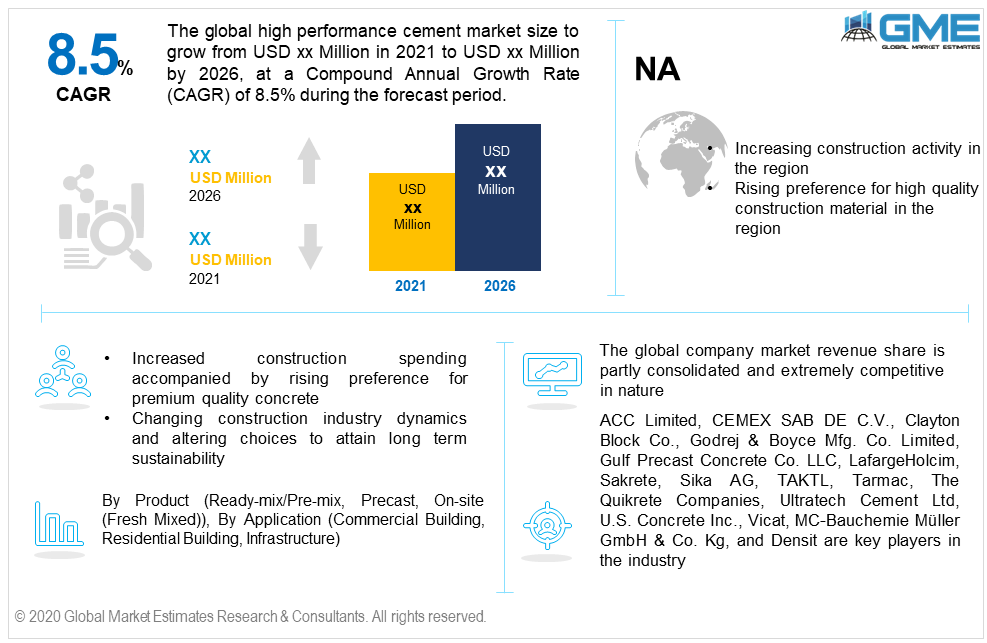

Global High Performance Cement Market Size, Trends & Analysis - Forecasts to 2026 By Product (Ready-mix/Pre-mix, Precast, On-site (Fresh Mixed)), By Application (Commercial Building, Residential Building, Infrastructure), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increased construction spending accompanied by a rising preference for premium quality concrete and admixtures will positively influence the high performance cement market growth. Changing construction industry dynamics and altering choices to attain long term sustainability are major success factors for companies to invest in these advanced products.

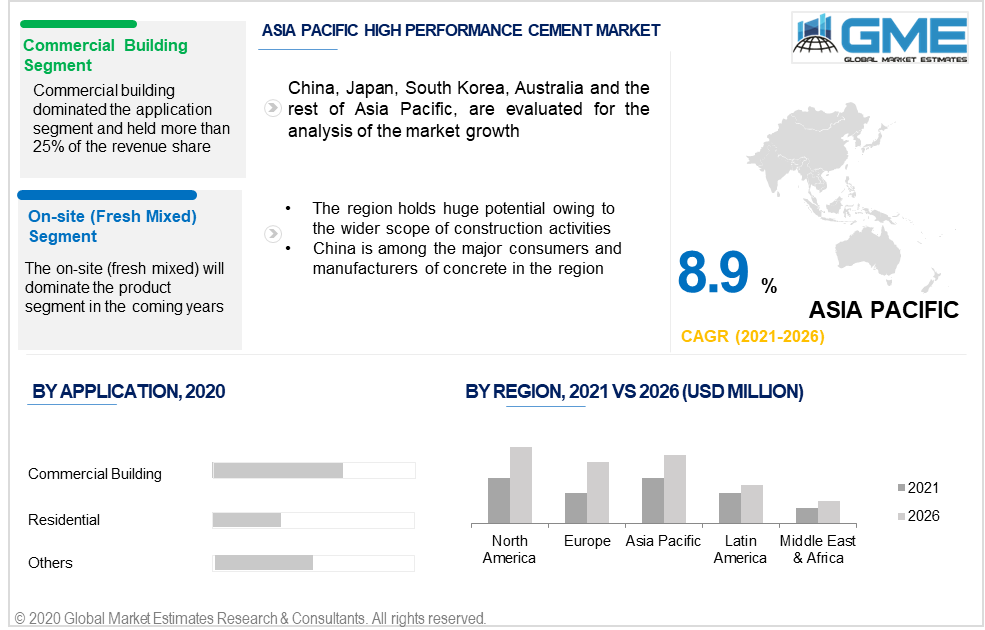

The global high performance cement market size will observe more than 8.5% growth from 2021 to 2026, with APAC witnessing the highest growth up to 2026. Construction industry expansion accompanied by a greater scope of infrastructural activities will induce market expansion. The introduction of novel construction material with advanced qualities related to strength, ruggedness, and longevity will result in numerous potential in the industry.

The other positive factors to fuel demand are rapid urbanization, increased government spending on infrastructure, and rising spending on the remodelling of residential spaces. Increased accident rates due to inferior quality construction material have resulted in the change in laws & regulations regarding material grade and quality. These alterations in regulations will positively influence the adoption of these innovative materials in the construction industry. However, the premium pricing of these materials may hinder their penetration and adoption in developing countries.

The products are categorized into On-site (Fresh Mixed), Ready-mix/Pre-mix, and Precast. The on-site (fresh mixed) will dominate the product segment in the coming years. These products are mixed and made during the construction activity which avoids excessive wastage and achieves cost efficiency. Easy availability and optimum costing are the major success factors to proliferate growth in this segment.

The other product which is observing high popularity is the ready mix/pre-mix. These products are proven to be easier to use and have no hustle in mixture quantities.

Commercial buildings, residential buildings, and infrastructure are the major applications in the industry. Commercial building dominated the application segment and held more than 25% of the revenue share in 2019. Increasing preference for premium quality construction materials along with high budget allocation are the major factors to induce demand in this segment.

The infrastructure applications will be the fastest growing application during the forecast period. The rising number of collapses and accidents due to poor infrastructure has led the industry towards more scrutiny and procurement of optimum quality concrete and other construction materials. Mostly the projects are run under government control which makes it essential for them to execute the construction activity efficiently.

The Asia Pacific dominated the regional demand and held more than 50% of the revenue share in 2019. The region holds huge potential owing to the wider scope of construction activities mainly in China, India, and Japan. China is among the major consumers and manufacturers of concrete in the region and is likely to hold its dominance in the coming years.

North America will observe more than 8.8% CAGR from 2021 to 2026. Increasing construction activity in the region along with a rising preference for high-quality construction material will drive the regional demand. Moreover, rising government intervention to support sustainable and high-quality infrastructure will result in a high preference for these construction materials.

The European market is likely to witness stagnant growth during the forecast period. Renovation and remodeling are the major construction activities witnessed in the region. The UK, France, Germany, and the Netherlands will be the major revenue-generating countries during the forecast period.

The Middle East & Africa is projected to be the fastest growing region from 2021 to 2026. Large-scale infrastructural construction activities along with high budget building projects will support the regional industry growth.

ACC Limited, CEMEX SAB DE C.V., Clayton Block Co., Godrej & Boyce Mfg. Co. Limited, Gulf Precast Concrete Co. LLC, LafargeHolcim, Sakrete, Sika AG, TAKTL, Tarmac, The Quikrete Companies, Ultratech Cement Ltd, U.S. Concrete Inc., Vicat, MC-Bauchemie Müller GmbH & Co. Kg, and Densit are key players in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

The global company market revenue share is partly consolidated and extremely competitive in nature. Currently, the top 5 players accounting for more than 50% of the revenue share in 2019. Niche product category along with limited reach in the local market may restrict the profitability of the international companies.

Enhancing distribution channel networks and long term partnerships with the construction companies are the prime strategies observed in the industry. The companies are also entering footsteps across the value chain to improvise profitability.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 High Performance Cement industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Product overview

2.1.3 End-use overview

2.1.4 Regional overview

Chapter 3 High Performance Cement Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 High Performance Cement Market, By Product

4.1 Product Outlook

4.2 Ready-mix/Pre-mix

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Precast

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 On-site (Fresh Mixed)

4.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 High Performance Cement Market, By Application

5.1 Application Outlook

5.2 Commercial Building

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Residential Building

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Infrastructure

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Others

5.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 High Performance Cement Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by product, 2019-2026 (USD Million)

6.2.3 Market size, by application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by product, 2019-2026 (USD Million)

6.2.4.2 Market size, by application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by product, 2019-2026 (USD Million)

6.2.5.2 Market size, by application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by product, 2019-2026 (USD Million)

6.3.3 Market size, by application, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by product, 2019-2026 (USD Million)

6.2.4.2 Market size, by application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by product, 2019-2026 (USD Million)

6.3.5.2 Market size, by application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by product, 2019-2026 (USD Million)

6.3.6.2 Market size, by application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by product, 2019-2026 (USD Million)

6.3.7.2 Market size, by application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by product, 2019-2026 (USD Million)

6.3.8.2 Market size, by application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by product, 2019-2026 (USD Million)

6.3.9.2 Market size, by application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by product, 2019-2026 (USD Million)

6.4.3 Market size, by application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by product, 2019-2026 (USD Million)

6.4.4.2 Market size, by application, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by product, 2019-2026 (USD Million)

6.4.5.2 Market size, by application, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by product, 2019-2026 (USD Million)

6.4.6.2 Market size, by application, 2019-2026 (USD Million)

6.4.7 India

6.4.7.1 Market size, by product, 2019-2026 (USD Million)

6.4.7.2 Market size, by application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by product, 2019-2026 (USD Million)

6.4.8.2 Market size, by application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by product, 2019-2026 (USD Million)

6.5.3 Market size, by application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by product, 2019-2026 (USD Million)

6.5.4.2 Market size, by application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by product, 2019-2026 (USD Million)

6.5.5.2 Market size, by application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by product, 2019-2026 (USD Million)

6.6.3 Market size, by application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by product, 2019-2026 (USD Million)

6.6.4.2 Market size, by application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by product, 2019-2026 (USD Million)

6.6.5.2 Market size, by application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 ACC Limited

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 CEMEX SAB DE C.V.

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Clayton Block Co.

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Godrej & Boyce Mfg. Co. Limited

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Gulf Precast Concrete Co. LLC

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 LafargeHolcim

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Sakrete

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Sika AG

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 TAKTL

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Tarmac

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 The Quikrete Companies

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Ultratech Cement Ltd

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 U.S. Concrete Inc.

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Vicat

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 MC-Bauchemie Müller GmbH & Co. Kg

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 Densit

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

The Global High Performance Cement Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the High Performance Cement Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS