Global Glucosamine Market Size, Trends & Analysis - Forecasts to 2026 By Application (Dairy Products, Food & Beverages, and Nutritional Supplements, and Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

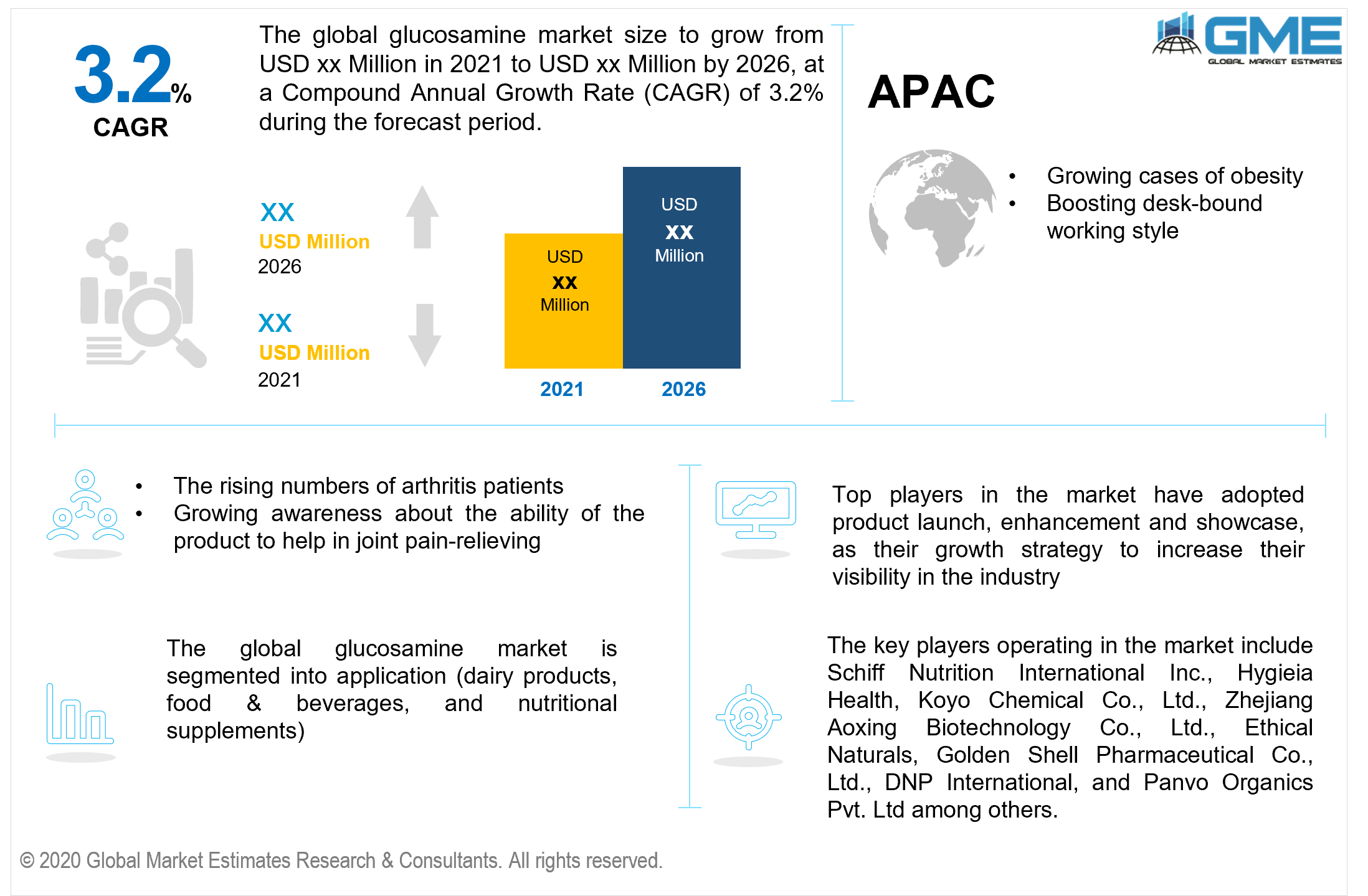

The Global Glucosamine Market is projected to grow at a CAGR of 3.2% from 2021 to 2026.

The increasing number of arthritis patients, boosting desk-bound working style in developing as well as developed nations, growing prevalence of obesity, rising consumption of dietary supplements, the ability of the product to help in joint pain-relieving, and rising innovation for vegan-friendly glucosamine are expected to be the major drivers of the glucosamine market.

Growing cases of arthritis around the world are raising awareness about the benefits of glucosamine, which is propelling the industry forward. Arthritis affects almost 54 million people in the United States. As shown in a Centre for Disease Control and Prevention analysis, the proportion of the population with arthritis is already on the rise, with over 78 million predicted by 2040. This obesity is also known to be a factor helping the penetration of glucosamine in the world. Over 1.9 billion people over the age of eighteen were overweight in 2016. If glucosamine is used in one's diet, it can support them lose weight while also improving joint stability.

The development of vegetarian glucosamine is critical at a period when many individuals are converting to a vegan diet to live a healthier lifestyle. Because of its vegetarian-friendly formula, vegetarian glucosamine is one of the safest vegetarian joint supplements. Unlike other non-vegetarian alternatives, this supplement does not contain any glucosamine derived from shellfish. This main substance is derived entirely from vegetarian-friendly sources.

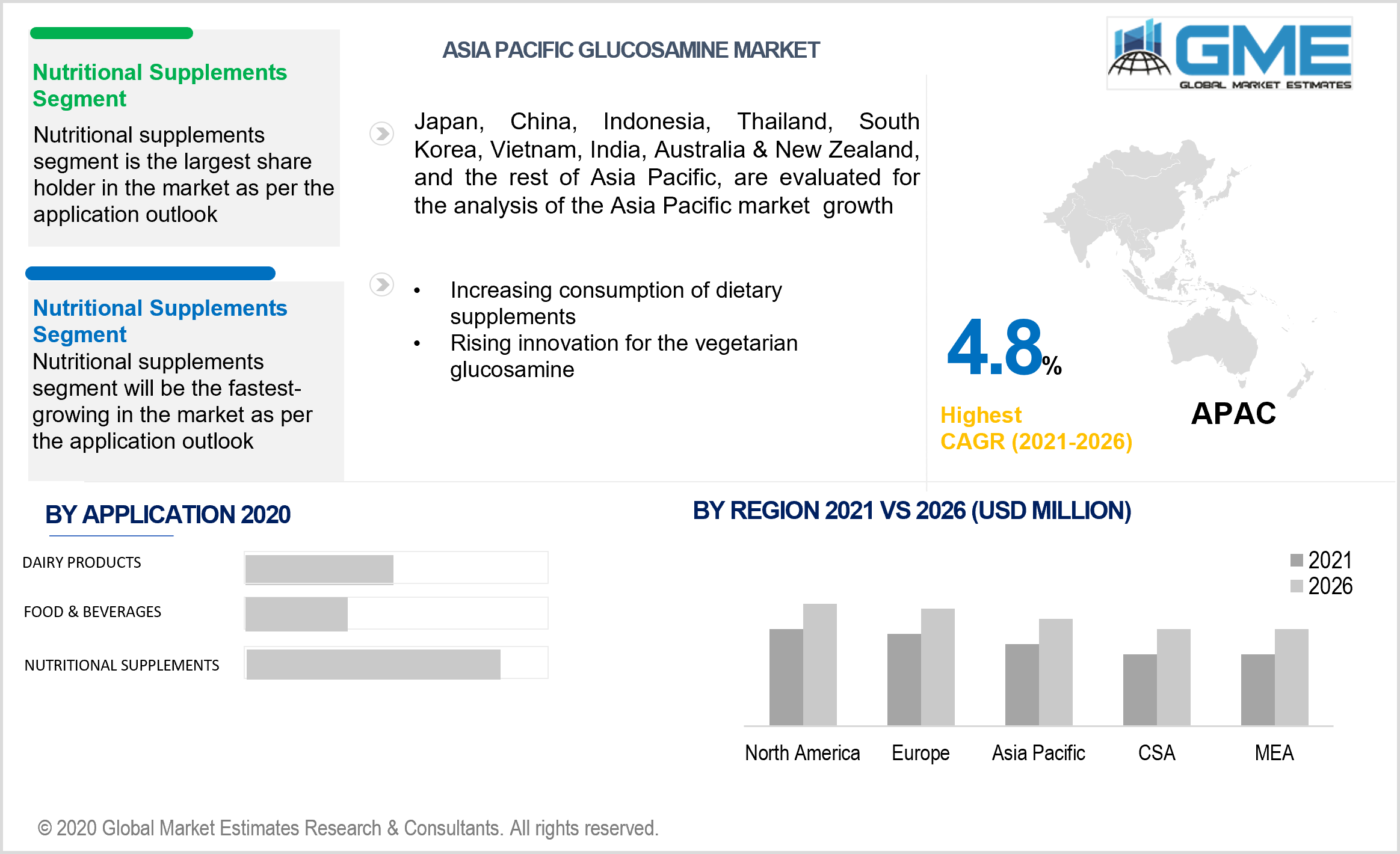

Based on the applications of glucosamine, the market is segmented into dairy products, food & beverages, and nutritional supplements, and others. The fastest-growing and dominant segment in the glucosamine market is predicted to be the nutritional supplements segment. The key drivers of this growth are the rising number of arthritis patients, the rise of the desk-bound current workforce in both developed and developing nations, the increasing levels of obesity, the rising use of dietary supplements which in turn increases the use of glucosamine, the product's ability to help with joint pain relief, and the growing investment in the development of novel vegan-friendly glucosamine supplements.

A healthy diet is crucial for optimal health, and several alternatives, as well as holistic therapists, provide dietary advice. Numerous people with arthritis, including inflammatory and osteoarthritis, will benefit from diet modifications. Glucosamine is a supplement that is commonly used to cure and avoid joint conditions including osteoarthritis. It may be consumed or added topically in the form of a gel or balm. Diseases and joint issues are becoming more common as a result of the global explosion of desk jobs. This requires easier-to-manage eating habits that can be integrated into one's regular activities without affecting one's way of life. Glucosamine is transforming into a supplement that can help with a wide range of issues.

As per the geographical analysis, the market can be classified into North America, Europe, Central, and South America, the Middle East and Africa, and the Asia Pacific regions.

The North American region in the glucosamine market is forecasted to be the dominating region. The key factors responsible for this domination are higher rates of obesity, the rise of vegetarian-friendly glucosamine due to the prevalence of vegan diets, the rising need for dietary supplements which increases the use of glucosamine, and the increased number of arthritis patients.

Obesity rates in the United States have doubled since 1960, with one-third of the population aged above 18 years being obese. Even more concerning is the growth in the number of overweight girls, which has increased from 6% to 19% in the last 25 years. Usage of glucosamine has shown to aid weight loss while also improving joint function. According to recent years' trends, the prevalence of the vegan diet is also strong in the country, resulting in better penetration of vegetarian glucosamine.

The global glucosamine market is dominated by a small number of major players including Schiff Nutrition International Inc., Hygieia Health, Golden Shell Pharmaceutical Co., Ltd., Koyo Chemical Co., Ltd., Zhejiang Aoxing Biotechnology Co., Ltd., DNP International, Ethical Naturals, and Panvo Organics Pvt. Ltd., among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Glucosamine Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Regional Overview

Chapter 3 Glucosamine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing number of people suffering from arthritis

3.3.2 Industry Challenges

3.3.2.1 Stringent regulations on supplements and their ingredients

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Glucosamine Market, By Application

4.1 Application Outlook

4.2 Dairy Products

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Food & Beverages

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Nutritional Supplements

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Glucosamine Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2020-2026 (USD Million)

5.2.2 Market Size, By Application, 2020-2026 (USD Million)

5.2.3 U.S.

5.2.3.1 Market Size, By Application, 2020-2026 (USD Million)

5.2.4 Canada

5.2.4.1 Market Size, By Application, 2020-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2020-2026 (USD Million)

5.3.2 Market Size, By Application, 2020-2026 (USD Million)

5.3.3 Germany

5.3.3.1 Market Size, By Application, 2020-2026 (USD Million)

5.3.4 UK

5.3.4.1 Market Size, By Application, 2020-2026 (USD Million)

5.3.5 France

5.3.5.1 Market Size, By Application, 2020-2026 (USD Million)

5.3.6 Italy

5.3.5.1 Market Size, By Application, 2020-2026 (USD Million)

5.3.7 Spain

5.3.7.1 Market Size, By Application, 2020-2026 (USD Million)

5.3.8 Russia

5.3.8.1 Market Size, By Application, 2020-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2020-2026 (USD Million)

5.4.2 Market Size, By Application, 2020-2026 (USD Million)

5.4.3 China

5.4.3.1 Market Size, By Application, 2020-2026 (USD Million)

5.4.4 India

5.4.4.1 Market Size, By Application, 2020-2026 (USD Million)

5.4.5 Japan

5.4.5.1 Market Size, By Application, 2020-2026 (USD Million)

5.4.6 Australia

5.4.6.1 Market Size, By Application, 2020-2026 (USD Million)

5.4.7 South Korea

5.4.7.1 Market Size, By Application, 2020-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2020-2026 (USD Million)

5.5.2 Market Size, By Application, 2020-2026 (USD Million)

5.5.3 Brazil

5.5.3.1 Market Size, By Application, 2020-2026 (USD Million)

5.5.4 Argentina

5.5.4.1 Market Size, By Application, 2020-2026 (USD Million)

5.6 MEA

5.6.1 Market Size, By Country 2020-2026 (USD Million)

5.6.2 Market Size, By Application, 2020-2026 (USD Million)

5.6.3 Saudi Arabia

5.6.3.1 Market Size, By Application, 2020-2026 (USD Million)

5.6.4 UAE

5.6.4.1 Market Size, By Application, 2020-2026 (USD Million)

5.6.5 South Africa

5.6.5.1 Market Size, By Application, 2020-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 Schiff Nutrition International Inc.

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Hygieia Health

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Golden Shell Pharmaceutical Co., Ltd.

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Koyo Chemical Co., Ltd.

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Zhejiang Aoxing Biotechnology Co., Ltd.

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 DNP International

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Ethical Naturals

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Panvo Organics Pvt. Ltd.

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Other Companies

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

The Global Glucosamine Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Glucosamine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS