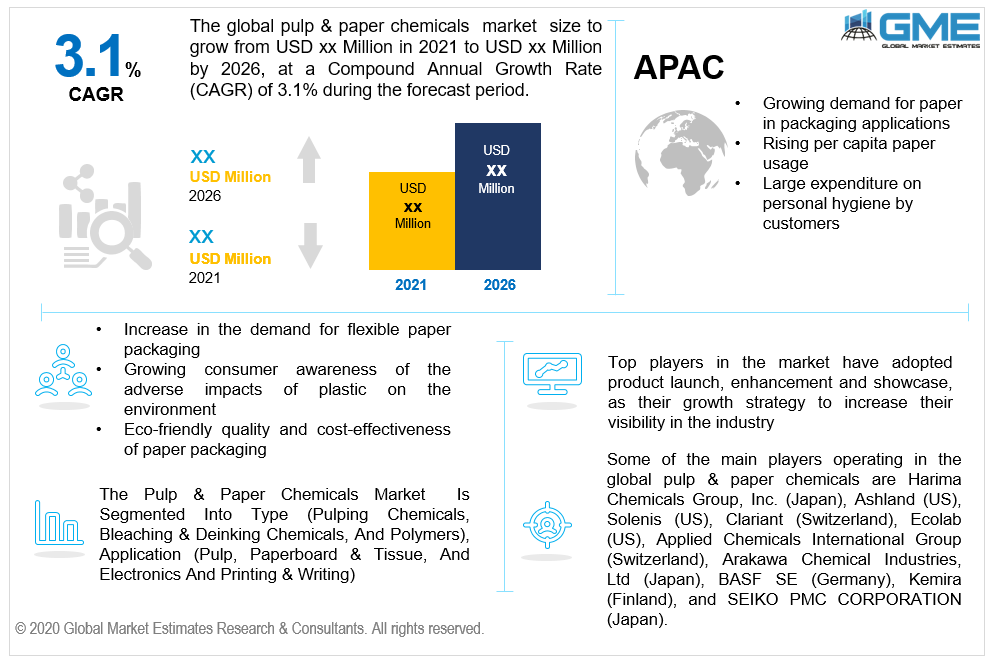

Global Pulp & Paper Chemicals Market Size, Trends, and Analysis- Forecasts To 2026 By Type (Pulping Chemicals, Bleaching & Deinking Chemicals, And Polymers), By Application (Pulp, Paperboard & Tissue; Electronics & Printing; and Writing), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Categorized under the section of specialty chemicals, pulp and paper chemicals majorly used in the papermaking process, from pulp processing to finished paper. These chemicals are used to help refine the paper manufacturing process and achieve desirable paper properties such as size, strength, and brightness while decreasing production costs.

The market is largely led by rising interest for flexible paper packaging, attributed to the rising user awareness of the adverse impacts of plastic on the environment, as well as the eco-friendly quality and cost-effectiveness of paper packaging. Inserts and dividers, wrapping paper, cartons, display packaging, corrugated boxes, tapes and labels, cups and trays, paper sacks and bags, and clamshells are examples of flexible and rigid paper packaging formats. From the point of production to the final customer, packaging plays an essential role in protecting products from harm.

Growing urbanization and middle-class population in developing economies, like China, and Brazil, along with rising literacy rates, would generate a massive market for paper goods like newsprint, packaging, and writing paper.

In addition, shifting consumer preferences for convenient packaging options while keeping sustainability in mind would minimize the demand for plastic packaging, thus boosting the paper and paperboard sector. Because of the shortage or unavailability of raw materials, paper recycling is becoming a major trend in the paper and paper board sector. Most paper mills in both emerging and developed countries use recycled paper as their primary raw material.

However, the demand for paper and pulp processing chemicals is likely to be hindered as automation gradually has substituted print media and scholarly publications.

During the forecast period, pulp chemicals are anticipated to be the largest segment of the paper chemicals market by type. The demand for bleaching chemicals such as sodium chlorate, sodium bisulfide, chlorine oxide, and hydrogen peroxide is accelerating the segment's development. Bleaching agents such as ozone and oxygen are already being used, which is anticipated to boost the segment over the forecast period. The demand for pulp chemicals is projected to be driven by capacity expansions by pulp suppliers in Europe, APAC and South America in the global paper and pulp chemicals market.

By application, the global pulp and paper chemicals market has been categorized into pulp, paperboard & tissue, and electronics and printing & writing. With a larger share, the writing and printing application leads the segment, followed by labeling. Another market holding a significant share of the market is the packaging category. Cups, cigarettes and filters, bags, corrugated board, composite containers and tubes, disposables (non-wovens), envelopes, labels/signs/decals, film: film and film: foil laminates, flexible packaging, remoistenable goods, carton side seams and closures, and specialty packaging are some of the applications. Almost all industrial goods are sold in packages, either for storage and shipping safety or for aesthetic purposes, leading to substantial growth over the forecast period. Paper products are mostly used in the publishing industry for writing, cardboards, brown paper, and other similar purposes. Several stages of pulp and paper production are used, and different chemicals are used at different stages. These additives improve the finished product's physical and chemical properties while also making the process easier and more cost-effective. The market for pulp and paper processing chemicals is projected to grow at a fast CAGR during the forecast period, owing to the demand for paper from different end-use sectors.

As a consequence of industrialization and urbanization in emerging economies such as China, India, and Southeast Asian nations, Asia-Pacific is analyzed to be the fastest growing segment in the global pulp and paper chemicals market. During the forecast period, growing demand for paper in packaging applications, as well as rising per capita paper usage and large expenditure on personal hygiene by customers in the region, is estimated to propel the demand for paper & pulp chemicals. Furthermore, the significant increase in e-commerce operations in the region, which is driving demand for paperboard packaging materials, is linked to the demand for paper and pulp processing chemicals in the region.

In terms of market share, North America is yet another attractive destination for pulp and paper chemicals; nevertheless, the regional market is projected to expand due to the mature paper industry and a shrinking print media market in the United States, which can be linked to the region's slowing growth of pulp and paper processing chemicals demand.

During the expected period, the Western European regional market is anticipated to develop moderately, while the Eastern European regional market is expected to grow significantly. The rising export of pulp and the growing recycling of paper in the European region can be contributed to the demand for pulp and paper processing chemicals in the region.

With increased urbanization and paper exports from the region, the Latin American market is projected to rise at a significant pace during the projected span. Because of the region's rapidly growing paper industry, the Middle East and African regional demand are projected to expand significantly.

Some of the main players operating in the global pulp & paper chemicals are Harima Chemicals Group, Inc., Ashland, Solenis, Clariant, Ecolab, Applied Chemicals International Group, Arakawa Chemical Industries, BASF SE, Kemira, and SEIKO PMC CORPORATION.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2018, Solenis and BASF agreed to merge BASF's paper and water chemicals companies to form a multinational specialty chemicals firm focused on consumers. Customers in two specialized chemical industries, paper technologies, and industrial water technology, will benefit from enhanced services and cost-effective solutions provided the Solenis brand.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Pulp and Paper Chemicals Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Pulp and Paper Chemicals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising interest for flexible paper packaging

3.3.1.2 Increasing user awareness of the adverse impacts of plastic on the environment

3.3.2 Industry Challenges

3.3.2.1 Gradual substitution of automation with print media and scholarly publications

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Pulp and Paper Chemicals Market, By Type

4.1 Type Outlook

4.2 Pulping Chemicals

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Bleaching & Deinking Chemicals

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Polymers

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Pulp and Paper Chemicals Market, By Application

5.1 Application Outlook

5.2 Pulp, Paperboard & Tissue

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Electronics & Printing

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Writing

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Pulp and Paper Chemicals Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Type, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Type, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Type, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Type, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Type, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Harima Chemicals Group, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Ashland

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Solenis

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Clariant

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Ecolab

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Applied Chemicals International Group

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Arakawa Chemical Industries

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 BASF SE

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 SEIKO PMC CORPORATION

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Pulp & Paper Chemicals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Pulp & Paper Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS