Global Harvesting Robots Market Size, Trends & Analysis - Forecasts to 2026 By Type of Farm Produce (Fruits & Orchards, Vegetables, Field Crops & Cotton, and Others), By Farming Environment (Indoor, and Outdoor), By Type of Farm (Greenhouse & Hoop Houses, Orchards, Commercial Farms, and Nurseries), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

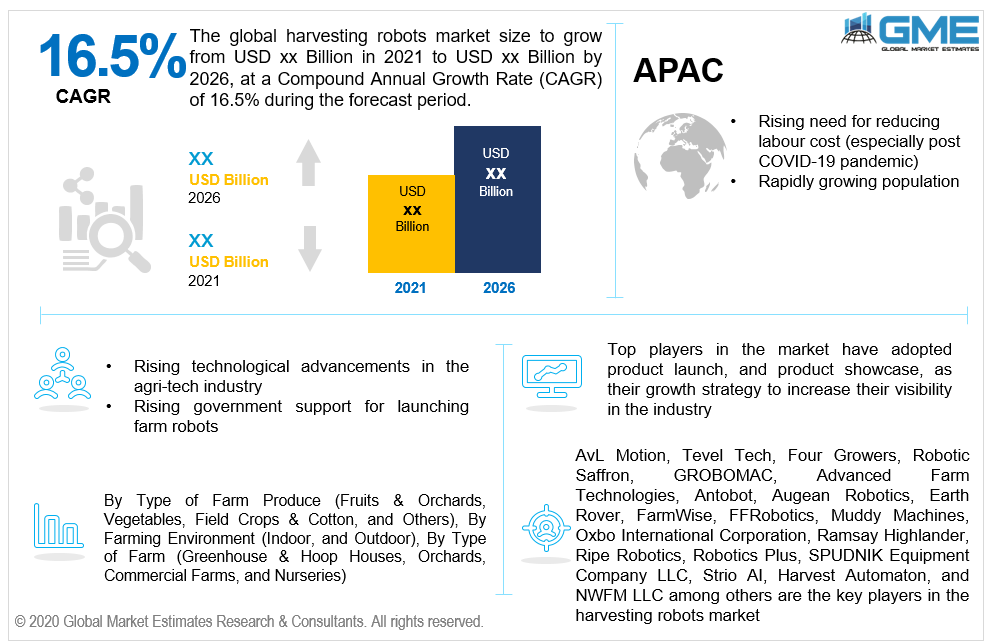

The global harvesting robots market is projected to grow at a CAGR value of 16.5% from 2021 to 2026.

The augment of robots in the agricultural field has drawn attention of many start-up firms and agricultural equipment companies to launch automatic machines. The technology is developing rapidly, not only advancing the production capabilities of farmers but also advancing robotics and automation technology. The major reason for the quick adoption of automated machines and robots in the agri-tech industry is the rapidly growing world population clubbed with rapidly increasing demand for food and food products.

As per the UN data, the global population will increase from 7.3 billion in 2020 to 9.7 billion in 2050. Hence, in order to keep up the ever growing demand, farmers and growers are bound to adopt latest innovations in their agricultural practices. From drones to harvesting robots, to autonomous tractors to robotic fruit pickers, the agri-tech industry is expected to grow exponentially in the market. Harvesting and picking is one of the most popular robotic applications in agriculture due to the accuracy and speed that robots can achieve to improve the size of yields and reduce waste from crops being left in the field.

Harvesting robots or automated harvest robots are defined as collecting arms or fruit picking arms which can be semi-automatic or completely automatic in nature. These robots seamlessly reach the foliage, and pick the vegetable/ cotton or fruit without damaging it. With the help of machine learning and AI, these robots are embedded with vision systems that can determine the location and ripeness of the farm produce even in harsh conditions (such as dust, temperature swings wind movements, and varying light intensity).

Rising need for reducing labour cost (especially post COVID-19 pandemic), rapidly growing global population, rising need for harvesting huge amount of crop or farm produce and increasing need for high productivity from the existing farm areas are the major drivers of this market. Moreover, rising technological advancements in the agri-tech industry and rising government support for launching farm robots are some of the other drivers of the market.

COVID-19 impacted most of the businesses globally which led to revenue losses and major disruption of supply chain. Factory shutdowns and regressive quarantine measures impacted and hauled most of the business strategies and steps. Moreover, this emergence also affected harvesting robots market. A significant reduction in the demand for robots on field, and lack of capital to purchase high-end machines were some of the outcomes of the pandemic. However, with the ease in restrictions and sudden increase in food consumption volume, the impact was analyzed to be short-term and the market is expected to pick up the pace during the forecast period.

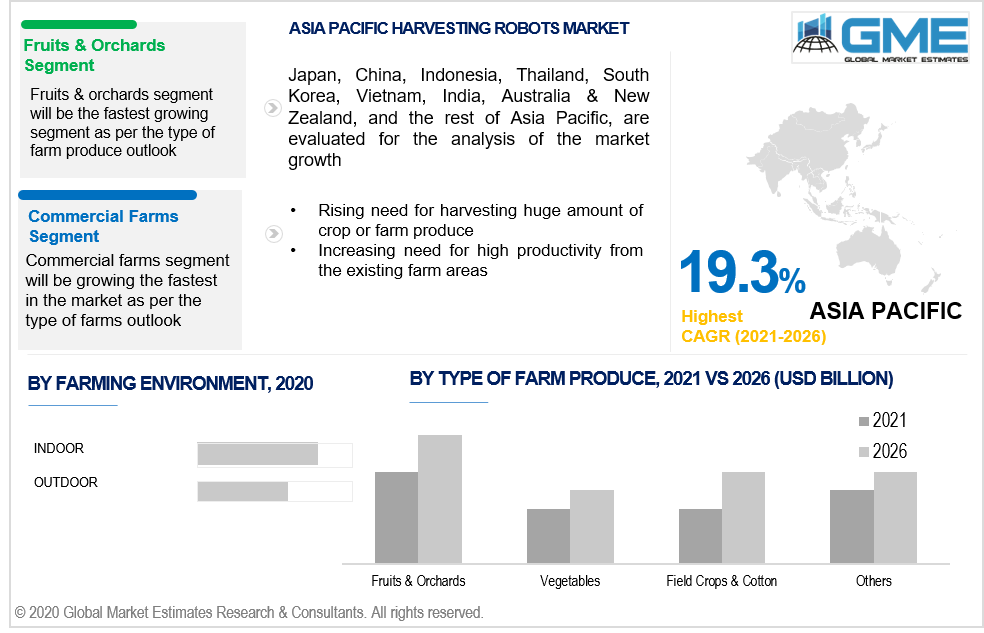

Based on the type of farm produce, the market is segmented into fruits & orchards, vegetables, field crops & cotton, and others. The segment of fruits & orchards is estimated to have the largest share in the market. This is mainly due to the rising launch of fruit picking robots/ fruit pickers in the market, and increasing number of start-up players for offering robots and machines for fruit farming industry.

Based on the farming environment, the market for harvesting robots is segmented into indoor, and outdoor farming environment. The indoor farming environment will be the fastest growing segment when compared to the outdoor farming environment. The concept of indoor farming has been adopted rapidly mainly because of its ability to increase the local food supplies and offer fresh farm produce to the local growers and consumers.

Based on the type of farm, the global harvesting robots market is divided into greenhouse & hoop houses, orchards, commercial farms, and nurseries. Commercial farms segment is expected to be the largest shareholder of the market. This is attributed mainly due to rising demand for robotic arms or pickers from large sized farms clubbed with increasing demand for food across the globe.

As per the geographical analysis, the harvesting robots market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the harvesting robots market from 2021 to 2026. This is mainly because of the presence of major agricultural machine manufacturing companies, start-up firms, and research institutes dedicated to agri-robot research. Moreover, high purchasing power, well-aware consumers and farmers, and rising government support for agri-tech products and machines are some of the other factors driving the North American market.

Moreover, the Asia-Pacific region is expected to be the fastest growing segment in the harvesting robots market during the forecast period. Rapidly increasing population clubbed with rising demand for fruits and vegetables, and presence of large sized fertile farms in Asian countries are the major reasons for the APAC market to grow the fastest.

AvL Motion, Tevel Tech, Four Growers, Robotic Saffron, GROBOMAC, Advanced Farm Technologies, Antobot, Augean Robotics, Earth Rover, FarmWise, FFRobotics, Muddy Machines, Oxbo International Corporation, Ramsay Highlander, Ripe Robotics, Robotics Plus, SPUDNIK Equipment Company LLC, Strio AI, Harvest Automaton, and NWFM LLC among others are the key players in the harvesting robots market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Harvesting Robots Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type of Farm Produce Overview

2.1.3 Farming Environment Overview

2.1.4 Type of Farm Overview

2.1.6 Regional Overview

Chapter 3 Harvesting Robots Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing need for high productivity from the existing farm areas

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness regarding latest farming robots in developing countries

3.4 Prospective Growth Scenario

3.4.1 Type of Farm Produce Growth Scenario

3.4.2 Farming Environment Growth Scenario

3.4.3 Type of Farm Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Type of Farm Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Harvesting Robots Market, By Farming Environment

4.1 Farming Environment Outlook

4.2 Indoor

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Outdoor

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Harvesting Robots Market, By Type of Farm Produce

5.1 Type of Farm Produce Outlook

5.2 Fruits & Orchards

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Vegetables

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

5.4 Field Crops & Cotton

5.4.1 Market Size, By Region, 2021-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Harvesting Robots Market, By Type of Farm

6.1 Greenhouse & Hoop Houses

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Orchards

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Commercial Farms

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

6.4 Nurseries

6.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Harvesting Robots Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.2.3 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.2.4 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.3 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.4 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.3.11.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.3.11.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.3 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.4.4 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Farming Environment, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.4.10.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.4.10.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.5.3 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.5.4 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.6.3 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.6.4 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type of Farm Produce, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Farming Environment, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By Type of Farm, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AvL Motion

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Tevel Tech

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Four Growers

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Robotic Saffron

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 GROBOMAC

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Advanced Farm Technologies

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Antobot

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Augean Robotics

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Earth Rover

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Harvesting Robots Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Harvesting Robots Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS