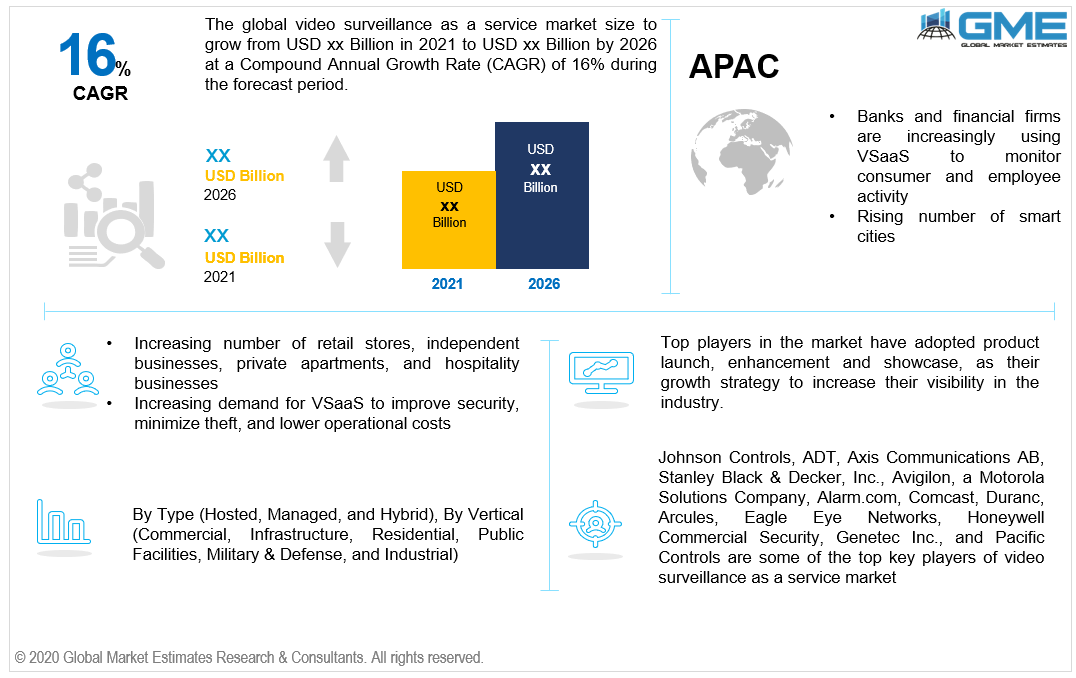

Global Video Surveillance as a Service Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Hosted, Managed, and Hybrid), By Vertical (Commercial, Infrastructure, Residential, Public Facilities, Military & Defense, and Industrial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Video surveillance as a service is a method of continuously tracking and daily recording an individual's or a group's actions, manual activity, and casual gestures to provide advanced security. The growing need for new cloud technologies enables companies of all sizes, including small, medium, and large companies, to store critical data in the cloud for tracking and vigilance. These growing on-cloud implementation processes will also help the company gain a higher market share by the end of the forecast period. Various industrial markets, including small retail shops, hospitals, municipal government offices, and the transportation industry, are one of the fastest-growing sectors where video surveillance is currently used as a service. The integrated convergence of video surveillance technologies for the modern transport industry is also a major focus for all the major players in recent years.

A growing interest in premier smart cities, as well as rapid deployment of local OPEX and CAPEX models, are all contributing to the market's growth. Furthermore, the increasing rivalry in the global business platform, which has been formed by major and numerous local players, has updated the organization by rapidly integrating them with relatively low or fewer implementation costs, and also enhanced the main investments, which would be a major risk for the key OEM in the marketplace. Several companies all over the world have increased their reliance on video surveillance as a service market support. Video surveillance as a service has evolved as an appealing and straightforward solution. The scope of video surveillance as a service has been enormous. Many developing economies relevant to speech analytics, like India, China, and Brazil, are expected to expand rapidly over the next few years.

The rising adoption of extremely high-end cameras, and also the growing IoT of advanced technologies in different industries, are two major drivers contributing to the global video surveillance as a service market's development. The implementation of advanced technology inbuilt cameras such as advanced HD cameras and modern IP cameras aids in the daily capture of clear and more specific images that can then be used for major analysis as and when it is meant or needed, and through the quick implementation of important VSaaS services such as a booming security infrastructure which can be formed across remote areas or sections without deploying significant manpower. The emergence of the most well-known advanced video surveillance technology is also expected to accelerate the overall market growth rate. Local area network security, efficient high infrastructure expense, which is largely attributed to regular implementation and company protocols, are also the key primary contributors or factors for the market's actual development.

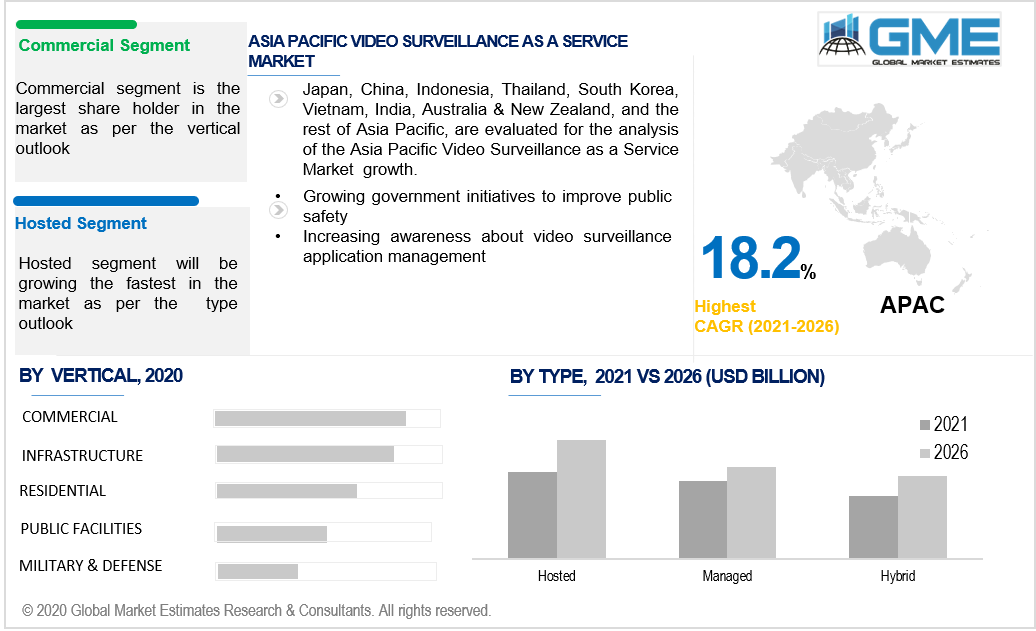

Based on type, video surveillance as a service market can be divided into hosted, managed, and hybrid. The hosted segment has held the highest share of the market and it is projected to become the fastest-growing segment. The demand for hosted VSaaS is being driven by rising user concerns about security, an expansion in government initiatives to improve public security, and ongoing improvements in infrastructure, such as transport hubs. The rising relevance of hosted VSaaS for retail, SMBs, and residential applications, as well as the growing number of smart cities, are boosting the hosted VSaaS segment forward.

Based on vertical, video surveillance as a service market can be divided into commercial, infrastructure, residential, public facilities, military & defense, and industrial. The commercial division has the largest share and is expected to expand at the fastest rate. The commercial sector has seen an augment in demand for VSaaS to improve protection, reduce theft, and minimize operating loss. Owing to the benefits provided by VSaaS, such as lower initial investment, flexibility in attaching sensors, and access control to surveillance data, the use of VSaaS in banks and financial institutions to track customers and personnel activities has been growing in recent years. Thus, eventually causing a surge in the demand in the commercial segment.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). North America is projected to be the leader in video surveillance as a service market due to rising criminal activity, extremism, and risks from unauthorized invaders targeting the countries. Moreover, growing security requirements from several end-users in this area are leading to the major demand from the North American region during the forecast period. Asia Pacific region is expected to prevail in the market due to the highest CAGR. The market's expansion is fueled by a rise in the number of supermarket chains, small businesses, residential apartments, and hospitality businesses. Also, the growing population of India and China are driving up demand for intelligent video surveillance systems. The involvement of a significant number of camera manufacturers, and also the cost-effectiveness of video surveillance systems, are allowing the VSaaS market to expand in the area. The need for VSaaS is also driven by government efforts to improve public protection and growing infrastructural improvements.

Johnson Controls, ADT, Axis Communications AB, Stanley Black & Decker, Inc., Avigilon, a Motorola Solutions Company, Alarm.com, Comcast, Duranc, Arcules, Eagle Eye Networks, Honeywell Commercial Security, Genetec Inc., and Pacific Controls are some of the top key players of video surveillance as a service market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2020, Motorola Solutions introduced several updates to its video security and analytics portfolio aimed at assisting companies when they consider alternatives for securely returning employees to their workplaces or facilities. Avigilon surveillance cameras with analytics will be available via Motorola Solutions' video security and analytics portfolio to help companies keep workers secure by adhering to health standards around defensive face masks and physical social distancing.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Video Surveillance as a Service Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Vertical Overview

2.1.4 Regional Overview

Chapter 3 Video Surveillance as a Service Market Trends

3.1 Market segmentation

3.2 Industry Background, 2019-2026

3.3 MarketKey Trends

3.3.1 Positive Trends

3.3.1.1 Low cost of investment

3.3.1.2 Increasing demand for real-time surveillance data

3.3.2 Industry Challenges

3.3.2.1 Privacy and security concerns regarding data usage

3.4 Prospective Growth Scenario

3.4.1 Integration of VSaaS with access control and alarm systems

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.7 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Video Surveillance as a Service Market, By Type

4.1 Type Outlook

4.2 Hosted

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Managed

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Hybrid

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Video Surveillance as a Service Market, By Vertical

5.1 Vertical Outlook

5.2 Commercial

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Infrastructure

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Residential

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Public Facilities

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Military & Defense

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Industrial

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Video Surveillance as a Service Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Vertical, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Vertical, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Millio

6.4.5.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Vertical, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Vertical, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Vertical, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Vertical, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Johnson Controls

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 ADT

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Axis Communications AB

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Stanley Black & Decker, Inc.,

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Avigilon

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Motorola Solutions Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Alarm.com

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Comcast

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Duranc

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Arcules

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Eagle Eye Networks

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Honeywell Commercial Security

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Genetec Inc.

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Pacific Controls

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Video Surveillance as a Service Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Video Surveillance as a Service Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS