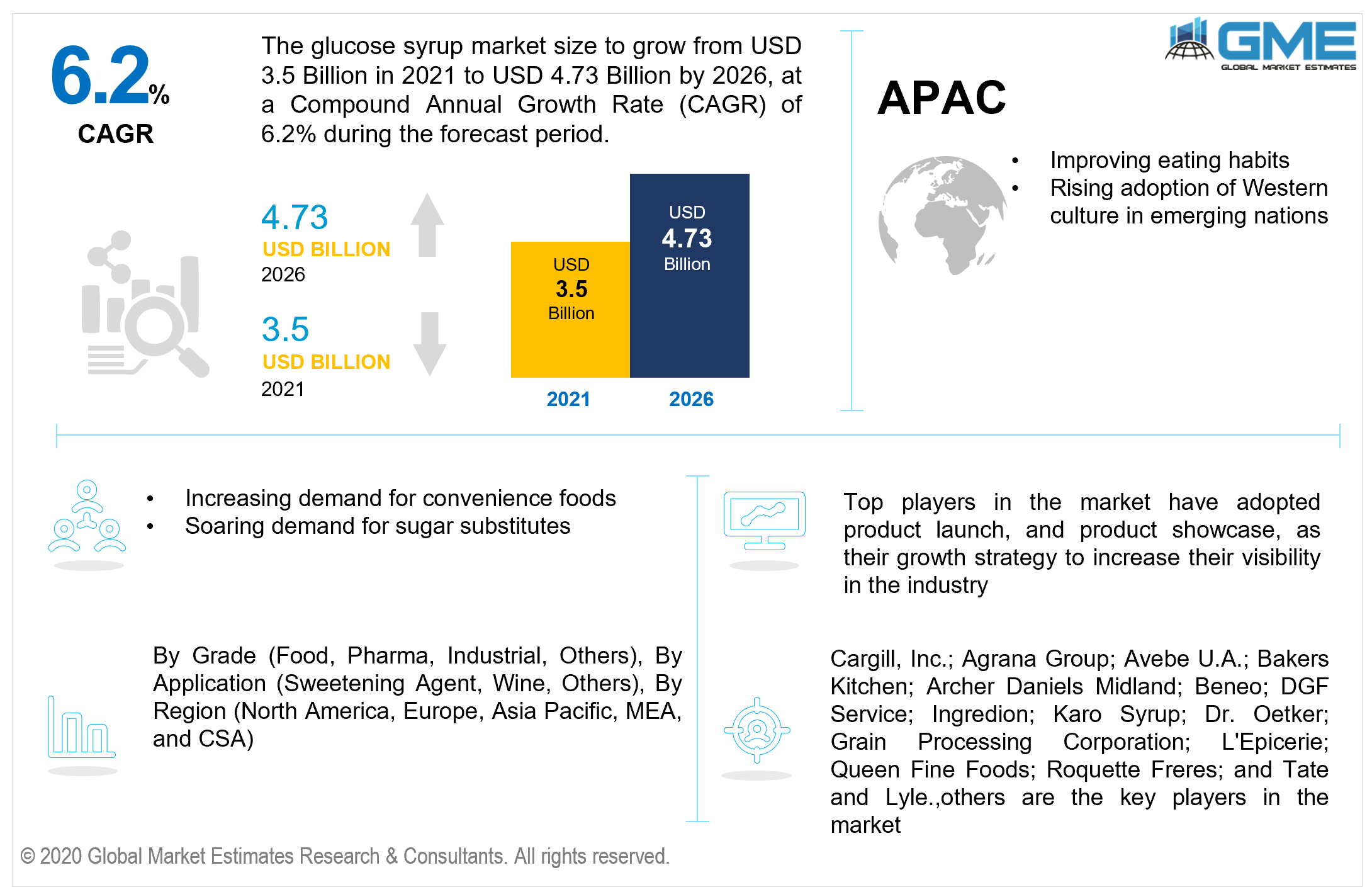

Global Glucose Syrup Market Size, Trends & Analysis - Forecasts to 2026 By Grade (Food, Pharma, Industrial, Others), By Application (Sweetening Agent, Wine, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Competitive Landscape, Company Market Share Analysis, and Competitor Analysis.

The global glucose syrup market is estimated to be valued at USD 3.5 billion in 2021 and is projected to reach USD 4.73 billion by 2026 at a CAGR of 6.2%. Glucose syrup has a high-calorie level but no fat content. It is made from cornstarch and contains traces of zinc, thiamine, and calcium. It is extensively used in the production of a myriad range of food and beverage products depending on the culture of the region. The rising clamor for convenience foods, as well as elevated employ of such syrups in bakery products including desserts, are amongst the factors driving market expansion. Confectionery, medicine, and the food and beverage industries all demand such syrups as a sweetener. Furthermore, due to the increasing demand for sugar substitutes, such syrups are utilized in the manufacturing of ice cream, chewing gum, chocolates, and canned meals.

Glucose syrup has mostly supplanted conventional granulated sugar as an alternative. Such syrups are also widely utilized in the convenience food sector and are gaining popularity. Because of their long shelf life, such syrups are becoming increasingly popular. Furthermore, such syrups varnish a food-grade by coating it with a glaze, boosting the organoleptic value of the grade. Globally, there is a significant increase in demand for baked goods and cakes. Thus, these aforementioned factors aid in boosting the overall market development.

Moreover, such syrup is widely utilized in the production of candies because its consistency aids in the prevention of crystallization. Chefs choose such syrups because they do not impact the aesthetics of the product and promote moisture retention, keeping the baked meal fresh. The use of such syrups in the production of confectionery goods has also expanded because they prevent a gritty texture and preserve a smooth texture. Because such syrup offers an energy source for yeast, its use in the brewing business has grown.

Development in the food and beverage industry in emerging economies is foreseen to propel advancement in the global market during the forecast period, owing to transformations in food consumption patterns and elevated health education. Because such syrup adds a gloss to fruit tarts and jams, its usage in the culinary business has grown. Since such syrup includes short carbs, it is easily digested by the elderly and newborns. All of these aspects contribute significantly to the popularity of such syrup, which will aid in the market's expansion over the forecast period.

The detrimental implications of exorbitant glucose syrup intake are having a deleterious impact on the market's expansion. Furthermore, the government's food supply chain, sugar diversification as a result of ineffectual rationing, and lower prices as a result of fragmentation are all challenges to the market. Nevertheless, rapid expansion in the food and beverage services industry in emerging economies is presumed to accelerate advancement in the global market during the forecast period, owing to transformations in food consumption behaviors and steadily increasing health education.

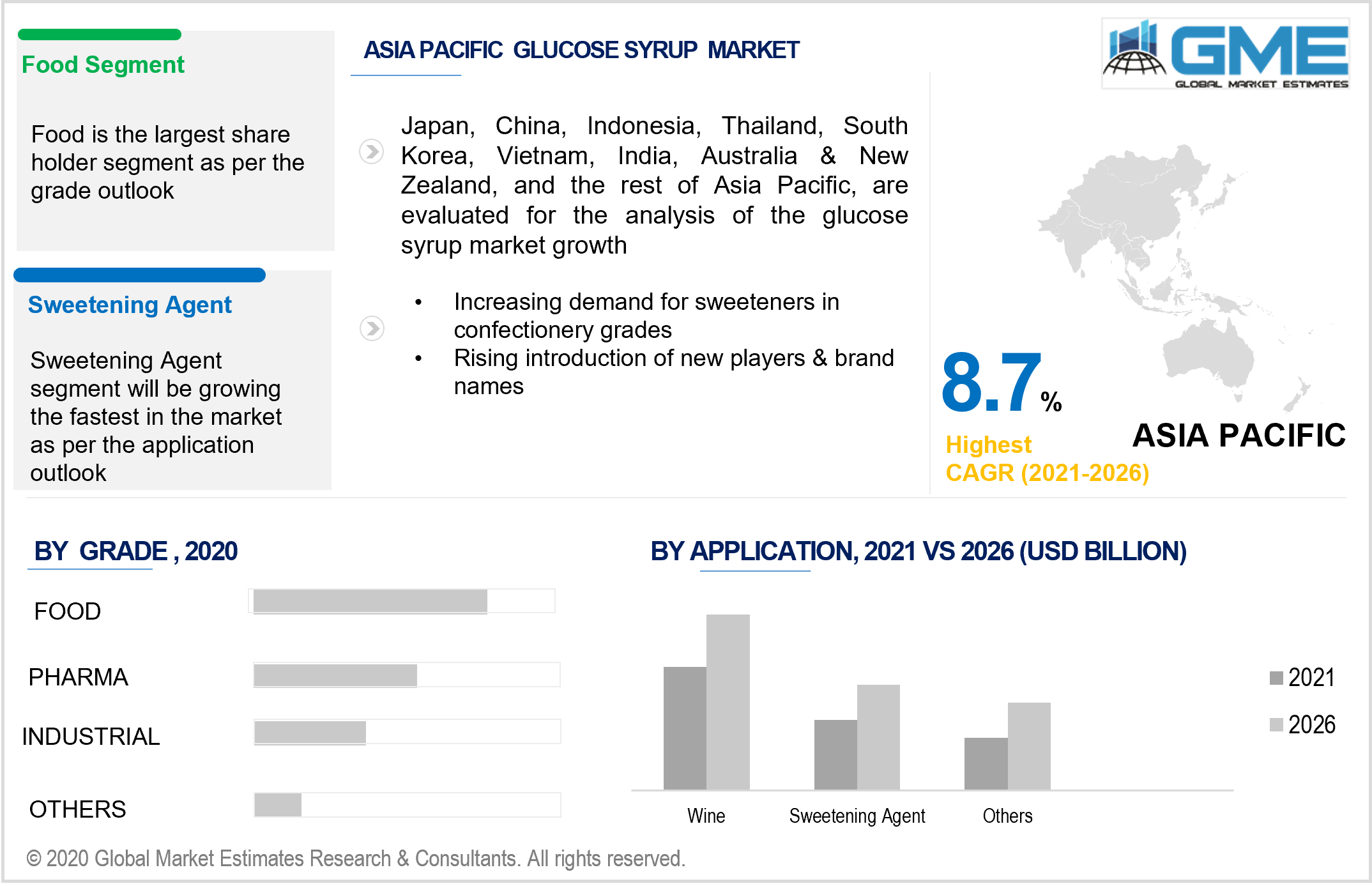

Based on the grade, the market is categorized as food, pharma, industrial, and others. The food-grade category is expected to predominate. High demand for sweeteners in confectionery grades, as well as the expansion of the bread industry, are the primary reasons driving category growth. Beverages such as cold drinks are included in the other categories. This segment accounts for a sizable portion of the market. Fruit drinks and soft drinks include a significant quantity of such syrup, accounting for over 50.0 percent of the total. Furthermore, soft drink consumption has surged fivefold in the last few years. This is predicted to have a favorable influence on the overall sales.

Based on the type of applications, the market is categorized as a sweetening agent, wine, and others. Wine is foreseen to hold the market's largest share. Sugar is an essential component of all wines. Grapes absorb the sugar in the form of glucose and fructose during fermentation. Natural glucose has a less sweet flavor than wine's fructose. As a result, dextrose syrup is employed in various wines to boost the sweetening effect. During fermentation, dextrose syrup is added, and the stirring speed is adjusted to give the wine a light pinkish tint, making it seem appealing. This is one of the integral rationales for using dextrose syrup during wine production.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa), and Central & South America (Brazil, Argentina, and Rest of Central and South America).

APAC is estimated to be the largest market during the forecast period. Large investments are being made in the food services and food & beverage manufacturing industries, which will drive the overall market. The region is the pioneering market owing to the surging consumption of such syrup in Asian countries, and also a burgeoning imperative for sugar supplements in these countries. To battle ailments like diabetes and obesity, consumers are seeking more natural and healthier alternatives to traditional sugar, which has led to an uptick in the utilization of such syrups in different foods and drinks.

Potential customers are switching from mainstream sugar options to a more organic and healthier alternative by purchasing syrup product lines that aid in the treatment of ailments including diabetes and obesity. Furthermore, owing to strengthened dietary behaviors and the enactment of western culture in emerging economies, Asia Pacific is foreseen to be the fastest-growing regional market. The introduction of new players & brand names and also the accessibility of sustainably grown snack foods on e-commerce channels in countries such as India and China are foreseen to drive regional market advancement.

In terms of regional development, North America is foreseen to thrive and experience healthy expansion over the forecast period, owing to government agricultural subsidies. The areas of the United States, Canada, and Mexico were the relevant markets for advancement, with the United States having the most stable economic system. Additionally, Europe is expected to be a main regional market during the forecast period, attributable to the rising trend for sustainably grown syrups in France and Germany.

Cargill, Inc.; Agrana Group; Avebe U.A.; Bakers Kitchen; Archer Daniels Midland; Beneo; DGF Service; Ingredion; Karo Syrup; Dr. Oetker; Grain Processing Corporation; L'Epicerie; Queen Fine Foods; Roquette Freres; and Tate and Lyle, among others, are the major players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Glucose Syrup Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Grade Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Glucose Syrup Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Food & Beverage Industry

3.3.1.2 Increasing Demand for Convenience Food

3.3.2 Industry Challenges

3.3.2.1 Detrimental Implications of Exorbitant Glucose Syrup Intake

3.4 Prospective Growth Scenario

3.4.1 Grade Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Glucose Syrup Market, By Grade

4.1 Grade Outlook

4.2 Food

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Pharma

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Industrial

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Glucose Syrup Market, By Application

5.1 Application Outlook

5.2 Sweetening Agent

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Wine

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Glucose Syrup Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Grade, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Grade, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Grade, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Grade, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Grade, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Cargill, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Agrana Group

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Avebe U.A.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Bakers Kitchen

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Archer Daniels Midland

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Beneo

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 DGF Service

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Ingredion

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Karo Syrup

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Dr. Oetker

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Grain Processing Corporation

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 L'Epicerie

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Queen Fine Foods

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Roquette Freres

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Tate and Lyle

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

7.17 Other Companies

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

The Global Glucose Syrup Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Glucose Syrup Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS