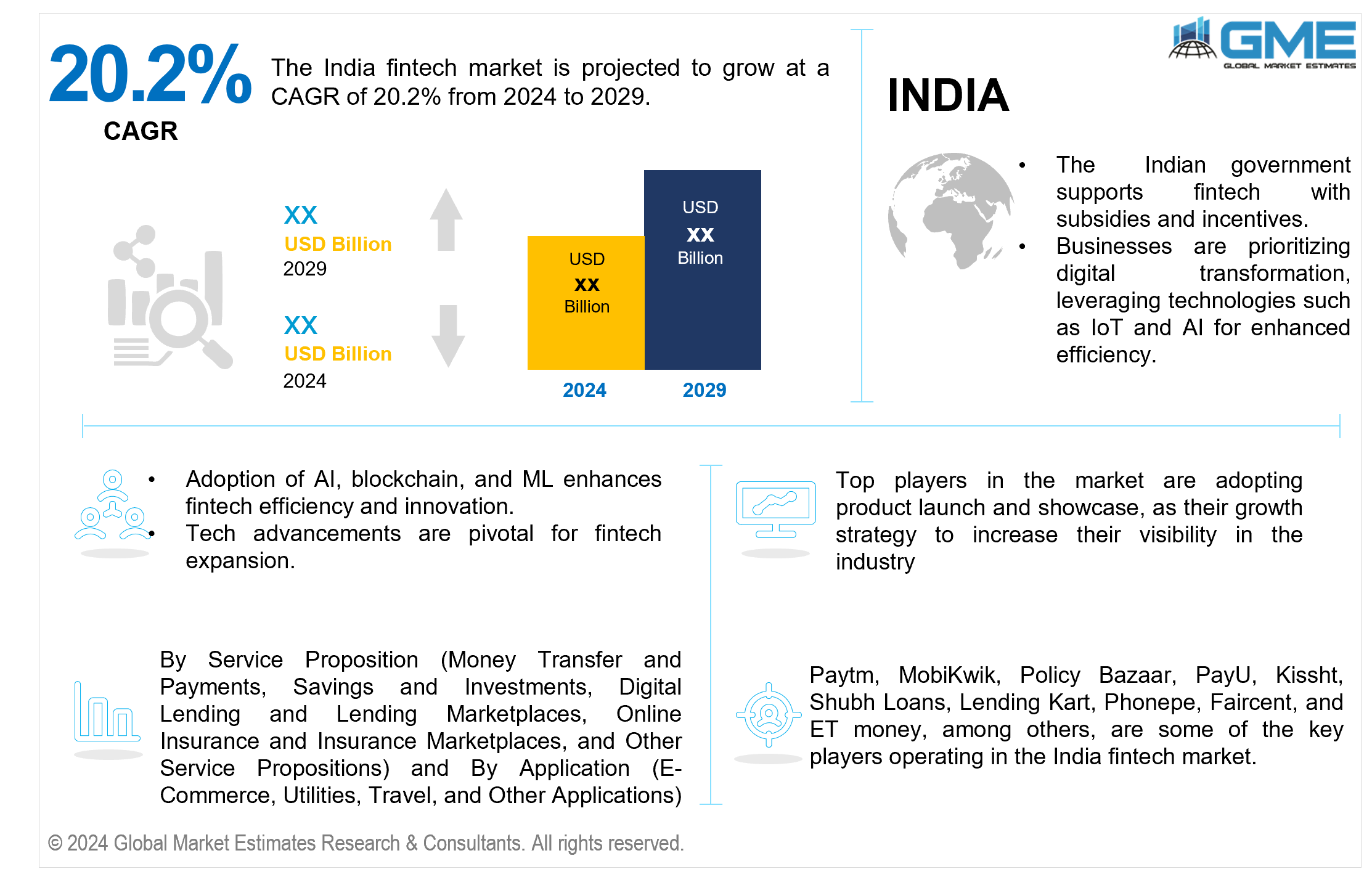

India Fintech Market Size, Trends & Analysis - Forecasts to 2029 By Service Proposition (Money Transfer and Payments, Savings and Investments, Digital Lending and Lending Marketplaces, Online Insurance and Insurance Marketplaces, and Other Service Propositions) and By Application (E-commerce, Utilities, Travel, and Other Applications), Competitive Landscape, Company Market Share Analysis, and End User Analysis

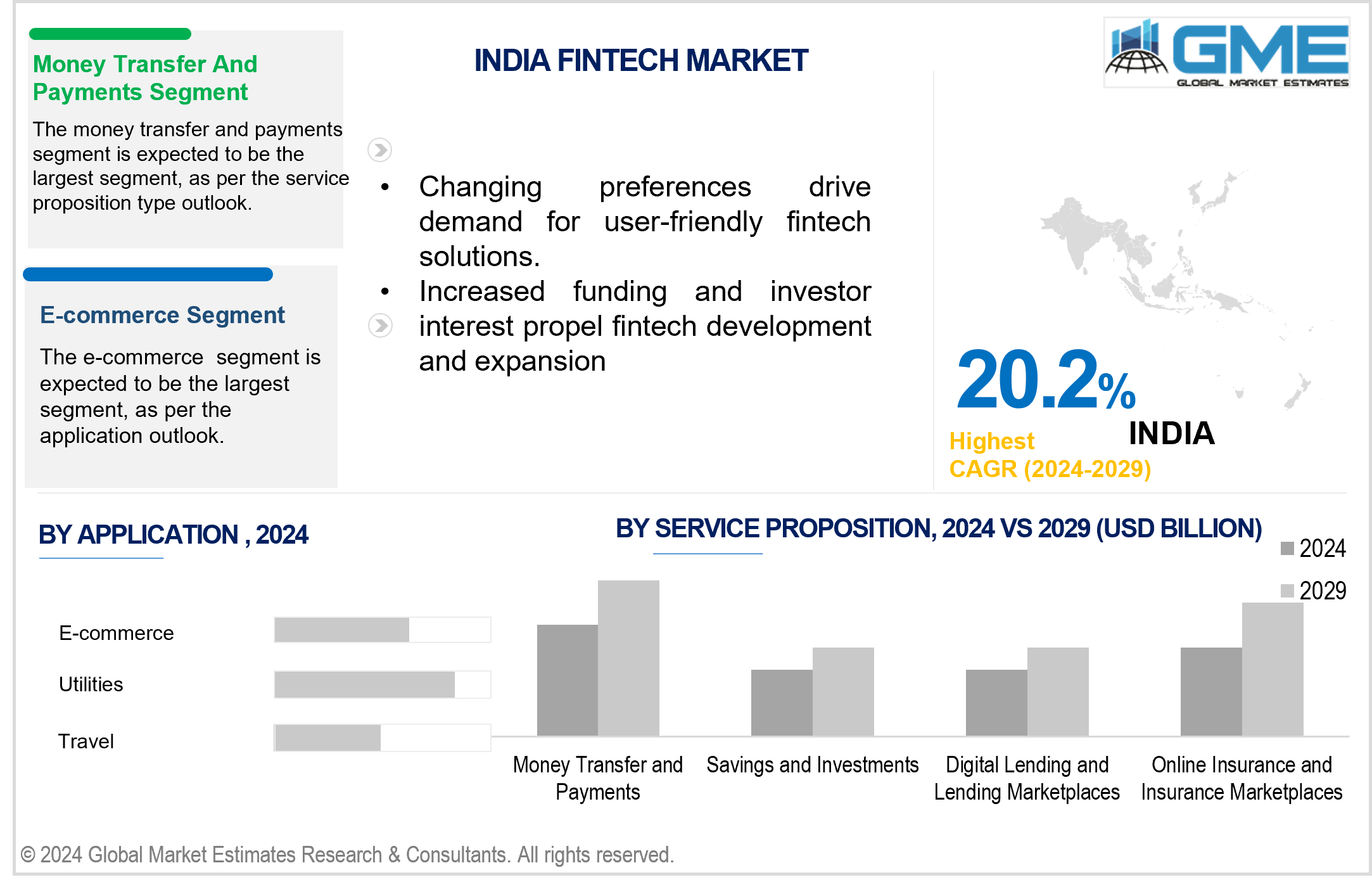

The India fintech market is projected to grow at a CAGR of 20.2% from 2024 to 2029.

Consumer outlooks are shifting in favor of digital and practical financial solutions. Tech-savvy consumers are increasingly drawn to fintech companies that provide personalized financial services, online lending platforms, and user-friendly apps.

The government's initiatives to encourage a cashless economy and the broad adoption of digital technologies are the main drivers of India's fintech sector's growth. For instance, campaigns like the 2016 demonetization effort have accelerated the shift to internet and mobile financial services. The intentional drive towards digitalization has not only expedited the change in the customs in which financial transactions are carried out but also played a role in the broader digital revolution in the Indian financial domain.

Programs like Digital India, Pradhan Mantri Grameen Digital Saksharta Abhiyan (PMGDSA), and Unified Payments Interface (UPI) have been instrumental in shaping India as a digitally empowered society and a prominent participant in the digital economy. These initiatives have played a crucial role in transforming the country into a digitally proficient community and a key player in digital commerce.

The majority of people in India can now access more affordable cell phones and have better internet connectivity, which has expanded the market for fintech services. Due to increased accessibility to digital financial services, traditionally marginalized groups have become more empowered in rural and semi-urban areas, where this development has notably encouraged financial inclusion. One of the main forces behind the development of a more accessible and inclusive financial environment nationwide has been the pervasive availability of these electronic resources.

However, fintech organizations face increased cybersecurity concerns due to their growing reliance on digital platforms. Fintech companies must invest heavily in robust cybersecurity solutions to protect sensitive financial data.

The money transfer and payments segment is expected to hold the largest share of the market. The demand for seamless, safe, and convenient financial transactions is increasing, and fintech companies are meeting this demand by offering sophisticated and user-friendly money transfer and payment services. Due to the growing trend of digital adoption, these services successfully cater to the changing needs of businesses and consumers, contributing to the expected dominance of the segment.

The savings and investments segment is expected to be the fastest-growing segment in the market from 2024-2029. Increased consumer knowledge and a growing interest in financial planning are the reasons for the segment's growth. The requirement for easily accessible and varied investment options is driving the increase in fintech innovations, especially those that provide user-friendly platforms for investing.

The travel segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The segment's growth is attributed to the travel industry's growing adoption of fintech solutions, which make secure and easy payment processing, booking, and cost management possible. Fintech advancements within the travel category are anticipated to contribute to market growth as customers seek more convenient and efficient financial solutions when planning and experiencing travel.

The e-commerce segment is expected to hold the largest share of the market. This is due to the increasing adoption of fintech solutions in online shopping. Fintech is becoming increasingly popular in the e-commerce industry because it guarantees safe and effective online transactions, offers various payment choices, and improves customer experiences.

Paytm, MobiKwik, Policy Bazaar, PayU, Kissht, Shubh Loans, Lending Kart, Phonepe, Faircent, and ET money, among others, are some of the key players operating in the India fintech market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Policybazaar's subsidiary, Policybazaar Insurance Brokers received in-principle approval from the insurance regulator to upgrade its license, enabling entry into the reinsurance business. This approval is seen as a strategic move to enhance insurance penetration in India, infusing technology, process control, and data analytics into reinsurance.

In February 2023, LendingKart, a company specializing in providing working capital loans, announced the acquisition of Upwards, a digital lending platform. LendingKart aims to provide finance to the underserved using advanced technology, and they believe that acquiring Upwards will align with this mission.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Service Propositions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Service Proposition Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA FINTECH MARKET, BY SERVICE PROPOSITION

4.1 Introduction

4.2 Fintech Market: Service Proposition Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Money Transfer and Payments

4.4.1 Money Transfer and Payments Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Savings and Investments

4.5.1 Savings and Investments Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Digital Lending and Lending Marketplaces

4.6.1 Digital Lending and Lending Marketplaces Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Online Insurance and Insurance Marketplaces

4.7.1 Online Insurance and Insurance Marketplaces Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Other Service Propositions

4.8.1 Other Service Propositions Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA FINTECH MARKET, BY APPLICATION

5.1 Introduction

5.2 Fintech Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 E-commerce

5.4.1 E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Utilities

5.5.1 Utilities Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Travel

5.6.1 Travel Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 India

6.4 Company Profiles

6.4.1 Paytm

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 MobiKwik

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Policy Bazaar

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 PayU

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Kissht

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 Shubh Loans

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Lending Kart

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 Phonepe

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 ET Money

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Faircent

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 India Fintech Market, By Service Proposition, 2021-2029 (USD Million)

2 Money Transfer and Payments Market, 2021-2029 (USD Million)

3 Savings and Investments Market, 2021-2029 (USD Million)

4 Digital Lending and Lending Marketplaces Market, 2021-2029 (USD Million)

5 Online insurance and online insurance marketplace Market, 2021-2029 (USD Million)

6 Other Service Propositions Market, 2021-2029 (USD Million)

7 India Fintech Market, By Application, 2021-2029 (USD Million)

8 E-commerce Market, 2021-2029 (USD Million)

9 Utilities Market, 2021-2029 (USD Million)

10 Travel Market, 2021-2029 (USD Million)

11 others Market, 2021-2029 (USD Million)

12 India Fintech Market, By Service Proposition, 2021-2029 (USD Million)

13 India Fintech Market, By Application, 2021-2029 (USD Million)

14 Paytm: Products & Services Offering

15 MobiKwik: Products & Services Offering

16 Policy Bazaar: Products & Services Offering

17 PayU: Products & Services Offering

18 Kissht: Products & Services Offering

19 Shubh Loans: Products & Services Offering

20 Lending Kart : Products & Services Offering

21 Phonepe: Products & Services Offering

22 ET Money, Inc: Products & Services Offering

23 Faircent: Products & Services Offering

24 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Fintech Market Overview

2 India Fintech Market Value From 2021-2029 (USD Million)

3 India Fintech Market Share, By Service Proposition (2023)

4 India Fintech Market Share, By Application (2023)

5 India Fintech Market, By Region (Asia Pacific Market)

6 Technological Trends In India Fintech Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Fintech Market

10 Impact Of Challenges On The India Fintech Market

11 Porter’s Five Forces Analysis

12 India Fintech Market: By Service Proposition Scope Key Takeaways

13 India Fintech Market, By Service Proposition Segment: Revenue Growth Analysis

14 Money Transfer and Payments Market, 2021-2029 (USD Million)

15 Savings and Investments Market, 2021-2029 (USD Million)

16 Digital Lending and Lending Marketplaces Market, 2021-2029 (USD Million)

17 Online Insurance and Insurance Marketplaces Market, 2021-2029 (USD Million)

18 Other Service Propositions Market, 2021-2029 (USD Million)

19 India Fintech Market: By Application Scope Key Takeaways

20 India Fintech Market, By Application Segment: Revenue Growth Analysis

21 E-commerce Market, 2021-2029 (USD Million)

22 Utilities Market, 2021-2029 (USD Million)

23 Travel Market, 2021-2029 (USD Million)

24 Others Market, 2021-2029 (USD Million)

25 India Fintech Market: Regional Analysis

26 India Fintech Market Overview

27 India Fintech Market, By Service Proposition

28 India Fintech Market, By Application

29 Four Quadrant Positioning Matrix

30 Company Market Share Analysis

31 Paytm: Company Snapshot

32 Paytm: SWOT Analysis

33 Paytm: Geographic Presence

34 MobiKwik: Company Snapshot

35 MobiKwik: SWOT Analysis

36 MobiKwik: Geographic Presence

37 Policy Bazaar: Company Snapshot

38 Policy Bazaar: SWOT Analysis

39 Policy Bazaar: Geographic Presence

40 PayU: Company Snapshot

41 PayU: Swot Analysis

42 PayU: Geographic Presence

43 Kissht: Company Snapshot

44 Kissht: SWOT Analysis

45 Kissht: Geographic Presence

46 Shubh Loans: Company Snapshot

47 Shubh Loans: SWOT Analysis

48 Shubh Loans: Geographic Presence

49 Lending Kart : Company Snapshot

50 Lending Kart : SWOT Analysis

51 Lending Kart : Geographic Presence

52 Phonepe: Company Snapshot

53 Phonepe: SWOT Analysis

54 Phonepe: Geographic Presence

55 ET Money, Inc.: Company Snapshot

56 ET Money, Inc.: SWOT Analysis

57 ET Money, Inc.: Geographic Presence

58 Faircent: Company Snapshot

59 Faircent: SWOT Analysis

60 Faircent: Geographic Presence

61 Other Companies: Company Snapshot

62 Other Companies: SWOT Analysis

63 Other Companies: Geographic Presence

The India Fintech Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Fintech Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS