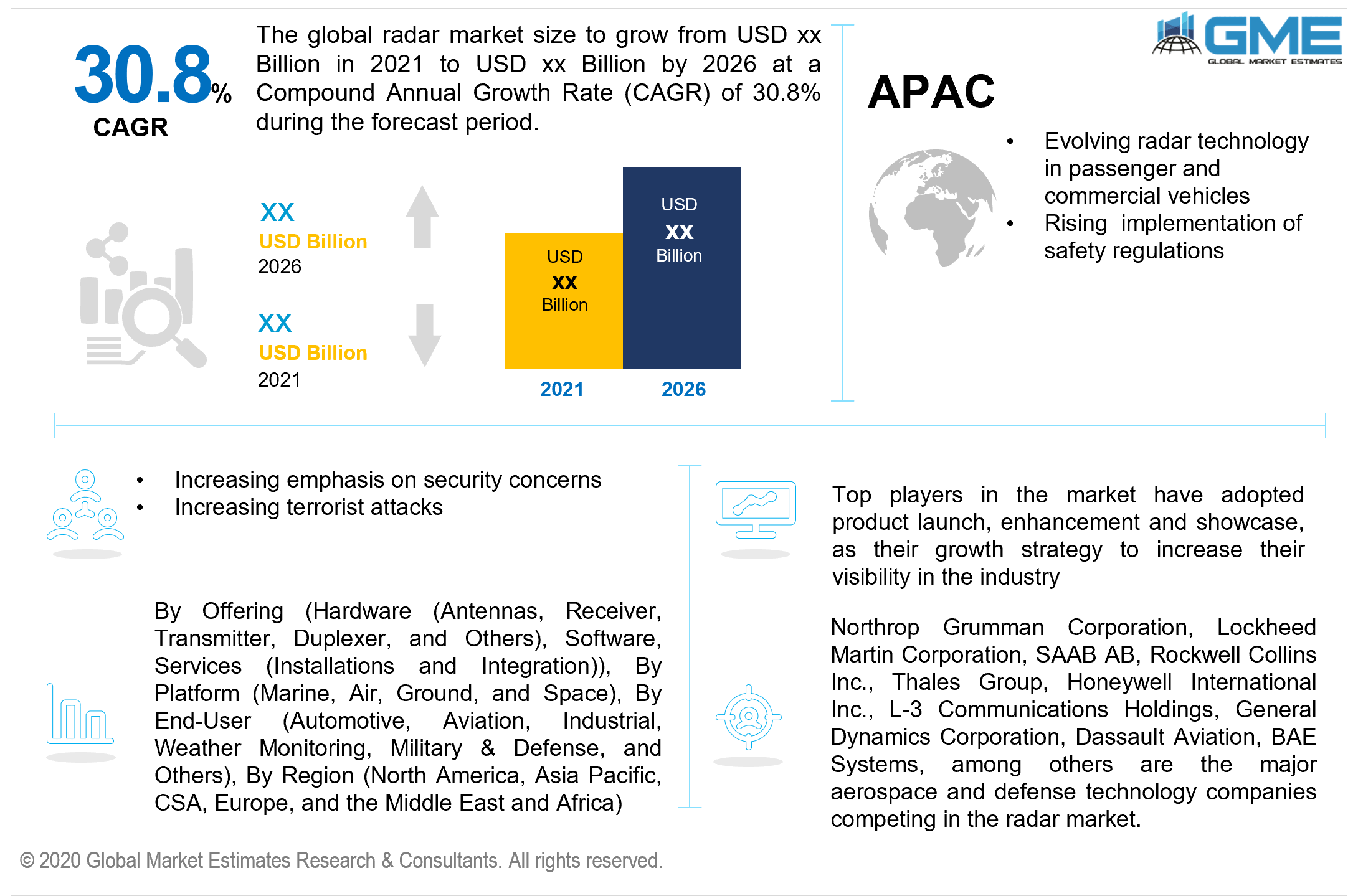

Global Radar Market Size, Trends, and Analysis - Forecasts To 2026 By Offering (Hardware (Antennas, Receiver, Transmitter, Duplexer, and Others), Software, and Services (Installations and Integration)), By Platform (Marine, Air, Ground, and Space), By End-User (Automotive, Aviation, Industrial, Weather Monitoring, Military & Defense, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The progressing security and protection objectives, as well as the growth of defense finances, are expected to propel market sales during the forecast period. Moreover, the expansion of new airports and docks globally is expected to considerably contribute to the overall growth of radar. The growing number of terrorist operations, inter-nation conflicts, and border invasions are all driving up demand for radar. The growth of global marine trade and the shipping of enormous amounts of goods is shifting the balance between supply and demand. Radar may be used to track these containers, which is foreseen to have a significant impact on the radar market growth.

Factors like augmenting technological advancements, increasing disposable income, growing safety and security concerns, new product developments, stringent government rules & regulations, increasing investments, increasing terrorist activities and conflicts, rising funding for research, growing complexity of industrial applications, rapid urbanization, global shift of technology, rising incorporation of radar technology on automobiles, speed & distance monitoring, growth in international maritime trade, and assistance in cruise control are all expected to increase demand for the radar market. The advent of Advanced Driver Assistance Systems (ADAS) in automobiles and electric vehicles is fueling market expansion even further. Moreover, features like flexible mounting, resistance to extreme weather conditions, low impact on the environment, and lower price & maintenance costs will further act as a demand expansion catalyst.

Some factors restrict or hinder the growth of the market, which include the unexpected changes in social, political, and economic circumstances, the declining volume of shipments, lack of knowledge, adverse climatic conditions, development of alternative technologies, high investment costs, restricted reimbursements, lack of training and the poor sensitivity of radar. However, the desire of economically developing countries for the integration of radar technology in numerous commercial and passenger vehicles is a significant factor driving the growth of the overall radar market. Furthermore, a spike in demand for high-end passenger vehicles, an upsurge in considerations regarding the vehicle and driver security, and the adoption of safety laws have all led to the evolution of the global radar market.

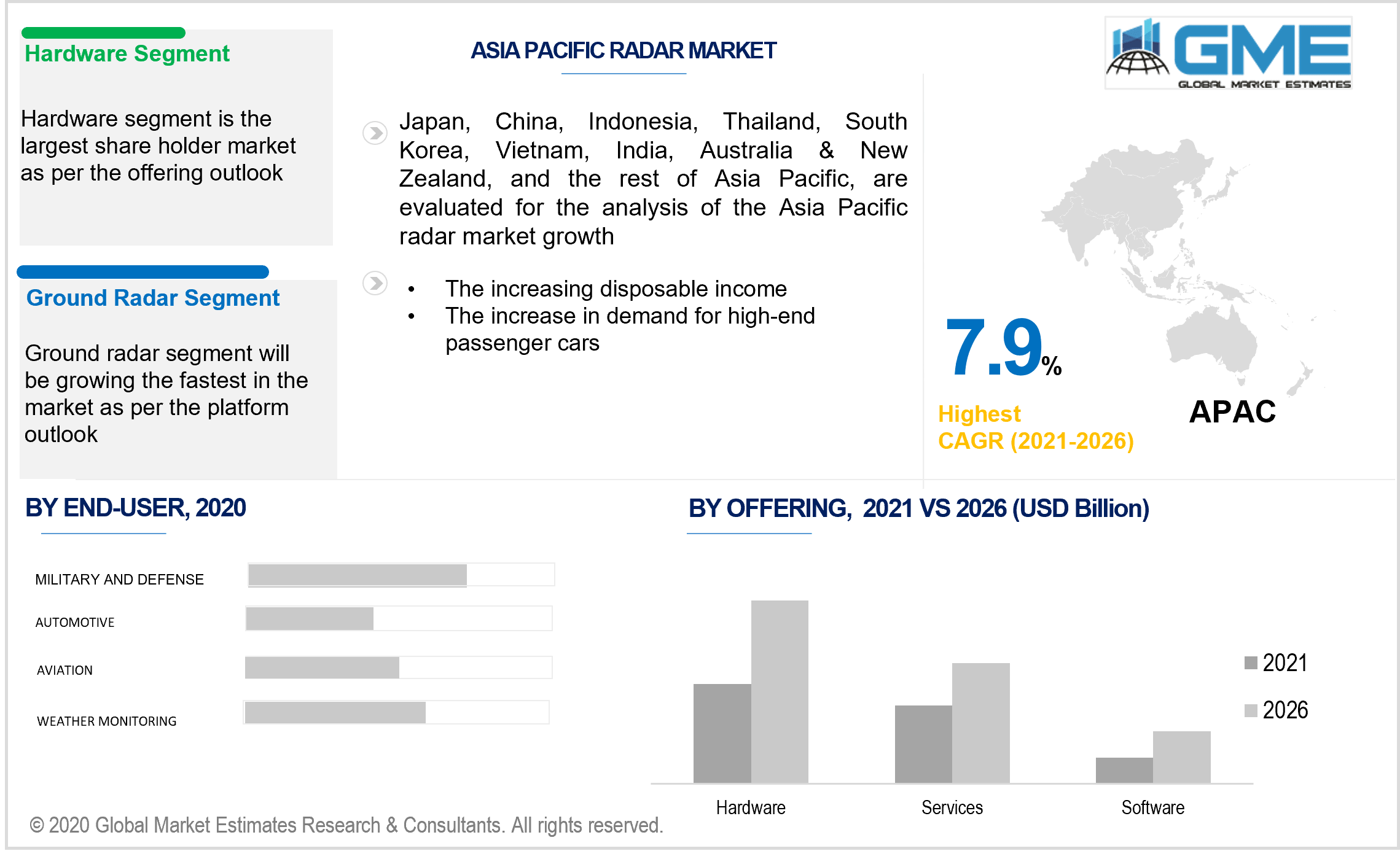

According to the offering segment, the market is categorized as hardware, software, and services. The category of the hardware is foreseen to be the largest shareholder. It has acquired the largest share in the market because of a variety of factors like higher efficacy and efficiency, high signal strength, performs multiple operations, increasing demand for digital signals, energy efficiency, improved performance, low price, high scalability, increasing deployment of radar systems, availability of computational support, availability in a variety of shapes and sizes, narrow spectrum, enhanced privacy and security, reduced interface, higher directivity, up-gradation of existing systems, higher gain and wide availability of technologically advanced products.

According to the platform analysis, the market is categorized as marine, air, ground, and space. The ground segment is predicted to be the market leader due to factors like the increasing need for strengthening cavalry units, enhanced security, ability to detect non-metallic materials, compatibility with line replace units, enhanced productivity, low consumption of power, elimination of health hazards, faster response time, global shift in-ground monitoring technology, low maintenance cost, capability to be deployed in the diversity of applications, higher reliability, accuracy, and durability, advanced features that enables wireless connection with larger surveillance area, the rising level of venture funding’s, innovative product launches, increased dynamic range, availability of depth estimates, easy to handle, and cost-efficient besides being highly preferred by the end-users.

According to the end-user analysis, the market is categorized as automotive, aviation, industrial, weather monitoring, military & defense, and others. The military & defense segment is predicted to be the largest shareholder in terms of revenue growth in the market due to increased military spending, availability of advanced infrastructure, all-weather day & night capability, multiple target handling, and engagement capability, ease to operate, latest product innovations, energy-efficient, complex design of functions, higher reliability, develops cost efficiencies, low manning requirements, growing safety and security concerns, and rising radar demand for specialized vehicles & airplanes. The requirement for detecting systems used for battlefield operations, fire control, Air Traffic Control (ATC), weaponry position determination, and vehicle search is driving the segment's expansion.

As per the geographical analysis, the market of the radar can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. The market for North America is presumed to be dominant due to the inclusion of a large proportion of key market players & industries, growing application of radar in the military sector, augmenting investments, presence of adequate reimbursement policies, increasing terrorist attacks, favorable government initiatives, rising nuclear bombing threats, increasing awareness, advancement in remote surveillance technology, strict regulations for environment conservation, presence of skilled professionals, increasing demand for high-end passenger cars, the increasing degree of research activity, faster acceptance amongst end-user industries, the continuous release of improved solutions, and the North America area being the core of innovations. However, the Asia Pacific region will grow the fastest due to the rising middle-class population, increasing growth opportunities, fast economic growth, and urbanization, improved manufacturing efficiencies, increasing radar technology adoption, increasing sea and training activities, upcoming remote surveillance projects, increasing investment in monitoring infrastructure, low labor cost, rising disposable income, and advancement in surveillance technology.

Northrop Grumman Corporation, Lockheed Martin Corporation, SAAB AB, Rockwell Collins Inc., Thales Group, Honeywell International Inc., L-3 Communications Holdings, General Dynamics Corporation, Dassault Aviation, BAE Systems, among others, are the major aerospace and defense technology companies competing in the radar market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Radar Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Platform Overview

2.1.4 End-User Overview

2.1.4 Regional Overview

Chapter 3 Radar Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rise in radar technology in passenger and commercial vehicles

3.3.1.2 The growth of the global radar industry

3.3.2 Industry Challenges

3.3.2.1 The adverse climatic conditions

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Platform Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Radar Market, By Offering

4.1 Offering Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Software

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Services

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Radar Market, By Platform

5.1 Platform Outlook

5.2 Marine

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Air

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Ground

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Space

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Radar Market, By End-User

6.1 Automotive

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Aviation

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Industrial

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Weather Monitoring

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Military & Defense

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

6.6 Others

6.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Radar Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Offering, 2019-2026 (USD Million)

7.2.3 Market Size, By Platform, 2019-2026 (USD Million)

7.2.4 Market Size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Platform, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Platform, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Offering, 2019-2026 (USD Million)

7.3.3 Market Size, By Platform, 2019-2026 (USD Million)

7.3.4 Market Size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Offering, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Platform, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Offering, 2019-2026 (USD Million)

7.4.3 Market Size, By Platform, 2019-2026 (USD Million)

7.4.4 Market Size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Platform, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Platform, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Platform, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.8.2 Market size, By Platform, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Offering, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Platform, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Offering, 2019-2026 (USD Million)

7.5.3 Market Size, By Platform, 2019-2026 (USD Million)

7.5.4 Market Size, By End-User, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Platform, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Platform, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Platform, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Offering, 2019-2026 (USD Million)

7.6.3 Market Size, By Platform, 2019-2026 (USD Million)

7.6.4 Market Size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Platform, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Platform, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Offering, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Platform, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Northrop Grumman Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Lockheed Martin Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 SAAB AB

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Rockwell Collins Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Thales Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Honeywell International Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 L-3 Communications Holdings

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 General Dynamics Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Dassault Aviation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 BAE Systems

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Radar Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Radar Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS