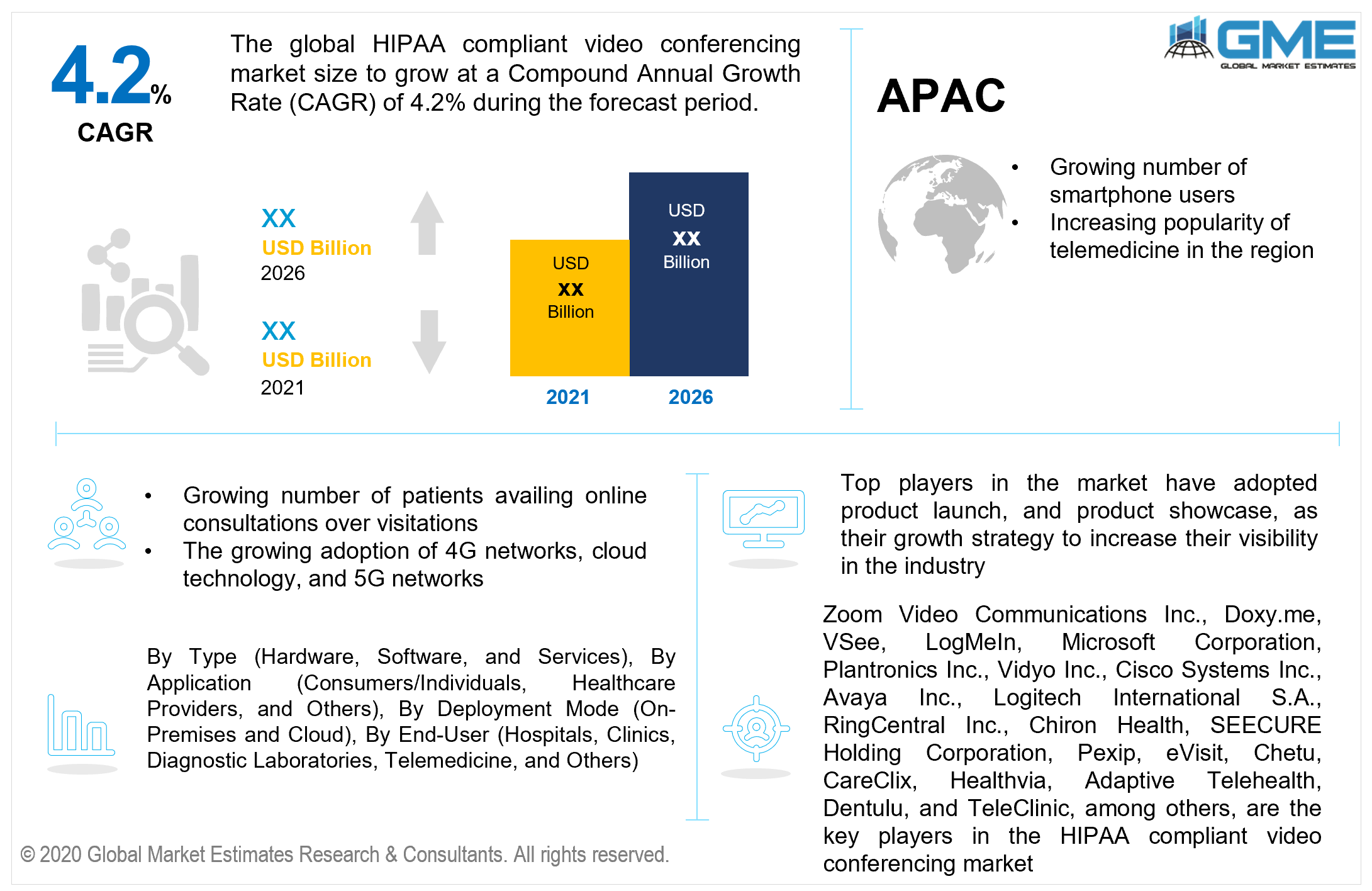

Global HIPAA Compliant Video Conferencing Market Size, Trends & Analysis - Forecasts to 2026 By Type (Hardware, Software, and Services), By Application (Consumers/Individuals, Healthcare Providers, and Others), By Deployment Mode (On-Premises and Cloud), By End-User (Hospitals, Clinics, Diagnostic Laboratories, Telemedicine, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The Global HIPAA Compliant Video Conferencing Market is projected to grow at a CAGR value of 4.2% between 2021 to 2026. The telemedicine industry has witnessed significant growth in recent years owing to technological advancements in the telecommunications industry and their adoption. The growing infrastructure development in developing nations has increased the number of internet users in the region, thereby prompting users to turn to telemedicine and online healthcare services. Many healthcare providers have already begun offering consultations and other services through online video conferencing platforms and digital healthcare platforms.

Healthcare data is highly confidential and privacy concerns have led to stringent regulations and policies regarding the transmission and storage of patient information. The HIPAA regulations have been widened to encompass video conferencing platforms. The increasing demand for HIPAA-compliant video conferencing solutions has seen existing video conferencing platforms create new products and services specifically for the healthcare community. Cloud-based technology is becoming more prominent in the industry due to benefits such as cost-effectiveness, greater accessibility, data security, and storage capabilities, among others.

The COVID-19 pandemic has created an upsurge in the demand for telemedicine and online healthcare services. Restrictions on movement, the number of patients, and the need to reduce direct contact are expected to increase the demand for HIPAA-compliant video conferencing platforms. The pandemic is expected to result in over 1 billion interactions through virtual healthcare platforms by the end of 2021. Many telemedicine vendors report massive spikes in demand for video requests with healthcare providers. Teladoc, a telemedicine company reports increase of up to 15,000 video requests daily during the pandemic. The need for HIPAA-compliant encryption for legally conducting video consultations in the United States is expected to drive the market in the North American region.

Many countries have their own set of regulations that are more or less similar in requirements to HIPAA which has seen healthcare providers across the globe turn to vendors providing HIPAA-compliant conferencing solutions. The market is restrained by the changing nature of the regulatory framework when it comes to data protection and the high cost of implementing such systems. The growing number of users turning to online healthcare services and telemedicine is expected to overcome the cost of implementing such systems during the forecast period.

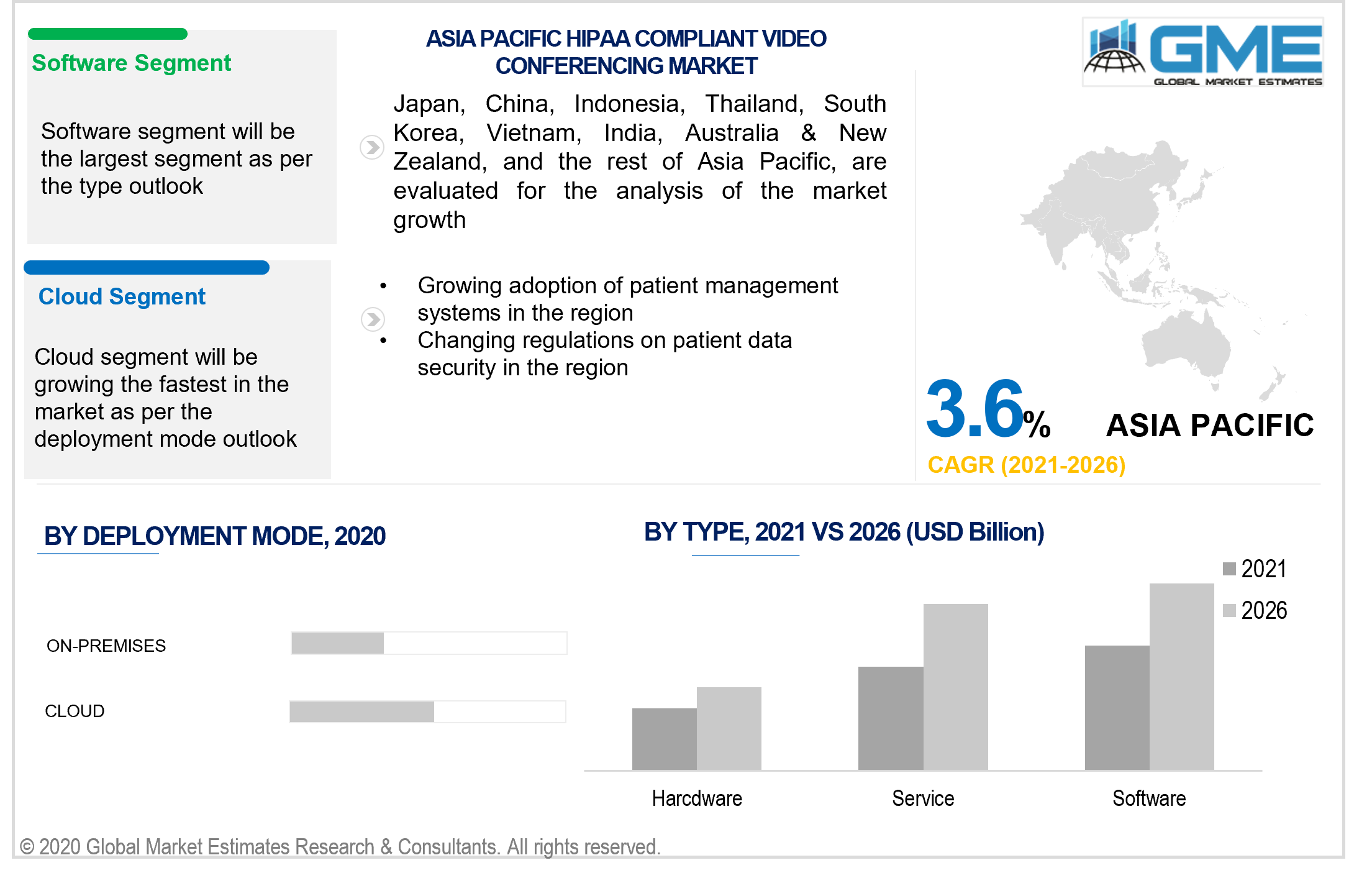

Based on the various types of HIPAA-compliant video conferencing solutions available in the market, the market is segmented into hardware, services, and software. The software segment is expected to hold the dominant share of the market. The popularity of traditional video conferencing software such as skype and more recent proliferation in the market by Zoom and Microsoft Teams have been the major drivers of the software segment.

The services segment is expected to witness the fastest growth rates during the forecast period. Healthcare providers are increasingly adopting various digital platforms for automating appointments, follow-ups, and patient registration. The growing demand for platforms has seen vendors providing complete service packages with 24/7 support and a greater degree of control through the use of cloud technology. The growing demand for cloud-based platforms and the need for greater support and manpower to regulate the growing demand for inline healthcare services is expected to drive the services segment.

Based on the application, the market is segmented into consumers/individuals, healthcare providers, and others. The healthcare providers segment is expected to dominate the market during the forecast period. Many healthcare providers have already implemented various digital healthcare management solutions and their experience in handling such software-based solutions has made them more susceptible to adopting video-conferencing solutions. The greater availability of capital among healthcare providers and the stringent regulations on healthcare providers are the major drivers of the segment.

Based on the deployment mode, the market is segmented into on-premises and cloud. The cloud segment is expected to clutch the lion's share of the market. The growing benefits of cloud services and the increasing need for remote access have resulted in the dominance of cloud-based solutions. The need for instantaneous access to patient information for healthcare providers and security features such as better end-to-end encryption are the major drivers of the segment. Adoption of novel telecommunication technology such as 5G will contribute to the rapid growth of this segment during the forecast period.

Based on the end-users, the market is segmented into Hospitals, Clinics, Diagnostic Laboratories, Telemedicine, and Others. The telemedicine segment is expected to hold the lion’s share of the market. Telemedicine vendors are heavily reliant on digital solutions and services to provide the best possible services to their clients. The growing number of restrictions on the industry and their need to ensure patient satisfaction have been the major drivers of the segment.

The hospitals segment is expected to witness the fastest growth rate during the forecast period. Hospitals are increasingly adopting digital solutions and the growing restrictions due to the pandemic have seen them turn to digital solutions to provide the care needed by patients who are not able to participate in direct physical consultations. The growing demand for home care and the growing number of portable monitoring systems are expected to further drive the demand for HIPAA-compliant video conferencing tools among hospitals

Based on region, the market can be broken into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions.

The North American region is expected to be the dominant force in the market during the forecast period and is expected to grow at the fastest rate during the forecast period. The growing demand for telemedicine, adoption of cloud-based services, cost-effectiveness, and ease of accessing healthcare services through online services is expected to drive the market in the North American region. Stringent regulations on transmission, storage, and the need for greater end-to-end encryption for digital healthcare services in the region is another major factor for growth in the region.

Zoom Video Communications Inc., Doxy.me, VSee, LogMeIn, Internet MegaMeeting LLC., DrChrono Inc., Microsoft Corporation, Plantronics Inc., Vidyo Inc., Cisco Systems Inc., Avaya Inc., Logitech International S.A., RingCentral Inc., Chiron Health, SEECURE Holding Corporation, Pexip, eVisit, Chetu, Blue Jeans Network Inc., QuickBlox, TheraNest, SimplePractice, VTConnect, AthenaHealth, Connexin Software, Deputy, Medici, Mend, PrognoCIS, RXNT, Updox, Thera-LINK, TigerConnect, OnCall Health, WiCis Telehealth, SynziMD, NextGen Healthcare, Agnes Connect, CareClix, Healthvia, Adaptive Telehealth, Dentulu, and TeleClinic, among others are the key players in the HIPAA compliant video conferencing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 HIPAA Compliant Video Conferencing Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Deployment Mode Overview

2.1.6 Regional Overview

Chapter 3 Industrial Tubes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the telecommunications industry such as loud technology and growing adoption of 5G networks

3.3.1.2 Growing demand for telemedicine

3.3.2 Industry Challenges

3.3.2.1 Changing regulatory scenario and high cost of implementation

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Deployment Mode Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Deployment Mode Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Industrial Tubes Market, By Type

4.1 Type Outlook

4.2 Materials

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Software

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Industrial Tubes Market, By End-User

5.1 End-User Outlook

5.2 Hospitals

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Clinics

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Diangostic Laboratories

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Telemedicine

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Industrial Tubes Market, By Application

6.1 Consumers/Individuals

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Healthcare Providers

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Others

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Industrial Tubes Market, By Deployment Mode

7.1 Others

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 On-Premises

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Industrial Tubes Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Type, 2020-2026 (USD Billion)

8.2.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.5 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Type, 2020-2026 (USD Billion)

8.3.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.5 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Type, 2020-2026 (USD Billion)

8.4.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.5 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Type, 2020-2026 (USD Billion)

8.5.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.5 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Type, 2020-2026 (USD Billion)

8.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.5 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Zoom Video Communications, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Doxy.me

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 VSee

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 LogMeIn

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Internet MegaMeeting, LLC.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 DrChrono Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Microsoft Corporation

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Plantronics, Inc.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Vidyo, Inc.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global HIPAA Compliant Video Conferencing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the HIPAA Compliant Video Conferencing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS