Global Private Label Food and Beverage Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Private Label Food, Private Label Beverage), By Distribution Channel (Supermarkets And Hypermarkets, Convenience Stores, Cash & Carries & Warehouse Clubs, Dollar Stores, Variety Stores & General Merchandise Retailers, Food & Drink Specialists, Department Stores, E-Retailers, Others), By Application (Offline, Online), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Private-label goods are those that are made in one country but marketed under the label of a different nation. The distributor is primarily responsible for the product's labeling and packaging. This model has been broadly embraced these days, with several local, native, and independent participants attempting to penetrate the food and beverage industry. These items are commonly used in a variety of businesses, including beverages, food, and cosmetics. In comparison to other brands, they are reasonably priced. The internet is among the most effective ways to find these items.

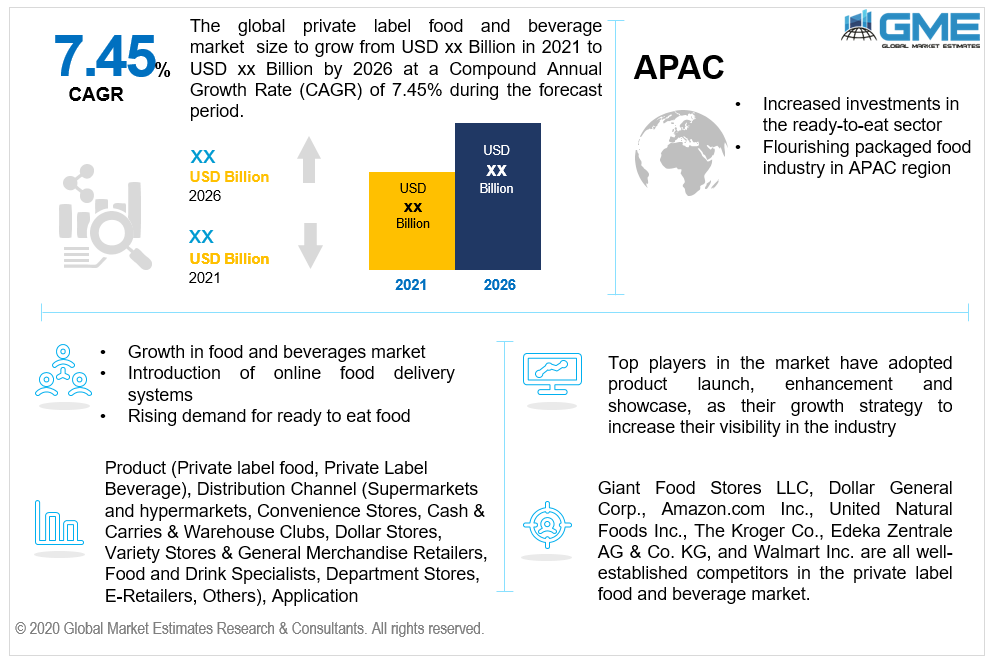

The global private label food and beverage industry is projected to expand significantly shortly, owing to a growing number of competitive private label participants in the ready-to-eat meals and nutritious snacks business segments around the globe.

Foodservice, production, hospitality, food processing, and agriculture services fall under the umbrella of the food and beverage sector. Over the projected timeframe, the introduction of online food delivery systems is predicted to be the most commonly adopted distribution mechanism in the global F&B sector.

Numerous nonprofit organizations, like The Council of Better Business Bureaus (CBBB) in Virginia, are anticipated to take proactive steps to boost the sector's development. CBBB's innovative marketing pledges for eleven food and beverage firms to monitor child's food preferences as a result of advertising's after-effects are predicted to change people's food choices over the projected timeline.

The private label food and beverage industry is anticipated to expand significantly due to an increase in demand for ready-to-eat foods, which will drive the growth of the manufacturing industry, particularly in the Asia Pacific region. The millennial generation, who are between the ages of 18 and 35, is a major force behind the rise of the ready-to-eat food industry. Individuals' fast-paced lives in advanced and emerging countries have resulted in a preference among the working class for easy-to-eat food items over traditional meat.

To keep up with already existing F&B labels internationally, private label food and beverage producers are forced to concentrate on "on-the-go" food items and expand the online retail business. Over the projected timeframe, usage of flexible packaging options like wraps, pouches, films, and contractual packaging by private label industry participants is anticipated to help in a drastic transition in consumers from branded to private label food items.

Furthermore, people's approval of private label items is influenced by their freshness, particularly in the case of dairy, poultry, and meat. Increasing customer awareness of a product's quality than its name has also contributed to the industry's growing trend in purchases of private label foods and drinks. The increasing presence of e-grocery shops is fueling development in the private label food and beverage industry. These channels are launching private-label food brands at low costs that are compatible with customers' budgets.

As a result of the COVID-19 lockdown forcing a vast number of people to sit at home, demand for ready-to-eat foods has skyrocketed. For the private label food and beverage industry, this factor may be a demand amplifier.

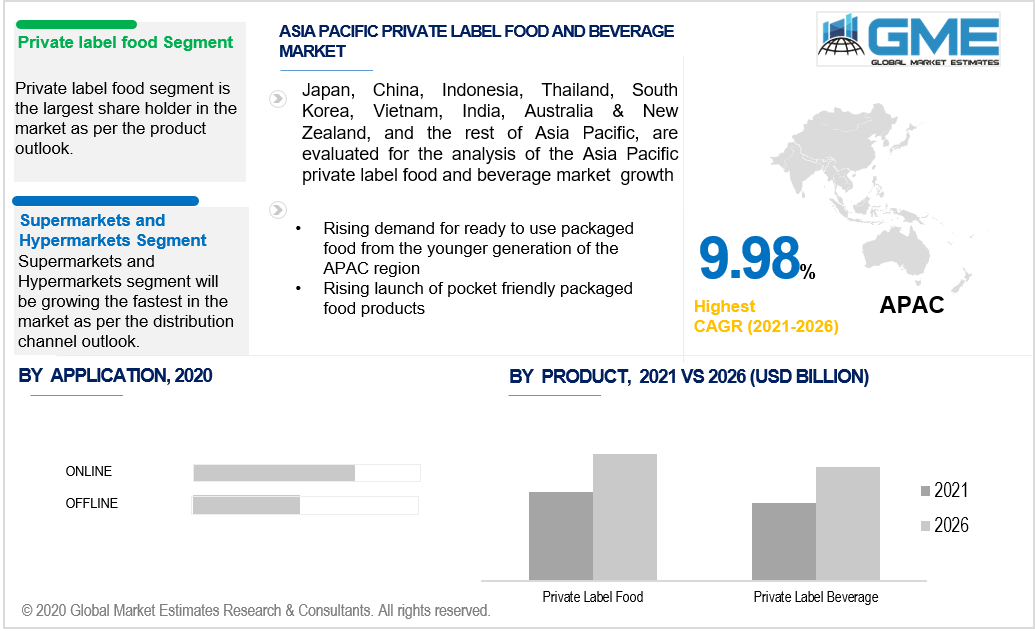

The private label food segment as per the product outlook is anticipated to lead the market growth during the projected timeframe. As a result of the pandemic, the market for essential grocery products such as flour, pasta, and rice, as well as meat products and snacks, has risen. Several supermarket stores have seen a significant rise in revenue over this period, and some have seen private label development outpace that of packaged brands. Local producers in the breakfast, snacks, frozen food and shelf-stable product markets witnessed growth as customers spent more time at the house. The growing quality and understanding of private labels, affordable pricing, and the variety of products offered are all contributing factors. As the stay-at-home guideline allows people to extend their culinary participation and get the pleasure of eating out at home, the ready-to-cook foods market is witnessing rapid development.

Supermarkets and hypermarkets are leading the private label food and beverage market during the projected timeframe. Private label development has been strong in hypermarkets and supermarkets across FMCG segments such as personal care, household care, and food and beverage. Shopping experiences, price discounts, instant grocery purchases, and the choice of a broad variety of items in a single store are all factors behind the growth of this distribution channel.

With the proliferation of the online food delivery network in the global food and beverage market shortly, online applications are expected to expand at the highest rate during the projected timeframe. Online sales have been boosted by the relentless rise in smartphones and broadband penetration, particularly in emerging countries. Various grocery items, such as chocolate, cookies, liquid milk, and chips/crisps, have seen significant increases in online sales around the globe. Moreover, as Generation Z and millennial customers get more comfortable with digital shopping, the sector's rise in the private label food and beverage industry has accelerated.

Due to increased investments in the ready-to-eat sector in the area, Asia Pacific will be the fastest-growing regional segment in the private label food and beverage market during the projected timeframe. Furthermore, the younger generation has embraced the on-the-go food trend to a large degree. As a result, the private label food and beverage industry may see significant development as a result of this factor. North America will be the largest shareholder with consistent growth and expansion during the forecast period.

Dollar General Corp., Giant Food Stores LLC, Amazon Inc., Walmart Inc., The Kroger Co., United Natural Foods Inc., Edeka Zentrale AG & Co. KG are all well-established competitors in the private label food and beverage market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2019, Amazon launched new private label milk under the Happy Belly product segment, as well as a new coconut water line under the Solimo brand name. This milk is lactose-free, low-fat, and fat-free. The key goal of the launch was to satisfy the growing demand for private-label goods among consumers.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Private Label Food & Beverage Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Distribution Channel Overview

2.1.6 Regional Overview

Chapter 3 Private Label Food & Beverage Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Distribution Channel Advancement in Food Testing and Packaged Food Production

3.3.2 Industry Challenges

3.3.2.1 Lack of Adequate Food Production Infrastructure in Developing Nations

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Distribution Channel Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Private Label Food & Beverage Market, By Product

4.1 Product Outlook

4.2 Private Label Food

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Private Label Beverage

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Private Label Food & Beverage Market, By Application

5.1 Application Outlook

5.2 Offline

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Online

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Private Label Food & Beverage Market, By Distribution Channel

6.1 Supermarkets and Hypermarkets

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Convenience Stores

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Cash & Carries & Warehouse Clubs

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Dollar Stores

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Food and Drink Specialists

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Variety Stores & General Merchandise Retailers

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Department Stores

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

6.8 E-Retailers

6.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Private Label Food & Beverage Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Product, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.4.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Product, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Product, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Product, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Product, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Dollar General Corp

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Giant Food Stores LLC

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Amazon Inc

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Walmart

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 The Kroger Co.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 United Natural Foods Inc

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Edeka Zentrale AG & Co. KG

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Other Companies

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

The Global Private Label Food and Beverage Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Private Label Food and Beverage Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS