Global Hybrid Closed-Loop Insulin Delivery Systems Market Size, Trends & Analysis - Forecasts to 2027 By Component (Glucose Meter, Insulin Pump, and Glucose Sensors), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

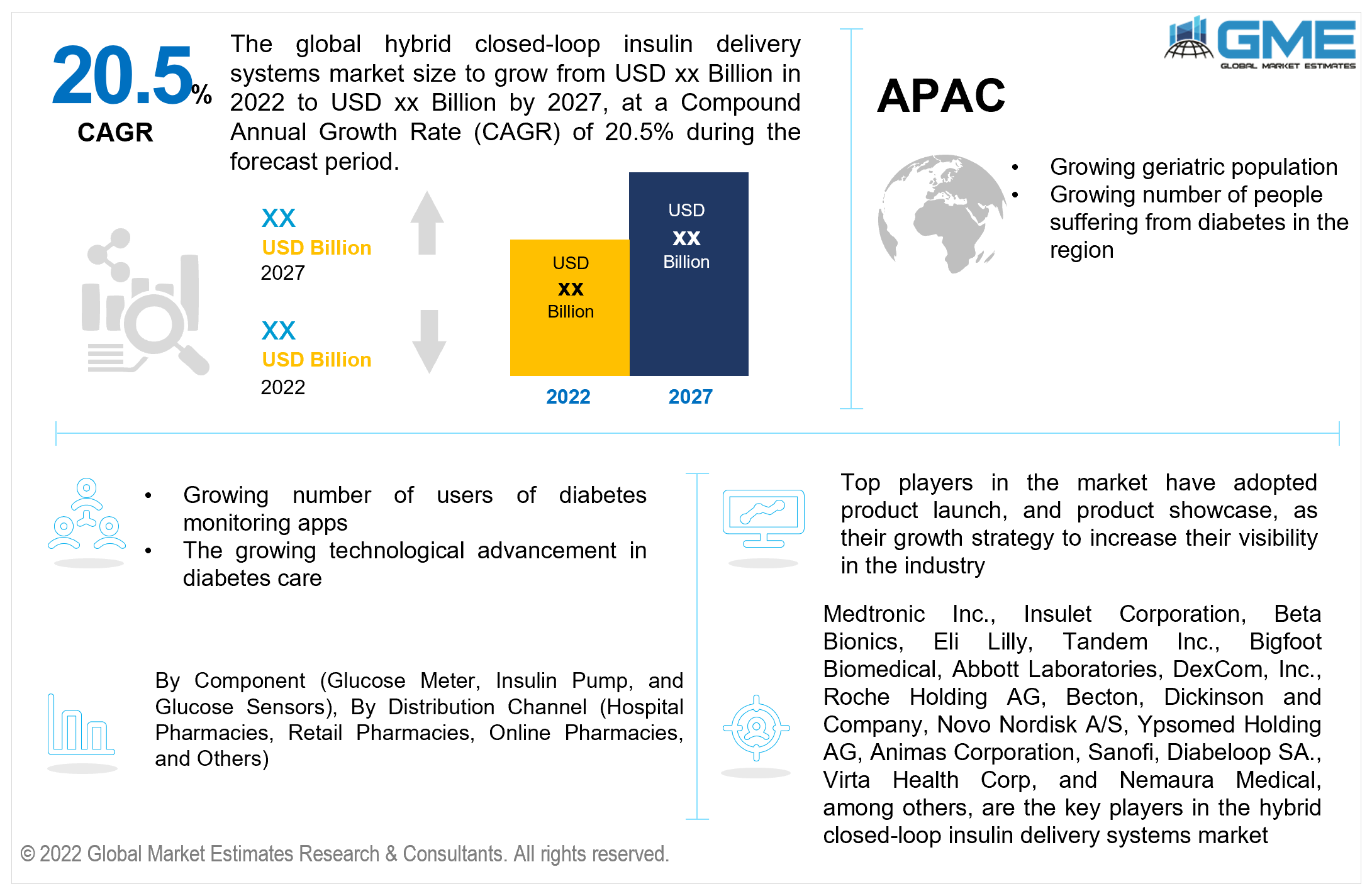

The global hybrid closed-loop insulin delivery systems market is projected to grow at a CAGR value of 20.5% from 2022 to 2027. Hybrid closed-loop delivery systems can deliver automated variable basal insulin through the integration of algorithms and real-time continuous glucose monitors. The ability of the delivery system to automatically calculate the amount of insulin your body would require every five minutes and deliver the same has been one of the key drivers of the product’s demand.

The growing advancement in wearable diagnostic technology especially in the medical devices sector has been instrumental in the development of such innovative products. Medical device manufacturers are increasing their investment in the research and development of devices that are capable of automated monitoring and control systems for biomedical applications.

The WHO reports and studies estimate that over 422 million people suffer from diabetes across the globe, causing over 1.6 million deaths annually. The World Bank estimates show that 8.5% of the population between the ages of 20 and 79 suffer from diabetes. The American Diabetes Association estimates are around 30.3 million people suffering from diabetes in the United States annually. The growing incidence of diabetes and increased awareness of the impact of diabetes is expected to increase the demand for diabetes management devices and consumables. The increasing number of diabetes patients and patient care is expected to cost the global healthcare industry USD 490 billion by the end of 2030.

The chronic nature of diabetes requires diabetes patients’ to constantly monitor and manage their insulin levels while maintaining a healthy lifestyle. Patients have to regularly monitor their blood sugar, monitor and record their diet practices, exercise and activities, and calculate the appropriate amount of insulin that they have to administer. Closed-loop insulin pumps are being increasingly adopted by patients so that they can continue with their lives without worrying about their insulin levels. With the advent of smartphones and increased adoption of applications among the public, diabetes care apps with detailed information on blood glucose levels and administered doses are being increasingly sought after by patients.

The hybrid closed-loop insulin delivery systems market is largely driven by the growing demand for wearable medical devices, increasing prevalence of diabetes, growing geriatric population, and increasing investment in medical device R&D across the globe.

The market’s growth is restrained by the availability of alternate devices for insulin monitoring, the lack of adequate insurance coverage in developing nations, and the high cost of such devices. The COVID-19 pandemic has in many ways increased the demand for hybrid closed-loop insulin delivery systems and other diabetes care products. Restrictions on hospital and clinical visits, increased stress on the healthcare system, and the growing awareness of healthier lifestyles during the pandemic has increased demand. The market is continued to thrive during the forecast period.

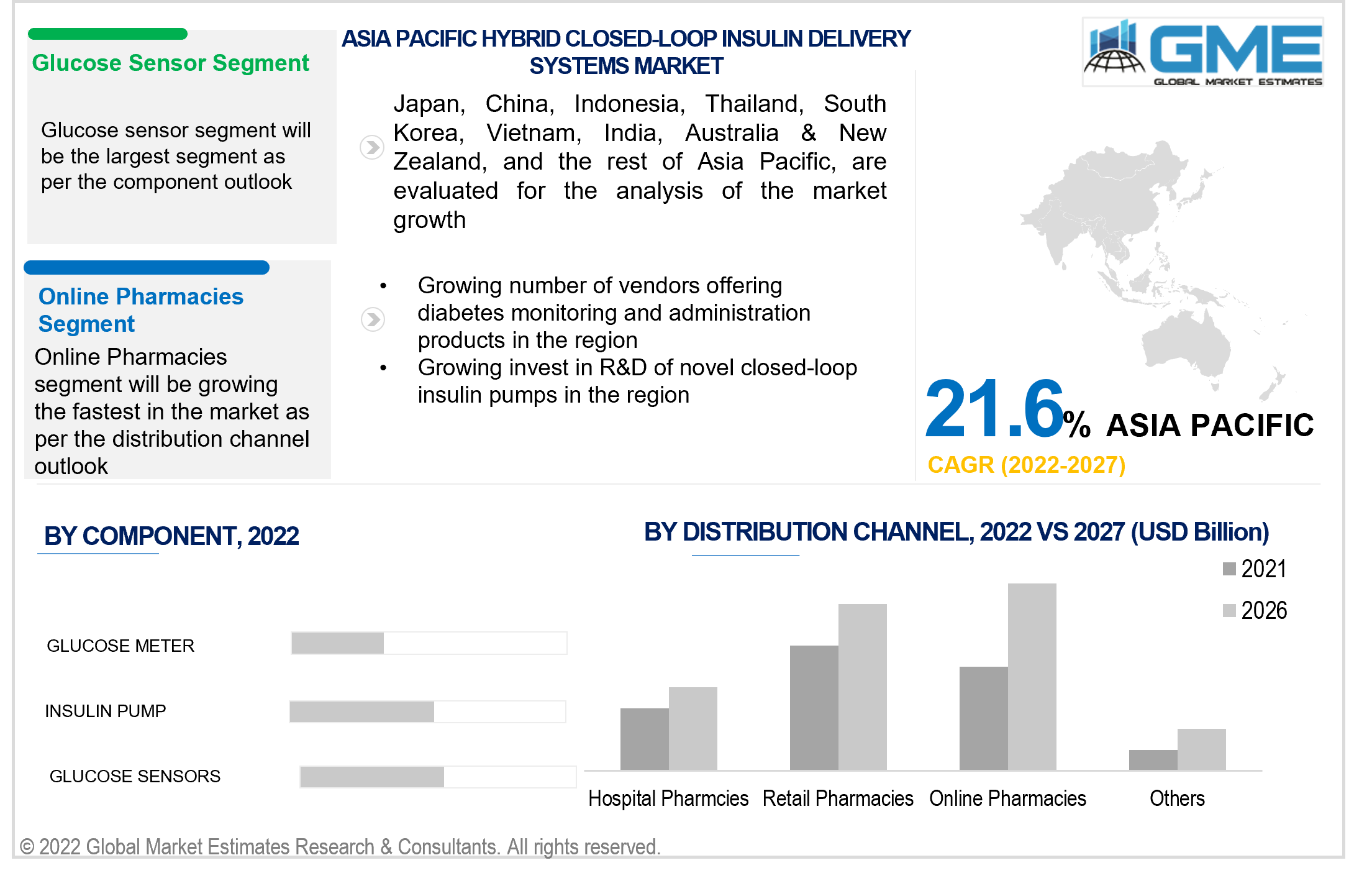

Based on the components, the hybrid closed-loop insulin delivery systems market is segmented into glucose meters, insulin pumps, and glucose sensors. The glucose sensors segment is expected to hold the largest piece of the market during the forecast period. Growing adoption and demand for continuous glucose meters have seen them increase in demand in recent years. The growing need for continuous glucose sensors and advancements in sensors have been the major drivers of the segment. The glucose sensors segment is expected to become the fastest-growing segment during the forecast period.

Based on the various distribution channels, the market is segmented into hospital pharmacies, online pharmacies, retail pharmacies, and others. The retail pharmacies segment held the lion’s share of the market. The preference for brick and mortar stores, insurance coverage, and specialized discounts have led to the dominance of the retail pharmacies segment.

The online pharmacies segment is expected to become the fastest-growing segment. The ease of online shopping, increased delivery options, a growing number of smartphone and internet users, and one-day shipping offers are the major drivers of the segment.

Based on region, the market can be broken into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The region has been witnessing an increased prevalence of diabetes as the geriatric population in the region increases. The heavy spending on research and development of new diabetes monitoring devices have also contributed to the dominance of the North American region in the market. The presence of the key players of the industry in the region and the excellent healthcare facilities in the region are some of the other contributors to the dominance of the North American region.

The APAC region is envisaged to log significantly greater growth rates than the other regions during the forecast period. The growing number of patients suffering from diabetes, changing lifestyle and food habits, and increased spending on healthcare by governments in the region are the major factors that contribute to the growth of this market in the APAC region.

Medtronic Inc., Insulet Corporation, Beta Bionics, Eli Lilly, Tandem Inc., Bigfoot Biomedical, Abbott Laboratories, DexCom, Inc., Roche Holding AG, Becton, Dickinson and Company, Novo Nordisk A/S, Ypsomed Holding AG, Animas Corporation, Sanofi, Diabeloop SA., Virta Health Corp, and Nemaura Medical, among others are the key players in the hybrid closed-loop insulin delivery systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Hybrid Closed-Loop Insulin Delivery Systems Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Hybrid Closed-Loop Insulin Delivery Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing prevalence of diabetes

3.3.2 Industry Challenges

3.3.2.1 High cost of devices and the lack of adequate insurance coverage

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Hybrid Closed-Loop Insulin Delivery Systems Market, By Component

4.1 Component Outlook

4.2 Glucose Meter

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Insulin Pump

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

4.4 Glucose Sensors

4.4.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Hybrid Closed-Loop Insulin Delivery Systems Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Hospital Pharmacies

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Retail Pharmacies

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

5.4 Online Pharmacies

5.4.1 Market Size, By Region, 2022-2027 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Hybrid Closed-Loop Insulin Delivery Systems Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Million)

6.2.2 Market Size, By Component, 2022-2027 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Component, 2022-2027 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Component, 2022-2027 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Million)

6.3.2 Market Size, By Component, 2022-2027 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Component, 2022-2027 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Million)

6.4.2 Market Size, By Component, 2022-2027 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Component, 2022-2027 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Component, 2022-2027 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Component, 2022-2027 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Component, 2022-2027 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2022-2027 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Component, 2022-2027 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Million)

6.5.2 Market Size, By Component, 2022-2027 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Component, 2022-2027 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Component, 2022-2027 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Component, 2022-2027 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Million)

6.6.2 Market Size, By Component, 2022-2027 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Component, 2022-2027 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Component, 2022-2027 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Component, 2022-2027 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2022-2027 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Medtronic Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Insulet Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Beta Bionics

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Eli Lilly

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Tandem Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Bigfoot Biomedical

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Abbott Laboratories

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 DexCom, Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Hybrid Closed-Loop Insulin Delivery Systems Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hybrid Closed-Loop Insulin Delivery Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS