Global Gourmet Salt Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Fleur De Sel, Sel Gris or Grey Salts, Himalayan Salts, Flake Salts, Specialty Salts (Flavored Salts and Smoked Salts), Others), By Application (Bakery & Confectionery, Meat & Poultry Products, Seafood Products, Sauces & Savory, Others (Desserts and Frozen Products), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

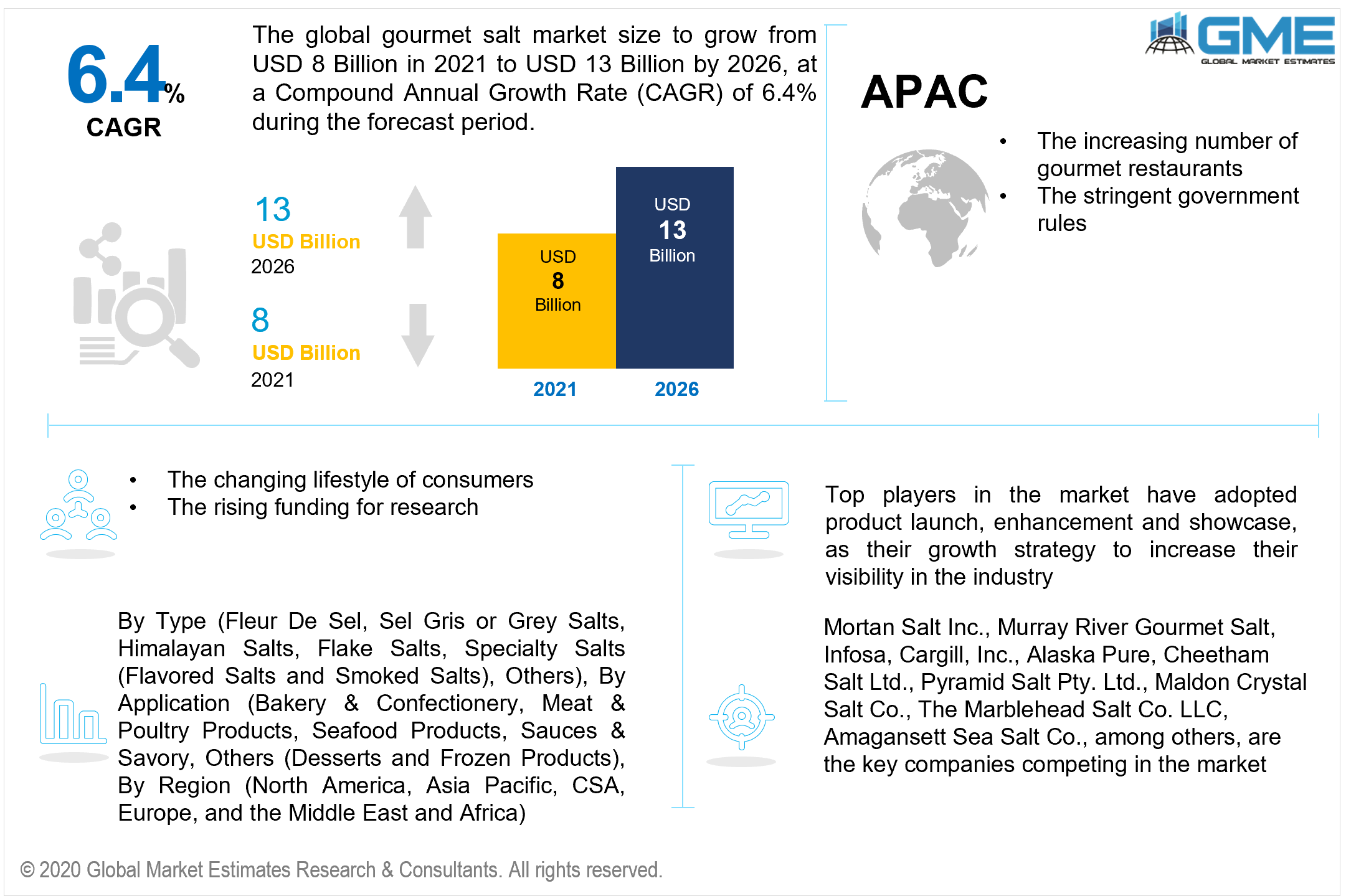

The global gourmet salt market is projected to grow from USD 8 billion in 2021 to USD 13 billion by 2026 at a CAGR value of 6.4% between 2021 to 2026. Over the forecast period, the global market is anticipated to be driven by rising demand in the food and beverage and culinary service sector. They are unprocessed sea salts that are collected by hand and add a luscious richness to meals. Global demand is proposed to increase due to its beneficial qualities including improving meal taste, color, distinctive flavor, enriching food look, and attractive scent. Expanding demand for gourmet salts from the food and beverage sectors to enhance food flavor profile, color, and character is a significant driver propelling the global market's rise.

Furthermore, the growing usage of gourmet salts for pickling and canning applications to extend the shelf lifespan of food goods is projected to fuel development in the global market over the forecast period. Gourmet salts are also employed to keep the moisture level of goods stable. In addition, the significant mineral concentration of gourmet salts is good for wellness, and the growing demand for classic delicacies are among the other significant factors expected to drive the global market.

The market is expanding due to the emergence of creative food cafes and high-profile dining options in the food sector, which is expected to create an imperial of gourmet salt demand. Ramping up food networks and programs with cooking courses are promoting the use of gourmet salts, raising community understanding.

Factors like the increasing demand in the food and beverage industries, high applicability in meat processing, technological advancements, increasing disposable income, the rapid development of application industries, rising health concerns acts as demand catalyst. The growing need for enhancing food taste, new product developments, stringent government rules, and regulations, rising demand from organic food items, increased shelf life of products, and enriching food experience are all growth inducers.

Rising funding for research, increase in the standard of living, an increasing number of programs and initiatives, pleasant aroma, growing demand for gourmet salts in the bakery industry, availability in a variety of colors, low sodium content, rising live cooking shows, developing demand by traditional cuisines, changing lifestyle of consumers, and a wide variety of health benefits aids in market expansion.

The strong influence of westernization, increase in the number of gourmet restaurants, increasing cosmopolitan culture, helpful in canning and pickling of food items, easy availability, and cost-effectiveness are expected to increase demand for the market. Increasing specialty restaurants throughout the world are projected to establish themselves as a significant potential for global market expansion. Expanding culinary and gourmet exhibitions are also likely to solidify themselves as development prospects in the near future. The absence of knowledge, combined with high manufacturing costs, are the primary reasons that are likely to stymie the global business in the near future.

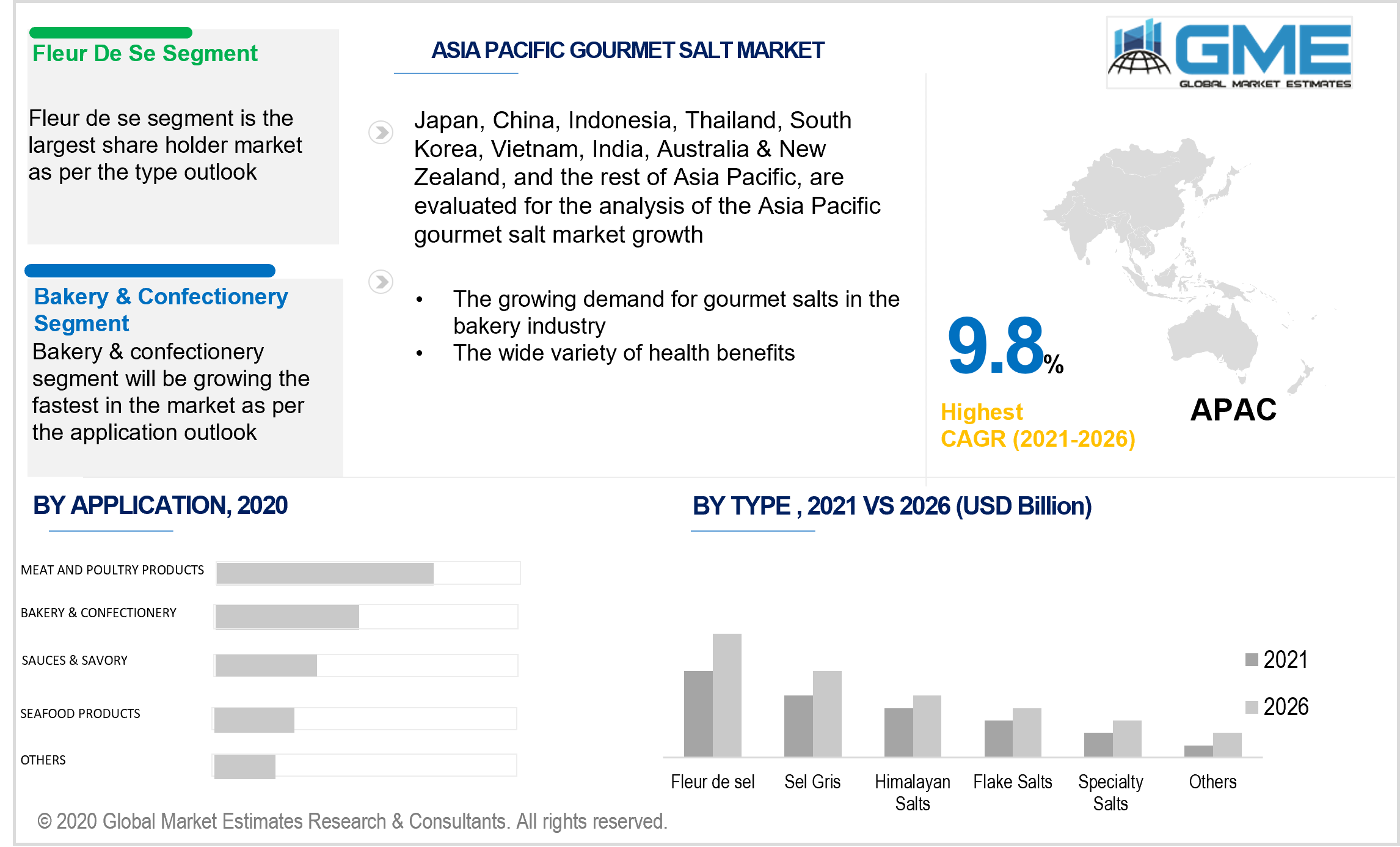

According to the type segment, the six categories include fleur de sel, sel gris or grey salts, Himalayan salts, flake salts, specialty salts (flavored salts and smoked salts), and others. The category of fleur de sel is the largest shareholder over the forecast period. It has acquired the largest share in the market because of the following factors like high nutritional value, growing per capita consumption of bakery products, inclusion in a diversity of applications including salads, roasted meats, and vegetable dishes. Wide acceptance in bakery products, convenience and ease to use, high level of sodium chloride, high standard of living, and rising health concerns coupled with rapid urbanization acts as a growth catalyst. It dissolves quickly, enhances the taste of food products, is cost-efficient, contrasts the level of sweetness, and has finer qualities.

However, the sel gris segment will grow the fastest in the market. It is also known as grey salt and contains no preservatives, additives, and chemicals. It will grow the fastest as a result of escalating demand for quality premium goods, mostly used for cooking and garnishing food products, rapidly expanding baking industry, advanced technologies, continuous product innovation, and higher accessibility & availability. It facilitates proper sleep, has a calming effect on the central nervous system, improves the function of the brain, and builds a higher immunity to diseases & infections.

According to the application analysis, the four segments are bakery & confectionery, meat & poultry products, seafood products, sauces & savory, and others (desserts and frozen products). The meat & poultry segment will acquire the largest share in the market because meat consumption is anticipated to surge globally with increasing disposable income and increasing focus on a healthy lifestyle. Strong application potential in meat processing and preservation of canned meats, hams, roasts, meatballs, and fish will favor market growth.

The bakery and confectionery segment is predicted to foster the fastest growth in the market due to the availability of a variety of flavors, better prices, wide adoption of gourmet salt in the preparation of cakes, increased tourism and traveling, rising live bakery shows, growing consumption of confectionery & bakery products, and a pleasant aroma.

Europe is a major participant in the global market, accounting for the greatest market share in terms of revenue when contrasted to certain other areas' marketplaces. This can be linked to increased use of gourmet salt as a flavoring component in foodstuff and drinks, as well as increased use of gourmet salt in preserving purposes in the area's nations.

Because of the significant discretionary income of customers, the market in North America contributes for the second-highest revenue share input in the global market, resulting in purchasing behaviors for goods enriched in gourmet salt, which are economical.

The Asia Pacific market is expected to expand the fastest in terms of revenue, primarily to evolving consumer tastes, developing economies, improved living standards, increased desire for processed foods, health-conscious behavior, and expansion in the food and beverage sectors.

Mortan Salt Inc., Murray River Gourmet Salt, Infosa, Cargill, Inc., Alaska Pure, Cheetham Salt Ltd., Pyramid Salt Pty. Ltd., Maldon Crystal Salt Co., The Marblehead Salt Co. LLC, and Amagansett Sea Salt Co., among others, are the key companies competing in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Gourmet Salt Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Gourmet Salt Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The developing demand for traditional cuisines

3.3.1.2 The strong influence of westernization

3.3.2 Industry Challenges

3.3.2.1 The high machinery and labor costs

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Gourmet Salt Market, By Type

4.1 Type Outlook

4.2 Fleur de sel

4.2.1 Market Size, By Region, 2021-2026 (USD Million)

4.3 Sel Gris

4.3.1 Market Size, By Region, 2021-2026 (USD Million)

4.4 Himalayan Salts

4.4.1 Market Size, By Region, 2021-2026 (USD Million)

4.5 Flake Salts

4.5.1 Market Size, By Region, 2021-2026 (USD Million)

4.6 Specialty Salts

4.6.1 Market Size, By Region, 2021-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2021-2026 (USD Million)

Chapter 5 Gourmet Salt Market, By Application

5.1 Application Outlook

5.2 Bakery & Confectionery

5.2.1 Market Size, By Region, 2021-2026 (USD Million)

5.3 Meat & Poultry products

5.3.1 Market Size, By Region, 2021-2026 (USD Million)

5.4 Seafood Products

5.4.1 Market Size, By Region, 2021-2026 (USD Million)

5.5 Sauces & Savory

5.5.1 Market Size, By Region, 2021-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2021-2026 (USD Million

Chapter 6 Gourmet Salt Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2021-2026 (USD Million)

6.2.2 Market Size, By Type, 2021-2026 (USD Million)

6.2.3 Market Size, By Application, 2021-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2021-2026 (USD Million)

6.3.2 Market Size, By Type, 2021-2026 (USD Million)

6.3.3 Market Size, By Application, 2021-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2021-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2021-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2021-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2021-2026 (USD Million)

6.4.2 Market Size, By Type, 2021-2026 (USD Million)

6.4.3 Market Size, By Application, 2021-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.5.2 Market Size, By Application

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.7.2 Market Size, By Application, 2021-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2021-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2021-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2021-2026 (USD Million)

6.5.2 Market Size, By Type, 2021-2026 (USD Million)

6.5.3 Market Size, By Application, 2021-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2021-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2021-2026 (USD Million)

6.6.2 Market Size, By Type, 2021-2026 (USD Million)

6.6.3 Market Size, By Application, 2021-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2021-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2021-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2021-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2021-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Morton Salt

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Murray River Gourmet Salt

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Infosa

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Cargill, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Alaska Pure

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Cheetham Salt Ltd.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Pyramid Salt Pty. Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Amagansett Sea Salt Co.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 The Marblehead Salt Co. LLC

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Gourmet Salt Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Gourmet Salt Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS