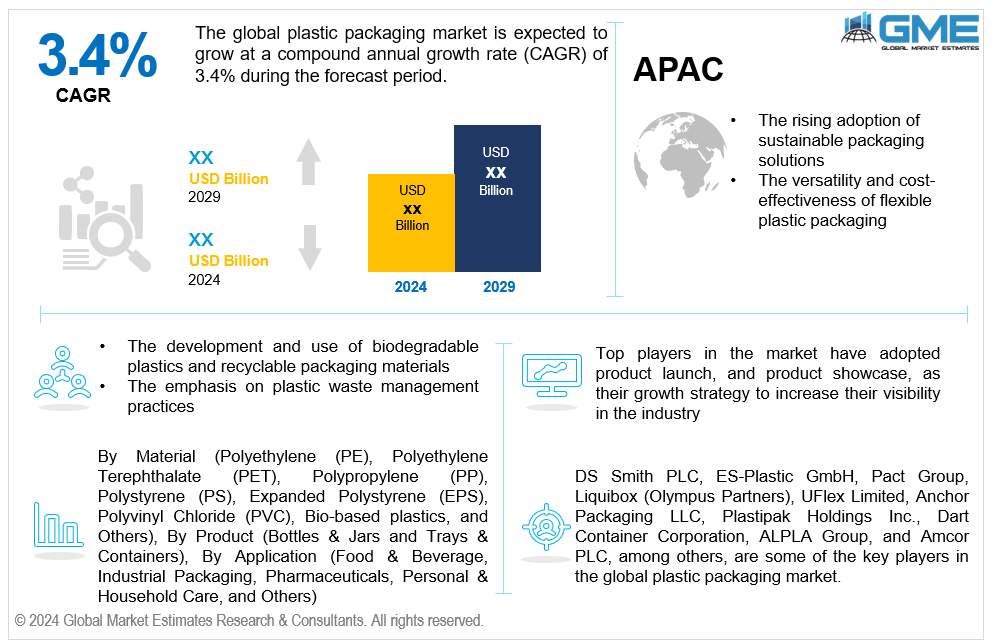

Global Plastic Packaging Market Size, Trends & Analysis - Forecasts to 2029 By Material (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Expanded Polystyrene (EPS), Polyvinyl Chloride (PVC), Bio-based plastics, and Others), By Product (Bottles & Jars and Trays & Containers), By Application (Food & Beverage, Industrial Packaging, Pharmaceuticals, Personal & Household Care, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global plastic packaging market is estimated to exhibit a CAGR of 3.4% from 2024 to 2029.

The primary factors propelling the market growth are the rising adoption of sustainable packaging solutions and the versatility and cost-effectiveness of flexible plastic packaging. Flexible packaging's adaptability makes it suitable for various products, mainly benefiting the food packaging industry by extending shelf life and ensuring product safety. Unlike rigid plastic containers, flexible options often require less material and energy to produce, reducing costs and environmental impact. This affordability and functionality align with current plastic packaging trends, where manufacturers and consumers favor practical and sustainable solutions. The packaging industry growth is bolstered by this demand, as flexible packaging caters to diverse consumer packaging preferences, including convenience and ease of use. Thus, the market's growth is driven by the ongoing transition to more effective and adaptable packaging alternatives, emphasizing the function of flexible plastic in addressing changing demands and spurring innovation. For instance, according to the Flexible Packaging Association, the flexible packaging industry generated USD 42.9 billion in sales in the United States in 2022.

The development and use of biodegradable plastics and recyclable packaging materials, along with the emphasis on plastic waste management practices, are expected to support the market growth. With rising awareness about environmental issues, plastic packaging manufacturers are adopting sustainable practices to align with single-use plastics regulations and reduce waste. These regulations are prompting packaging design innovations to create more eco-friendly options. As a result, the market is witnessing a surge in smart packaging technologies, which enhance recyclability and track environmental impact. The growing market demand for plastic packaging is being met with solutions that prioritize waste reduction and sustainability. This shift is encouraging the development of advanced materials and processes that minimize waste, fostering a more responsible packaging industry.

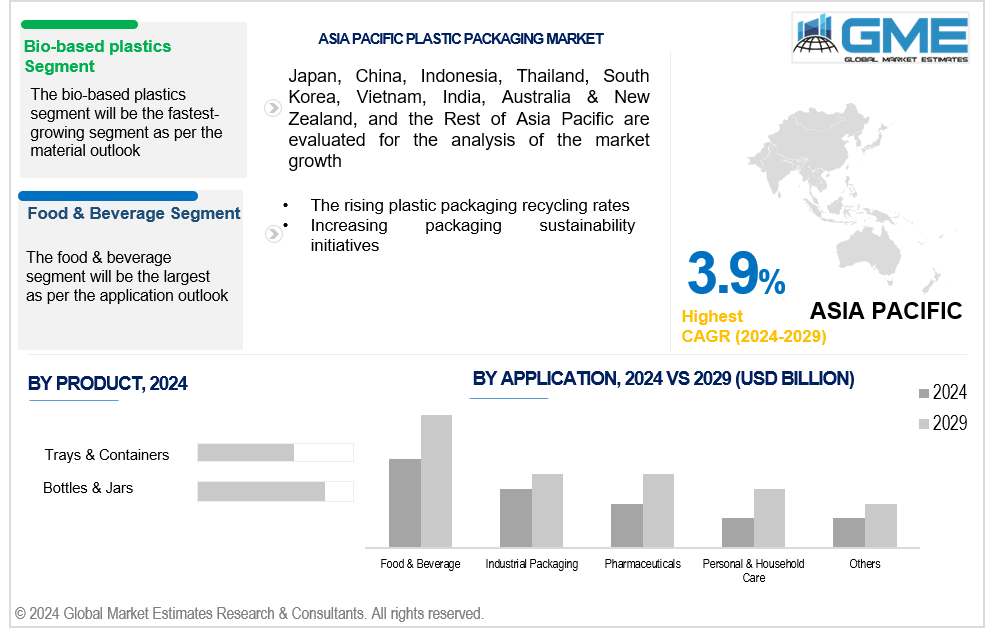

The rising plastic packaging recycling rates, coupled with the increasing packaging sustainability initiatives, propel market growth. Growing recycling rates are becoming important as governments and consumers call for more environmentally friendly alternatives. A thorough packaging market analysis demonstrates this change by pointing out that consumers are becoming increasingly interested in packaging solutions that use recycled materials. Manufacturers are able to exceed customer expectations and regulatory obligations by incorporating more recycled content into their products due to improved recycling infrastructure and technology.

RFID tags, QR codes, and NFC are examples of technology that can be integrated into plastic packaging to improve supply chain transparency, customer interaction, and product monitoring while opening up new business opportunities. Additionally, the development of cutting-edge plastic materials with improved barrier qualities can extend the shelf life and improve product safety, especially for packaged items in the food and beverage sector. This can create opportunities for premium packaging solutions.

However, the presence of eco-friendly packaging alternatives and the environmental impact of plastics may impede market growth during the forecast period.

The polyethylene terephthalate (PET) segment is expected to hold the largest share of the market over the forecast period. PET is a popular material for beverage packaging, particularly for soft drinks and water, due to its superior strength, clarity, and low weight. The rising global consumption of bottled drinks fuels the need for PET packaging.

The bio-based plastics segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Sustainable packaging solutions are in high demand due to growing environmental consciousness and the damaging effects of conventional plastics on the environment. Plastics made from renewable resources, or bio-based materials, are more environmentally benign than those made from petroleum.

The bottles & jars segment is expected to hold the largest share of the market over the forecast period. In numerous sectors, such as food, beverages, personal care, medicines, and home goods, bottles and jars are vital packaging options. Their wide variety of applications and adaptability help them maintain a substantial market share.

The trays & containers segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Trays and containers are becoming increasingly necessary as the demand for convenience foods, ready-to-eat meals, and takeout services rises. These products are perfect for packing snacks, cooked meals, and other food items that need to be packaged securely and with a high level of durability.

The food & beverage segment is expected to hold the largest share of the market over the forecast period. Due to shifting lifestyles, urbanization, and rising disposable incomes, there is an increasing demand for packaged foods and beverages worldwide. This industry extensively uses plastic packaging due to its adaptability, affordability, and capacity to maintain product freshness.

The personal & household care segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Innovations and new product launches occur often in the personal and home care sectors. To draw in consumers, companies constantly create new formulas and package styles, which increases the demand for adaptable and creative plastic packaging solutions.

North America is expected to be the largest region in the global market. The need for dependable and protected packaging solutions has grown significantly as a result of North America's e-commerce industry's explosive growth, and this demand is fueling the market's growth. With its strength and low weight, plastic packaging is perfect for transporting various goods, including food and drink, electronics, and personal hygiene products.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific's food and beverage market is expanding quickly due to shifting consumer preferences for packaged beverages, processed and convenience meals, and altering eating patterns. This sector relies heavily on plastic packaging due to its cost-effectiveness, adaptability, and capacity to prolong shelf life.

DS Smith PLC, ES-Plastic GmbH, Pact Group, Liquibox (Olympus Partners), UFlex Limited, Anchor Packaging LLC, Plastipak Holdings Inc., Dart Container Corporation, ALPLA Group, and Amcor PLC, among others, are some of the key players in the global plastic packaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2023, Greif Inc., a U.S.-based company that offers industrial packaging products and services, paid USD 538 billion to acquire IPACKCHEM Group SAS, a France-based producer of barrier and non-barrier jerrycans and small plastic containers. This acquisition allowed Greif Inc. to expand its product line horizontally.

In February 2023, in response to the growing need for recycled plastic, NOVA Chemical Corporation announced the formation of NOVA Circular Solutions, which would concentrate on recycled solutions. The company wants to produce recycled plastic solutions and use its resources and technological expertise to support the circular economy.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL PLASTIC PACKAGING MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL PLASTIC PACKAGING MARKET, BY MATERIAL

4.1 Introduction

4.2 Plastic Packaging Market: Material Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Polyethylene (PE)

4.4.1 Polyethylene (PE) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Polyethylene Terephthalate (PET)

4.5.1 Polyethylene Terephthalate (PET) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Polypropylene (PP)

4.6.1 Polypropylene (PP) Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Polystyrene (PS)

4.7.1 Polystyrene (PS) Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Expanded Polystyrene (EPS)

4.8.1 Expanded Polystyrene (EPS) Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Polyvinyl Chloride (PVC)

4.9.1 Polyvinyl Chloride (PVC) Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Bio-based plastics

4.10.1 Bio-based plastics Market Estimates and Forecast, 2021-2029 (USD Million)

4.11 Others

4.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL PLASTIC PACKAGING MARKET, BY APPLICATION

5.1 Introduction

5.2 Plastic Packaging Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Food & Beverage

5.4.1 Food & Beverage Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Industrial Packaging

5.5.1 Industrial Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Pharmaceuticals

5.6.1 Pharmaceuticals Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Personal & Household Care

5.7.1 Personal & Household Care Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL PLASTIC PACKAGING MARKET, BY PRODUCT

6.1 Introduction

6.2 Plastic Packaging Market: Product Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Bottles & Jars

6.4.1 Bottles & Jars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Trays & Containers

6.5.1 Trays & Containers Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL PLASTIC PACKAGING MARKET, BY REGION

7.1 Introduction

7.2 North America Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Material

7.2.2 By Application

7.2.3 By Product

7.2.4 By Country

7.2.4.1 U.S. Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Material

7.2.4.1.2 By Application

7.2.4.1.3 By Product

7.2.4.2 Canada Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Material

7.2.4.2.2 By Application

7.2.4.2.3 By Product

7.2.4.3 Mexico Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Material

7.2.4.3.2 By Application

7.2.4.3.3 By Product

7.3 Europe Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Material

7.3.2 By Application

7.3.3 By Product

7.3.4 By Country

7.3.4.1 Germany Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Material

7.3.4.1.2 By Application

7.3.4.1.3 By Product

7.3.4.2 U.K. Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Material

7.3.4.2.2 By Application

7.3.4.2.3 By Product

7.3.4.3 France Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Material

7.3.4.3.2 By Application

7.3.4.3.3 By Product

7.3.4.4 Italy Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Material

7.3.4.4.2 By Application

7.2.4.4.3 By Product

7.3.4.5 Spain Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Material

7.3.4.5.2 By Application

7.2.4.5.3 By Product

7.3.4.6 Netherlands Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Material

7.3.4.6.2 By Application

7.2.4.6.3 By Product

7.3.4.7 Rest of Europe Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Material

7.3.4.7.2 By Application

7.2.4.7.3 By Product

7.4 Asia Pacific Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Material

7.4.2 By Application

7.4.3 By Product

7.4.4 By Country

7.4.4.1 China Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Material

7.4.4.1.2 By Application

7.4.4.1.3 By Product

7.4.4.2 Japan Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Material

7.4.4.2.2 By Application

7.4.4.2.3 By Product

7.4.4.3 India Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Material

7.4.4.3.2 By Application

7.4.4.3.3 By Product

7.4.4.4 South Korea Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Material

7.4.4.4.2 By Application

7.4.4.4.3 By Product

7.4.4.5 Singapore Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Material

7.4.4.5.2 By Application

7.4.4.5.3 By Product

7.4.4.6 Malaysia Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Material

7.4.4.6.2 By Application

7.4.4.6.3 By Product

7.4.4.7 Thailand Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Material

7.4.4.7.2 By Application

7.4.4.7.3 By Product

7.4.4.8 Indonesia Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Material

7.4.4.8.2 By Application

7.4.4.8.3 By Product

7.4.4.9 Vietnam Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Material

7.4.4.9.2 By Application

7.4.4.9.3 By Product

7.4.4.10 Taiwan Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Material

7.4.4.10.2 By Application

7.4.4.10.3 By Product

7.4.4.11 Rest of Asia Pacific Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Material

7.4.4.11.2 By Application

7.4.4.11.3 By Product

7.5 Middle East and Africa Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Material

7.5.2 By Application

7.5.3 By Product

7.5.4 By Country

7.5.4.1 Saudi Arabia Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Material

7.5.4.1.2 By Application

7.5.4.1.3 By Product

7.5.4.2 U.A.E. Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Material

7.5.4.2.2 By Application

7.5.4.2.3 By Product

7.5.4.3 Israel Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Material

7.5.4.3.2 By Application

7.5.4.3.3 By Product

7.5.4.4 South Africa Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Material

7.5.4.4.2 By Application

7.5.4.4.3 By Product

7.5.4.5 Rest of Middle East and Africa Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Material

7.5.4.5.2 By Application

7.5.4.5.2 By Product

7.6 Central and South America Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Material

7.6.2 By Application

7.6.3 By Product

7.6.4 By Country

7.6.4.1 Brazil Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Material

7.6.4.1.2 By Application

7.6.4.1.3 By Product

7.6.4.2 Argentina Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Material

7.6.4.2.2 By Application

7.6.4.2.3 By Product

7.6.4.3 Chile Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Material

7.6.4.3.2 By Application

7.6.4.3.3 By Product

7.6.4.4 Rest of Central and South America Plastic Packaging Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Material

7.6.4.4.2 By Application

7.6.4.4.3 By Product

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 DS Smith PLC

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 ES-Plastic GmbH

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Pact Group

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Liquibox (Olympus Partners)

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 UFlex Limited

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 ANCHOR PACKAGING LLC

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Plastipak Holdings Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Dart Container Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 ALPLA Group

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Amcor PLC

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Plastic Packaging Market, By Material, 2021-2029 (USD Mllion)

2 Polyethylene (PE) Market, By Region, 2021-2029 (USD Mllion)

3 Polyethylene Terephthalate (PET) Market, By Region, 2021-2029 (USD Mllion)

4 Polypropylene (PP) Market, By Region, 2021-2029 (USD Mllion)

5 Polystyrene (PS) Market, By Region, 2021-2029 (USD Mllion)

6 Expanded Polystyrene (EPS) Market, By Region, 2021-2029 (USD Mllion)

7 Polyvinyl Chloride (PVC) Market, By Region, 2021-2029 (USD Mllion)

8 BIO-BASED PLASTICS MARKET, BY REGION, 2021-2029 (USD MLLION)

9 OTHERS MARKET, BY REGION, 2021-2029 (USD MLLION)

10 Global Plastic Packaging Market, By Application, 2021-2029 (USD Mllion)

11 Food & Beverage Market, By Region, 2021-2029 (USD Mllion)

12 Industrial Packaging Market, By Region, 2021-2029 (USD Mllion)

13 Pharmaceuticals Market, By Region, 2021-2029 (USD Mllion)

14 Personal & Household Care Market, By Region, 2021-2029 (USD Mllion)

15 Others Market, By Region, 2021-2029 (USD Mllion)

16 Global Plastic Packaging Market, By Product, 2021-2029 (USD Mllion)

17 Bottles & Jars Market, By Region, 2021-2029 (USD Mllion)

18 Trays & Containers Market, By Region, 2021-2029 (USD Mllion)

19 Regional Analysis, 2021-2029 (USD Mllion)

20 North America Plastic Packaging Market, By Material, 2021-2029 (USD Million)

21 North America Plastic Packaging Market, By Application, 2021-2029 (USD Million)

22 North America Plastic Packaging Market, By Product, 2021-2029 (USD Million)

23 North America Plastic Packaging Market, By Country, 2021-2029 (USD Million)

24 U.S. Plastic Packaging Market, By Material, 2021-2029 (USD Million)

25 U.S. Plastic Packaging Market, By Application, 2021-2029 (USD Million)

26 U.S. Plastic Packaging Market, By Product, 2021-2029 (USD Million)

27 Canada Plastic Packaging Market, By Material, 2021-2029 (USD Million)

28 Canada Plastic Packaging Market, By Application, 2021-2029 (USD Million)

29 Canada Plastic Packaging Market, By Product, 2021-2029 (USD Million)

30 Mexico Plastic Packaging Market, By Material, 2021-2029 (USD Million)

31 Mexico Plastic Packaging Market, By Application, 2021-2029 (USD Million)

32 Mexico Plastic Packaging Market, By Product, 2021-2029 (USD Million)

33 Europe Plastic Packaging Market, By Material, 2021-2029 (USD Million)

34 Europe Plastic Packaging Market, By Application, 2021-2029 (USD Million)

35 Europe Plastic Packaging Market, By Product, 2021-2029 (USD Million)

36 Europe Plastic Packaging Market, By Country 2021-2029 (USD Million)

37 Germany Plastic Packaging Market, By Material, 2021-2029 (USD Million)

38 Germany Plastic Packaging Market, By Application, 2021-2029 (USD Million)

39 Germany Plastic Packaging Market, By Product, 2021-2029 (USD Million)

40 U.K. Plastic Packaging Market, By Material, 2021-2029 (USD Million)

41 U.K. Plastic Packaging Market, By Application, 2021-2029 (USD Million)

42 U.K. Plastic Packaging Market, By Product, 2021-2029 (USD Million)

43 France Plastic Packaging Market, By Material, 2021-2029 (USD Million)

44 France Plastic Packaging Market, By Application, 2021-2029 (USD Million)

45 France Plastic Packaging Market, By Product, 2021-2029 (USD Million)

46 Italy Plastic Packaging Market, By Material, 2021-2029 (USD Million)

47 Italy Plastic Packaging Market, By application, 2021-2029 (USD Million)

48 Italy Plastic Packaging Market, By Product, 2021-2029 (USD Million)

49 Spain Plastic Packaging Market, By Material, 2021-2029 (USD Million)

50 Spain Plastic Packaging Market, By Application, 2021-2029 (USD Million)

51 Spain Plastic Packaging Market, By Product, 2021-2029 (USD Million)

52 Netherlands Plastic Packaging Market, By Material, 2021-2029 (USD Million)

53 Netherlands Plastic Packaging Market, By Application, 2021-2029 (USD Million)

54 Netherlands Plastic Packaging Market, By Product, 2021-2029 (USD Million)

55 Rest Of Europe Plastic Packaging Market, By Material, 2021-2029 (USD Million)

56 Rest Of Europe Plastic Packaging Market, By Application, 2021-2029 (USD Million)

57 Rest of Europe Plastic Packaging Market, By Product, 2021-2029 (USD Million)

58 Asia Pacific Plastic Packaging Market, By Material, 2021-2029 (USD Million)

59 Asia Pacific Plastic Packaging Market, By Application, 2021-2029 (USD Million)

60 Asia Pacific Plastic Packaging Market, By Product, 2021-2029 (USD Million)

61 Asia Pacific Plastic Packaging Market, By Country, 2021-2029 (USD Million)

62 China Plastic Packaging Market, By Material, 2021-2029 (USD Million)

63 China Plastic Packaging Market, By Application, 2021-2029 (USD Million)

64 China Plastic Packaging Market, By Product, 2021-2029 (USD Million)

65 India Plastic Packaging Market, By Material, 2021-2029 (USD Million)

66 India Plastic Packaging Market, By Application, 2021-2029 (USD Million)

67 India Plastic Packaging Market, By Product, 2021-2029 (USD Million)

68 Japan Plastic Packaging Market, By Material, 2021-2029 (USD Million)

69 Japan Plastic Packaging Market, By Application, 2021-2029 (USD Million)

70 Japan Plastic Packaging Market, By Product, 2021-2029 (USD Million)

71 South Korea Plastic Packaging Market, By Material, 2021-2029 (USD Million)

72 South Korea Plastic Packaging Market, By Application, 2021-2029 (USD Million)

73 South Korea Plastic Packaging Market, By Product, 2021-2029 (USD Million)

74 malaysia Plastic Packaging Market, By Material, 2021-2029 (USD Million)

75 malaysia Plastic Packaging Market, By Application, 2021-2029 (USD Million)

76 malaysia Plastic Packaging Market, By Product, 2021-2029 (USD Million)

77 Thailand Plastic Packaging Market, By Material, 2021-2029 (USD Million)

78 Thailand Plastic Packaging Market, By Application, 2021-2029 (USD Million)

79 Thailand Plastic Packaging Market, By Product, 2021-2029 (USD Million)

80 Indonesia Plastic Packaging Market, By Material, 2021-2029 (USD Million)

81 Indonesia Plastic Packaging Market, By Application, 2021-2029 (USD Million)

82 Indonesia Plastic Packaging Market, By Product, 2021-2029 (USD Million)

83 Vietnam Plastic Packaging Market, By Material, 2021-2029 (USD Million)

84 Vietnam Plastic Packaging Market, By Application, 2021-2029 (USD Million)

85 Vietnam Plastic Packaging Market, By Product, 2021-2029 (USD Million)

86 Taiwan Plastic Packaging Market, By Material, 2021-2029 (USD Million)

87 Taiwan Plastic Packaging Market, By Application, 2021-2029 (USD Million)

88 Taiwan Plastic Packaging Market, By Product, 2021-2029 (USD Million)

89 Rest of Asia Pacific Plastic Packaging Market, By Material, 2021-2029 (USD Million)

90 Rest of Asia Pacific Plastic Packaging Market, By Application, 2021-2029 (USD Million)

91 Rest of Asia Pacific Plastic Packaging Market, By Product, 2021-2029 (USD Million)

92 Middle East and Africa Plastic Packaging Market, By Material, 2021-2029 (USD Million)

93 Middle East and Africa Plastic Packaging Market, By Application, 2021-2029 (USD Million)

94 Middle East and Africa Plastic Packaging Market, By Product, 2021-2029 (USD Million)

95 Middle East and Africa Plastic Packaging Market, By Country, 2021-2029 (USD Million)

96 Saudi Arabia Plastic Packaging Market, By Material, 2021-2029 (USD Million)

97 Saudi Arabia Plastic Packaging Market, By Application, 2021-2029 (USD Million)

98 Saudi Arabia Plastic Packaging Market, By Product, 2021-2029 (USD Million)

99 UAE Plastic Packaging Market, By Material, 2021-2029 (USD Million)

100 UAE Plastic Packaging Market, By Application, 2021-2029 (USD Million)

101 UAE Plastic Packaging Market, By Product, 2021-2029 (USD Million)

102 Israel Plastic Packaging Market, By Material, 2021-2029 (USD Million)

103 Israel Plastic Packaging Market, By Application, 2021-2029 (USD Million)

104 Israel Plastic Packaging Market, By Product, 2021-2029 (USD Million)

105 South Africa Plastic Packaging Market, By Material, 2021-2029 (USD Million)

106 South Africa Plastic Packaging Market, By Application, 2021-2029 (USD Million)

107 South Africa Plastic Packaging Market, By Product, 2021-2029 (USD Million)

108 Rest of Middle East and Africa Plastic Packaging Market, By Material, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Plastic Packaging Market, By Application, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Plastic Packaging Market, By Product, 2021-2029 (USD Million)

111 Central and South America Plastic Packaging Market, By Material, 2021-2029 (USD Million)

112 Central and South America Plastic Packaging Market, By Application, 2021-2029 (USD Million)

113 Central and South America Plastic Packaging Market, By Product, 2021-2029 (USD Million)

114 Central and South America Plastic Packaging Market, By Country, 2021-2029 (USD Million)

115 Brazil Plastic Packaging Market, By Material, 2021-2029 (USD Million)

116 Brazil Plastic Packaging Market, By Application, 2021-2029 (USD Million)

117 Brazil Plastic Packaging Market, By Product, 2021-2029 (USD Million)

118 Argentina Plastic Packaging Market, By Material, 2021-2029 (USD Million)

119 Argentina Plastic Packaging Market, By Application, 2021-2029 (USD Million)

120 Argentina Plastic Packaging Market, By Product, 2021-2029 (USD Million)

121 Chile Plastic Packaging Market, By Material, 2021-2029 (USD Million)

122 Chile Plastic Packaging Market, By Application, 2021-2029 (USD Million)

123 Chile Plastic Packaging Market, By Product, 2021-2029 (USD Million)

124 Rest of Central and South America Plastic Packaging Market, By Material, 2021-2029 (USD Million)

125 Rest of Central and South America Plastic Packaging Market, By Application, 2021-2029 (USD Million)

126 Rest of Central and South America Plastic Packaging Market, By Product, 2021-2029 (USD Million)

127 DS Smith PLC: Products & Services Offering

128 ES-Plastic GmbH: Products & Services Offering

129 Pact Group: Products & Services Offering

130 Liquibox (Olympus Partners): Products & Services Offering

131 UFlex Limited: Products & Services Offering

132 ANCHOR PACKAGING LLC: Products & Services Offering

133 Plastipak Holdings Inc.: Products & Services Offering

134 Dart Container Corporation: Products & Services Offering

135 ALPLA Group, Inc: Products & Services Offering

136 Amcor PLC: Products & Services Offering

137 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Plastic Packaging Market Overview

2 Global Plastic Packaging Market Value From 2021-2029 (USD Mllion)

3 Global Plastic Packaging Market Share, By Material (2023)

4 Global Plastic Packaging Market Share, By Application (2023)

5 Global Plastic Packaging Market Share, By Product (2023)

6 Global Plastic Packaging Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Plastic Packaging Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Plastic Packaging Market

11 Impact Of Challenges On The Global Plastic Packaging Market

12 Porter’s Five Forces Analysis

13 Global Plastic Packaging Market: By Material Scope Key Takeaways

14 Global Plastic Packaging Market, By Material Segment: Revenue Growth Analysis

15 Polyethylene (PE) Market, By Region, 2021-2029 (USD Mllion)

16 Polyethylene Terephthalate (PET) Market, By Region, 2021-2029 (USD Mllion)

17 Polypropylene (PP) Market, By Region, 2021-2029 (USD Mllion)

18 Polystyrene (PS) Market, By Region, 2021-2029 (USD Mllion)

19 Expanded Polystyrene (EPS) Market, By Region, 2021-2029 (USD Mllion)

20 Polyvinyl Chloride (PVC) Market, By Region, 2021-2029 (USD Mllion)

21 Bio-based plastics Market, By Region, 2021-2029 (USD Mllion)

22 Others Market, By Region, 2021-2029 (USD Mllion)

23 Global Plastic Packaging Market: By Application Scope Key Takeaways

24 Global Plastic Packaging Market, By Application Segment: Revenue Growth Analysis

25 Food & Beverage Market, By Region, 2021-2029 (USD Mllion)

26 Industrial Packaging Market, By Region, 2021-2029 (USD Mllion)

27 Pharmaceuticals Market, By Region, 2021-2029 (USD Mllion)

28 Personal & Household Care Market, By Region, 2021-2029 (USD Mllion)

29 Others Market, By Region, 2021-2029 (USD Mllion)

30 Global Plastic Packaging Market: By Product Scope Key Takeaways

31 Global Plastic Packaging Market, By Product Segment: Revenue Growth Analysis

32 Bottles & Jars Market, By Region, 2021-2029 (USD Mllion)

33 Trays & Containers Market, By Region, 2021-2029 (USD Mllion)

34 Regional Segment: Revenue Growth Analysis

35 Global Plastic Packaging Market: Regional Analysis

36 North America Plastic Packaging Market Overview

37 North America Plastic Packaging Market, By Material

38 North America Plastic Packaging Market, By Application

39 North America Plastic Packaging Market, By Product

40 North America Plastic Packaging Market, By Country

41 U.S. Plastic Packaging Market, By Material

42 U.S. Plastic Packaging Market, By Application

43 U.S. Plastic Packaging Market, By Product

44 Canada Plastic Packaging Market, By Material

45 Canada Plastic Packaging Market, By Application

46 Canada Plastic Packaging Market, By Product

47 Mexico Plastic Packaging Market, By Material

48 Mexico Plastic Packaging Market, By Application

49 Mexico Plastic Packaging Market, By Product

50 Four Quadrant Positioning Matrix

51 Company Market Share Analysis

52 DS Smith PLC: Company Snapshot

53 DS Smith PLC: SWOT Analysis

54 DS Smith PLC: Geographic Presence

55 ES-Plastic GmbH: Company Snapshot

56 ES-Plastic GmbH: SWOT Analysis

57 ES-Plastic GmbH: Geographic Presence

58 Pact Group: Company Snapshot

59 Pact Group: SWOT Analysis

60 Pact Group: Geographic Presence

61 Liquibox (Olympus Partners): Company Snapshot

62 Liquibox (Olympus Partners): Swot Analysis

63 Liquibox (Olympus Partners): Geographic Presence

64 UFlex Limited: Company Snapshot

65 UFlex Limited: SWOT Analysis

66 UFlex Limited: Geographic Presence

67 ANCHOR PACKAGING LLC: Company Snapshot

68 ANCHOR PACKAGING LLC: SWOT Analysis

69 ANCHOR PACKAGING LLC: Geographic Presence

70 Plastipak Holdings Inc. : Company Snapshot

71 Plastipak Holdings Inc. : SWOT Analysis

72 Plastipak Holdings Inc. : Geographic Presence

73 Dart Container Corporation: Company Snapshot

74 Dart Container Corporation: SWOT Analysis

75 Dart Container Corporation: Geographic Presence

76 ALPLA Group, Inc.: Company Snapshot

77 ALPLA Group, Inc.: SWOT Analysis

78 ALPLA Group, Inc.: Geographic Presence

79 Amcor PLC: Company Snapshot

80 Amcor PLC: SWOT Analysis

81 Amcor PLC: Geographic Presence

82 Other Companies: Company Snapshot

83 Other Companies: SWOT Analysis

84 Other Companies: Geographic Presence

The Global Plastic Packaging Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Plastic Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS