Global Identity and Access Management Market Size, Trends & Analysis - Forecasts to 2027 By Component (Solution and Services), By Solution (Data Directory, Identity Lifecycle Management, Provisioning, De-provisioning, Authentication, Verification, Password Management, Self-Service Password Reset, Password Reset, Password Synchronization, Access Management and Authorization, Audit, Compliance, and Governance), By Service (Integration and Deployment, Support and Maintenance, and Consulting), By Deployment Mode (Cloud and On-premises), By Vertical (BFSI, Travel and Hospitality, Healthcare, Retail and e-Commerce, IT and ITeS, Education, and Others (Energy and Utilities, Telecommunication, Other Citizen Services)), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

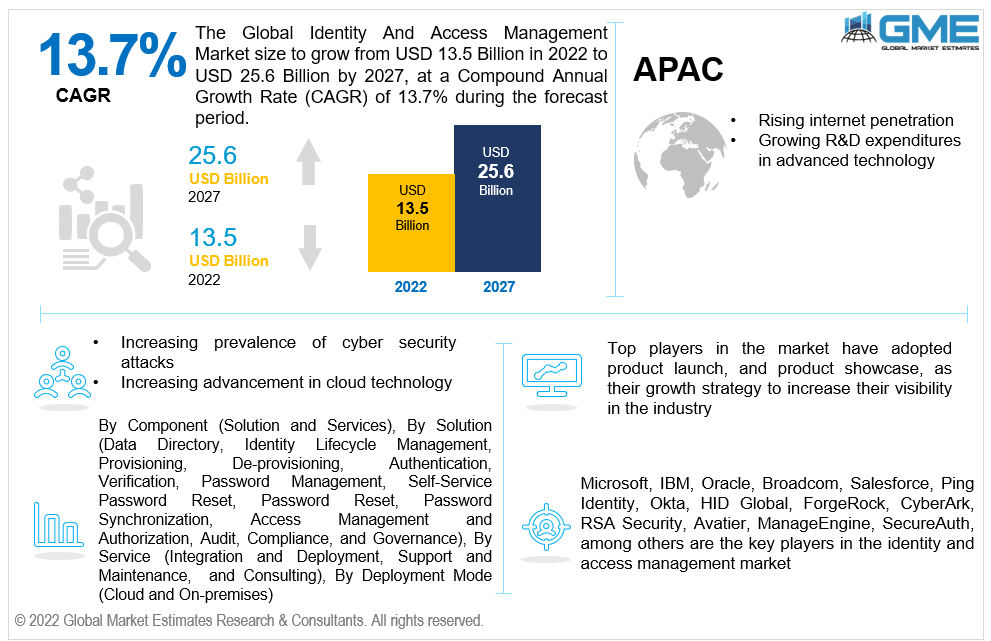

The global identity and access management market is projected to grow from USD 13.5 Billion in 2022 to USD 25.6 Billion in 2027 at a CAGR value of 13.7% from 2022 to 2027.

Identity and access management (IAM) is a security framework that organizations are increasingly using to manage digital identities and access to company resources and information. The market will be driven during the forecast period by advancements in IoT and artificial intelligence, rising awareness about regulatory compliance management, rising dependence on digital platforms and automation, and growing adoption of cloud technologies across industries.

IAM vendors will benefit from the ethnic shift from the traditional IAM to IAM, the pervasiveness of cloud-based IAM solutions and services, and the increasing adoption of the hybrid cloud model, as well as the increased adoption of technologies such as Artificial intelligence, ML, blockchain, and biometrics into identity and access management, are further propelling the market growth. Furthermore, the demand for IAM is being driven by an increase in web-based software, portfolio management services such as policy-based adherence, audit management, as well as cost-cutting efforts.

According to research; stolen, default or weak passwords are responsible for over 80% of data breaches. Other factors driving market growth include IAM systems' ability to enforce best practices in credential management and virtually eliminate risk, as well as their power to limit the destruction caused by malware insiders by ensuring restricted system administrators and assisting enterprises in transitioning from two-factor to three-factor authentication using functionalities such as iris tracking, biometric sensors, and facial detection.

Some of the factors driving market growth include lower production costs making application administration simple and easy, centralizing process time for connectivity and identity modifications for increasing user reliability, providing simpler access to signup, sign-in, and user management processes for application owners, as well as implementing policies and procedures related to user authentication and prerogatives. However, high installation costs of identity and access management systems can prove to be a market restraint during the forecast period.

According to a Proof Point analysis, businesses that rely on online platforms reported a two-thirds surge in ransomware and phishing assaults as a result of the pandemic, with severe lockdowns and travel restrictions in place, and corporate activities shifting exclusively to online platforms. As a result, the pandemic has not only fuelled the growth of the identity and access management market but has also increased demand for security and privacy while maintaining operational integrity.

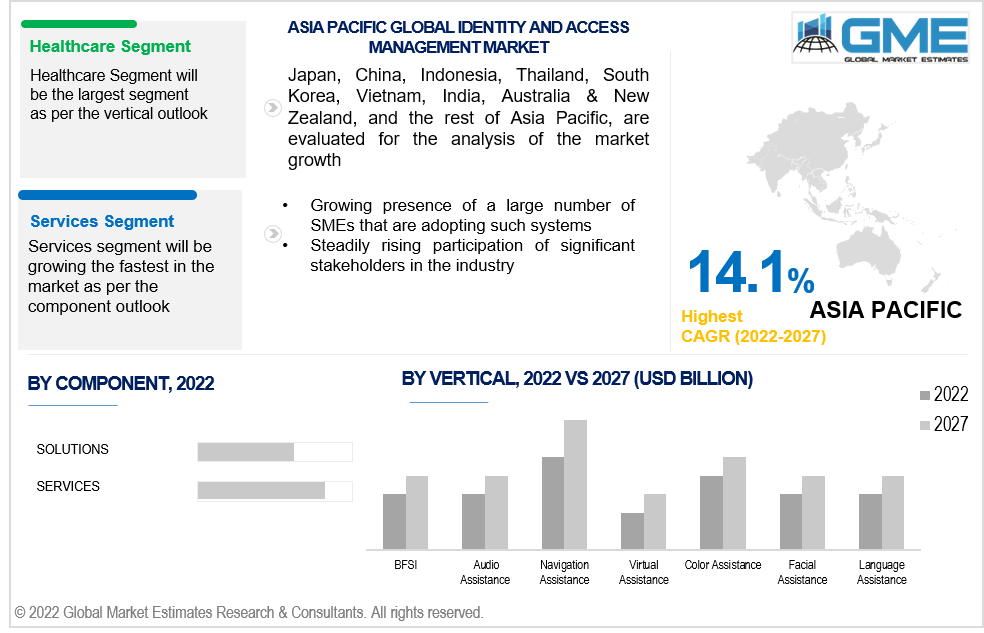

Based on the component, the identity and access management market is divided into solutions and services. The services segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Identity management as a service adds a layer of protection by accurately identifying, validating, and permitting individuals, and then granting them accessibility to a company's information systems, thereby promoting segment growth.

Based on the solution, the identity, and access management market is divided into the data directory, identity lifecycle management, provisioning, de-provisioning, authentication, verification, password management, self-service password reset, password reset, and password synchronization, access management and authorization, audit, compliance, and governance. The verification segment is expected to be the largest segment in the market from 2022 to 2027.

The increase can be ascribed to a variety of factors, including government laws, security, and fraud, among others. It also aids in the prevention of fraud and money laundering, as well as enhancing customer experience and confirming that a person's identity matches the one that is meant to be there.

Based on the service segmentation, the identity and access management market is divided into integration and deployment, support and maintenance, and consulting. The support and maintenance segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Support and maintenance management software is supporting segment expansion by assisting firms in frequently monitoring and maintaining equipment and satisfying safety regulations to prevent malfunction and critical failures. In addition, as a result of this software, less time is lost at work due to accidents, and equipment is safer for both operators and the environment.

Based on the deployment mode segmentation, the identity and access management market is divided into cloud and on-premises. The cloud segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Cloud computing has several advantages for any operations, including lower costs for repairing and controlling IT systems, faster access to data for continuing business as normal with less disruption and productivity loss, as well as guaranteeing data back up and storing information in a secure and safe location.

Based on the vertical type, the identity and access management market is divided into BFSI, travel and hospitality, healthcare, retail and e-commerce, IT and ITeS, education, and others like energy and utilities, telecommunication, and other citizen services. The healthcare segment is expected to be the largest segment in the market from 2022 to 2027.

The rising adoption of digitalization, growing investment in healthcare applications and telemedicine, and the presence of a large amount of patient data that needs safekeeping are some of the factors contributing to segment growth.

As per the geographical analysis, the identity and access management market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the identity and access management market from 2022 to 2027. Well-established technology infrastructure that allows the adoption of such a system, increased cases of cyber-attacks due to high internet penetration rates faced by firms and rising demand for data safety and cybersecurity management are factors boosting the market growth in this region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the identity and access management market during the forecast period. Rapid digital infrastructural development, rising internet penetration rates, the presence of a large number of SMEs that are adopting such systems as well as rising digitalization of operations are contributing to regional market growth.

Microsoft, IBM, Oracle, Broadcom, Salesforce, Ping Identity, Okta, HID Global, ForgeRock, CyberArk, RSA Security, Avatier, ManageEngine, SecureAuth, among others are the key players in the identity and access management market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Identity and Access Management Market Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Solution Overview

2.1.4 Service Overview

2.1.5 Deployment Mode Overview

2.1.6 Vertical Overview

2.1.7 Regional Overview

Chapter 3 Global Identity and Access Management Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising adoption of advanced technologies

3.3.2 Industry Challenges

3.3.2.1 High installation costs

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Solution Scenario

3.4.3 Service Growth Scenario

3.4.4 Deployment Mode Growth Scenario

3.4.5 Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 Central & South America

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Global Identity and Access Management Market, By Component

4.1 Component Type Outlook

4.2 Solutions

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Service

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Global Identity and Access Management Market, By Solution

5.1 Solution Outlook

5.2 Data Directory

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Identity Lifecycle Management

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Provisioning

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 De-provisioning

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Authentication

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

5.7 Verification

5.7.1 Market Size, By Region, 2022-2027 (USD Billion)

5.8 Password Management

5.8.1 Market Size, By Region, 2022-2027 (USD Billion)

5.9 Self-Service Password Reset

5.9.1 Market Size, By Region, 2022-2027 (USD Billion)

5.10 Password Reset

5.10.1 Market Size, By Region, 2022-2027 (USD Billion)

5.11 Password Synchronization

5.11.1 Market Size, By Region, 2022-2027 (USD Billion)

5.12 Access Management and Authorization

5.12.1 Market Size, By Region, 2022-2027 (USD Billion)

5.13 Audit, Compliance, and Governance

5.13.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Global Identity and Access Management Market, By Service

6.1 Integration and Deployment

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Support and Maintenance

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Consulting

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Global Identity and Access Management Market, By Deployment Mode

7.1 Cloud

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 On-premises

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 Global Identity and Access Management Market, By Vertical

8.1 BFSI

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Travel and Hospitality

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Healthcare

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Retail and e-commerce

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 IT and ITeS

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Education

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Others (Energy and Utilities, Telecommunication, Other Citizen Services)

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 Global Identity and Access Management Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2022-2027 (USD Billion)

9.2.2 Market Size, By Component, 2022-2027 (USD Billion)

9.2.3 Market Size, By Solution, 2022-2027 (USD Billion)

9.2.4 Market Size, By Service, 2022-2027 (USD Billion)

9.2.5 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.6 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.7 U.S.

9.2.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.7.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.2.7.3 Market Size, By Service, 2022-2027 (USD Billion)

9.2.7.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.7.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.8 Canada

9.2.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.8.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.2.8.3 Market Size, By Service, 2022-2027 (USD Billion)

9.2.8.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.8.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.2.9 Mexico

9.2.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.2.9.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.2.9.3 Market Size, By Service, 2022-2027 (USD Billion)

9.2.9.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.2.9.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3 Europe

9.3.1 Market Size, By Country 2022-2027 (USD Billion)

9.3.2 Market Size, By Component, 2022-2027 (USD Billion)

9.3.3 Market Size, By Solution, 2022-2027 (USD Billion)

9.3.4 Market Size, By Service, 2022-2027 (USD Billion)

9.3.5 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.6 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.7 Germany

9.3.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.7.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.3.7.3 Market Size, By Service, 2022-2027 (USD Billion)

9.3.7.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.7.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.8 UK

9.3.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.8.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.3.8.3 Market Size, By Service, 2022-2027 (USD Billion)

9.3.8.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.8.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.9 France

9.3.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.9.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.3.9.3 Market Size, By Service, 2022-2027 (USD Billion)

9.3.9.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.9.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.3.10 Italy

9.3.10.1 Market Size, By Component, 2022-2027 (USD Billion)

9.3.10.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.3.10.3 Market Size, By Service, 2022-2027 (USD Billion)

9.3.10.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.3.10.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2022-2027 (USD Billion)

9.4.2 Market Size, By Component, 2022-2027 (USD Billion)

9.4.3 Market Size, By Solution, 2022-2027 (USD Billion)

9.4.4 Market Size, By Service, 2022-2027 (USD Billion)

9.4.5 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.6 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.7 China

9.4.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.7.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.4.7.3 Market Size, By Service, 2022-2027 (USD Billion)

9.4.7.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.7.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.8 India

9.4.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.8.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.4.8.3 Market Size, By Service, 2022-2027 (USD Billion)

9.4.8.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.8.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.4.9 Japan

9.4.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.4.9.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.4.9.3 Market Size, By Service, 2022-2027 (USD Billion)

9.4.9.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.4.9.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5 MEA

9.5.1 Market Size, By Country 2022-2027 (USD Billion)

9.5.2 Market Size, By Component, 2022-2027 (USD Billion)

9.5.3 Market Size, By Solution, 2022-2027 (USD Billion)

9.5.4 Market Size, By Service, 2022-2027 (USD Billion)

9.5.5 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.6 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.7.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.5.7.3 Market Size, By Service, 2022-2027 (USD Billion)

9.5.7.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.7.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.8 UAE

9.5.8.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.8.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.5.8.3 Market Size, By Service, 2022-2027 (USD Billion)

9.5.8.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.8.5 Market Size, By Vertical, 2022-2027 (USD Billion)

9.5.9 South Africa

9.5.9.1 Market Size, By Component, 2022-2027 (USD Billion)

9.5.9.2 Market Size, By Solution, 2022-2027 (USD Billion)

9.5.9.3 Market Size, By Service, 2022-2027 (USD Billion)

9.5.9.4 Market Size, By Deployment Mode, 2022-2027 (USD Billion)

9.5.9.5 Market Size, By Vertical, 2022-2027 (USD Billion)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2022

10.2 Microsoft

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 IBM

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Oracle

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Broadcom

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Salesforce

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Ping Identity

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 Okta

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.9 HID Global

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 ForgeRock

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 CyberArk

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 RSA Security

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

10.13 Avatier

10.13.1 Company Overview

10.13.2 Financial Analysis

10.13.3 Strategic Positioning

10.13.4 Info Graphic Analysis

10.14 Other Companies

10.14.1 Company Overview

10.14.2 Financial Analysis

10.14.3 Strategic Positioning

10.14.4 Info Graphic Analysis

The Global Identity and Access Management Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Identity and Access Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS