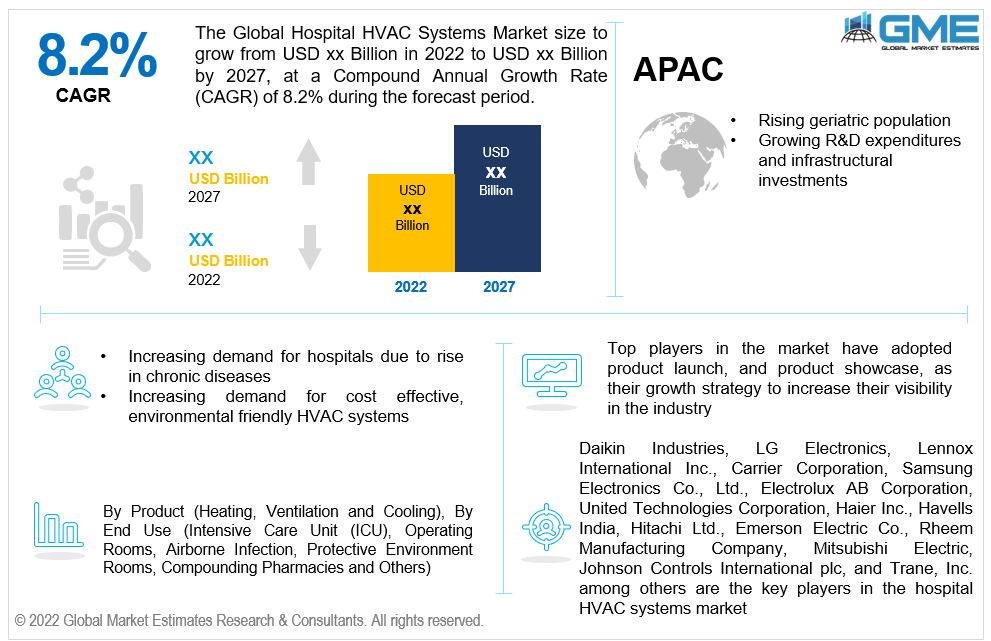

Global Hospital HVAC Systems Market Size, Trends & Analysis - Forecasts to 2027 By Product Type (Heating, Ventilation, and Cooling), By End-Use (Intensive Care Unit (ICU), Operating Rooms, Airborne Infection, Protective Environment Rooms, Compounding Pharmacies and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global Hospital HVAC Systems Market is projected to grow at a CAGR value of 8.2% from 2022 to 2027. Apart from creating a conducive dwelling and secure environment for patients, ICU staff, and visitors; heating ventilation, and air conditioning (HVAC) plays an important role in regulating surgical site infections in the intensive care unit (ICU).

The market will be driven during the forecast period, by an increase in the geriatric population as well as several autoimmune disorders, which will result in increased demand for hospitals, expanding investments for the advancement of the healthcare system, and increased demand for infection control and restorative conditioning systems in hospitals. Furthermore, the potential of HVAC systems to function using natural renewable energy will support market growth by lowering hospital power costs and replacing obsolete systems with cost-effective, environmentally friendly strategies.

The COVID-19 epidemic has had a positive influence on the HVAC industry in hospitals as the demand for such HVAC systems soared, with increasing demand for hospitals and hospital beds in general. The requirement for expenditure in such HVAC systems to ensure effective airflow and seclusion of areas has fuelled market demand since poor circulation in tight spaces has been linked with increased viral spread.

Over the forecast period, hospital product demand is expected to be driven by the rehabilitation of existing facilities or an upgrade from old to new facilities, as well as the introduction of sophisticated goods and a paradigm shift in terms of deployment of green technologies. Poor hospital architecture, a lack of suitable sensors, poor data collection, archiving, and visualization by building automation systems, as well as the complexity of preventing airborne infection spread, are all limiting market growth.

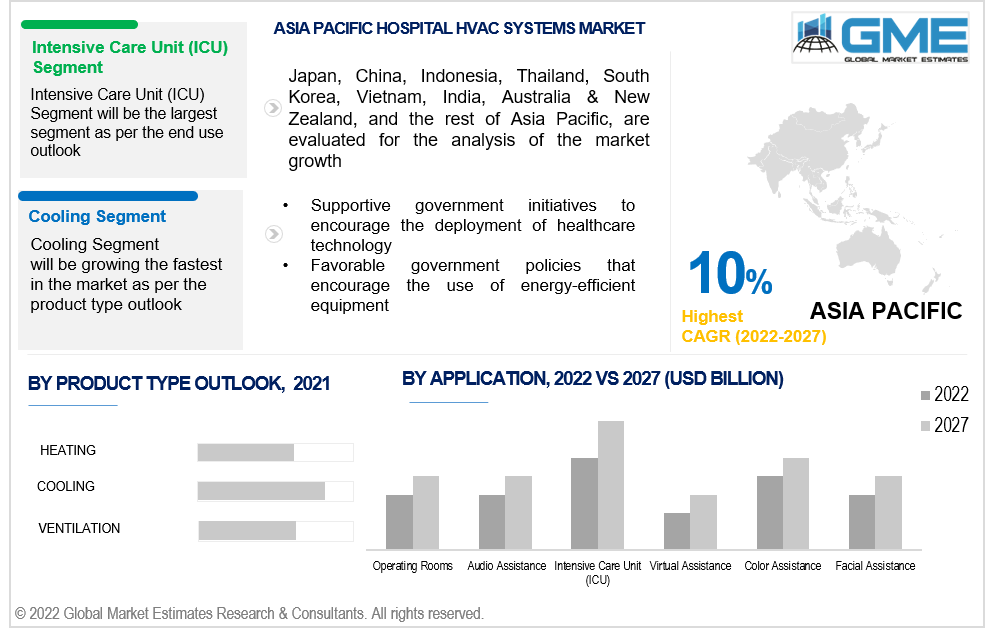

Based on the product type, the hospital HVAC systems market is divided into heating, ventilation, and cooling. The cooling segment is expected to be the fastest-growing segment in the market from 2022 to 2027. The use of air conditioning systems aids healthcare facilities in temperature regulation, controlling dampness that stimulates the spread of microorganisms and maintaining good air quality essential for patient comfort and recovery. Thus, the imminent need to achieve the aforementioned benefits is expected to drive demand for cooling systems at healthcare facilities.

Based on the end-use, the hospital HVAC systems market is divided into intensive care units (ICU), operating rooms, airborne infection, protective environment rooms, compounding pharmacies, and others. The intensive care unit (ICU) segment is expected to be the largest segment in the market from 2022 to 2027. The tendency of HVAC systems to aid in the mitigation of contamination and cross-contamination, protection of the environment while also protecting operators, and sustaining good indoor air quality (IAQ), which is an important non-pharmacological strategic approach in halting hospital-acquired infectious diseases, are all factors driving the segment growth.

As per the geographical analysis, the hospital HVAC systems market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the hospital HVAC systems market from 2022 to 2027. The primary element driving market expansion in the North American area is the high investment in the healthcare business in the United States and Canada, as well as rising building automation system technology to reduce carbon footprints and to save energy along with the presence of major HVAC manufacturers are driving the market growth.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the hospital HVAC systems market during the forecast period. The expansion is likely to be fuelled by factors such as aging population, an increase in noncommunicable diseases, expanding healthcare initiatives, and favourable government policies that encourage the use of energy-efficient equipment by giving subsidies and tax benefits.

Daikin Industries, LG Electronics, Lennox International Inc., Carrier Corporation, Samsung Electronics Co., Ltd., Electrolux AB Corporation, United Technologies Corporation, Haier Inc., Havells India, Hitachi Ltd., Emerson Electric Co., Rheem Manufacturing Company, Mitsubishi Electric, Johnson Controls International plc, and Trane, Inc. among others are the key players in the hospital HVAC systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Hospital HVAC Systems Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End Use Overview

2.1.4 Regional Overview

Chapter 3 Global Hospital HVAC Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of geriatric population

3.3.2 Industry Challenges

3.3.2.1 Poor data collection, archiving, and visualization by building automation systems

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 Central & South America

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Global Hospital HVAC Systems Market, By Product

4.1 Product Outlook

4.2 Heating

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Ventilation

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Cooling

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Global Hospital HVAC Systems Market, By End Use

5.1 End Use Outlook

5.2 Intensive Care Unit (ICU)

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Operating Rooms

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Airborne Infection

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Protective Environment Rooms

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Compounding Pharmacies

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Global Hospital HVAC Systems Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Product, 2022-2027 (USD Billion)

6.2.3 Market Size, By End Use, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Product, 2022-2027 (USD Billion)

6.3.3 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Product, 2022-2027 (USD Billion)

6.4.3 Market Size, By End Use, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2022-2027 (USD Billion)

6.4.7.2 Market size, By End Use, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Product, 2022-2027 (USD Billion)

6.5.3 Market Size, By End Use, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Product, 2022-2027 (USD Billion)

6.6.3 Market Size, By End Use, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By End Use, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By End Use, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Daikin Industries

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 LG Electronics

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Lennox International Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Carrier Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Samsung Electronics Co., Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Electrolux AB Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 United Technologies Corporation

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Haier Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Havells India

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Hitachi Ltd.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Emerson Electric Co.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Rheem Manufacturing Company

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Mitsubishi Electric

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Johnson Controls International plc

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Trane, Inc

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

7.17 Other Companies

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

The Global Hospital HVAC Systems Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hospital HVAC Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS