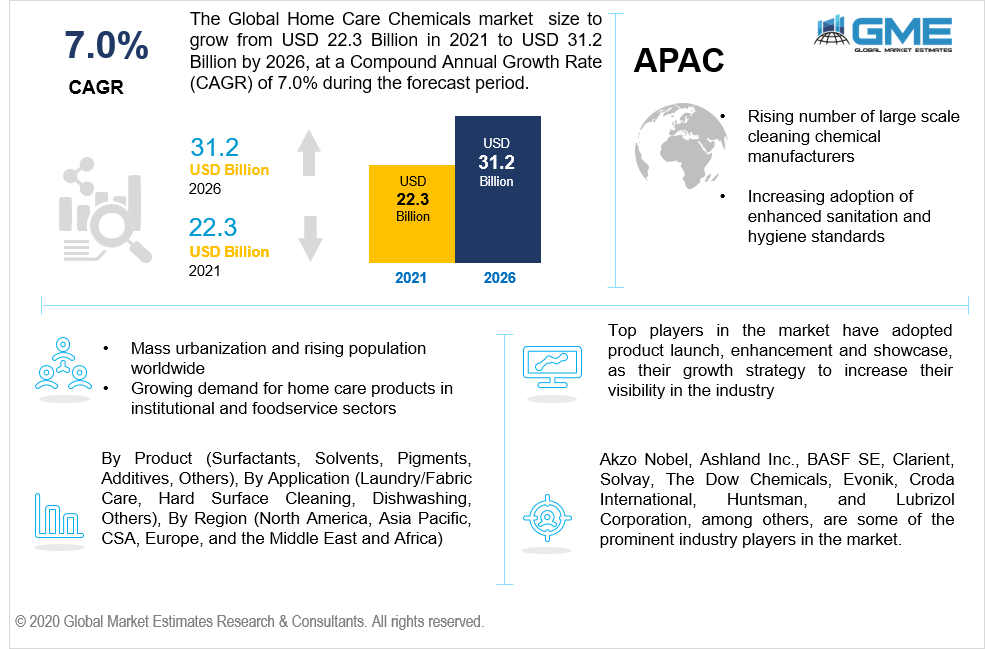

Global Home Care Chemicals Market Size, Trends, and Analysis - Forecasts to 2026 By Product (Surfactants, Solvents, Pigments, Additives, Others), By Application (Laundry/Fabric Care, Hard Surface Cleaning, Dishwashing, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global home care chemicals market is projected to grow from USD 22.3 billion in 2021 to USD 31.2 billion by 2026 at a CAGR value of 7.0%.

The global home care chemicals market is driven by factors such as mass urbanization, rapidly rising population, launch of innovative products and services, growing demand for home care products in institutional and foodservice sectors and increasing awareness about health and hygiene especially post COVID-19. Also, increasing use of green products and eco-friendly formulations is set to gain pace in global home care chemicals market.

However, restraints faced by the global home care chemicals market are stringent government regulations and limitations on input costs and prices.

Home care is one fundamental thing every household regularly follows as a part of their daily routine. The whole world is greatly inclined towards cleanliness and hygiene maintenance especially after the augmentation of COVID-19. Many countries have come up with policies and missions to encourage people to keep their surroundings clean to avoid contraction of any diseases or viruses.

Home care constitutes various activities from floor cleaning, dusting, clothes washing, kitchen care, and many more. Studies across different countries have shown that there are 31% chances of contracting diseases from within the house due to insufficient cleanliness, inadequately groomed domestic pets, lack of hygiene while preparing food or handling kitchen essentials. The government of various countries has been spending a tremendous amount of funds on healthcare, which is one of the major drivers of the market growth.

Studies have also shown that cloths and utensils cleaning cloths are at a high risk of spreading diseases, followed by regular clothes and linens, washrooms, toilets, baths, and sinks. The least at risk of spreading diseases are walls and furniture. Using these home care chemicals on a regular basis reduces the risk of getting exposed to germs and viruses.

These chemicals containing antibacterial agents into their solution fulfill the whole motive of getting rid of unrequired bacteria. Surveys have showcased that approximately 45% of the people are allergic to dust and have asthma problems. These aspects motivate people to use home care chemicals to maintain cleanliness and hygiene religiously.

The COVID-19 pandemic has condemned agencies like World Health Organisation (WHO), along with the government bodies of different countries to bring in stringent rules and regulations regarding cleaning and hygiene maintenance to avoid getting exposed to the virus. Various central and local organizations have taken initiatives to provide home care chemicals at a lower cost, thus boosting the demand for them in the market.

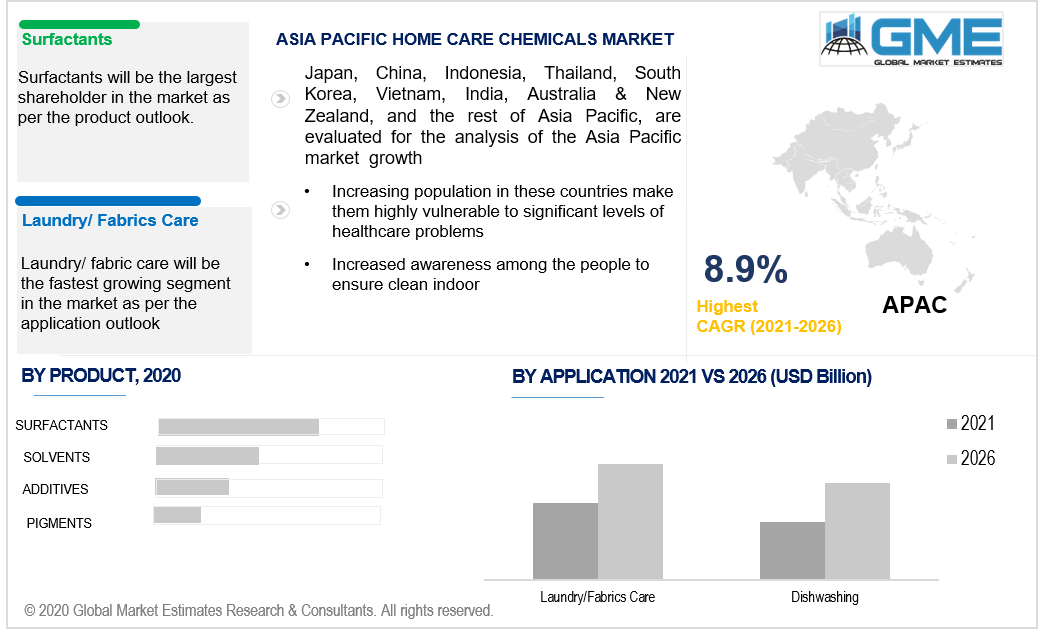

Based on product type, the home care chemicals market is divided into surfactants, solvents, pigments, additives, and others. Surfactants are compounds that are being used highly as home care chemicals and hence are poised to grow the fastest in the market from 2021 to 2026.

Surfactants are used in various range of applications, from laundry to cleaning floors and many more. These compounds have the ability to reduce the surface tension in the water and regulate the molecules present in the compound to come in the act with the oil and grease present on the surfaces. When added to the cleaning compounds, these surfactants increase the mixability nature of the compound and facilitate better cleaning.

Laundry/fabric care, hard surface cleaning, dishwashing, and others are the application areas of the home care chemicals market. Home care chemicals or cleaning agents are extensively used in laundry or fabric care applications and hence, this segment is expected to have the largest shareholder in the market. The cleaning agents for fabric application are available in liquid or powder forms that match the requirements of the consumer and the appliances that they are using to wash clothes and fabrics.

These cleaning chemicals have potent agents in their solution, which ease the process of removing various salts, dust, sugars, perspiration, and urea from the clothes and fabrics. High ratios of surfactants are used in laundry or fabric detergents which are the appropriate compound ratios required for the cleaning action.

Home care chemicals are extremely essential in laundry and fabric care as these clothes come in direct contact with the human body. Dirt or germs in clothes can cause infections and rashes, which can be avoided by using washing chemicals on regular turns. As per the researched reports of 2018, the analysis show that approximately 14 million metric tons of powdered chemical detergents are used worldwide, which is double the demand for liquid chemical detergents used for laundry and washing fabrics. With the rising competitive landscape in the home care chemical market, the manufacturers bring in detergents with floral fragrances and colors that have mass appeal and demand from end users. Hence, rising organic and inorganic growth strategies in the market by the top players is helping the segment grow the fastest.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North America, and Asia Pacific regions.

North America and Europe have collectively showcased a dominant share in the home care chemical market. However, the Asia Pacific region is analyzed to grow the fastest in the market from 2021 to 2026. APAC is home to most of the large-scale cleaning chemical manufacturers. APAC countries have been extensively adapting and enhancing their sanitation and hygiene standards, encouraging people to utilize more household cleaning products. Countries like China and India, being the two largest populated countries in the world, are highly vulnerable to significant levels of healthcare problems. Due to this, governments of these countries are constantly spreading awareness and running campaigns about indoor cleanliness and hygiene maintenance, thus avoiding getting exposed to germs, bacteria, and viruses.

Akzo Nobel, Ashland Inc., BASF SE, Clarient, Solvay, The Dow Chemicals, Evonik, Croda International, Huntsman, and Lubrizol Corporation, among others, are key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Home Care Chemicals Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Home Care Chemicals Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Mass urbanization, and rapidly rising population

3.3.2 Industry Challenges

3.3.2.1 Stringent government regulations and limitations on input costs and prices

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Home Care Chemicals Market, By Type

4.1 Type Outlook

4.2 Surfactants

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Solvents

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Pigments

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Additives

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Home Care Chemicals Market, By Application

5.1 Application Outlook

5.2 Laundry/Fabric Care

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Hard Surface Cleaning

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Dishwashing

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Home Care Chemicals Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Akzo Nobel

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Ashland Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 BASF SE

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Clarient

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Solvay

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 The Dow Chemicals

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Evonik

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Croda International

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Home Care Chemicals Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Home Care Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS