Global Histology and Cytology Market Size, Trends & Analysis - Forecasts to 2026 By Type of Examination (Histology [By Technique {Microscopy, Immunohistochemistry, Molecular Pathology, Cryostat & Microtomy}], Cytology [By Technique {Microscopy, Immunohistochemistry, Molecular Pathology, Cryostat & Microtomy}, By Application {Breast Cancer, Cervical Cancer, Bladder Cancer, Lung Cancer, Other cancers}]), By Product (Instruments and Analysis Software Systems and Consumables & Reagents), By Application (Drug Discovery & Designing, Clinical Diagnostics, and Research), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

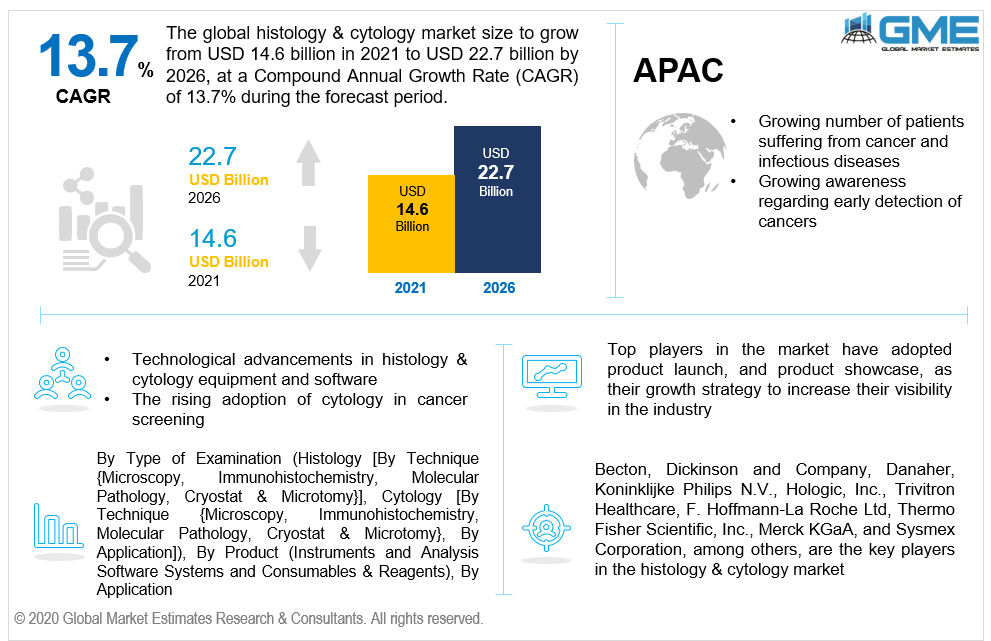

The global histology and cytology market is projected to grow from USD 14.6 billion in 2021 to USD 22.7 billion by 2026 at a CAGR value of 13.7%.

The histology and cytology market is driven by the growing number of pathological laboratories, rising demand for advanced pathological diagnostic tests, and the increasing prevalence of cancer and other infectious diseases.

Histology analysis is used to study the tissue structure of animal and plant cells while cytology is used to analyze the structure and function of the cells. Both techniques are widely used in screening for cancer and other infectious diseases.

Technological advancements in digital pathology and the growing number of laboratories have been instrumental in the growing application of these techniques. Histology equipment companies, as well as cytology equipment companies, have begun integrating artificial intelligence and machine learning with the equipments to improve their image analyzing capabilities.

The growing demand for cancer screening in developing nations is expected to be a lucrative opportunity for players looking to expand their product reach. Growing investment in improving healthcare facilities and healthcare accessibility in developing nations is expected to further enhance the growth of the market for these procedures. The growing number of patients suffering from chronic cancer across the globe has increased awareness amongst people for the need for early detection of tumour and other infectious diseases.

Histology and cytology can be used for screening various diseases like inflammatory diseases, smallpox, rabies, abnormal growth, and leukemia, among others. The market is restrained by the cost of these tests, the need for skilled professionals, and stringent government regulations for disease diagnosis. The debate of histology VS. cytology has been ongoing for a time now and, cytology is expected to be more preferred going forward as it can be used to identify various types of cancer. The market is restrained by the cost of these tests, the need for skilled professionals, and stringent government regulations.

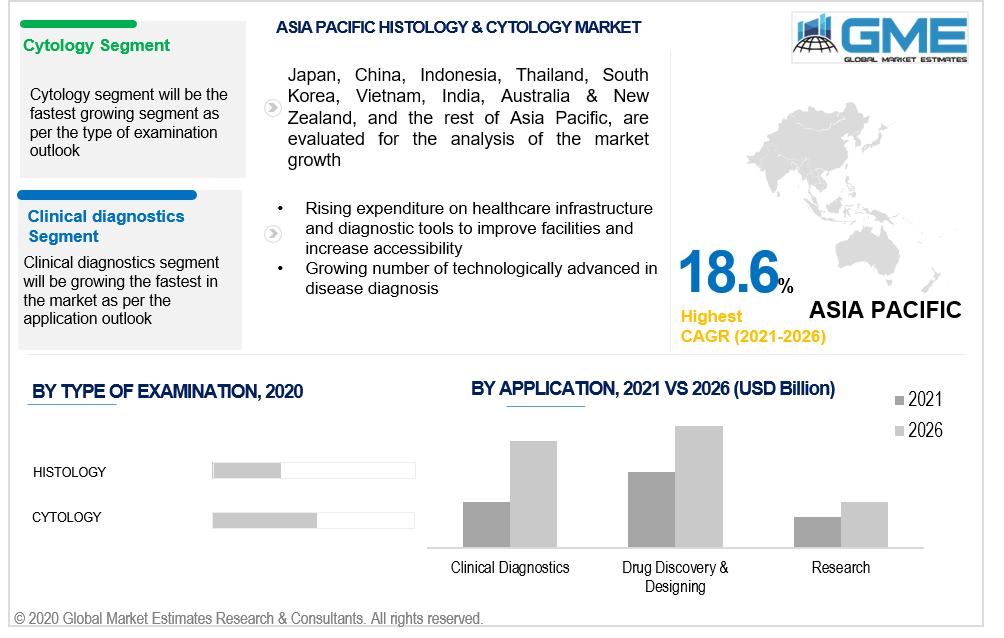

Based on the type of examination, the market is segmented into histology and cytology. The cytology segment is expected to hold the dominant share of the market as well as showing faster growth rates than the histology segment. The cytology segment’s dominance arises from its ability to be used in screening for various cancers like cervical, lung, and breast cancers. These tests are also cheaper than histology tests which have also contributed to the large demand for cytology tests over histology tests. The growing prevalence of cancer is expected to increase the demand for cytology during the forecast period. Cytology has also been recommended by the WHO for detecting cervical cancer owing to its low cost and greater flexibility.

Based on the product type, the market is segmented into instruments and analysis software systems and consumables & reagents. The consumables & reagents segment is envisaged to grasp the largest share of the market revenue during the forecast period. The large demand for various consumables in cytology and histology tests such as sample containers, stains & reagents, kits, and other consumables have contributed to the dominance of this segment. The demand for cytology in cancer screening procedures has also played a crucial role in the increased demand for consumables & reagents. The development of cheaper kits and reagents has been instrumental in the dominance of this segment.

However, the instruments and analysis software systems segment is envisaged to grow at a faster growth rate than the consumables & reagents segment. Technological developments such as photoacoustic microscopy and multimodal nonlinear microscopy in histology and cytology analysis are expected to play a vital role in the growth of the market.

Based on the applications of histology and cytology, the market is segmented into drug discovery & designing, clinical diagnostics, and research segments. The drug discovery & designing segment is expected to hold the dominant share of the market. Widespread usage of histomorphometry and IHC staining in drug development has contributed to the dominance of the segment. The clinical diagnostics segment is envisaged to log better growth rates than the other segments during the forecast period. The growing adoption of cytology for cancer screening is expected to have a positive impact on the growth of the clinical diagnostics segment.

Based on region, the market is segmented into various regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The North American region is expected to be the dominant region in the market during the forecast period. The growing prevalence of cancer and large investment in drug development in the region has been pivotal in the dominance of the market in the region. The availability of excellent healthcare infrastructure and insurance reimbursement policies for histology and cytology screening has also been crucial to the growth of the market in the region.

However, the APAC region is envisaged to become the fastest-growing region in the market. Increased investment in drug development and the growing pharmaceuticals and biotechnology industry in the region is expected to play a crucial role in the growth of the market. The growing awareness of the need for early detection of cancer and the growing geriatric population in countries like Japan are expected to further enhance the growth of the market in the region.

Becton, Dickinson and Company, Danaher, Koninklijke Philips N.V., Hologic, Inc., Trivitron Healthcare, F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, Inc., Merck KGaA, and Sysmex Corporation, among others are the key players in the histology and cytology market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Histology & Cytology Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type of Examination Overview

2.1.3 Product Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Histology & Cytology Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of cervical, lung, and breast cancer in the population

3.3.2 Industry Challenges

3.3.2.1 High cost of histology & cytology equipment and the growing need for skilled professionals

3.4 Prospective Growth Scenario

3.4.1 Type of Examination Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Histology & Cytology Market, By Type of Examination

4.1 Type of Examination Outlook

4.2 Histology

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.2.2 Technique

4.2.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Cytology

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3.2 Technique

4.3.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3.3 Application

4.3.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Histology & Cytology Market, By Product

5.1 Product Outlook

5.2 Instrument and Analysis Software Systems

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Consumables & Reagents

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Histology & Cytology Market, By Application

6.1 Drug Discovery & Designing

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Clinical Diagnostics

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Research

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Histology & Cytology Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.2.3 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.3 Market Size, By Product, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.3 Market Size, By Product, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Product, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.5.3 Market Size, By Product, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.6.3 Market Size, By Product, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Type of Examination, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Becton, Dickinson and Company

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Danaher

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Koninklijke Philips N.V.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Hologic, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Trivitron Healthcare

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 F. Hoffmann-La Roche Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Thermo Fisher Scientific, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Merck KGaA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Sysmex Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Histology and Cytology Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Histology and Cytology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS