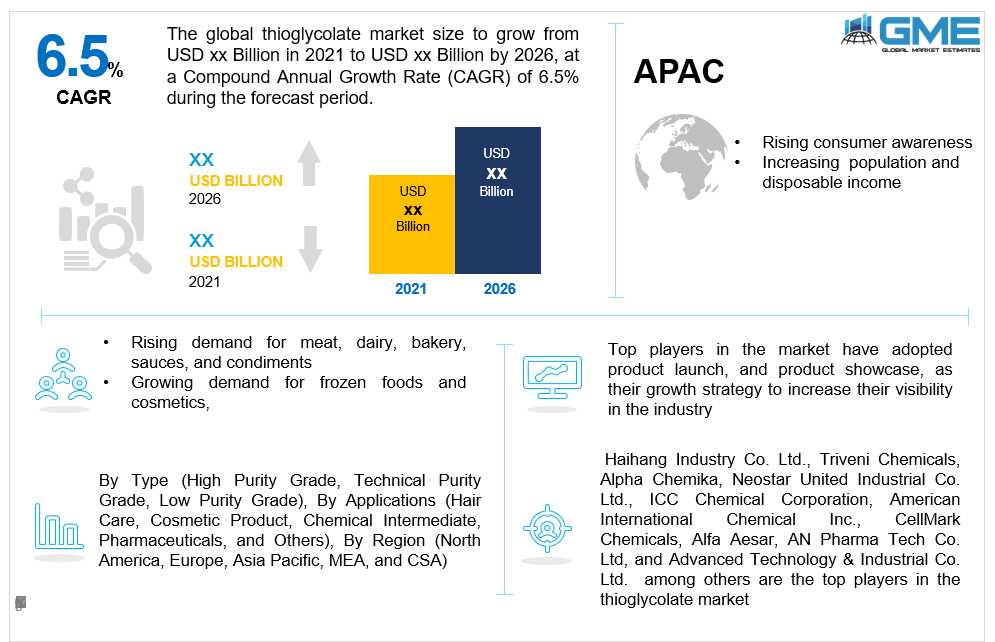

Global Thioglycolate Market Size, Trends & Analysis - Forecasts to 2026 By Type (High Purity Grade, Technical Purity Grade, Low Purity Grade), By Applications (Hair Care & Cosmetic Product, Chemical Intermediate, Pharmaceuticals, and Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The market drivers which contribute to development in the thioglycolate market include the mounting population coupled with disposable revenue, novel government initiatives to promote the bakery industry, increasing demand for frozen foods & cosmetics, as well as augmenting consumer awareness about the benefits & application of thioglycolate. The global thioglycolate market is also being driven by technological innovation and progression in the manufacturing process followed by various end-use industries of thioglycolate in both developed and developing countries.

Thioglycolate is used in chocolate, as a salt reducer, as an intermediate in frozen snacks and drinks, and in various cosmetics products for skin & hair. Thus, demand for thioglycolate is likely to surge with the rise in the populaces of the core demographics using these products. Moreover, the growing demand for meat goods, milk products, baked goods, sauces, and seasonings as a result of the demographic growth and rising discretionary income is projected to boost the overall thioglycolate market.

Restrictive legislation and recommendations issued by bodies such as the FDA and the EU Cosmetics Directive, on chemical compositions and negative health effects are expected to impede the development of the global thioglycolate market. Conversely, research and development programs to develop new technologies that meet customer demands without causing any negative health consequences promise a plethora of prospects for thioglycolate market participants.

The growing market of sodium and potassium thioglycolates as a result of the ease of application in frozen foods is driving up demand for thioglycolates. The global demand for thioglycolates is expected to rise as the market for cosmetics and frozen foods grow. Huge demand for personal care and cosmetic product is expected to translate into massive demand for thioglycolates. Since, thioglycolates are extensively used in cosmetics such as skincare, haircare, and hair removal products, the demand for thioglycolates will be driven by rising customer consciousness and affluent lifestyles that have allowed them to invest heavily in organic food items and cosmetics. Sales for thioglycolates are expected to remain strong in developed economies, aided by a high level of thioglycolates-based product availability. Furthermore, consumer buying power is relatively strong in such economies, which will help the global thioglycolates market to expand significantly throughout the forecast period.

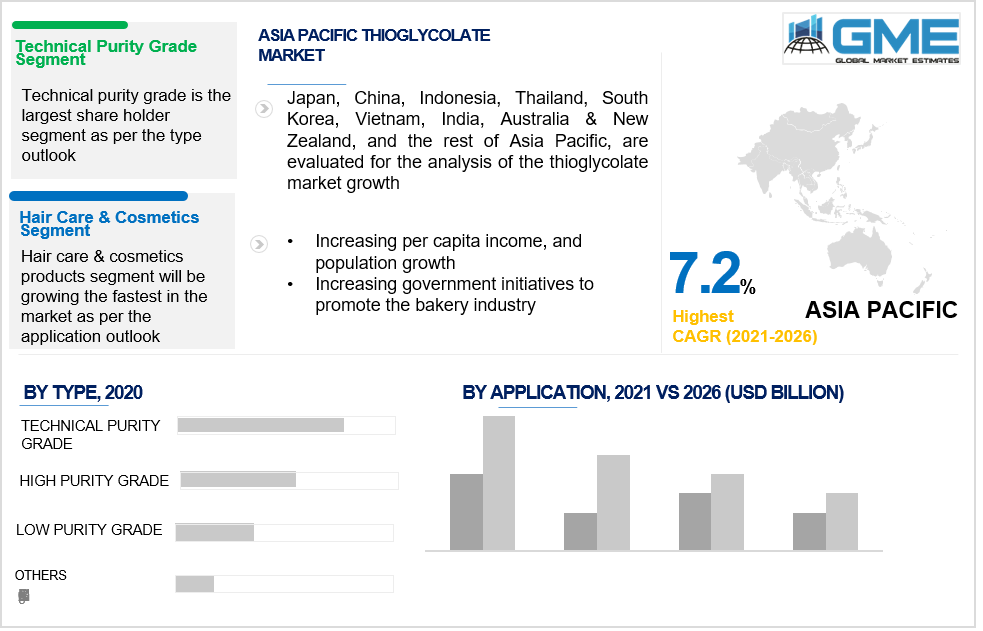

Based on type, the market is segmented into high purity grade, technical purity grade, and low purity grade. During the forecast period, the market for technical purity grade is projected to lead. Factors driving market demand are technological innovation and customization of skincare & hair care products based on customer needs to improvise their skin or hair quality. Technical purity grade thioglycolates have a large variety of active ingredients and solutions in their formulations that aids in the manufacturing of final products that would be free of any additives and have minimal side effects on the human body. In the near future, product demand for technical purity grade thioglycolates will be fueled by advanced lifestyle preferences and growing populaces of customers that are inclined towards organic products.

Based on application, the market is segmented into hair care & cosmetic products, chemical intermediate, pharmaceuticals, and others. The hair care & cosmetic product segment is likely to lead the thioglycolate market throughout the forecast period. The availability of a vast supply chain for the industry, which would need a huge volume of thioglycolate-based goods, is estimated to aid market expansion. Moreover, due to enhanced work-life and a primary emphasis on personal hygiene and cleanliness, a huge proportion of the female population is actively involved with these items in their normal schedule. Thus, leading to this segment's supremacy.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. North America has the highest demand for thioglycolates in the world, trailed by the Asia Pacific and Europe. North America currently leads the market, owing in large part to the bakery industry in the country. Trade agreements such as the North America Free Trade Agreement (NAFTA), as well as its increasing role in subscribing to businesses in South, and Central America, and the Caribbean, are intended to help in its development. However, due to improving socio-economic conditions in the country, Asia Pacific is expected to rise at the fastest pace. The overall market is expected to benefit from increased demand for meat products, dairy products, bakery products, sauces, and organic condiments as the population grows and disposable income rises. Emerging markets such as China, Malaysia, India, Russia, Indonesia, and Brazil are expected to increase their demand for thioglycolate. The surge in demand in the Asia Pacific is presumed to be led by China and India since China is a big producer as well as a consumer of thioglycolates around the world. Frozen food consumption, as well as cosmetics and beauty products for women and men, has increased rapidly in the country. Hair grooming applications such as coloring and straightening use various forms of thioglycolate is leading to robust growth in the thioglycolate market of APAC.

Haihang Industry Co. Ltd., Triveni Chemicals, Alpha Chemika, Neostar United Industrial Co. Ltd., ICC Chemical Corporation, American International Chemical Inc., CellMark Chemicals, Alfa Aesar, AN Pharma Tech Co. Ltd, and Advanced Technology & Industrial Co. Ltd. are the top players in thioglycolate market.

Please note: This is not an exhaustive list of companies profiled in the report.

On January 27, 2021, American International Chemical (AIC) announced an extended relationship with Innophos, a world pioneer in specialty minerals. AIC and Innophos' partnership is a strategic step to increase quality standards and satisfy the growing demand for specialist minerals in the food and nutrition Industry.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Thioglycolate Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Type Overview

2.1.4 Regional Overview

Chapter 3 Thioglycolate Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Demand for Bakery Products

3.3.1.2 Increasing Application of Thioglycolate In Cosmetic Industry

3.3.2 Industry Challenges

3.3.2.1 Negative Repercussions on The Human Body

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Thioglycolate Market, By Application

4.1 Application Outlook

4.2 Hair Care

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Cosmetic Product

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Chemical Intermediate

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Pharmaceuticals

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Thioglycolate Market, By Type

5.1 Type Outlook

5.2 High Purity Grade

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Technical Purity Grade

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Low Purity Grade

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Thioglycolate Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.3 Market Size, By Type, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.3 Market Size, By Type, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Application, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Application, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Type, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.3 Market Size, By Type, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Application, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Application, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2019-2026 (USD Million)

6.4.7.2 Market size, By Type, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Type, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.3 Market Size, By Type, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.3 Market Size, By Type, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Type, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Haihang Industry Co. Ltd.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Triveni Chemicals

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Alpha Chemika

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Neostar United Industrial Co. Ltd.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 ICC Chemical Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 American International Chemical Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 CellMark Chemicals

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Alfa Aesar

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 AN Pharma Tech Co. Ltd

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Advanced Technology & Industrial Co. Ltd.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Thioglycolate Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Thioglycolate Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS