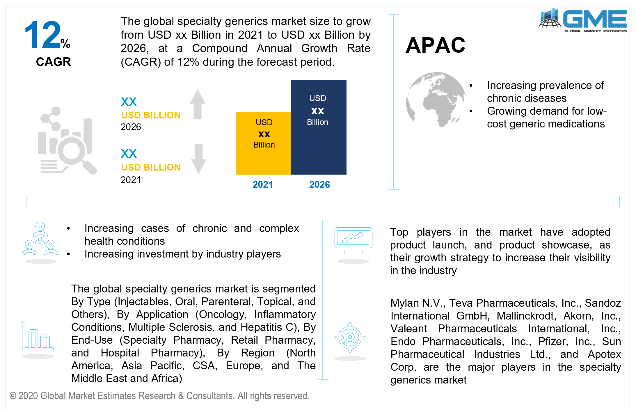

Global Specialty Generics Market Size, Trends & Analysis - Forecasts to 2026 By Type (Injectables, Oral, Parenteral, Topical, and Others), By Application (Oncology, Inflammatory Conditions, Multiple Sclerosis, and Hepatitis C), By End-Use (Specialty Pharmacy, Retail Pharmacy, and Hospital Pharmacy), By Region (North America, Asia Pacific, CSA, Europe, and The Middle East and Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The standard equivalents of specialist pharmaceutical drugs or conventional generics are known as specialty generics. In a dissent to conventional generics, they are less expensive. Biopharmaceuticals, blood-derived drugs, and large molecules are examples of specialty generics. Specialty generics are cost-effective medications used to treat chronic, complex disorders such as rheumatoid arthritis, infectious illnesses, diabetes, HIV, multiple sclerosis, and cancer. These medications also necessitate specialized administration and handling, usually by injection or infusion. When a specialist drug's patent expires, it's replaced with a generic product. Low-cost oral or injectable specialty generics are used to treat complex clinical diseases such as cancer, HIV, Hepatitis, and multiple sclerosis.

They are often regarded as biologics (derived from living cells) that can be injected or infused. According to the US Food and Drug Administration, generic medications cost 80 percent to 85 percent less than marketed drugs because they do not entail costly manufacturing and marketing costs. This has led to a rise in the volume of off-patent prescription drugs which is expected to drive the sustainable growth of the specialty generic drugs industry. For example, the Novartis drug Gilenya's patent is set to expire in 2019. Novartis' earnings have increased by about 14 percent as a result of this medication.

Patent expirations at an early stage are expected to accelerate global demand expansion. Furthermore, an increase in the number of cancer patients is expected to boost overall business growth. The specialty generics market is expected to expand faster throughout the forecast period, owing to factors such as the launch of cost-effective medications for the treatment of multiple diseases including sclerosis, cancer, and other infectious diseases, an increase in the number of off-patent specialty drugs, and early patent expirations of a variety of branded specialty medications, which are expected to fuel the entry of new generics.

The FDA adopted CGMP recommendations for specialty generic processing. Furthermore, these specialty generic products are priced lower than marketed drugs, resulting in considerably lower profit margins for producers. Furthermore, the FDA has increased its efforts to enact GMP on suppliers, preventing them from capitalizing on generic products. This is assumed to be a primary factor impeding the global specialty generics market's expansion. Several factors are currently driving the global specialty generics industry, including an aging population, the growing prevalence of numerous life-threatening diseases such as cancer, multiple sclerosis, HIV, and others, cost-cutting initiatives implemented by prominent healthcare providers, demand from emerging markets, and so on.

The increased incidence of chronic illnesses namely, cancer, multiple sclerosis (MS), hepatitis C, and others has resulted in a strong market for specialist prescription medications. Healthcare prices have increased due to the high cost of pharmaceuticals. As a result, policymakers all over the world are concentrating on the production of cost-effective medicines. The United States remains the top-paying nation in terms of healthcare, and it has recently started stressing the importance of reducing healthcare expenditure. This emphasizes the significance of creating novel, enhanced, and cost-effective approaches for the production of specialty generics. Thus, the aforementioned factors are presumed to reduce healthcare expenditures while still boosting the demand in the specialty generics market.

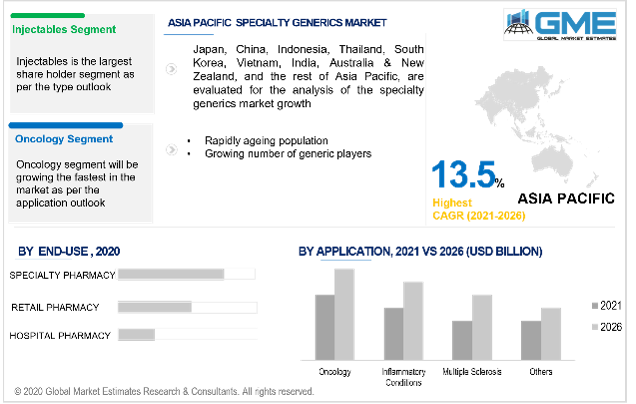

Based on the types, the market for specialty generics is categorized as injectables, oral, parenteral, topical, others. Due to the advantages such as fast absorption, long duration of action, and immediate dosage delivery, the injectables segment accounted for the largest market share. The rising prevalence of chronic disorders such as inflammatory disorders, multiple sclerosis, and cancer would also fuel demand for injectables. The injectable segment is among the fastest-growing segments, attributed to the expanding use of self-monitored injectables by patients. Furthermore, multiple strategies in the form of acquisitions and new product releases by leading market players in different regions around the world are expected to boost business growth in the immediate future. Acquisition and collaboration allow market participants to acquire exposure to and improve injectable medications, infusion techniques, and biosimilar businesses. State governments are putting a lot of effort into developing long-term healthcare infrastructure, which is helping the segment expand even further.

Based on the type of applications, the market of specialty generics is classified as oncology, inflammatory conditions, multiple sclerosis, hepatitis C. In terms of sales, the oncology segment led in this market. The rising prevalence of cancers has hiked the demand for generic specialty drugs all over the world. Moreover, cancer mortality rates are higher in emerging & underdeveloped economies than in developed economies. The high cost of cancer treatment and medications, as well as the lack of accessibility to modern healthcare facilities in these nations, are among the main reasons for the elevated mortality rate. As a result, there is a strong market for low-cost generics that are both highly competitive and less costly than marketed medications.

Based on the type of end-use, the market for specialty generics is classified as specialty pharmacy, retail pharmacy, and hospital pharmacy. Since specialty drugs are technically complex, expensive, and must be treated with extreme caution, specialty pharmacies hold the highest sales share of the overall market. Moreover, the increased emphasis on improving healthcare facilities in developing economies in the Asia Pacific and African areas is likely to boost the segment's growth. Increasing healthcare understanding and the development of novel therapeutics for the management of a variety of chronic diseases are expected to drive segment development.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to various favorable government medical policies and well-developed healthcare infrastructure in this area, North America predominates the specialty generics market. Moreover, healthcare organizations such as WHO are significantly active in policy formulation, such as National Cancer Control Programmes, which are expected to broaden the region's development prospects. Throughout the forecast period, the Asia Pacific market is foreseen to augment at a robust CAGR. The market is being fuelled by an increase in the incidence of chronic diseases and also a growing demand for low-cost generic medications. Furthermore, the disposable income, which raises the likelihood of using specialist generics, and ongoing healthcare infrastructure upgrades are expected to provide the market with strong potential growth prospects throughout the forecast period.

Mylan N.V., Teva Pharmaceuticals, Inc., Sandoz International GmbH, Mallinckrodt, Akorn, Inc., Valeant Pharmaceuticals International, Inc., Endo Pharmaceuticals, Inc., Pfizer, Inc., Sun Pharmaceutical Industries Ltd., and Apotex Corp. are the major players in the specialty generics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Types

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Specialty Generics Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-Use Overview

2.1.5 Regional Overview

Chapter 3 Specialty Generics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Cases of Chronic And Complex Health Conditions

3.3.1.2 Increasing Number of Off-Patent Specialty Drugs

3.3.2 Industry Challenges

3.3.2.1 Limited Availability Skilled Workforce And Sourcing Of Raw Materials

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Specialty Generics Market, By Drug

4.1 Type Outlook

4.2 Injectables

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Oral

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Parenteral

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Topical

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Specialty Generics Market, By Application

5.1 Application Outlook

5.2 Oncology

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Inflammatory Conditions

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Multiple Sclerosis

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Hepatitis C

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Specialty Generics Market, By End-Use

6.1 End-Use Outlook

6.2 Specialty Pharmacy

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Retail Pharmacy

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Hospital Pharmacy

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Specialty Generics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.8.2 Market size, By Application, 2016-2026 (USD Million)

7.4.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.4 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.5.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Mylan N.V.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Teva Pharmaceuticals Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Sandoz International GmbH

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Mallinckrodt

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Akorn, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Valeant Pharmaceuticals International, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Endo Pharmaceuticals, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Pfizer, Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Sun Pharmaceutical Industries Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Apotex Corp.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Specialty Generics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Specialty Generics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS