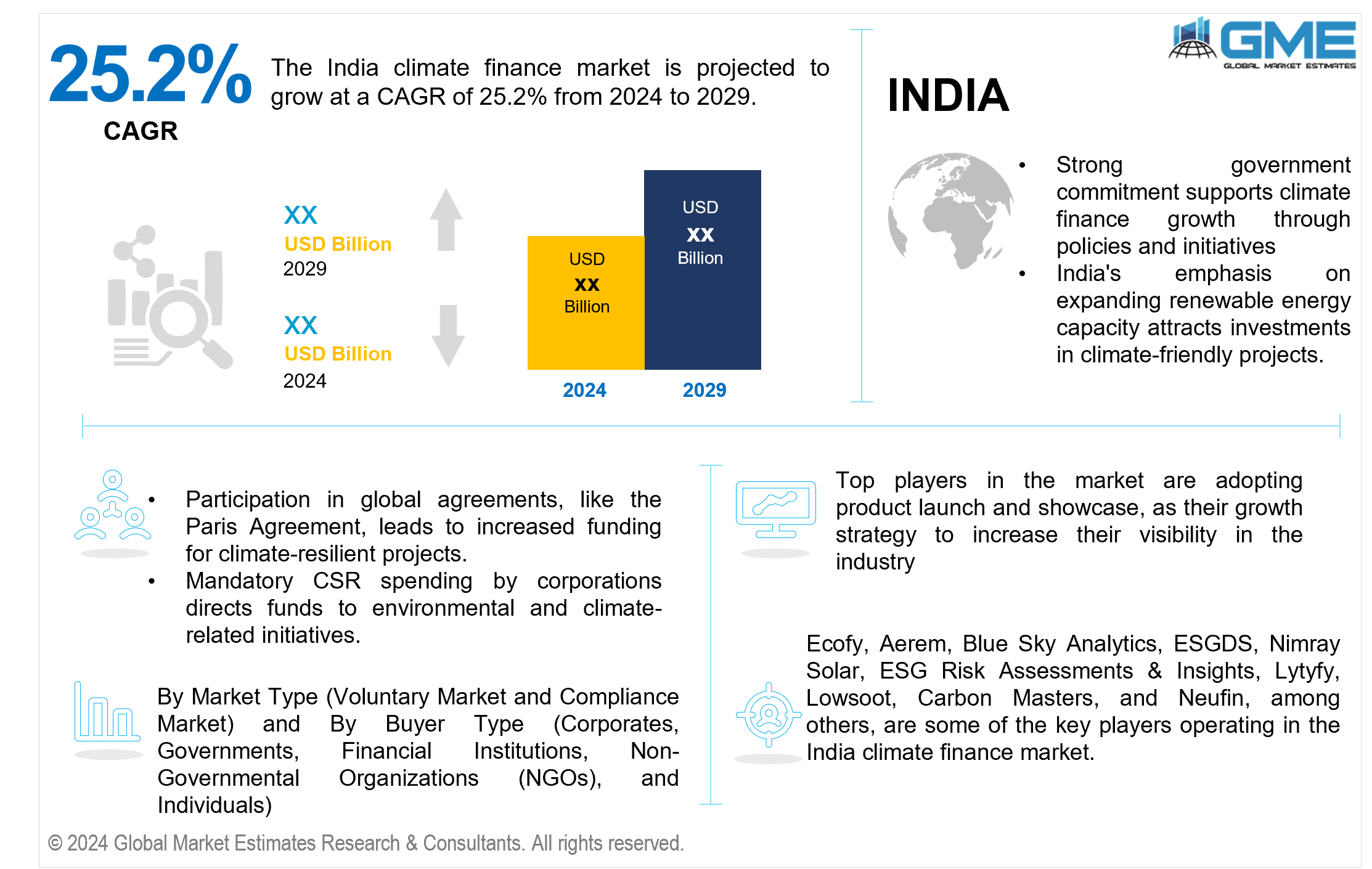

India Climate Finance Market Size, Trends & Analysis - Forecasts to 2029 By Market Type (Voluntary Market and Compliance Market) and By Buyer Type (Corporates, Governments, Financial Institutions, Non-Governmental Organizations (NGOs), and Individuals), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The India climate finance market is projected to grow at a CAGR of 25.2% from 2024 to 2029.

The Indian government has a considerable impact on the climate finance sector through policies and laws that promote clean energy, sustainable growth, and environmental conservation. The government encourages investments in climate-friendly initiatives by offering incentives, subsidies, and advantageous regulatory frameworks, building a more sustainable and ecologically conscious financial sector.

India has signed international climate-change agreements and pledges, including the Paris Agreement. These worldwide accords have an impact on the country's climate financing market by establishing targets and expectations for carbon reductions, renewable energy adoption, and other sustainable practices.

Mandatory corporate social responsibility (CSR) spending by Indian firms has increased investment in social and environmental activities, particularly climate programs. This proactive engagement positively impacts the climate financing industry as corporations allocate capital to address pressing environmental concerns. The commitment to CSR meets regulatory requirements and contributes to a larger sustainability agenda by linking corporate investments with efforts to solve climate challenges and build a more ecologically responsible business landscape.

Advances in technology, particularly in the renewable energy industry, help to make environmentally friendly projects more economically viable. Improved efficiency and lower costs make these projects more appealing to investors, resulting in increased growth in the climate financing industry.

Many climate-friendly projects, particularly in renewable energy and sustainable infrastructure, necessitate significant initial investment. Limited access to affordable financing may limit the implementation of such projects.

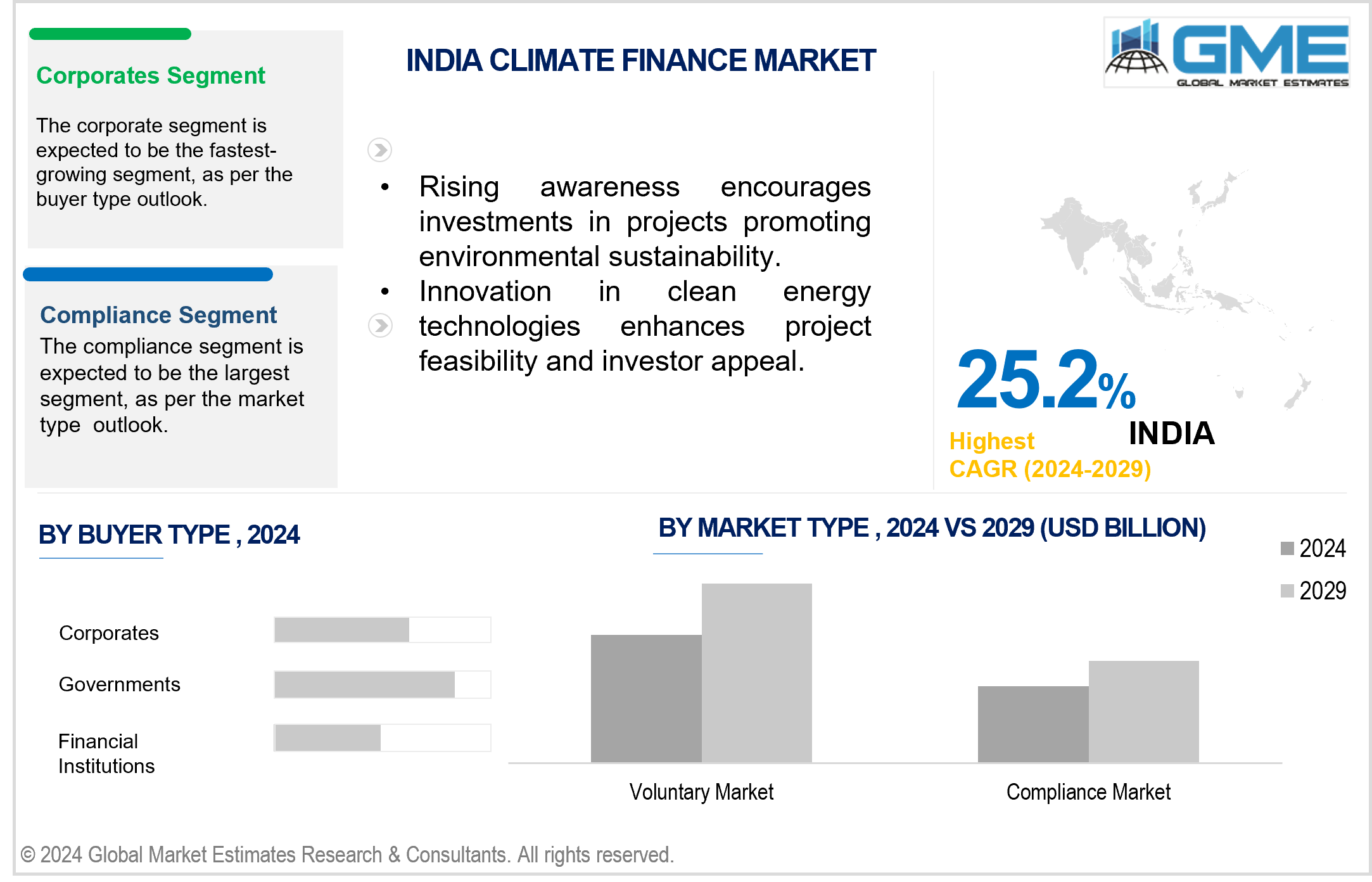

The compliance market segment is expected to hold the largest share of the market. This is attributed to regulatory mandates and government policies promoting environmental responsibility. Businesses are under increasing pressure to invest in climate-friendly projects in order to meet regulatory requirements.

The voluntary market segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to the increasing recognition of the value of proactive environmental initiatives beyond regulatory mandates. Businesses are voluntarily committing to sustainability goals and carbon neutrality, driving a surge in investments in climate projects.

The corporate segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The segment's anticipated growth is due to increasing corporate emphasis on sustainability. Corporations are proactively investing in climate-friendly projects as environmental responsibility becomes more widely recognized, and ESG (Environmental, Social, and Governance) factors are integrated.

The government segment is expected to hold the largest share of the market during the forecast period. This is due to the important role of government authorities in driving climate-related initiatives. Government bodies play a central role in formulating and implementing policies, regulations, and funding mechanisms that support sustainable development and climate resilience.

Ecofy, Aerem, Blue Sky Analytics, ESGDS, Nimray Solar, ESG Risk Assessments & Insights, Lytyfy, Lowsoot, Carbon Masters, and Neufin, among others, are some of the key players operating in the India climate finance market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, Mumbai-based non-banking finance company Ecofy, specializing in green energy, successfully raised USD 10.8 million (INR 90 crores) in funding from the Dutch entrepreneurial development bank FMO. The funding, divided into two equal tranches, aims to strengthen Ecofy's loan book, diversify its product offerings, and improve its credit rating.

In March 2023, Mumbai-based solar tech platform Aerem secured USD 5 million in a Pre-Series A funding round led by Avaana Capital, with participation from Blume Ventures and debt financing from prominent financial institutions. Aerem plans to use the funds to expand its innovative solar technology and financing solutions. The company aims to build an ecosystem involving financial institutions, engineering, procurement, and construction (EPC) companies, and micro, small, and medium enterprises (MSMEs) to enable end-to-end solutions for rooftop solar projects.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Buyer Types

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Buyer Type Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA CLIMATE FINANCE MARKET, BY BUYER TYPE

4.1 Introduction

4.2 Climate Finance Market: Buyer Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Corporates

4.4.1 Corporates Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Governments

4.5.1 Governments Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Financial Institutions

4.6.1 Financial Institutions Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Non-Governmental Organizations (NGOs)

4.7.1 Non-Governmental Organizations (NGOs) Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Individuals

4.8.1 Individuals Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA CLIMATE FINANCE MARKET, BY MARKET TYPE

5.1 Introduction

5.2 Climate Finance Market: Market Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Voluntary Market

5.4.1 Voluntary Market Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Compliance Market

5.5.1 Compliance Market Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 India

6.4 Company Profiles

6.4.1 Ecofy

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Aerem

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Blue Sky Analytics

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 ESGDS

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Nimray Solar

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 ESG Risk Assessments & Insights

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Lytyfy

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 Lowsoot

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 Carbon Masters

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Neufin

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 India Climate Finance Market, By Buyer Type, 2021-2029 (USD Million)

2 Corporates Market, 2021-2029 (USD Million)

3 Governments Market, 2021-2029 (USD Million)

4 Financial Institutions Market, 2021-2029 (USD Million)

5 Non-Governmental Organizations (NGOs) Market, 2021-2029 (USD Million)

6 Individuals Market, 2021-2029 (USD Million)

7 India Climate Finance Market, By Market Type, 2021-2029 (USD Million)

8 Voluntary Market Market, 2021-2029 (USD Million)

9 Compliance Market Market, 2021-2029 (USD Million)

10 Ecofy: Products & Services Offering

11 Aerem: Products & Services Offering

12 Blue Sky Analytics: Products & Services Offering

13 ESGDS: Products & Services Offering

14 Nimray Solar: Products & Services Offering

15 ESG Risk Assessments & Insights: Products & Services Offering

16 Lytyfy : Products & Services Offering

17 Lowsoot: Products & Services Offering

18 Carbon Masters, Inc: Products & Services Offering

19 Neufin: Products & Services Offering

20 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Climate Finance Market Overview

2 India Climate Finance Market Value From 2021-2029 (USD Million)

3 India Climate Finance Market Share, By Buyer Type (2023)

4 India Climate Finance Market Share, By Market Type (2023)

5 India Climate Finance Market, By Region (Asia Pacific Market)

6 Technological Trends In India Climate Finance Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Climate Finance Market

10 Impact Of Challenges On The India Climate Finance Market

11 Porter’s Five Forces Analysis

12 India Climate Finance Market: By Buyer Type Scope Key Takeaways

13 India Climate Finance Market, By Buyer Type Segment: Revenue Growth Analysis

14 Corporates Market, 2021-2029 (USD Million)

15 Governments Market, 2021-2029 (USD Million)

16 Financial Institutions Market, 2021-2029 (USD Million)

17 Non-Governmental Organizations (NGOs) Market, 2021-2029 (USD Million)

18 Individuals Market, 2021-2029 (USD Million)

19 India Climate Finance Market: By Market Type Scope Key Takeaways

20 India Climate Finance Market, By Market Type Segment: Revenue Growth Analysis

21 Voluntary Market Market, 2021-2029 (USD Million)

22 Compliance Market Market, 2021-2029 (USD Million)

23 Travel Market, 2021-2029 (USD Million)

24 Others Market, 2021-2029 (USD Million)

25 Four Quadrant Positioning Matrix

26 Company Market Share Analysis

27 Ecofy: Company Snapshot

28 Ecofy: SWOT Analysis

29 Ecofy: Geographic Presence

30 Aerem: Company Snapshot

31 Aerem: SWOT Analysis

32 Aerem: Geographic Presence

33 Blue Sky Analytics: Company Snapshot

34 Blue Sky Analytics: SWOT Analysis

35 Blue Sky Analytics: Geographic Presence

36 ESGDS: Company Snapshot

37 ESGDS: Swot Analysis

38 ESGDS: Geographic Presence

39 Nimray Solar: Company Snapshot

40 Nimray Solar: SWOT Analysis

41 Nimray Solar: Geographic Presence

42 ESG Risk Assessments & Insights: Company Snapshot

43 ESG Risk Assessments & Insights: SWOT Analysis

44 ESG Risk Assessments & Insights: Geographic Presence

45 Lytyfy : Company Snapshot

46 Lytyfy : SWOT Analysis

47 Lytyfy : Geographic Presence

48 Lowsoot: Company Snapshot

49 Lowsoot: SWOT Analysis

50 Lowsoot: Geographic Presence

51 Carbon Masters, Inc.: Company Snapshot

52 Carbon Masters, Inc.: SWOT Analysis

53 Carbon Masters, Inc.: Geographic Presence

54 Neufin: Company Snapshot

55 Neufin: SWOT Analysis

56 Neufin: Geographic Presence

57 Other Companies: Company Snapshot

58 Other Companies: SWOT Analysis

59 Other Companies: Geographic Presence

The India Climate Finance Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Climate Finance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS