Global High Speed Engine Market Size, Trends, and Analysis - Forecasts to 2026 By Speed (1000–1500 RPM, 1500–1800 RPM, Above 1800 RPM), By Power Output (0.5–1 MW, 1–2 MW, 2–4 MW, Above 4 MW), By End User (Power Generation, Marine, Mining, Oil & Gas, Railway, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

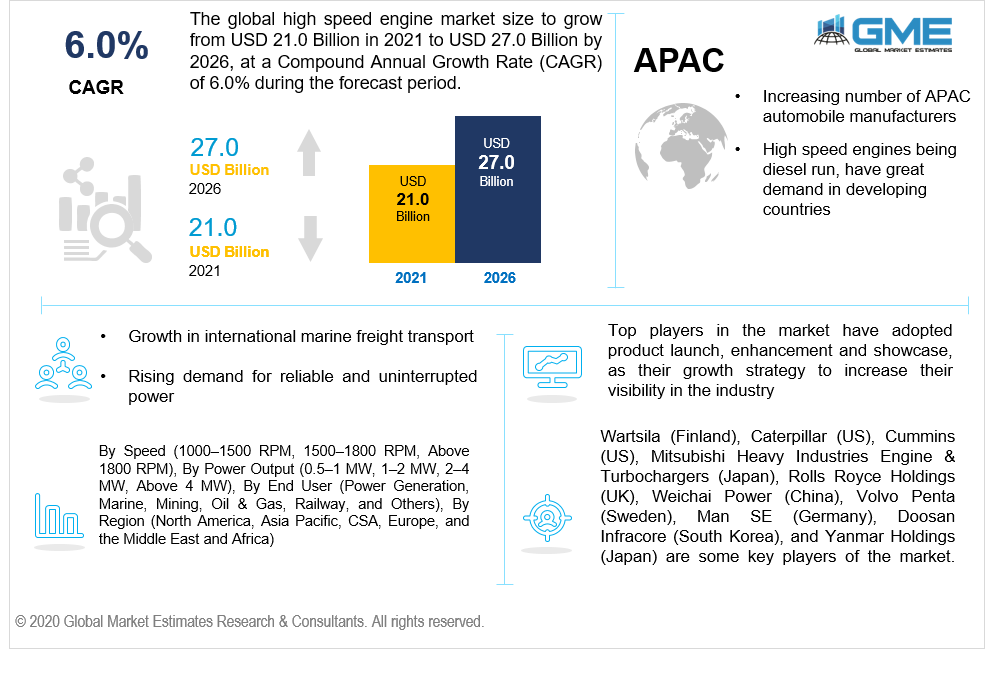

The global high speed engine market will grow from USD 21.0 billion in 2021 to USD 27.0 billion by 2026 at a CAGR value of 6.0% from 2021 to 2026.

Rising demand for reliable and uninterrupted power, growth in international marine freight transport, and flourishing maritime tourism are the major drivers of the high-speed engine market. Furthermore, increasing demand for backup power solutions is further expected to support the growth of the market.

With augmentation of automation in the automotive industry and with growing industrialization, the need for high performance and a reliable power source is increasing, thereby leading to increasing demand for high speed engines. High speed engines are high-power diesel engines that are used today by various end-user industries.

Industries require engines that have higher efficiencies and higher performance rates. Inspite of the heavy-duty or high cost of these engines, the demand for high speed engines is tremendously increasing, and the features attributed by these engines are highly appreciated within the end-user community. These engines also exhibit low emission rates along with fewer constraints on fuel consumption, which are highly favored by end-use industries. Thus, these trends have helped the high speed engines market grow rapidly.

However, in recent times, the energy sources for high speed engines have diversified. Initially, the design of high speed engines was structured as per the requirements in off-road vehicles and their machines. However, today, these engines are used in a wide range of industries like marine and activities like power generation and locomotive fields.

The COVID-19 pandemic hampered the automotive industry on a large scale. Most of the manufacturing facilities and sites were shut due to worldwide lockdown. Moreover the raw material supply chain was heavily disturbed due to lack of labour source. However, during the forecast period, the high speed engine market is expected to grow exponentially owing to rising demand for reliable and uninterrupted power engines.

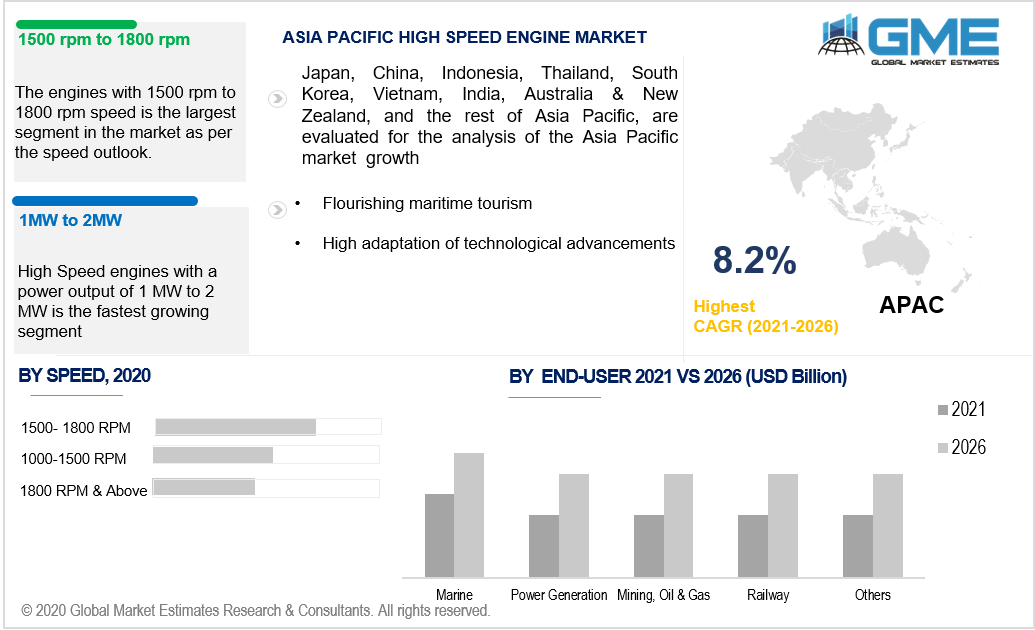

Based on speed, the market is segmented into 1000–1500 rpm, 1500–1800 rpm, and above 1800 rpm. The engines with 1500 rpm to 1800 rpm speed are highly demanded in developed countries. This segment is analyzed to be the fastest growing segment in the market from 2021 to 2026.

These high speed engines are majorly used in ships, ferries, and other marine activities. The 1500 to 1800 rpm speed engines are four stroke engines that are highly diesel based. The majority of the high speed engines across various verticals have 95 liters engine displacement capacity, lower and better than engines with less rpm. These engines with a speed of 1800 rpm also have considerably lower weight than the engines with lesser speed. The 1800 rpm speed in these engines facilitates the end-users by generating more power, while the low displacement created through this speed consumes very little fuel than the engines with lower rpm.

Based on power output, the market is segmented into 0.5–1 MW, 1–2 MW, 2–4 MW, and above 4 MW. High Speed engines with a power output of 1 MW to 2 MW are widely used in various industries and hence are also the largest shareholder in the market.

This range of power output is extensively beneficial for power generation in all the locomotive fields. These engines are likely to create 1 MW to 2MW power. Many industries across the globe use generators to create power and utilize in various application. Electricity is used in various outlets, and the power generation through 2 MW diesel engines helps maintain sustainability in the operations of various activities in different industries and sectors.

Based on end user, the market is segmented into power generation, marine, mining, oil & gas, railway, and others. High speed engines are extensively used in marine operations and hence the marine segment is the largest segment in the market.

The diesel based high speed engines have their application in various ships, vessels, ferries, and many others. High speed engines’ usage is tremendously expanding in the marine world, attributing to their features like low emission rates of nitrogen oxides, carbon monoxide, hydrocarbons, and higher efficiency rates.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North America, and Asia Pacific regions.

North America is analyzed to be the largest regional market for high speed engines. However, APAC is analyzed to be the fastest growing segment. Countries like India, China, and Japan are homes to some of the large scale automobile manufacturers. The high speed engines being diesel run, have great demand in APAC. With the flourishing manufacturing industry and the power generation industry in the APAC region the market is ought to be growing the fastest.

Wartsila (Finland), Caterpillar (US), Cummins (US), Mitsubishi Heavy Industries Engine & Turbochargers (Japan), Rolls Royce Holdings (UK), Weichai Power (China), Volvo Penta (Sweden), Man SE (Germany), Doosan Infracore (South Korea), and Yanmar Holdings (Japan) are some key players of the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2020, Wärtsilä signed an agreement with Isla Norte Energy Corp’s (Philippines) to deliver diesel based power engines. The agreement proposed that Wärtsilä will supply W32 series diesel power engines and ehance their product portfolio.

In January 2020, Cummins announced the launch of 500 kW mobile diesel genset, a compilation of Tier 4 emission standards.

In August 2019, Doosan Infracore signed a contract for engine production and sales with BBI Indonesia. The company, through this contract, will manufacture 1600 units to fulfill the requirements of the South East Asian market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 High Speed Engine Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Speed Overview

2.1.3 Power Output Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 High Speed Engine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for reliable and uninterrupted power

3.3.2 Industry Challenges

3.3.2.1 High cost high-speed engines for third world countries

3.4 Prospective Growth Scenario

3.4.1 Speed Growth Scenario

3.4.2 Power Output Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 High Speed Engine Market, By Speed

4.1 Speed Outlook

4.2 1000–1500 RPM

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 1500–1800 RPM

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Above 1800 RPM

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 High Speed Engine Market, By Power Output

5.1 Power Output Outlook

5.2 0.5–1 MW

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 1–2 MW

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 2–4 MW

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Above 4 MW

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 High Speed Engine Market, By End-User

6.1 Power Generation

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Marine

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

6.3 Mining, Oil & Gas

6.3.1 Market Size, By Region, 2020-2026 (USD Million)

6.4 Railway

6.4.1 Market Size, By Region, 2020-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 High Speed Engine Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Speed, 2020-2026 (USD Million)

7.2.3 Market Size, By Power Output, 2020-2026 (USD Million)

7.2.4 Market Size, By End-User, 2020-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Speed, 2020-2026 (USD Million)

7.2.4.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Speed, 2020-2026 (USD Million)

7.3.3 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.4 Market Size, By End-User, 2020-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Speed, 2020-2026 (USD Million)

7.3.11.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Speed, 2020-2026 (USD Million)

7.4.3 Market Size, By Power Output, 2020-2026 (USD Million)

7.4.4 Market Size, By End-User, 2020-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Speed, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Speed, 2020-2026 (USD Million)

7.4.9.2 Market size, By Power Output, 2020-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Speed, 2020-2026 (USD Million)

7.4.10.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Speed, 2020-2026 (USD Million)

7.5.3 Market Size, By Power Output, 2020-2026 (USD Million)

7.5.4 Market Size, By End-User, 2020-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Speed, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Speed, 2020-2026 (USD Million)

7.6.3 Market Size, By Power Output, 2020-2026 (USD Million)

7.6.4 Market Size, By End-User, 2020-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Speed, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Speed, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Power Output, 2020-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Wartsila (Finland)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Caterpillar (US)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Cummins (US)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Mitsubishi Heavy Industries Engine & Turbochargers (Japan)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Rolls Royce Holdings (UK)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Volvo Penta (Sweden)

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Man SE (Germany)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Doosan Infracore (South Korea)

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Other Companies

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

The Global High Speed Engine Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the High Speed Engine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS